Alexei Lesk

notes:

I cover Grindrod Shipping Holdings Ltd. (NASDAQ:NASDAQ: GRIN) previously, so investors should consider this an update from me Earlier articles About the company.

Grindrod Shipping Holdings Ltd. or “Grindrod Shipping” is a mid-sized dry bulk shipping company that focuses on smaller, well-equipped dry bulk shipping companies. Ship category.

At the end of 2022, major shareholder Taylor Maritime Investments Limited (OTCPK: TMILF) or “Taylor Maritime” launched a cash tender offer The total value per common share is $26.

Although Taylor Maritime managed to accumulate an 83.23% stake in Grindrod Shipping, the company failed to meet the 90% mandatory takeover threshold required to subsequently squeeze out remaining shareholders.

Taylor Marine and Grindrod Shipping have been working over the past year to reduce debt levels and consolidate the business under the leadership of Taylor Marine founder Edward Buttery.

After Thursday’s regular meeting, Taylor maritime roll out New efforts to achieve 100% ownership of Grindrod Shipping (emphasis added by author):

The Board of Directors of Taylor Maritime Investments Limited (“TMI” or the “Company”), a listed specialist dry bulk shipping investment company, is pleased to announce that its subsidiary, Grindrod Shipping Holdings Ltd. (“Grindrod”) announced today Recommended implementation of selective capital reduction activities (“Selective Capital Reduction”) pursuant to sections 78G to 78I of the Companies Act 1967 of Singapore.

Pursuant to the selective capital reduction, Grindrod intends to cancel all shares held by its shareholders except for the 3,479,225 shares held by Good Falkirk (MI) Limited (“Good Falkirk”). Good Falkirk is a wholly-owned subsidiary of the Company, through which the Company currently holds the existing equity interest in Grindrod.

Subject to the implementation of an optional capital reduction and meeting certain conditions described below, each participating Grindrod shareholder will receive $14.25 for each canceled Grindrod share.

Selective capital reductions must be approved by special resolution at an extraordinary general meeting of Grindrod shareholders. The Company, Good Falkirk and their respective parties acting in concert will abstain from voting on the special resolution in relation to the selective capital reduction. (…)

If the selective capital reduction is successfully completed, Grindrod will become a wholly-owned subsidiary of the Company.

In layman’s terms:

Grindrod Shipping offered to acquire the minority shareholders’ shares for $14.25 in cash per common share.

Unsurprisingly, the news sent the company’s shares up 30% on Friday, with trading volume well above average:

Yahoo Finance

However, approval will not be an easy task as controlling shareholder Taylor Marine is not allowed to vote on the proposal, especially with Singapore law setting high hurdles.

More precisely, shareholders will have the opportunity to vote on the proposed selective capital reduction plan at an extraordinary general meeting. At the meeting, a special resolution supporting the proposal must be passed by minority shareholders, but this requires approval by at least 75% of the total number of shares voted by shareholders present and voting at the meeting.

Passing the required special resolution may be an uphill battle, however, as the company is currently only offering $14.25 per share to shareholders who decided against a $26.00 per share cash tender offer in late 2022.

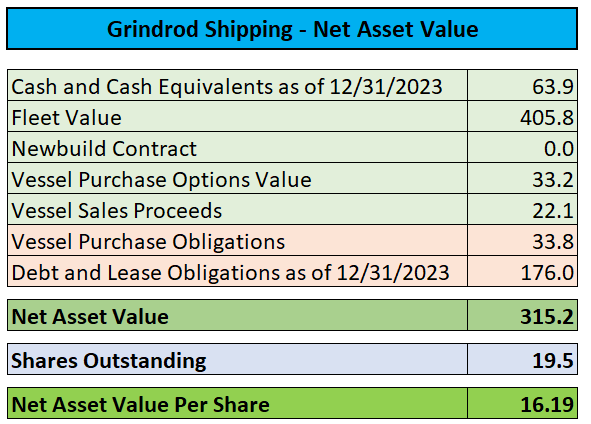

Furthermore, based on my calculations, the offer represents an approximate 12% discount to the estimated net asset value (“NAV”):

Supervision Filing/Advantages of Value Investors

Granted, there may have been some movement in the shareholder base since Taylor Marine’s tender offer expired at the end of 2022, but given the stock’s meager average trading volume, it’s fair to assume that most shareholders have held on to their shares.

With this question in mind, reaching the 75% threshold looks like a tall order, and as far as I’m concerned, I wouldn’t be surprised if Grindrod Shipping falls well below the required volume.

With approval pending and the share price only 4% below the proposed acquisition price, I strongly recommend investors consider selling their shares on the open market next week to avoid the possibility of the share price giving up all of Thursday’s gains if the special resolution fails to pass. risk. The unscheduled extraordinary general meeting of shareholders will not be held for the time being.

bottom line

It seems unlikely, at least to me, that Taylor Maritime will renew its efforts to achieve 100% ownership of Grindrod Shipping.

However, with the shares trading slightly below the proposed acquisition price, Grindrod Shipping shareholders should consider selling their shares on the open market and moving forward to avoid the risk of the share price giving back all of Thursday’s gains if the acquisition proposal is not approved. The upcoming extraordinary general meeting of shareholders.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.