Summary 205

paper

iShares Core Total USD Bond Market ETF (NASDAQ:IUSB) is a large-cap fixed income ETF owned by BlackRock. According to its documentation:

The iShares Core Total USD Bond Market ETF is designed to track the investment results of a specific bond An index composed of U.S. dollar-denominated bonds rated investment grade or high yield.

The next closest index is the Bloomberg U.S. Universal Index (ticker LC07TRUU), but despite the broad mandate of the index and ETF, it actually focuses on Treasury and agency MBS bonds, which account for more than 57% of collateral.

As the market retreats from interest rate cut expectations and the yield curve has risen sharply since the beginning of the year, we believe that interest rate sensitive assets such as Treasury bonds and MBS bonds have generational opportunities.

In this article we will analyze IUSB and its components, risk factors and drivers, and sheds light on why we believe today’s macro environment is an ideal one to buy the name.

Interest rates rise this year amid strong economy

Although the market expected six interest rate cuts at the end of last year, recent strong economic data has significantly reduced interest rate expectations:

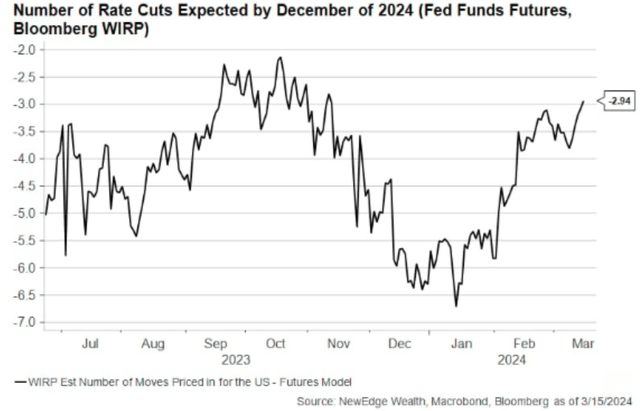

Interest rate cut expectations (Bloomberg)

The chart above, provided by Bloomberg, shows the number of rate cuts implied by federal funds futures. The line has moved higher as markets predict a limited number of rate cuts.

It is worth noting that the Federal Reserve’s Neel Kashkari even hinted that there will be no interest rate cut in 2024 in his policy report. speech yesterday. Fewer rate cuts in 2024 have led to a rise in the yield curve, lowering the price of fixed income. We’re seeing fixed income prices at generational lows, and while we can’t say for sure when the Fed will begin its easing cycle, we can say with certainty that interest rates will be even lower a year from now.

The fund increases its holdings of Treasuries and agency MBS bonds

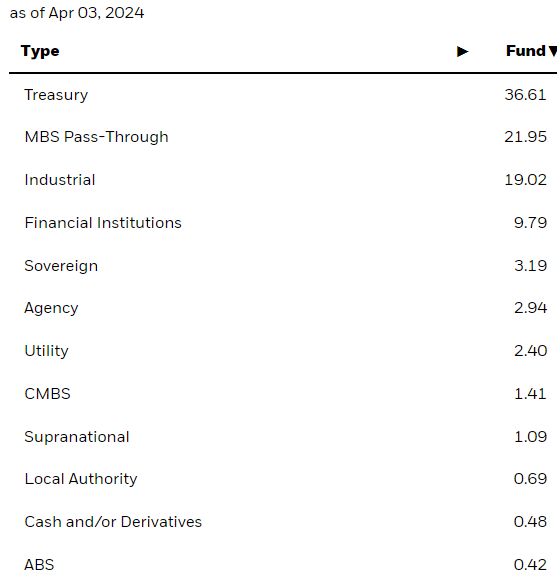

While the ETF provides a cross-sectional view of the bond market, its composition is overweight Treasury and agency MBS bonds:

Collateral (Fund website)

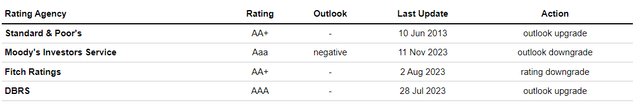

U.S. Treasuries and MBS account for more than 57% of collateral, so the fund is exposed to interest rate changes primarily through its duration profile. Please note that fund parsing now reflects that the United States is a Double AA rated jurisdiction:

Rating (Fund website)

Currently, only Moody’s rates the United States as an Aaa country, while both Standard & Poor’s and Fitch rate it as AA+.

