Eetum/iStock via Getty Images

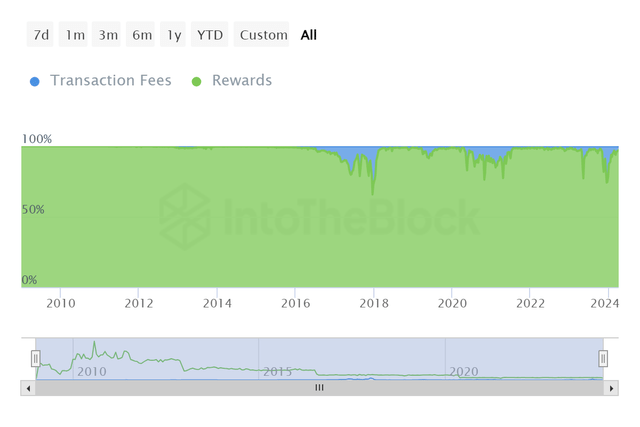

When I last reported on marathon numbers (NASDAQ:MARA) In December’s Seeking Alpha, the Bitcoin (BTC-USD) network’s transaction fees as a percentage of total block rewards rose sharply.Potential long-term stickiness Transaction fees would be very beneficial for BTC miners like Marathon as it would minimize the impact of the emissions halving – which is about two weeks away from article submission.

Miner reward distribution (Enter the block)

In the months since that article was published, transaction fees have failed to reach the level of excitement surrounding Q4 2023. While we could theoretically see transaction fees pick up in the future, I suspect the more BTC that flows into spot ETFs, the less likely this will be. The end result may be. Therefore, I provide an update.We will examine its forward guidance based on the company’s most recent report, Q1’24 production data, and assess whether Regardless, MARA is a fundamental acquisition valued at $5 billion.

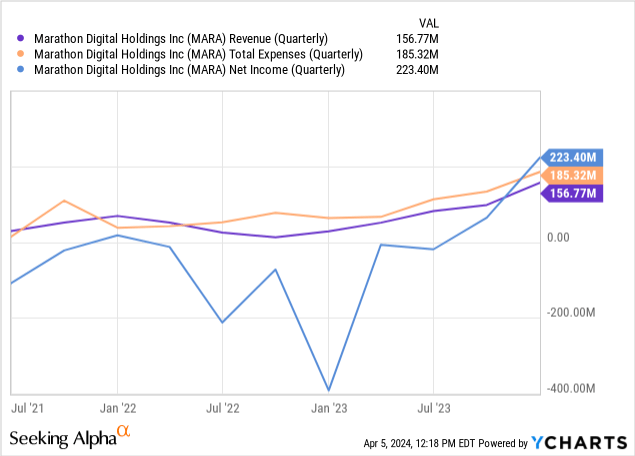

2023 4Q results

In the final quarter of 2023, Marathon Digital’s quarterly revenue was $156.8 million, while total expenses were $185.3 million.What jumps off the page can be scary positive Quarterly net profit exceeded US$200 million. How can this happen if expenses exceed sales? Chief Financial Officer Salman Khan said during the last conference call:

If the company does not adopt the new FASB fair value accounting rules early, our net income attributable to common shareholders in the fourth quarter of 2023 will be a net loss of $5 million, or a diluted loss of $0.02 per share. Net income for the year ended December 31, 2023 was $33 million, or $0.17 per diluted share.

For the full year, MARA produced 12,853 Bitcoins, and its Bitcoin vault increased by 2,942 Bitcoins compared to the same period last year. From a production cost perspective, MARA’s breakeven price in Q4 was significantly higher, based on my own estimates. But the company’s production costs have actually been much better than most others in the industry over the past twelve months.

