Igor

The more experienced you are in investing, especially when it comes to individual companies, the better you’ll be able to grasp what their values should be and what direction stocks should ultimately go.It’s not a perfect process Everyone makes mistakes.But one company that I have a pretty good track record with so far is Gentex Corporation (NASDAQ:GNTX). For those unfamiliar with the company, it is an automotive supplier that provides customers with a wide range of digital vision, connected car and dimmable glass products. It also sells some fire protection products.

Since I first rated the company a Buy in April 2022, the stock has gained 35.9%. That’s far better than the S&P 500’s 19.5% during the same period.However, by December 2023, I ended up downgrading The company has a Hold rating to reflect my view that the stock should perform more or less in line with the direction the market is headed. From then on, this is roughly what happened. Since the article was published, the stock price has increased 11.4%. That’s only slightly better than the index’s 10.3% gain. After further gains, the question that needs to be asked is whether the stock warrants further skepticism, or whether now is the time to upgrade the business again with new data coming out and guidance pointing to a fairly strong fiscal 2024. Based on my own opinion, I think the former still applies.

Steady despite positive expectations

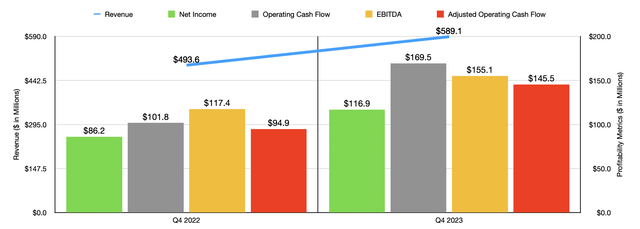

Perhaps the best starting point for revisiting Gentex is to look at the company’s financial performance in the most recent quarter for which data is available. This will be the last quarter of fiscal year 2023. During the period, the company had revenue of $589.1 million. This was a 19.3% increase from $493.6 million a year ago. Notably, approximately $5 million of the revenue generated in the final quarter of 2023 came from one-time cost recovery. So if we take that out of the equation, revenue would have grown a slightly more modest 18.3%. This growth was driven by a 6% increase in light vehicle production in the key markets in which the company operates. These markets include North America, Europe, Japan and South Korea.

Author – SEC EDGAR Data

Fundamentally speaking, the graphics have also been improved considerably. Net profit jumped from $86.2 million to $116.9 million. Of course, other profitability indicators are performing well as well. For example, operating cash flow successfully grew from US$101.8 million to US$169.5 million. If we adjust for changes in working capital, our funding would increase from $94.9 million to $145.5 million. During the same time period, the business’s EBITDA grew from $117.4 million to $155.1 million. It is worth noting that from a profit and cash flow perspective, the company’s growth was driven not only by revenue growth, but also by the expansion of the company’s gross profit margin from 31.2% to 34.5%. The cost recovery mentioned above does help. That would be a 100% profit margin or close to it. However, the company also benefited from higher prices charged to customers. Even accounting for the one-time nature of cost recovery, management believes the company’s gross margin will further improve in 2024, reaching a range of 35% to 36%.

