summer

Axos Financial Corporation (NYSE:AX), founded in 1999 and headquartered in Las Vegas, Nevada, is a diversified financial services company that provides consumer and business banking products nationwide.

From rapid business growth to broad prospects As well as a strong solvency/liquidity position, there’s a lot to like here. But the current price seals the deal and makes it a good opportunity that investors may want to pay attention to.

Business & Portfolio

Axos is a relatively small institution, with assets of $21.6 billion, deposits of $18.2 billion, loans of $18.2 billion, and a market capitalization of $2.95 billion.

Its main source of revenue comes from its loan portfolio, which accounted for 69% of total revenue as of last quarter. Additionally, 75.8% of the portfolio consists of commercial loans, with real estate loans accounting for 77.74% of this segment.

The renewable energy portfolio spans the country, with underlying assets located in California, New York, Florida, New Jersey, Arizona, Washington, D.C., Texas, Georgia and Illinois, among others. However, you should note that 41.3% of renewable energy loans are backed by assets in California, 25.2% in New York, and 8% in Florida, making these states key markets.

Management is now particularly committed to delivering value to shareholders by setting quantifiable business goals: maintain an ROE ratio of 17% or higher, achieve annual interest-earning asset growth of 12% or higher, and maintain an annualized return of 40% Efficiency bank level % or less.

Some investors may be reluctant to appreciate a bank with such a large renewable energy business. But although in the last quarter’s report, about 64% of the loans were floating rate and 28% were hybrid ARMs, which may mean higher risk, its weighted average LTV ratio was 48.9%, indicating a larger safety margin.

Performance

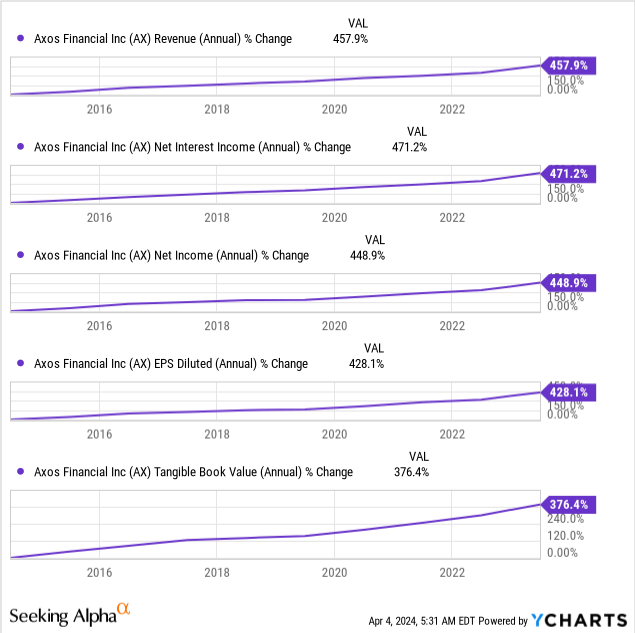

Looking first at the long-term performance, the rate at which the business is growing appears to be staggering:

In the past ten years, deposits have experienced double-digit growth almost every year; the following is the annual growth rate of deposits in each year:

Seeking Alpha

However, you should know that the company has been acquiring deposits and other businesses in the past to achieve this growth.

Additionally, its loan portfolio follows:

Seeking Alpha

Let’s move on to the last reported quarterly results (December quarter); growth expressed as a percentage refers to year-over-year changes unless otherwise noted.

First, the loan portfolio yield increased to 8.18% from 6.62% last year. In addition, the net interest margin dropped slightly from 3.64% to 3.58%, indicating moderate liability sensitivity. However, the net interest margin increased from 4.49% to 4.55%; I need to add that based on what I typically see at banks now, the margins are not even that high.

In terms of profitability, interest income increased to US$394.6 million, a growth of 41.15%, and net interest income increased to US$215.1 million, a growth of 9.24%.

For the following items, keep in mind that I excluded the bank’s acquisition of the FDIC loan portfolio because the purchase contributed $92.4 million in noninterest income, net income, and earnings per share from the transaction, and I want to provide near-term clarity Condition operate Performance.

Non-interest income reached $31.7 million, an increase of 12%. While net profit fell 27.2% to $59.4 million, earnings per share increased to $1.56, a change of 15.7%.

Finally we look at some key metrics. The efficiency ratio dropped from 46.29% to 30.96%; lower than the target set by management. Additionally, tangible book value grew 25% to $33.45 per share. Last year ROA climbed from 1.77% to 2.9%, and ROE rose from 18.71% to 30.39%; this time it is much higher than management’s target.

