Ivanb – Photo/iStock Editorial via Getty Images

introduce

It’s been over six months since I last discussed Galp Energia (OTCPK:GLPEF) (OTCPK:GLPEY) on Seeking Alpha, so maybe it’s time for an update.Not only did the company release its full-year results; This appears to be a sizable new discovery in Namibia, with Brent oil prices currently trading above $90/barrel. Galp has a lot of tailwinds, but the stock is only trading 15% above where it was trading 7 months ago, so I wanted to see if this created an interesting opportunity.

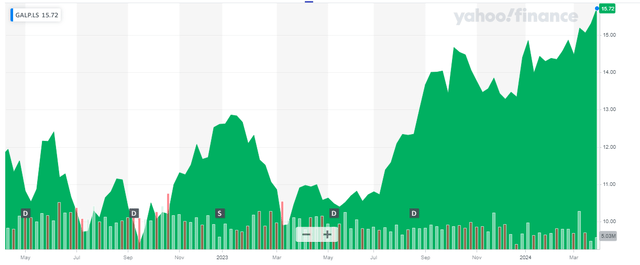

Yahoo Finance

Galp’s main listing place is Euronext Lisbon, trading under the symbol GALP (Simple).this Average daily trading volume is approximately 1.6 million shares, making it the trading venue offering the highest liquidity figures.have Now 773.1 million shares outstandingresulting in a market value of approximately 12.15B euros, and the current stock price is 15.72 euros per share.

End 2023 on a strong note

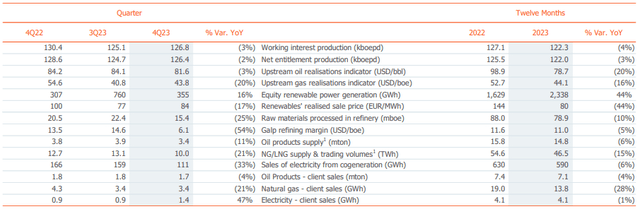

In 2023, the company is expected to produce an average of just over 122,000 barrels of oil equivalent per day, but average production will certainly be affected in the second half of the year as Q3 production was Just over 125,000 boe/day In the fourth quarter, total working equity production was close to 127,000 barrels of oil equivalent per day.this Production costs are only US$2.1 per barrel of oil equivalent In the fourth quarter of 2023, this explains the impressive profits Galp generated.

Galp Investor Relations

As shown in the chart above, average oil prices did fall (no surprise there), but it’s good to see refining margins remain relatively stable in 2023, despite the severe decline seen in the last quarter of 2023, when refining margins fell to A barrel of oil equivalent is only US$6.1.

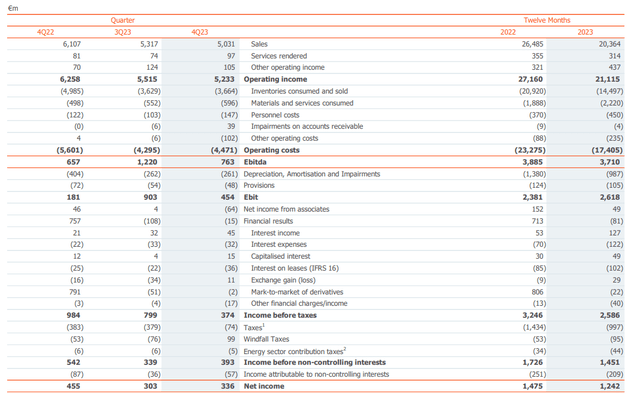

Looking at Galp’s Q4 results, it reported total revenue of €5.23B (Galp refers to revenue as “operating income,” which is quite confusing), while its reported EBITDA totaled €763M. This decreased 40% compared to the previous quarter due to lower total revenue and higher operating expenses. Fortunately, there were no further negative results and EBIT of €454 million was about 50% lower than in the third quarter of this year.

Galp Investor Relations

As shown in the above income statement, pre-tax income was 374 million euros and net profit was 393 million euros, of which 336 million euros were attributed to Galp ordinary shareholders. That’s about 12% growth compared to the previous quarter, which is a pretty surprising move considering EBIT fell 50%. This difference can be explained by a windfall tax difference of €175 million. Although Galp recorded a surprise tax hit of €76 million in the third quarter of 2023, it was able to recover some of the tax previously recorded, resulting in a net tax benefit in the fourth quarter.

Judging from the company’s full-year performance, the total EBITDA was quite flat, with a decrease of less than 5%. In a year when oil prices fell sharply and refining gross profits declined slightly, this was already a pretty good result. Reported net profit was approximately €1.24B, including tax of approximately €1.1B (including net unexpected tax of €95M). In addition to the current share count of 773 million shares, earnings per share are approximately €1.42 (the reported EPS of €1.33 per share is based on the average share count).

