ajr_image

We previously reported on Intel (NASDAQ:NASDAQ: INTC) in January 2024 discussed why the stock’s intrinsic growth premium offers minimal margin of safety, while impressive forward guidance led to a sobering correction in its stock price following its recent earnings call.

While some may choose to view management’s forward-looking comments as kitchen sink guidance, with subsequent forecast beats potentially offering significant upside potential, we preferred to view it conservatively at the time, triggering our hold There are ratings.

In this article, we discuss INTC’s underperforming Foundry outlook following the release of a new segment report, as IDM 2.0 will naturally bring uncertain cash burn and drag down its overall profitability.

This is at the top of its delayed node roadmap compared to its foundry peers, suggesting that Intel’s foundry has an uncertain future given its nascent stage.

when we are Despite the positive sentiment on the stock’s U.S. manufacturing, it remains to be seen when INTC’s foundry segment can achieve the key combination of node advancement, volume manufacturing, and profitability, leading us to reiterate our Hold rating.

INTC’s foundry investment thesis is currently speculative

INTC Foundry’s Cash Burn Rising

International Trade Centre

INTC recently reported new reportable segments through early April 2024, with Intel OEM It is worth noting that the operating loss in fiscal 2023 was -$6.95B (-34.6% year-on-year), the profit margin was -36.7% (-18 percentage points year-on-year), and it was unable to make a profit.

It is clear from these figures that cash burn has increased significantly year-on-year and is expected to be “low years The foundry was operating at a loss.“

At the same time, INTC management actively guides “Even profit and loss operating profit margin“By approximately 2027 and”By 2030, non-GAAP gross profit margin will reach 60%, and non-GAAP operating profit margin will reach 40%.“

Given that Intel foundries currently only report “Lifetime transaction value with external customers exceeds $15B,This compares to fiscal 2023 revenue of $18.91B (-31.2% year-over-year).

Compared to market leader Taiwan Semiconductor Manufacturing Company (TSM) Revenue for fiscal year 2023 is $69.29B (-8.1% year-on-year) and operating profit margin of 42.6% (-6.9 percentage points year-on-year), considering that INTC is indeed in its nascent stage, its data seems very aggressive.

As a result of this development, we believe INTC’s long-term foundry prospects appear uncertain, especially since TSM has diversified its global operations into Japan and Arizona, partially balancing the latter’s geopolitical headwinds.

INTC node roadmap

INTC, Tom’s Hardware

INTC’s latest roadmap It is also stated that the 14A node (equivalent to 1.4nm) is expected to be put into production in 2026, and the 10A node (equivalent to 1nm) will begin development in 2027. It remains to be seen when mass production will be achieved.

This compares to TSM’s current roadmap, where 3nm is now in volume production and 2nm will be in 2025, with management not providing further details.

If anything, readers must also note that while INTC’s node roadmap emphasizes that the 18A node is already in production, the reality is that 18A is just “on track and production ready at the end of” In 2024, with the future 18A Xeon processor, clearwater woodsexpected to be released in 2025.

Therefore, we think readers need to temper their expectations for INTC’s advanced nodes, as the same will likely happen with 14A and 10A, “five new nodes in four years” seems to be loose terminology, and volume production may occur over a longer period of time. in a period of time.

It is for this reason that we agree with TSM’s comments in the Q4 2023 earnings call, because more importantly “Work with customers to provide them with the best transistor technology and the best energy-saving technology at a reasonable cost – Technology maturity That is, in high-volume production.“

For now, it might be prudent to reserve judgment on the foundry’s technology rollout timeline, especially since INTC’s foundry unit is expected to remain profitable in the coming years, implying its lack of manufacturing scale.

With INTC reporting on its FQ1’24 earnings call on April 25, 2024, readers may want to keep an eye on Intel’s foundry results, especially since the segment is expected to peak in losses in fiscal 2024.

Currently, the market is also pricing in dismal 1Q24 revenue of $12.78B (-17% QoQ/ +9% YoY) and adjusted EPS of -$0.14 (-122.2% QoQ/ +78.7% YoY), below Management’s expected kitchen sink EPS guidance is $0.13 (-79.3% QoQ/+181.2% YoY).

We believe that with the recent rally in stocks, consensus estimates are indeed not overly pessimistic. x86 CPU market share Growth as of 1Q24 was 62.6% (+1.6 points QoQ/-0.1 points YOY), likely due to significant price cuts and impact on margins, as I discussed in my previous article.

Combined with bloated operating expenses and capex, we may see further deterioration in INTC’s balance sheet, with net debt of $21.94B reported in FQ4’23 (+134.6% YoY/+81.1% FQ4’19 level), management Layer appears to be financing its dividend payments with debt.

Readers may want to keep an eye on these indicators going forward, as INTC stock could experience greater volatility in the coming weeks.

Consensus forward estimate

Tikkel Pier

Finally, as INTC races to expand its global footprint in locations such as the United States, Israel, Ireland, Germany, and Mexico, there will no doubt be an impact on its free cash flow generation, as reflected in consistent forward forecasts. The company may be highly dependent on government subsidies/local incentives.

wireless networkINTC Ohio oned Arizona factory completed ArlIf the clock drags on, the pain could last longer as the market prices in flat revenue/profits from fiscal 2019 to fiscal 2026.

Inco Valuation

Seeking Alpha

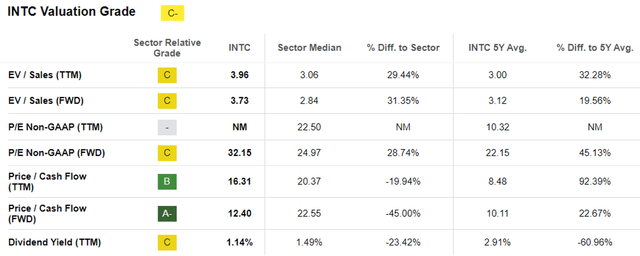

With its minimal growth prospects, we are uncertain about INTC’s premium FWD P/E valuation of 32.15x and FWD price/cash flow valuation of 12.40x, although this has slowed down from the previous article at 34.65x/12.45x, But it is still higher compared with the same period last year. The 5Y averages are 22.15 times/10.11 times respectively, and the industry medians are 24.97 times/22.55 times respectively.

So, is INTC stock a buy?sell, or hold?

INTC 2-Year Stock Price

trading view

Now, INTC has regained some of its recent gains, with the stock appearing to retest previous support at $40 at the time of writing.

Based on annualized adjusted EPS of $1.36 in 4Q23 (after adjusting for $1.2B in litigation benefits to improve accuracy, rather than the reported $2.52) and an average 5-year P/E valuation of 22.15x, the Shares appear to be trading well above our fair value estimate of $30.10.

We believe it is more prudent to refer to INTC’s 5-year P/E average here, given that INTC is expected to lack growth between FY19 and FY2026 and impact profitability as the company undergoes a shift towards IDM 2.0 Not sure about the transition.

Meanwhile, its dividend appears unstable, with an affected TTM interest coverage ratio of 0.04x and a TTM dividend coverage ratio of 0.55%, according to the Seeking Alpha Quant rating, compared with the industry medians of 10.97x and 2.82%, respectively.

Based on the many factors discussed above, we believe that there is still great uncertainty in the future execution of INTC.

Due to mixed signals, we prefer to continue to rate INTC stock as a Hold. It may be prudent to watch management’s medium-term execution before adding to holdings based on this perceived decline.