8vFanI

Rising interest rates have been a boon for business development companies (BDCs) over the past year or so.Some of these companies posted record profits, including Golub Capital BDC (Nasdaq ticker: GBDC), investment growth 55% For the fiscal year ending September 30, 2023, revenue and net investment income (NII) grew 49%. 99% of debt investments have floating interest rates.

Company Profile:

Golub Capital BDC is an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940 and as a regulated investment company (RIC) code for federal tax purposes. It leverages the established loan origination pipeline developed by Golub Capital, a leading lender to middle market companies with more than $65 billion of capital under management as of January 1, 2024. (GBDC website)

Holdings:

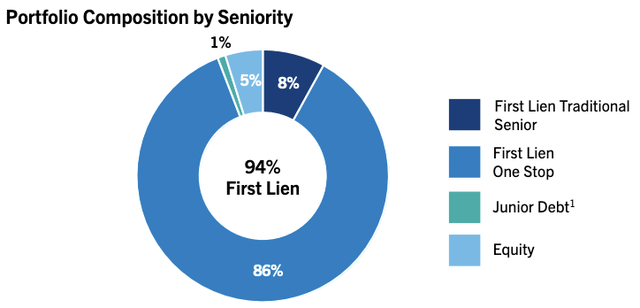

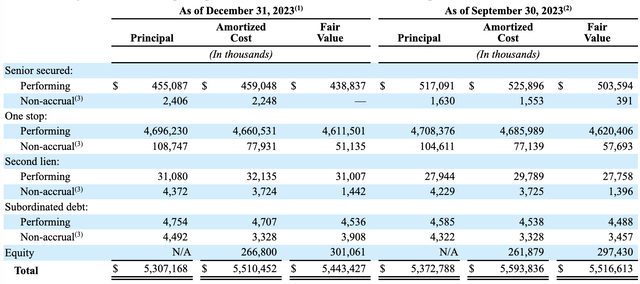

8% of GBDC’s $5.4B portfolio is in first lien senior loans, of which 86% is in first lien one-stop loans secured by mortgage interest. It also holds 5% equity and 1% junior debt.

GBDC website

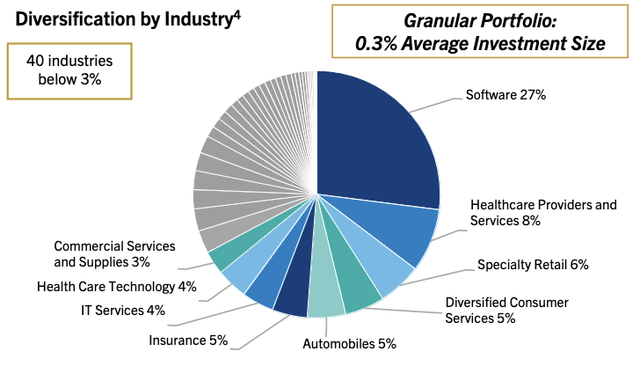

GBDC’s average borrower earns $73 million in EBITDA annually. 16% of the loan recipients were borrowers with annual EBITDA less than $20 million, while 76% were borrowers with annual EBITDA less than $100 million.

GBDC website

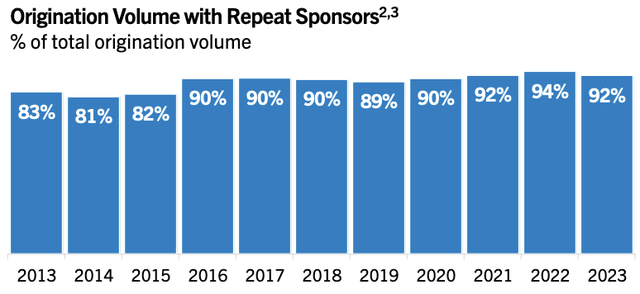

GBDC has a long-standing relationship with its sponsors, the companies that invest the majority of their capital in the underlying companies. Since 2020, the repeat sponsorship rate has reached 90% or above:

GBDC website

Portfolio Company Ratings:

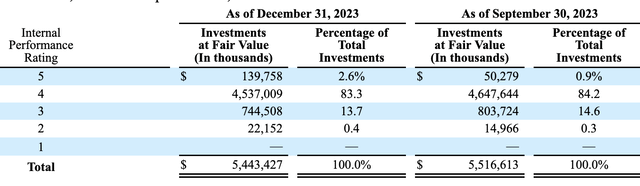

As with other BDCs, management reassesses its holdings quarterly. They use a 5-tier system, with 5 being the top tier and 1 being the lowest tier.