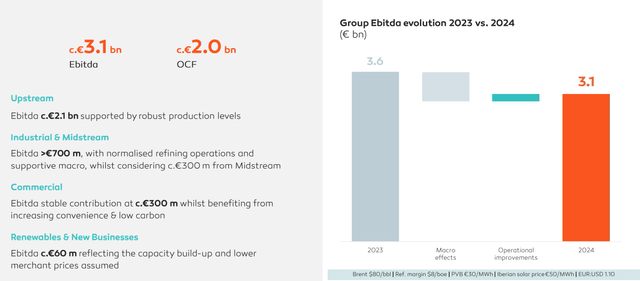

High oil prices will benefit Galp in 2024

With Brent crude oil prices above $90 per barrel, there is no doubt that Galp Energia is off to a good start this year.The company’s fiscal 2024 outlook is based on a Brent price of $80, so it’s safe to say 3.1B Euro EBITDA guidance Operating cash flow guidance for €2B is relatively conservative based on current oil prices. If Brent oil prices continue to trade around these levels, I think it would be realistic for Galp to raise its full-year guidance.

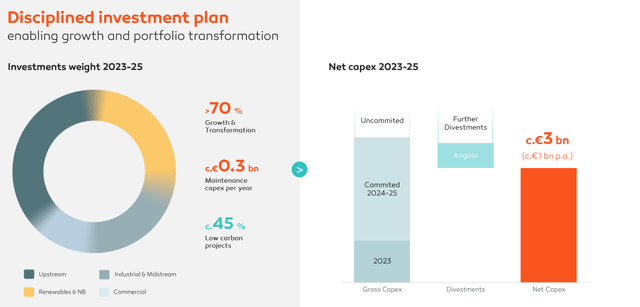

Galp Investor Relations

Interestingly, Galp’s €1 billion per year capex plan includes approximately €700 million per year in growth and transformation capex. In fact, Galp is guiding for ongoing capex of €300m per year, which means using operating cash flow of €2B per year, underlying net free cash flow on an ongoing basis is around €1.7B or €2.20 per share. Based on the guidance provided by Galp Energia, we should still deduct approximately €300 million of interest and lease expenses from this result, indicating underlying free cash flow of €1.4B or €1.81 per share. According to the report, free cash flow was €1B (including €700m of growth and transformation capex, mainly in the renewable energy sector mentioned by Galp) Return on investment 14%) will still result in a free cash flow result of 1.3-1.35 euros per share and 1.15 euros per share after taking into account the payment of minority interests. If the company continues its stock repurchase program, vested FCFPS may be higher.

Galp Investor Relations

Galp also provided a sensitivity analysis, showing that a $5 change in Brent crude oil prices would impact operating cash flow by €85 million per year. Therefore, if Brent oil prices averaged $85 over the year, the free cash flow result per share would increase by approximately 11 euro cents.

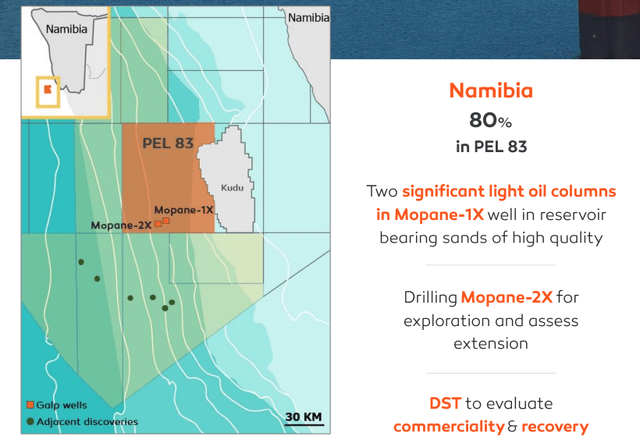

I also look forward to seeing more details about its recent discovery offshore Namibia. Galp Energia, which owns 80% of the licenses, remains tight-lipped.

Galp Investor Relations

For what it’s worth, Canadian-listed Sintana Energy (SEI:CA) indirectly holds a 5% stake in the mandate, which currently has a market capitalization of approximately €138 million. Although Sintana also owns other assets, the majority of its valuation is supported by its 5% license stake.

investment thesis

I hold a small long position in Galp Energia because I like the company’s low operating expenses due to its exposure to low-cost oil fields. Ongoing capital expenditures are lower, which creates additional financial flexibility for the company. Galp will pay a dividend of €0.54 per share (subject to Portuguese dividend withholding tax of 35%) and has also launched a new €350 million share buyback program that will reduce the share count by approximately 3%.

I look forward to seeing the results of the Namibia discovery, and while I don’t think it will add billions to Galp’s market cap, it could further fill its development pipeline. The Bacalhau oil project, which will be up and running by summer 2025, will add 10,000 barrels per day of low-cost oil to Galp’s production base.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.