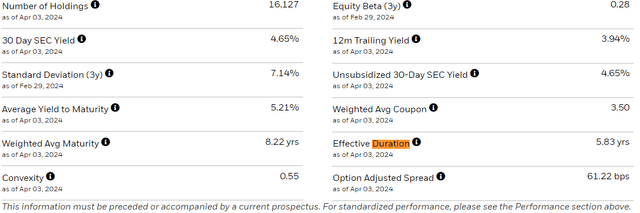

The fund has a maturity of 5.8 years, making it susceptible to mid-range interest rates:

detail (Fund website)

For every 100 basis points drop in the 6-year rate, IUSB will rise 5.8% in addition to the conventional yield of 4.65% (as measured by the 30-day SEC yield).

The remainder of the fund’s collateral is investment-grade corporate bonds, and given its composition, the fund’s overall selection-adjusted spread is just 61 basis points. The primary risk factor for this ETF is interest rates, which are currently at all-time highs.

Expected earnings if the Fed cuts interest rates

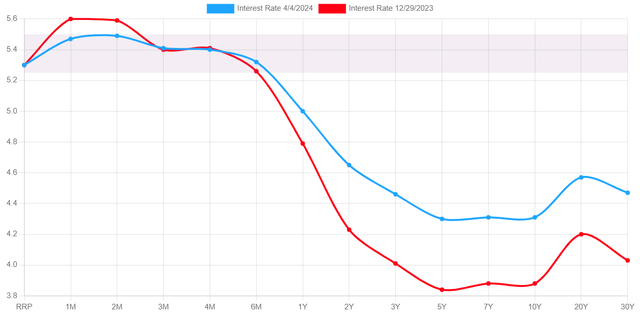

Let’s look at how the yield curve has changed this year to get a better idea of where we’re headed:

yield curve (ustreasuryieldcurve.com)

As you can see from the chart above, the yield curve has shifted significantly upward compared to the end of 2023. More specifically, the 5-year and 6-year yield curves have shifted upward by 50 basis points. This trend is expected to reverse once the Fed cuts rates or once the market starts pricing in an impending rate cut.

We expect that by the end of this year, the overall 6-year government bond will see a 100 basis point change, and the Federal Reserve will only cut interest rates twice this year, and then pause. In our base case, IUSB will earn 6% from duration and 4.5% from dividends, so the total return is over 10%.

Keep in mind that this is a very low-risk bond fund, with annualized volatility of just 6.4% and a standard deviation of 7%, according to the name’s Seeking Alpha “Risk” tab.

Please find further analysis on this fund below:

- Assets under management: $28 billion.

- Sharpe ratio: -0.69.

- standard. Deviation: 7%.

- Yield: 4.65%. (30-day SEC yield)

- Premium/discount to NAV: 0%.

- Z Statistics: Not applicable.

- Leverage: 0%.

- Validity period: 5.8 years

- Expense ratio: 0.06%

- Composition: U.S. Consolidated Bond Fund

You want to buy bonds when interest rates are high

Bond funds are generally not very interesting because they are in a low return/low volatility sector. With interest rates reaching levels not seen in more than a decade, the name’s appeal has only grown. In the bond sector, investors can only expect dividend yields in a fixed interest rate environment. The only time investors can record capital gains is when interest rates or spreads move lower. Given current risk-free yield levels and market-implied pricing, investors can count on capital gains over the next 12 months here for the first time in a long time.

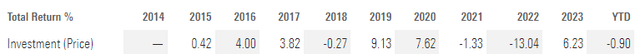

The current repricing of inflation expectations and Fed rate cuts is an ideal opportunity to get into IUSB, which is pretty lackluster from a total return perspective:

historic returns (Morning Star)

The only other historical context in the past decade where the name has produced total returns close to 10% was in 2019, the year the Fed lowered interest rates after raising rates in 2018. It is expected that the 2024/2025 period will be similar, with interest rate cuts from the Federal Reserve translating into a lower interest rate environment, thus resulting in capital gains for medium-duration bond funds.

risk factors

The main risk factor for this name is further interest rate hikes by the Fed, which would push the yield curve higher, resulting in capital losses. This possibility is extremely slim, as the Fed chairman has made it quite clear that raising interest rates is past time.

Powell is in a bit of a tough spot because interest rates on the U.S. debt are spiraling out of control in a presidential election year with dire macro-inflation conditions. We believe he is cutting rates just to signal intent, regardless of the 2% target number, and that he will cut rates in the summer to avoid being tied to the presidential election period. For example, cuts during an election might be seen as helping the sitting president.

in conclusion

IUSB is BlackRock’s fixed income ETF. The fund aims to track the Bloomberg U.S. General Index and is overweight U.S. Treasuries and agency MBS bonds, with a portfolio duration of 5.8 years. With the recent pullback in expectations for a rate cut in 2024, the yield curve has moved significantly higher, providing the best entry point for IUSB. We expect the total return over the next 12 months to be above 10%, with duration capital gains above 6% and dividend yield component above 4%.