In the quarter ended December 31, 2023, holdings of top 5 assets increased by approximately $89 million, accounting for 2.6% of the portfolio; while Tier 2 increased by approximately $7 million, accounting for only 0.4%.

GBDC website

Non-accrual items fell 10 basis points sequentially to 1.1% of total debt investments at fair value in the quarter ended December 31, 2023. There are no new presets. As of December 31, 2023, portfolio company investments with non-accrual status remained at nine.

During the COVID-19 chaos, GBDC’s payment default rate was 0.00%; since 2004, the average annual loss rate from payment defaults has been a very low 0.01%.

GBDC 10Q

income:

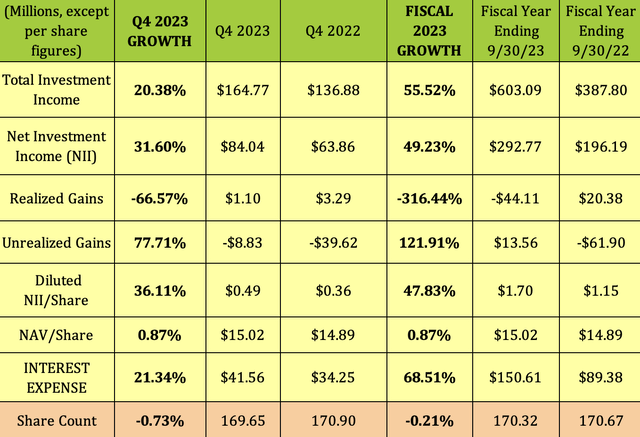

GBDC’s fiscal year ends on September 30. In the latest quarter ended December 31, 2023, its positive performance continued, with revenue growing by 20%, NII growing by 31.6%, and NII/share growing by 36%. Adjusted net investment income per share was $0.50, consistent with the fiscal fourth quarter of 2023 (the period ended September 30, 2023) and the company’s highest ever adjusted NII per share.

Unrealized gains increased to -$8.8 million, while realized gains fell to $1.1 million. Like most other companies, GBDC’s interest expense rose 21% in the quarter. Net value per share rose from $14.89 to $15.02.

In fiscal year 2023, revenue will grow by 55.5%, NII will grow by 49%, and NII/share will grow by approximately 48%.

Hidden Dividend Stocks Plus

new progress:

-GBDC has entered into a definitive merger agreement with Golub Capital BDC 3 Inc., with GBDC as the surviving company, subject to certain stockholder approvals and customary closing conditions.

-GBDC’s investment adviser agreed to reduce GBDC’s income incentive fee and capital gains incentive fee from 20% to 15% in support of the proposed merger. The reduction in incentive fees is effective January 1, 2024.

dividend:

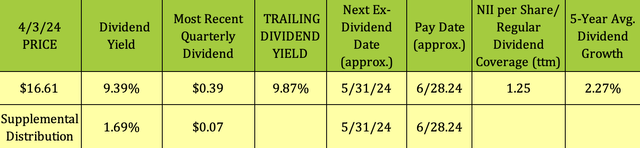

GBDC’s board of directors increased the company’s regular quarterly distribution from $0.37 to $0.39 per share in conjunction with the announcement of the proposed merger and the corresponding reductions and incentive payments.

GBDC has a base yield of 9.39% at $16.61, and the most recent top-up payment of $0.07 has increased by 1.69%, for a total yield of 11.08%. Due to dividend reductions affected by the COVID-19 epidemic in 2020-2021, the company’s 5-year dividend growth rate is 2.27%.

