Wavebreakmedia/iStock via Getty Images

Previous papers

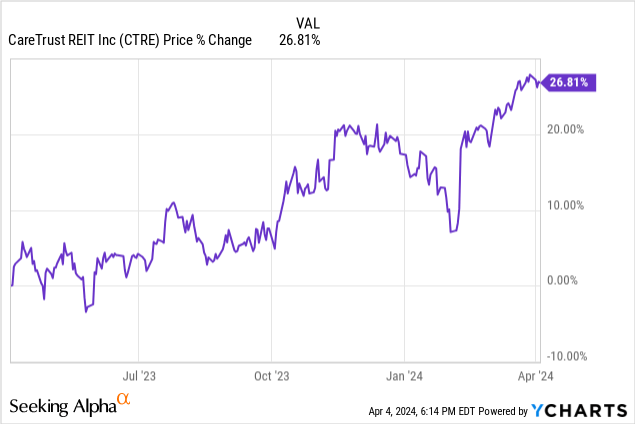

I last covered CareTrust REIT (NYSE: CTRE) back in November on Seeking Alpha.I think this stock is a safer alternative to another healthcare REIT, which is the most popular Dividend Investors, Omega Healthcare Investors (Oy). Since CTRE rose nearly 20% after that article was published, investors who bought during that time enjoyed some nice capital gains.

I also talked about the company’s opportunities to grow through expected future revenue growth in the healthcare industry. I discussed their stable cash flows and dividend growth, which make REITs very attractive in the first place.

Seven months later, the company continues to perform strongly amid a challenging macro environment, particularly for the real estate investment trust industry (XLRE).I’ll highlight the company’s strong acquisitions Their recent results will drive strong revenue and earnings growth going forward. In the long run, the aging baby boomer population will benefit CTRE and its peers.

brief overview

Before we get into what makes Care Trust REIT so attractive, let’s talk about the company’s business. CTRE is a healthcare REIT similar to peers Omega Healthcare Investors and Medical Properties Trust (MPW).They specialize in medical real estate, acquiring skilled nursing facilities, and assisted and independent living facilities throughout the United States

Most of their holdings are concentrated in the two most populous states: California and Texas. As of the end of 2023, CTRE owned 207 properties in 25 states and 23 different operators. Some of their tenants you may have heard of: Ensign Group, Providence Group, Cascadia Healthcare and Bayshire Senior Communities Just to name a few.

CTRE Investor Introduction

Long-term performance compared to peers

Because they pay a dividend yield close to 5%, Well! Just kidding, but that’s part of what makes REITs so attractive, and we’ll talk more about that later. Now let’s talk about the performance of REITs in the current macro environment. Over the past year, while many of its peers have been decimated, CareTrust REIT has held on and performed exceptionally well, rising nearly 27%.

Meanwhile, popular peers like Realty Income (O) and VICI Properties (VICI) both fell by double digits. Compared to Omega Healthcare Investors and Sabra Healthcare REIT (SBRA), the former lags slightly behind SBRA. As there is uncertainty about the economy, healthcare REITs and stocks have performed quite well while their peers in other sectors have underperformed.

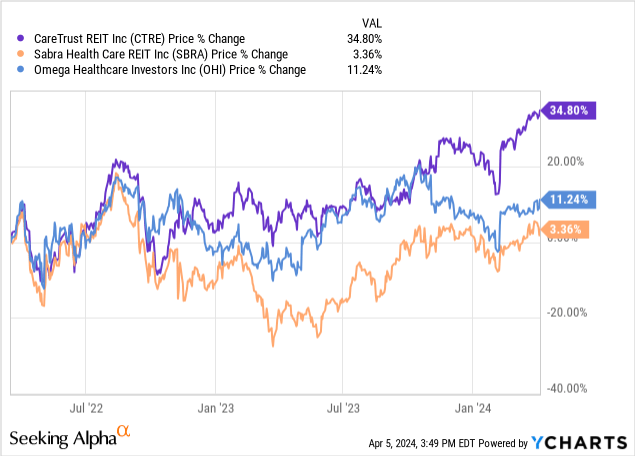

But as a long-term investor, further evaluating a company’s performance can give you a clearer picture of its fundamentals and overall business. Although it’s important to remember that past performance is not predictive of future performance. But looking at the chart below, you can see that CareTrust REIT is the only healthcare REIT to post a profit compared to the two. This also explains the recent pandemic, when many healthcare companies faced a lot of turmoil and headwinds.