As for capital allocation, the company repurchased approximately $59 million worth of stock last quarter, an acceleration from the $24 million it repurchased in the previous quarter. Overall, the average cost of the buybacks was $36.49 per share, and the shares represented 2.8% of shares outstanding as of the end of 2023. Management made it clear that the recent buybacks were an attempt to “take advantage of an unreasonable decline in the stock price.”

Appearance

Before we continue, let me briefly mention something about the short-term future. First, per the last earnings call, management expects its loan portfolio to achieve high single-digit to low double-digit year-over-year organic growth in the coming quarters.

Now, purchasing two commercial renewable energy loan pools from the FDIC has some important implications worth considering. First, the unpaid principal balance of these pools totaled approximately $1.25 billion, with Axos paying 63% of face amount.

Second, management expects its net interest margin to widen further, even based on the assumption that no prepayments will occur and the loans will not be sold before maturity. The reason it makes its first assumption (further beyond its control) is that these are fixed-rate loans with interest rates below current market rates; in other words, there may be no incentive to refinance for some time. As a result, management forecasts margin expansion of 40-50 basis points over the next four to six quarters from the target of 4.25-4.35 basis points.

However, keep in mind that management expects its loan portfolio to grow at a good rate ($500 million to $700 million per quarter, to be precise) organically. This means that the contribution of FDIC loans to profit growth will diminish over time. This weakness may be partially offset by prepayments, resulting in the recognition of the remaining coupon discount. However, I think it’s unlikely that interest rates will fall fast enough to increase the likelihood of refinancing. Therefore, I believe the net interest margin improvement from FDIC purchases is short-term.

Regardless, NIM prospects look very good for Axos. Speaking of interest rates falling, as I’ve already mentioned, 28% of the loan portfolio consists of hybrid ARMs. Now, 16% of these are repricing within a year, 18% are repricing within 2 years, and 18% are repricing during 2026. Therefore, as interest rates fall over the next few years, the decline in overall loan portfolio yields will be largely offset by ARM repricing. In addition, deposit rates will also be repriced, so a significant compression of net interest margins seems unlikely. Axos has an advantage here for two reasons: 1) deposits with interest rates tied to the federal funds rate account for 16% of the total base, so they can be repriced more quickly; 2) 90% of consumer deposits are non-maturity deposits, So there is more flexibility to lower their rates.

Solvency and Liquidity

When it comes to its solvency and liquidity, Axos’ metrics suggest they are both very strong. As of the last quarter’s report, the institution was “well capitalized” under the Basel III framework, with its Tier 1 leverage ratio of 9.39%, up from 9.06% in the same period last year and well above the 5% requirement. The common equity Tier 1 leverage ratio was 9.39%. The capital adequacy rate is 10.97%, higher than the 10.55% in the same period last year, far exceeding the minimum supervision requirement of 6.5%; the total capital rate is 13.79%, higher than the 13.49% in the same period last year, exceeding the 10% requirement.

The strong capital position is accompanied by very low capital costs, with a weighted average cost of total deposits of 3.64% over the past 10 quarters and a wholesale cost of funds of 3.78%. Notably, interest-bearing deposits make up the majority of the base at 84.4%, which makes the low cost even more impressive.

While the LDR is 100%, the above CET1 capital ratio reflects ample liquidity and therefore a margin of safety in the event of accelerated withdrawals during an economic downturn.

Finally, the loan portfolio does not appear to raise any major credit risk red flags. Special mention loans and substandard loans accounted for 1.15% and 1.67% of the total loans respectively, and there were zero doubtful loans. In addition, non-performing loans increased only slightly year-on-year, from 0.61% to 0.65%. The reserve coverage ratio did increase from 1% in the same period last year to 1.33%, but the net write-off rate fell to 0.02% from 0.05% in the same period last year.