| Q1-23 | Q2-23 | Q3-23 | Q4-23 | TTTM | |

|---|---|---|---|---|---|

| revenue cost | $33,400,000 | US$55,200,000 | $59,600,000 | $75,100,000 | US$223,300,000 |

| Adjusted operating expenses | $21,600,000 | $42,800,000 | $53,900,000 | US$110,300,000 | US$228,600,000 |

| Mining Bitcoin | 2,195 | 2,926 | 3,490 | 4,242 | 12,853 |

| breakeven price | $25,057 USD | $33,493 | $32,521 | $43,706 | $35,159 |

Source: Seeking Alpha, Marathon Digital, author’s calculations

I do want to mention that these break-even numbers are not meant to be taken as gospel, they are simply an outside estimate that can be applied equally to all companies in the space to gauge efficiency over time among peers. If we strip out FASB’s accounting changes and combine cost of revenue, SG&A, and depreciation/amortization to establish an immediate breakeven Bitcoin price for MARA, then divide that number by the number of BTC the company produces each quarter, we get $43.7 Marathon Digital’s profit-and-loss BTC price in the fourth quarter was US$35,100, and the BTC price for the full year of 2023 was US$35,100.

Current status and future guidance

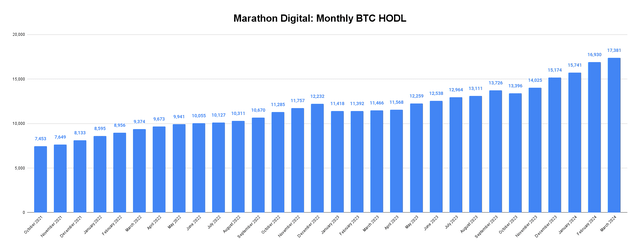

Author’s chart (marathon numbers)

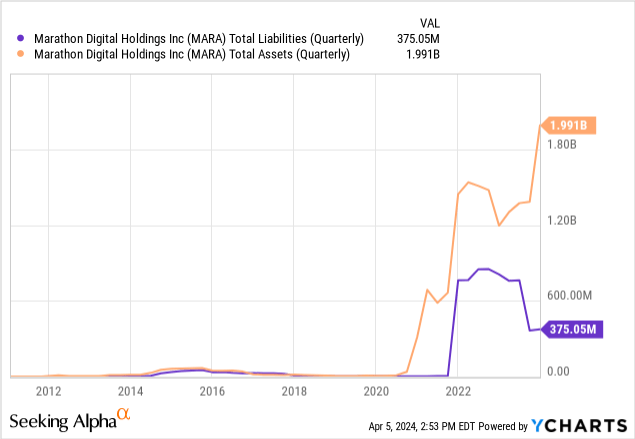

As of the end of March, Marathon Digital had 17,381 BTC on its balance sheet. At a token price of $68,000, MARA has nearly $1.2 billion in liquidity from BTC alone. After the crypto winter, the company is in much better financial shape than it was a year ago. Over the past few quarters, Marathon Digital has done a good job of growing assets and lowering debt:

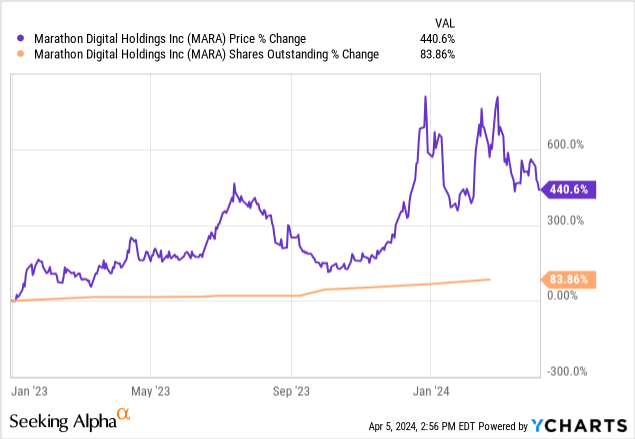

Much of this asset growth has come at the expense of shareholder dilution, but with the price of MARA stock up more than 400% since the end of 2022, anyone who bought capitulated shares in December of that year has significantly outperformed them since then Dilution since:

During the call, CEO Fred Thiel mentioned how different the miner setup is today compared to a year ago, when BTC was trading below $25,000 per coin and the company had more debt than liquidity:

We have $1 billion of liquidity on our balance sheet and have reduced debt by more than $411 million while saving shareholders $100 billion, bringing net debt to $331 million.