Seeking Alpha

If you look at the 5-year total returns, the REIT once again outperformed its peers, returning 36.29%, while SBRA returned 11.50% and OHI returned 26.50% during the same period. In my opinion, this is a testament not only to their management team, but to the fact that they are making strong acquisitions at a very attractive blended yield of almost 10%! while maintaining a healthy balance sheet.

Although the rental ladder in the healthcare sector is more attractive at 2.5%, which is higher than the REIT average of 1% to 2%, CTRE has made new investments at higher yields, while SBRA and OHI have yields of approx. is 9%. In addition, this also led to double-digit growth in rental income, and normalized FFO increased by $3 million year-over-year to $149.6 million.

Seeking Alpha

Dividend safety

As a dividend investor and someone heavily invested in REITs, dividend safety is always my primary concern. REITs are viewed by many as a bond alternative, but they do provide a period of outperformance but, most importantly, a steady, reliable income stream.

The company recently raised its dividend by 4% to $0.29, making it the REIT’s ninth consecutive year of dividend increases. This also exceeded my expectations for management to be extra cautious and raise half a cent. But it’s even better for shareholders. In its fourth-quarter earnings report in February, the dividend was fully covered by FFO of $0.36. This is an increase of $0.01 from the previous three quarters, when FFO was flat at $0.35. But it did increase by $0.02 from the same period last year.

Their revenue also grew from the previous quarter to $55.78 million, exceeding expectations by $1.09 million. Annual growth is double digits at 17%, which is impressive considering the challenges REITs and many businesses face.

CTRE’s full-year FFO was $1.41 and dividends were paid out at $1.12, giving the REIT a safe payout ratio of about 80%. Leveraging their outstanding shares of 106.1 million and funds available for distributions of $156.8 million, this brings their payout ratio even lower to 76%, giving them room to increase their dividend further in the foreseeable future. Management expects this price to be between $1.47 and $1.49 in 2024.

For those unfamiliar with allocable funds or FAD, which is similar to what many people know as Adjusted Funds from Operations, or AFFO. FAD considers items such as straight-line rent, non-cash items, and recurring expenses related to real estate. Simply put, this number is used to measure a REIT’s real cash, or adjusted cash flow.

Low leverage balance sheet

As a REIT investor, especially in this high interest rate environment, REITs’ strong balance sheets are critical as they use debt to fund growth. By the end of 2023, CTRE’s leverage ratio is very low, only 1.4x! This is down from 3.7x at the end of 2022. Even better, their fixed charge coverage ratio is 7x. By comparison, Omega Health Investors has net debt to adjusted EBITDA of 5.0x and fixed charge coverage of 3.8x.

In addition, their debt maturities are staggered, with none having maturities longer than two years. Even so, if they choose not to issue any stock, the company can use the $300 million in cash on hand to meet this requirement without issuing any stock.

CTRE Investor Introduction

Additionally, they increased liquidity to $600 million, the highest level in the company’s history. I’m not sure about you, but that tells me that the company is preparing to make some acquisitions, and management talked about that in the fourth quarter and said they expect 2024 to be a strong year for investment. I wouldn’t be surprised if CTRE gets an upgrade to investment grade status, as they have a BB+ rating from Fitch.

Acquisitions grow strongly

Speaking of acquisitions, CTRE impressively made $288 million worth of new investments, resulting in a combined yield of 9.8%. That momentum continued in the new year as the real estate investment trust purchased three continuing care communities in California for $60 million. Last month they also purchased three nursing facilities in Texas and Missouri.

This will likely increase FFO and its rental income growth in 2024. Management issued guidance of $1.43 to $1.45. While that’s not strong compared to the $1.41 they bring in by the end of 2023, I would expect them to move their guidance to the right over time, probably in Q2 or Q3.

Revenue is expected to grow about 3% to 4% by the end of the year, but if the company continues to make strong acquisitions, both revenue and FFO could see stronger growth going forward.In addition, the aging baby boomer population May increase by 75% Demand for care will increase through 2030, which could benefit companies like CareTrust REIT.