Valuation

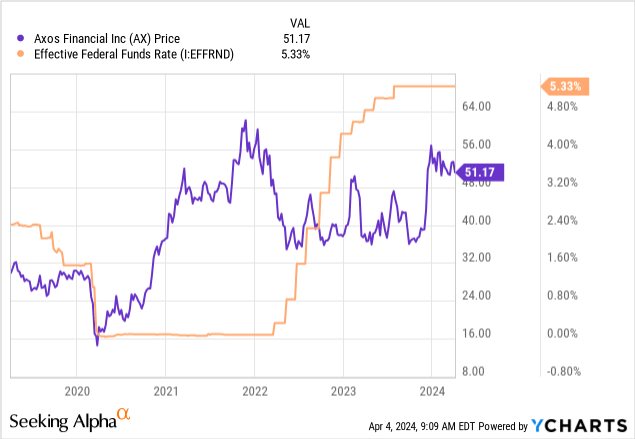

Now comes the fun part. The price of AX did not drop significantly after the Fed raised interest rates in 2022, as you can see:

One could argue that the market recognizes that rising interest rates are not negatively impacting the overall business, as we observed above. Although many stocks staged a modest partial recovery when markets regained confidence in late 2023 (likely reflecting the expected lower federal funds rate in 2024), AX recouped most of the cap losses incurred in 2022.

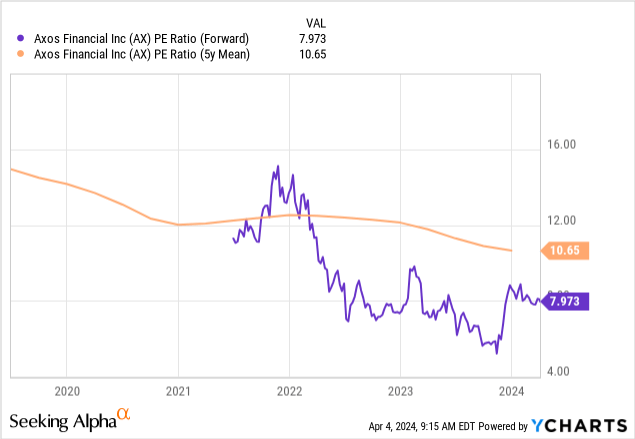

But here’s the thing. This price support isn’t enough to keep the business at least reasonably valued. The forward P/E ratio is lower than the 5-year average P/E ratio:

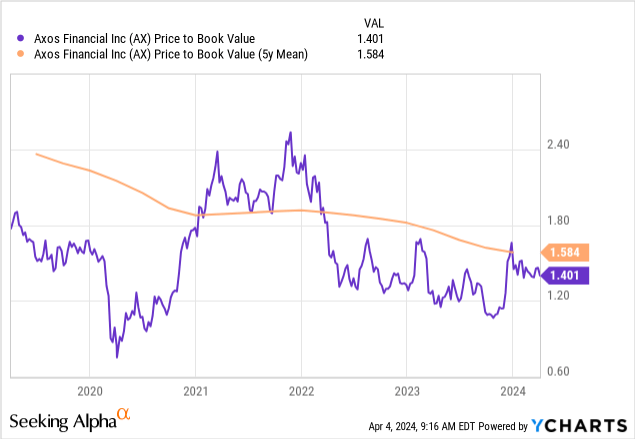

Likewise, the book value premium is below the 5-year average:

The question investors need to ask at this time is: Is the stock worth being valued at this multiple? In my view, that’s not the case, and regardless of value, I generally prefer banks that trade below tangible book value when the market exaggerates certain risks. So, this is a rare case for me.

Firstly, if you consider the 12.5% yield, the current price-to-earnings ratio reflects very good value. Additionally, consider the company’s long-term earnings per share growth rate to understand how shareholders might be better off buying at the current price. Furthermore, the 5-year average P/E ratio suggests upside potential of approximately 18%. As for the 40% premium to book value, this is justified by the quality of management shown in performance over the years. Similar to the P/E ratio, you also have to consider that book value per share has also grown significantly over the past decade. While a margin of safety can be established in a well-capitalized, liquid business, over time shareholders may also develop a more specific margin of safety with a cost basis of approximately $50 per share (current price levels) .

risk

That being said, there are some risks you should be aware of. First, the bank’s loan portfolio is heavily exposed to commercial real estate in New York. While its risk management may be tightly disciplined, this is often overlooked when sentiment toward a particular market is negative. That seems to be the case these days.

Additionally, investors should keep in mind that AX does not pay a dividend, so if the price remains about the same over the long term, there will be no offsetting factors to reduce the severity of the opportunity cost.

In addition to this, you should also keep in mind some general risks that can affect a company’s profits, such as credit risk, interest rate risk, regulatory risk and macroeconomic risk. I say “more generally” because the credit quality and outlook here look solid.

judgment

To sum up, AX is a purchase at current prices. It’s a well-managed, liquid, and profitable business. In addition to the already high net interest margin, the short-term outlook also appears very optimistic.

What do you think? Do you own or plan to own this stock? If I may ask, what is your cost basis? Please let me know below and I will get back to you as soon as possible. Thank you for reading.