Marathon’s balance sheet results are certainly impressive. Thiel went on to mention that the company plans to control about half of the total computing power, and we’ve already seen some of these dominoes fall, with Marathon recently agreeing to purchase Applied Digital’s (APLD) data center in Garden City, Texas, for $100 .$87 million. MARA has historically used APLD for Bitcoin mining hosting services. According to Marathon, the deal will reduce mining costs at the site by 20%.

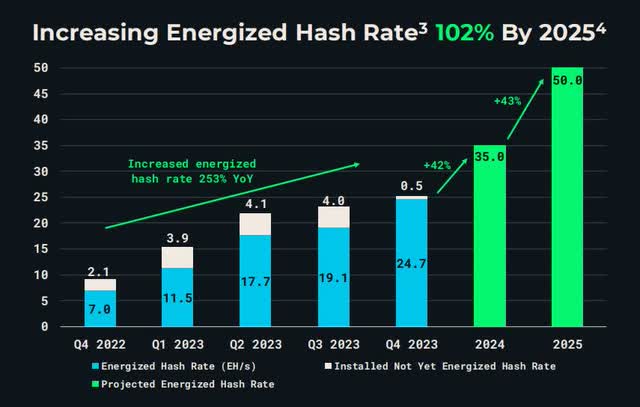

Investor Platform, Slide 3 (marathon growth)

Looking ahead, Marathon Digital is targeting substantial growth for Exahash from the remainder of this year through 2025. By the end of this year, Exahash will grow 42% faster than at the end of 2023. By 2025, the speed will reach 50 EH/s. Year-end levels doubled. Thiel mentioned that it’s possible that this timeline could be accelerated if given the opportunity; this likely refers to post-halving consolidation, which occurs when weaker mining rigs exit and shut down their machines.

first season production

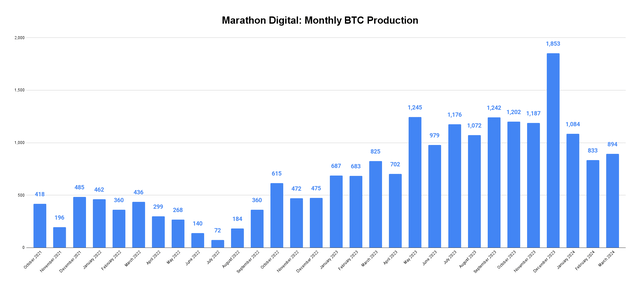

Author’s chart (marathon numbers)

While production metrics have been excellent for most of 2023, the first quarter has not been particularly good for MARA from a total BTC mining volume perspective and an efficiency perspective. After mining at least 1,000 BTC for seven consecutive months from July to January, Marathon mined an average of just 864 BTC in February and March. Although production increased year-on-year in the first quarter, the price of growth is the long-term sacrifice of BTC per EH/s efficiency:

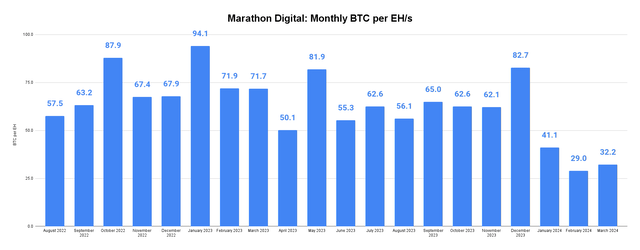

Author’s chart (marathon numbers)

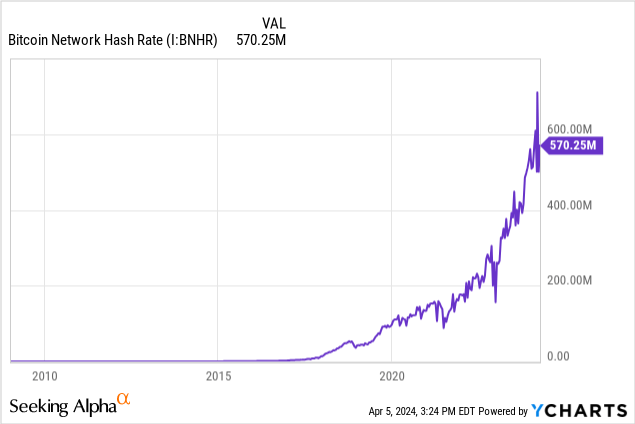

Marathon’s BTC per EH/s numbers have been on a general downward trend for over a year, illustrating the fundamental problem with everyone in the industry chasing share gains from the shrinking nominal BTC pie:

It might be appropriate to call the Bitcoin network a global hash parabola. Companies like MARA hope to increase their share of global computing power relative to their peers. The company has achieved this goal in consecutive quarters so far. But even assuming Marathon can achieve its scaling goals, the block reward halving later this month is a major long-term headwind.