Valuation

CareTrust REIT currently trades at a P/FFO ratio of 17.1x, which is higher than the 5-year average of 15x and the industry median of 12.5x. But looking at their strong acquisitions and fundamentals, I think the stock has further upside and may continue its upward trajectory as they make acquisitions at more attractive spreads than their peers. Omega Health Investors’ distributable funds also declined year-over-year, with its payout ratio rising above 100%, while Sabra Health REIT’s revenue declined year-over-year.

For comparison purposes, they also trade at a premium to peers OHI and SBRA of 11.19x and 10.86x respectively, possibly for the reasons mentioned above, as the market may have priced this in, making CTRE’s current P/FFO even higher. high.

Additionally, as mentioned previously, REITs have outperformed other REITs in both price and total returns over the past one and five years, and as such, they command higher premiums and price targets as they continue to outperform showed resilience, while peers’ financial conditions declined during this period. Challenging economic backdrop. The stock has significantly outperformed both of these companies since interest rate hikes began about two years ago, and I think CTRE shares approaching $30 are within reach.

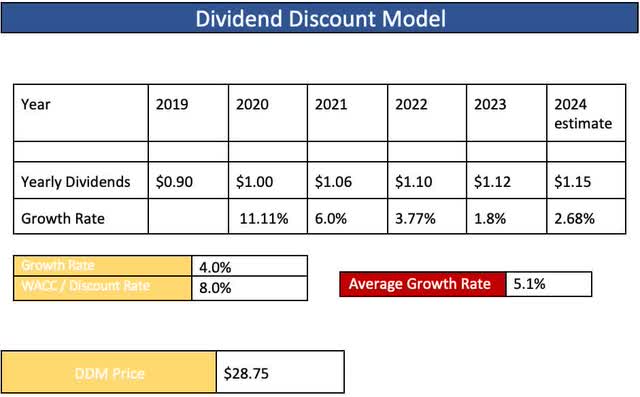

Using the dividend discount model, my price target is nearly $29 per share. In my last paper, I set a price target of $22.80, which was slightly higher than the analyst price target of $22.17 at the time. But the stock continues to perform strongly and continues to move higher, causing me and the Street to move our price targets to the right. There is approximately 19% upside potential from the current price of approximately $24.

AuthorDDM

I decided to manage expectations using a growth rate below the 5-year average of 5.1%. My typical WACC for REITs is 8%, which is slightly above the lower end of the S&P’s historical average return of 7% – 10%.

For certain dividend stocks, many people may prefer to use the DCF model or DDM to value them. Also, either way works, but for REITs, I prefer the latter because REITs’ cash flows can be unpredictable due to the unpredictable ability of their tenants to pay rent.

Dissertation Risks

CareTrust REIT appears to be firing on all cylinders in terms of acquisitions, liquidity levels, and healthy debt. But if interest rates remain elevated for an extended period, the company could face financial pressure from carriers, similar to fellow medical property trusts. Although three interest rate cuts are still expected and inflation remains higher than expected, the Fed may decide to keep interest rates unchanged for the remainder of 2024.

If future data shows that inflation is accelerating in the coming months, there is also the possibility of another interest rate hike to deal with this problem. This could result in CTRE extending loans to distressed tenants, which would impact the acquisition and its future financial position. Their occupancy rates may also take a hit if there is a sudden downturn in the economy, such as a recession. CTRE tenants are still returning to pre-pandemic levels, as the numbers have declined slightly over the past 4 years.

bottom line

CareTrust REIT has performed exceptionally well over the past year, while the stock prices of many of its REIT peers continue to struggle. They even outperform their healthcare peers on price and total return, which is a testament not only to their high quality, but also to their management team.

Additionally, the company has improved liquidity while managing to reduce leverage levels, putting them in a financially strong position to make accretive acquisitions to continue growing their portfolio. The dividend payout ratio is also safe, and although dividend growth has slowed in recent years, I expect it to continue for the foreseeable future. I continue to give CareTrust REIT a Buy rating due to its staggered debt maturities, ample liquidity, and upside potential.