Luis Alvarez/DigitalVision via Getty Images

VIP room(NYSE: DLX) performed reasonably well, but we felt it was hanging a bit on the edge. Most of its debt is locked in at current interest rates.The interest won’t be much higher, but what? profit? We’re concerned about coverage because some of Deluxe’s most profitable businesses are in controlled decline, or at least unlikely to generate incremental growth. This is a balance sheet issue. Deluxe’s assets are even decent, but leverage is a very serious issue and everything points to higher for longer.Follow up on our last report Focus on debtAt present, the situation seems to be under control, but it is also relatively unstable. Since the leverage is quite extreme, the valuation discussion is moot. The debt position should be shareholders’ biggest concern right now.

benefit

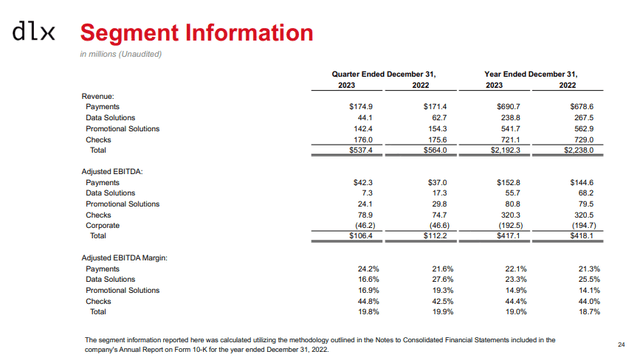

Segmented data (Season 4 News)

The segment information above is worth taking a look at, especially the adjusted EBITDA. There were a variety of inorganic impacts, primarily divestitures, that exaggerated declines in certain segments on an overall revenue basis.

Data Solutions looked bad on its fourth-quarter results, but not on its fiscal year results, which boils down to the presence of a revenue pull effect. This is highly unusual and does look like a modest revenue pull compared to last year’s quarters where EBITDA was completely flat. Data Solutions’ overall EBITDA grew year over year. The issue in the first half was more about adjusted EBITDA. So when you annualize the second-half results, the results aren’t actually that bad.

Payments look pretty solid. Organic growth is actually ahead of overall growth due to some divestitures. Their business services business is doing very well and is an excellent, high-value business that they acquired at a great price when they acquired First American. Overall, this is an impeccable segment that should continue to grow, assuming no significant recessionary pressure on U.S. consumer spending.

On the leverage question, we want to focus on those segments that have been declining for a long time, which is promotions and checks. Both are printing businesses, the former business cards and printed forms, the latter a long-term decline but still important form of payment. Checks are a luxury cash cow. Promotional activity was up slightly despite lower revenue due to strategic efforts to create a positive mix effect and deflation in certain merchandise inputs. The check exceeded expectations, but expectations were down. Things were managed so well that profits and revenue actually increased in the fourth quarter, which was a little unusual but attributed to some special business wins.

bottom line

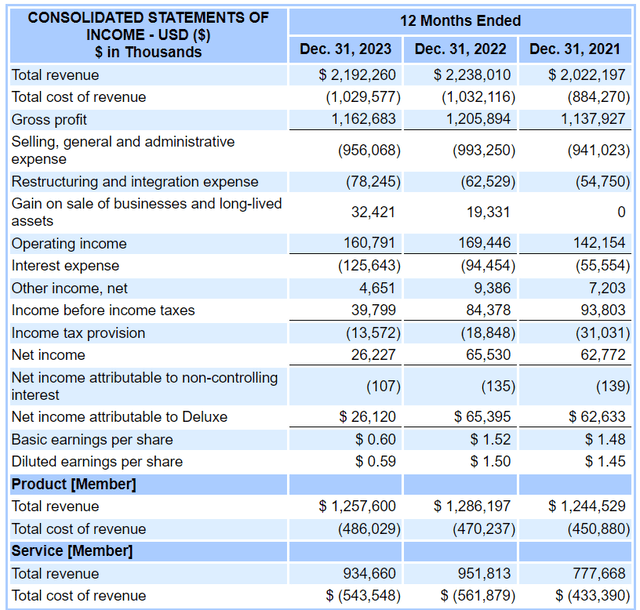

Proof of income (SEC.gov)

Interest coverage is indeed quite weak. EBIT was $160 million and interest expense was $125 million.

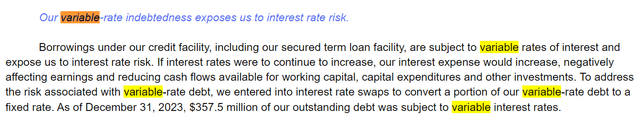

variable interest rate (SEC.gov)

Most of the debt, totaling about $1.5 billion, is now fixed-rate, either because it was raised as fixed debt or because it is hedged through swaps. About 50% of debt is fixed, about 25% has been hedged to behave as a fixed date until around 2026, and the remainder is variable. Effective interest rates won’t rise much further, which is good, but interest coverage is extremely low. Assuming operating leverage of 50% and interest costs increasing by another 3% or so (consistent with the point increase in current interest rates versus DLX’s credit risk premium), a $60 million revenue decline would make DLX’s net margin negative. That’s just a 2-3% revenue decline. Note that the business in managed decline is by far the most profitable, with EBITDA margins more than double the company’s average margin.

There may not be a need to sound the alarm significantly. With smart cost management and the occasional special business win, checks can preserve EBITDA over time. Printing is a bit iffy, but theoretically possible. The data solutions business should continue to grow, albeit with lower margins than the payments business, which has grown more reliably. But the point is, more than half of EBITDA is just checks. 2/3 are from printing companies. In order to sustain growth, growth companies must grow at more than twice the rate of decline of printing companies, otherwise, they will not even be able to pay interest permanently.

They have about $240 million in credit lines that could ease their financial situation, but they have to do better than just paying interest to give investors a safe outlook. It was enough for us to get through.