Hidden Dividend Stocks Plus

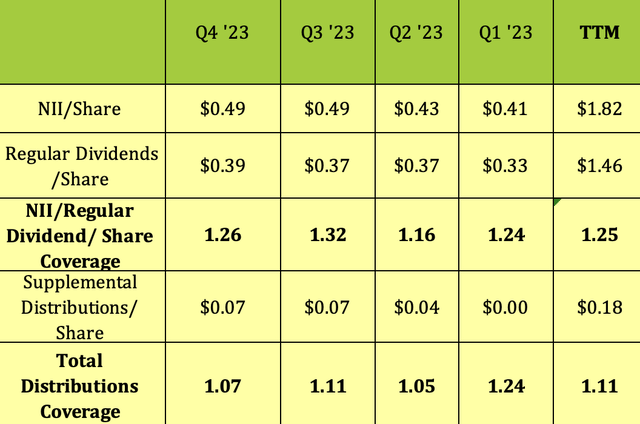

Dividend coverage has been strong over the past 4 quarters, reaching 1.26x for the quarter ended December 31, 2023, with an average of 1.25x.

GBDC has also paid 3 consecutive supplementary distributions in the last 3 quarters – its total distribution coverage ratio averaged 1.11x:

Hidden Dividend Stocks Plus

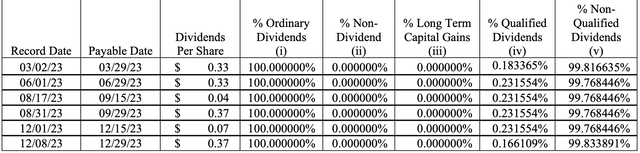

Taxes:

Distributions for the fiscal year ending September 30, 2023 are considered approximately 99.8% ineligible.

GBDC 10Q

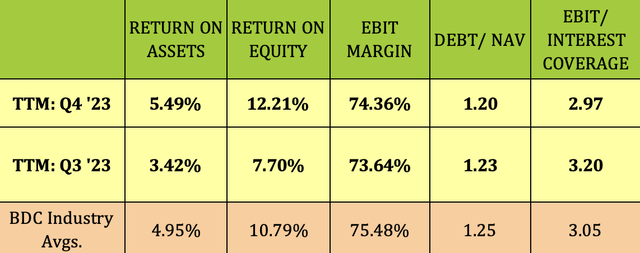

Profitability and Leverage:

For the fourth quarter ended December 31, 2023, both ROA and ROE improved significantly and were both higher than the BDC industry average. Debt/NAV is roughly flat, and interest coverage is slightly lower, but still in line with industry averages.

Hidden Dividend Stocks Plus

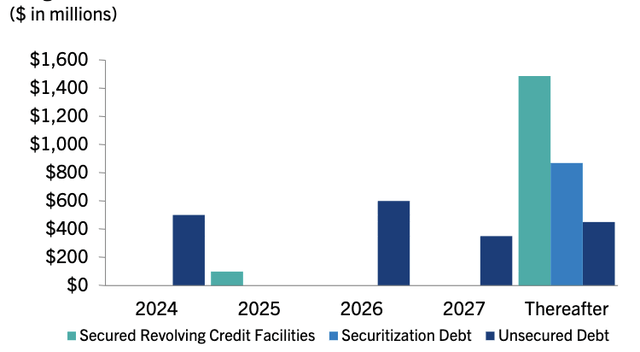

Debt and Liquidity:

As of 12/31/23, GBDC had $1.3B of liquidity derived from unrestricted cash, undrawn commitments from its corporate revolving rounds, and unused unsecured revolving rounds from its advisors.

It has $500 million in unsecured notes due in 2024.

On February 1, 2024, GBDC issued $600 million of 2029 unsecured notes with a fixed interest rate of 6.000% and a maturity date of July 15, 2029. In connection with the 2029 Notes, they entered into an interest rate swap agreement for the entire principal amount of the 2029 Notes, in which GBDC charges a fixed interest rate of 6.248% and pays a floating interest rate of 1-month SOFR plus 2.444%.

