Golodenkov

introduce

Lately, I’ve covered a number of banks and their preferred stock offerings. Financial institutions are a major source of preferred stock because they can count it toward Tier 1 capital requirements in most cases.In other words, a problem is discovered Diversification that allows investors to escape banking problems is always worth exploring.To achieve this goal, this article will review Hofnarnia Enterprises (NYSE:HOV) and one of its issued preferred shares, Hofnanian Enterprise Co., Ltd. PFD DEP1/1000A (Honip).

Hofnarnia Enterprise Review

Seeking Alpha describes the homebuilder as:

Hovnanian Enterprises, Inc., through its subsidiaries, designs, builds, markets and sells residential homes in the United States. It offers single-family detached homes, attached townhouses and apartments, urban infill and active lifestyle residences, with amenities such as a clubhouse, swimming pool, tennis courts, tot lot and open areas.The company markets and builds homes for first-time homebuyers, first-time and second-time upgraders, luxury buyers, and active buyers Lifestyle buyers and empty nesters. It also provides mortgage, title and home insurance services. The company was founded in 1959 and is headquartered in Matawan, New Jersey.

Source: Seeking Alpha

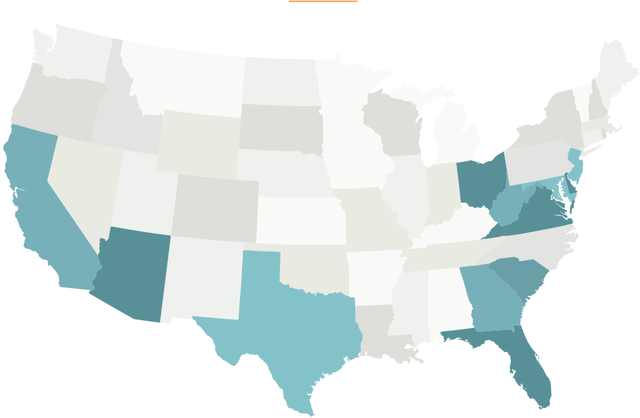

The image below shows where Hovnanian Enterprises is building the house.

khov.com

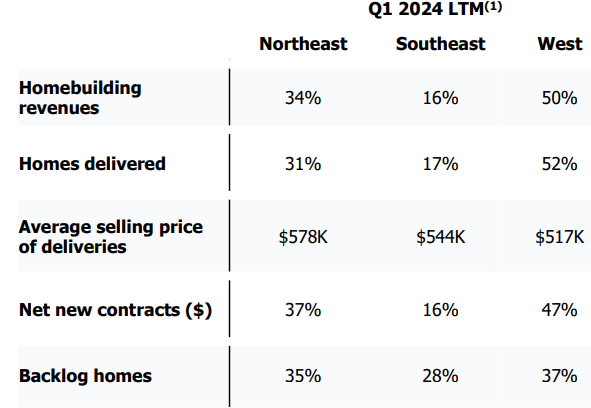

Hovnanian is one of the largest homebuilding companies in the United States, delivering 5,473 homes in fiscal 2023 and generating total revenue of $2.76 billion. Residential construction revenue by region is: Northeast: 34%; Southeast: 17%; Southwest: 49%. Detailed information for each region is also provided.

khov.com

I’m a little surprised that average home prices in the Southeast are close to those in the Northeast. The website shows city-level data, which is crucial to understanding the average sales price in each area.

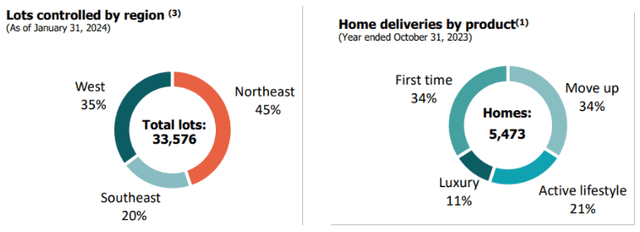

khov.com

Controlled lots help show where future income is likely to come from, as does the average home price in the three areas. The pie chart on the right shows which categories of buyers are attracted to Hovnanian homes, with first-time buyers being linked to upgraders.

Since home sales vary significantly by quarter, I chose to use annual data for the next section.

