Prekhodov

What is Alphabet’s business model?

It is a fact that the alphabet (NASDAQ: Google) (NASDAQ: Google) 77% of total revenue comes from digital advertising, and 57% of total revenue comes directly from advertising on Google search.

Basically, Google owns 91.37% of the market Sharing the global search market, when we search the web for some reason, we see ads and click on those ads. Alphabet gets paid for every click and every ad we see. This is Alphabet’s business model – digital advertising.

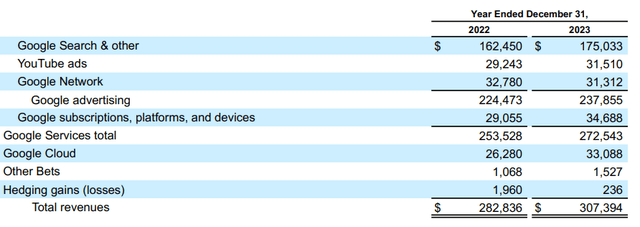

Here’s a breakdown of Alphabet’s sales by segment:

Letter 10K

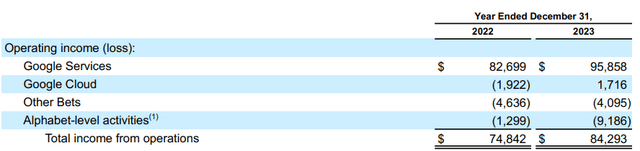

But more importantly, Alphabet’s profits come directly from advertising – the Google services part. In 2022, all other divisions posted losses, and in 2024, Google Cloud was profitable, but accounted for less than 2% of Google Services profits. As a result, Alphabet’s profitability relies entirely on digital advertising.

Letter 10K

Alphabet actually warns of: 1) slower growth, 2) lower profit margins 10,000 in 2023 Report, Management’s Discussion section, “Our Business Trends and Financial Impact” section.

With the development of the digital economy, user behavior and advertising continue to shift online. Since our founding, the continued growth of the online world has fueled the growth of our business and revenue.We expect this evolution to continue to be beneficial to our business and revenue, although slower pace than we have experienced historically, especially following the significant increase in our advertising revenue during the COVID-19 pandemic.

Users continue to use different devices and methods (smartphones, wearables, connected TVs and smart home devices) to access our products and services, making new ad formats potentially beneficial to our revenue, but adversely affect our profits. We expect these trends to continue to impact our revenues and put pressure on our margins.

The thing is, desktop search has very high profit margins, but most people now search in other ways, which have lower profit margins. In addition, Alphabet believes that growth in the post-pandemic era is unsustainable.

But this is a bigger problem

The biggest problem with Google search is “annoying” ads – but that’s how Alphabet makes money. ChatGPT’s recent innovations could pose an existential threat to Alphabet’s ad-based business model.

This is what Sam Altman, founder of OpenAI (ChatGPT) said think About advertising:

I kind of hate advertising because it’s just an aesthetic choice. I think advertising needs to be online for a number of reasons in order for it to grow, but it’s a ephemeral industry. The world is richer now. I love that people pay for ChatGPT and know that the answers they get are not influenced by advertisers. I’m sure there’s an AD unit that would make sense for an LLM, and I’m sure there’s a way to participate in the deal flow in an unbiased way, which can be done, but it’s also easy to think of the future where you ask ChatGPT for something and it says , “Oh, you should consider buying this product,” or “You should consider vacationing here,” or whatever.

ChatGPT is essentially a chatbot – you ask questions and you get answers. This could be a new way to search for information.

But here’s the thing – there are no ads in ChatGPT. It seems people need a paid subscription to access the premium version of ChatGPT, or it’s free – no ads.

Sam Altman didn’t want to compete with Google search, nor did he want to improve Google search. Altman wanted to create a new way to search for information—without ads.

So, this is essentially a Google search killer, not right away, but eventually. To be more precise, this is the Google search business model killer. Google can easily incorporate LLM into searches, but the problem is that it can’t include ads.

Alphabet must adapt or die

So, obviously, Alphabet has to adapt, has to create new business models. Apparently Alphabet plans to charge a subscription fee for advanced AI searches, but apparently it still plans to run ads — even on the premium version. This approach won’t work if competitors offer ad-free AI search.