Already priced to perfection?

If we take MARA’s end-2024 EH/s guidance and calculate the annualized revenue we can reasonably expect in a post-halving environment, at a BTC price of $100,000 we could earn $1.1 billion from mining Annual income:

| bitcoin price | 30 hours/second | 35 hours/second |

|---|---|---|

| $60,000 | US$587,520,000 | $685,440,000 |

| $70,000 | US$685,440,000 | US$799,680,000 |

| $80,000 | US$783,360,000 | $913,920,000 |

| $90,000 | US$881,280,000 | US$1,028,160,000 |

| $100,000 | $979,200,000 | US$1,142,400,000 |

| $150,000 | US$1,468,800,000 | US$1,713,600,000 |

| $200,000 | US$1,958,400,000 | US$2,284,800,000 |

| $250,000 | US$2,448,000,000 | US$2,856,000,000 |

Source: Author’s calculations

This calculation makes some assumptions about efficiency and production after the halving. Specifically, I used the trailing 12-month weighted average monthly EH/s of 54.4 and trimmed it to 27.2 as my estimate of BTC per EH/s post-halving. This obviously does not take into account changes in global hashrate or Marathon’s share of global hashrate. But at 30 EH/s, MARA will mine 816 BTC after the halving. At 35 EH/s, their speed is 952. Like the breakeven price earlier in this article, think of this more as an envelope estimate than a forecast.

Regardless, following this approach, MARA stock is already trading at about 3x forward sales to the $150,000 BTC price, or more than double today’s Bitcoin price. The median forward price-to-sales ratio for the information technology industry is 2.9. This estimate also assumes Marathon Digital sells products after the halving, which history suggests the company typically does not do.

Other considerations

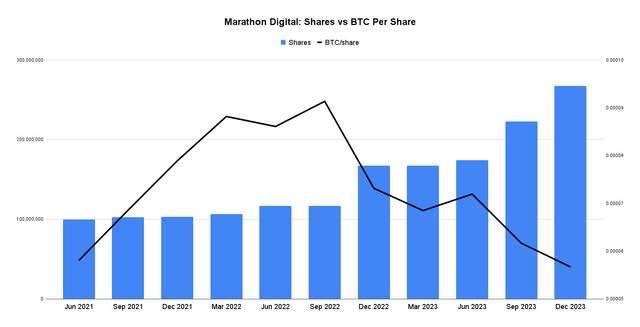

I’ve been writing about Bitcoin miners for Seeking Alpha for nearly two years. During that time, it has been clear to me that I personally do not believe that BTC mining companies are great long-term investments. I think they are really great for traders, so I still own some MARA stock. But if you buy MARA for BTC stacking, your equity may continue to be diluted over time:

Author’s chart (Seeking Alpha, Marathon Numbers)

In the chart above, I show the trend of quarterly shares outstanding and BTC per MARA share over the last three years. Over the past five quarters, MARA shareholders’ BTC per share has almost halved. This is not to say that MARA is necessarily a bad BTC proxy bet, but simply to point out that each investor should be mindful of their personal goals.

Important points for investors

If you are trying to optimize volatility trading and have a company with a revenue stream denominated in BTC, then MARA is perfect for you. You just have to be prepared for volatility. However, if you simply want to increase your exposure to BTC, the newly approved spot ETFs may be a better long-term option. I personally still hold MARA stock because I think some of the longer-term targets are actually quite interesting; particularly the wasted heat and trapped gas opportunities. But these are currently highly speculative.

In terms of the merits of the underlying business right now, I think the spot ETF better expresses the $150,000 BTC thesis than the $19 MARA. This might change my situation if transaction fees make a comeback. But the more BTC the ETF managers absorb, the fewer active addresses on the chain I expect to pay fees.