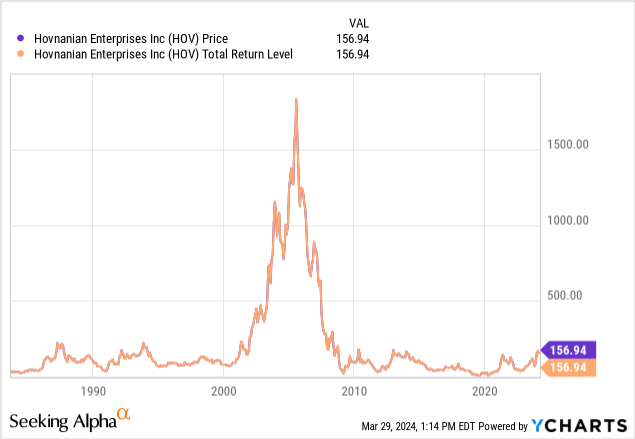

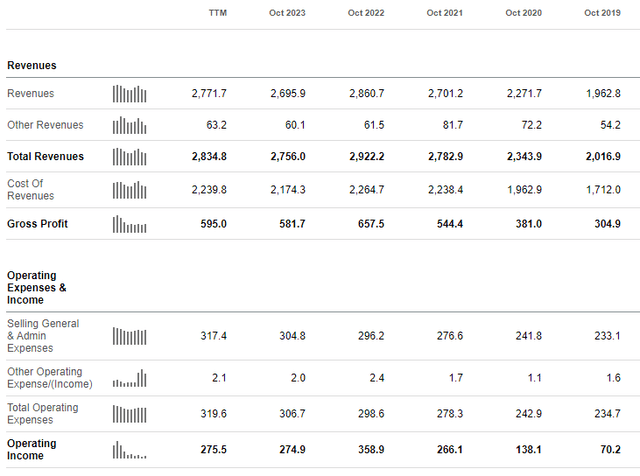

sekingalpha.com Profit and Loss Statement

Even on an annual basis, operating income is unstable. Things went so badly that the 2019 HOV record was 1-25 in reverse. The price chart above shows the losses that pre-2019 investors would have suffered if they had held.

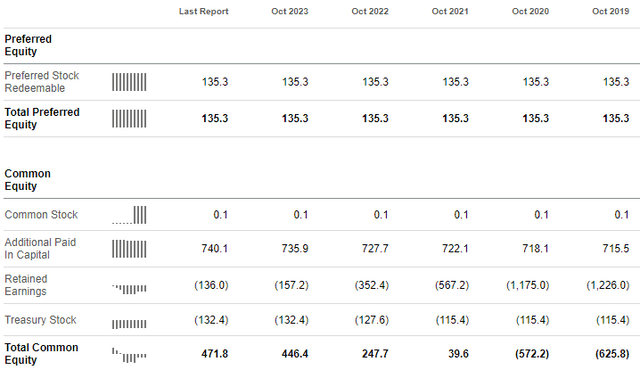

So, how are preferred stockholders protected? To do this, we need to look at the balance sheet. While better (negative before 2021), the coverage at 3.5x is the smallest I’ve seen.

balance sheet

HOVNP review

Seekingalpha.com Chart

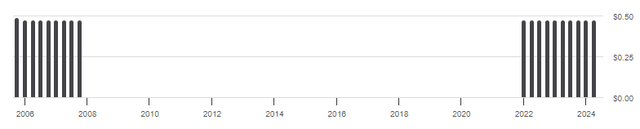

I chose the 10-year chart because it clearly shows that no preferred stock dividends have been paid for many years.

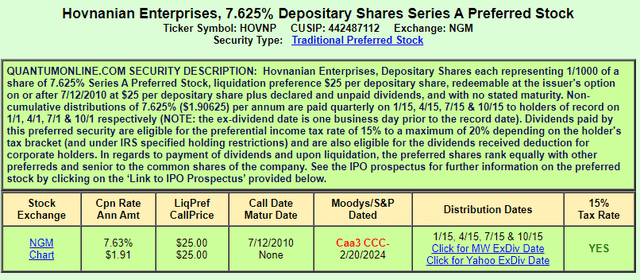

Quantum line Internet Quantum line Internet

Pay attention to the ratings, it confirms my concerns about low coverage; you can’t get a lower rating! In fact, the problem is non-cumulative, meaning investors lost all expected dividends over fourteen years, between 2008 and the end of 2021!

Seekingalpha.com HOVNP DVD

Since common stockholders do not currently receive dividends, the non-payment of dividends to these investors does not provide any protection to HOVNP holders.

Portfolio Strategy

The 10.7% yield, combined with diversifying your preferred stock allocation away from stocks dominated by financial institutions, is very tempting. One of the reasons HOVNP doesn’t offer diversification is by adding cumulative preferred stock to your portfolio. This has proven painful for preferred stock holders/purchasers for more than a decade.

All of my recent preferred stock commentary has focused on the banking sector, including money center and larger regional banks. The current yields on these products range from 5.5% to 10.2% CitiTrust Preferred Stock (Article link). Since “there is no such thing as a free lunch”, this issue has floating coupons that can be redeemed and sell for more than $29. Although the coupon rate is high above 12%, Citigroup has not issued a notice, but it is a risk that investors need to consider compared to whether Hovnanian Enterprise can maintain sufficient profitability to continue paying the dividends owed to HOVNP holders. For analysis, I refer readers to this Seeking Alpha article: Hovnanian’s Valuation, Ownership and Debt Issues: Is it a Viable Investment?

The U.S. real estate market is dominated by a few major players including local builders and Hovnanian. High mortgage rates have slowed new home construction and people looking to upgrade, the second largest source of buyers for HOV. Years of low numbers of new units on the market and the reluctance of low-rate mortgage holders to sell also add to the unique inputs builders need to face. All of this adds uncertainty to the long-term viability of the issue. That said, for investors who understand the risks (probably better than I do), HOVNP gets a Buy rating. For the rest of us, look elsewhere for such bountiful yields.

final thoughts

Aside from the no-payout risk presented by HOVNP’s non-cumulative feature, as an investor I’m not a fan of a company where one class of stock (Class B in this case) is controlled by a limited number of insiders and receives 10 per share There is only one ticket for HOV Class A holders.