Let’s look at the main competitor in the search field – Microsoft (MSFT). Currently, Microsoft and Bing have a 3% market share in the search field. Microsoft invested in OpenAI and included ChatGPT in search as Copilot.

Microsoft sells productivity tools, and it offers Copilot as one of them. This is a new way of combining search (as information gathering) with analysis (Excel spreadsheets) and report preparation (MS Word). The same principle can be applied to any workload—creativity, for example. So, searching is only the first part – information gathering. Alphabet could try to copy Microsoft’s all-inclusive productivity subscription model, but that would be prohibitively expensive.

The key is that Alphabet must adjust its business model to rely less on advertising and more on subscriptions. Alternatively, you can try to compete with cloud services and learn from the experience of Amazon (AMZN), whose only growth driver is AWS.

current indicator

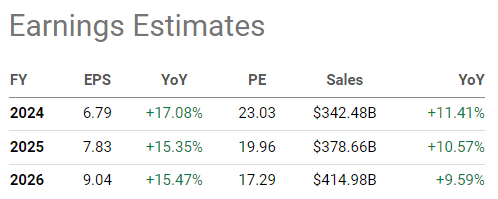

Alphabet faces serious threats and must reorganize. Alphabet’s current revenue/profit forecasts do not take into account ChatGPT’s threat to Google’s search advertising revenue.

Even so, Alphabet expects revenue growth to gradually decline over the next three years, falling below 10% by 2026. This is consistent with the growth warnings in the 10K report. Earnings are expected to grow by around 15%. But this estimate does not take into account the margin warning in the 10K statement (due to changing patterns).

Seeking Alpha

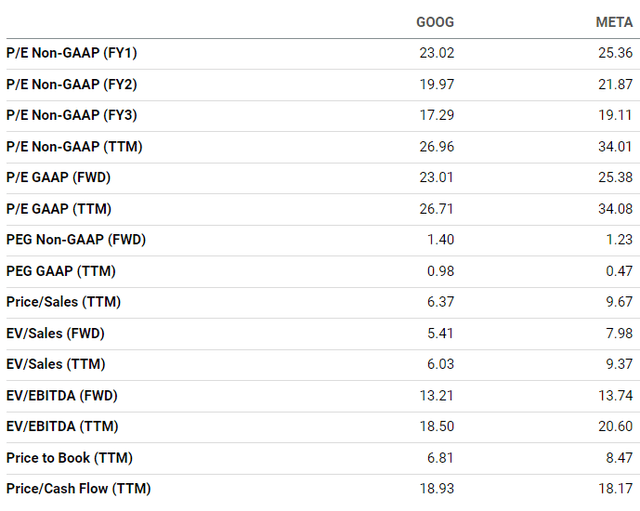

Alphabet is currently overvalued, with a ttm PE ratio of 26 and a ttm PS ratio of 6.37, but this is not a bubble. The forward price-to-earnings ratio is 23, indicating that earnings growth expectations are not optimistic – confirming the 15% earnings growth forecast. Meta (META) is comparable to Alphabet in that it generates almost all of its revenue from digital advertising, although the business model is very different. According to ttm PE (34) calculation, Meta is slightly more expensive than Alphabet. According to forward PE (26) calculation, Meta is slightly more expensive than Alphabet.

Seeking Alpha

Both Alphabet and Meta are overvalued based on current metrics, but Alphabet is cheaper than Meta — suggesting the market is pricing in slower growth, which is actually negative for Alphabet.

Influence

Google search, Alphabet’s main business model, is facing serious threats. Microsoft is innovating its search business to make ChatGPT (Copilot) part of its productivity tools. Therefore, the search part is bundled with other productivity tools and sold as a subscription.

Alphabet recognizes this threat and is working to adjust (Gemini). At the same time, however, holding Alphabet stock is too risky. Therefore, my rating on Alphabet is Sell.

The risks of this bearish thesis are as follows:

- Artificial Intelligence regulations, e.g. I have taken action, Potentially halting the progress of Gen AI, which could favor traditional ad-based search models, although that’s not a positive for the tech industry as a whole and Alphabet stock.

- Clearly, Alphabet was able to quickly adapt and adjust to new circumstances and transition to a new business model without any significant negative impact on profitability.