GBDC website

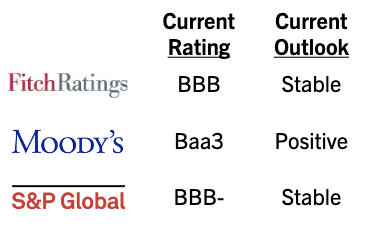

GBDC’s debt is rated investment grade by Fitch, Moody’s and S&P Global:

GBDC website

Performance:

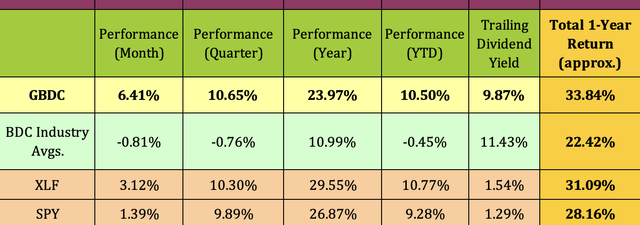

Over the past year, GBDC’s total returns have outperformed the BDC industry, the financial industry as a whole, and the S&P 500 Index. It has also outperformed the BDC Industries and S&P Index on a price basis so far in 2024:

Hidden Dividend Stocks Plus

Analyst price targets:

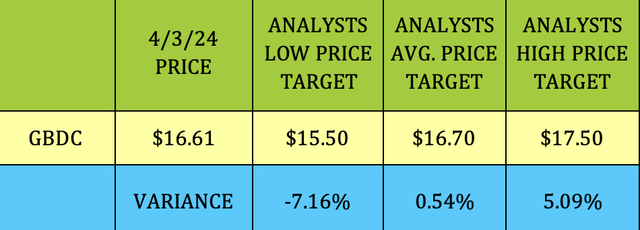

GBDC received a rating from B of A Securities on March 25, 2024, which was upgraded from “neutral” to “buy”.

GBDC’s price of $16.61 is roughly in line with Street analysts’ average price target of $16.70 and 5% below the top target of $17.50.

Hidden Dividend Stocks Plus

Valuation:

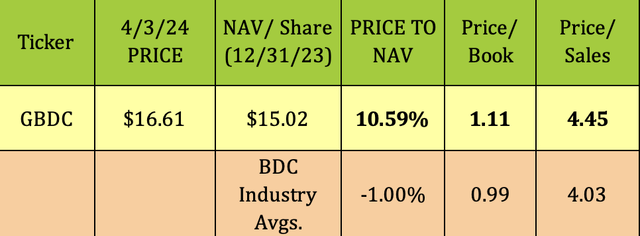

GBDC received a 10.6% premium to NAV per share from the market at a price of $16.61, much higher than the 1% discount to NAV in the BDC industry. It’s also higher on a P/S ratio.

Hidden Dividend Stocks Plus

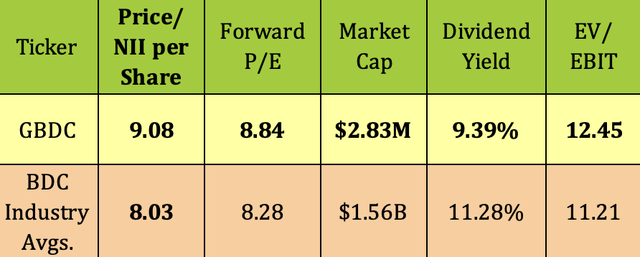

GBDC’s earnings multiples (both past and future) are higher than the industry average, as is its EV/EBIT. Its underlying dividend yield is below average.

Hidden Dividend Stocks Plus

Parting thoughts:

Golub Capital BDC is trading about 1% below its 52-week high. Clearly, Mr. Market is pleased with the merger, lower incentive fees, and record earnings. We’re going to wait for Mr. Market’s next irrational hiss before trying to acquire Golub Capital BDC stock at a lower valuation.

All tables provided by Hidden Dividend Stocks Plus unless otherwise stated