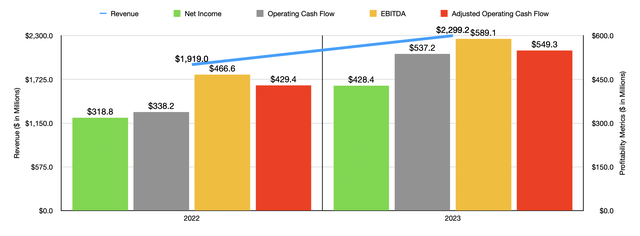

Author – SEC EDGAR Data

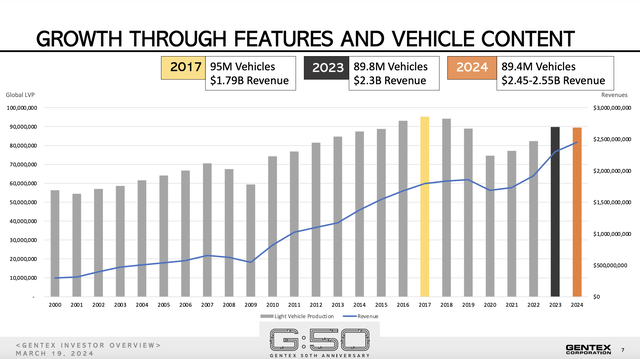

As you can see in the chart above, overall financial results for 2023 are quite strong compared to 2022. The factors that come into play in the final quarter of the year also contribute significantly to the full year overall. However, I would like to talk about some of the improvements that are being made in the business. As I already mentioned, management’s gross margin target for this year is 35% to 36%. For the full year of 2023, it will be approximately 33.2%. This improvement could be driven by further price increases, pushing sales higher. For example, consider income. Management expects 2024 sales to be between $2.45 billion and $2.55 billion. At the midpoint, this would be 8.7% higher than in 2023. You might typically think this is because of increased demand.However, due to supply chain issues, continued chip shortages, labor shortages and other factors, the global light vehicle ownership expected Quite low. This year, the company expects to produce 89.4 million such vehicles. That’s down from the 89.8 million reported in 2023 and down from 95 million in 2017.

Gentai

When revenue increases due to rising prices, profit margins typically expand. That’s likely why management is forecasting midpoint profits of about $466.9 million. That would be significantly higher than the $428.4 million reported in 2023. Guidance also appears to point to adjusted operating cash flow of $587 million and EBITDA of $629.5 million. Management did provide further projections for the future, predicting revenue will increase to $2.65 billion to $2.75 billion in 2025. But since we don’t know what the bottom line is going to be, I’m going to stick to fiscal 2024.

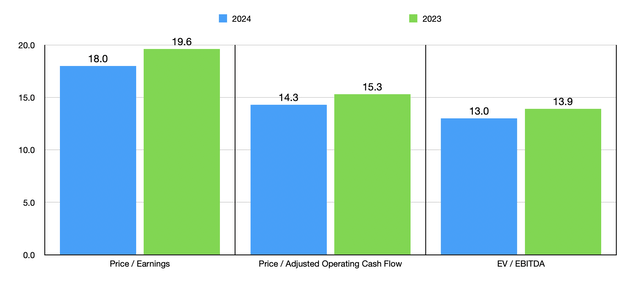

Author – SEC EDGAR Data

Using estimates for 2024 and historical results for 2023, I was able to value the company, as shown in the chart above. In the long term, stocks do get cheaper. But I wouldn’t say they are cheap. Instead, I’d say we’re looking at a company that’s more or less fairly valued. However, the stock does look a bit expensive relative to other companies. In the chart below you can see exactly what I mean. On a price-to-earnings basis, two of these five companies end up trading cheaper than Gentex. But when using both the price-to-operating-cash-flow ratio method and the enterprise value-to-EBITDA ratio method, that number increases to four out of five.

| company | price/yield | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| Gentex Corporation | 19.6 | 15.3 | 13.9 |

| Autoliv(ALV) | 21.2 | 10.6 | 10.5 |

| Lear Corporation (LEA) | 15.0 | 6.9 | 6.6 |

| Fox Factory Holdings Inc. (FOXF) | 17.6 | 11.9 | 12.4 |

| Standard Motor Products (SMP) | 21.9 | 5.2 | 6.9 |

| Made in Modin (MOD) | 22.5 | 23.6 | 17.6 |

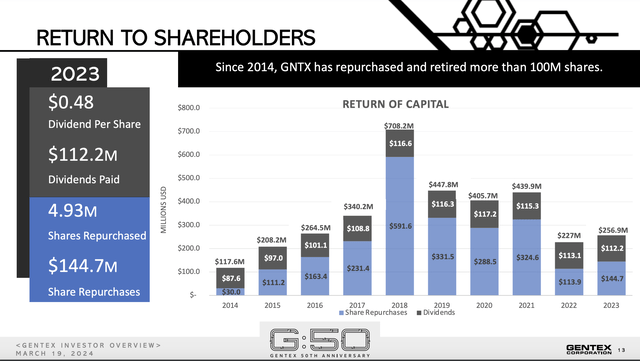

Even though the stock price is expensive, that doesn’t mean the company is bad. I have pointed out that growth is coming. Of course, growing up isn’t cheap. Management plans to allocate $225 million to $250 million annually to capital expenditures, most of which will be used for growth initiatives. In fact, this year alone the company has completed three new projects, two of which were expansions of existing facilities. From this year to next, they will open a nursery at another location. That doesn’t mean the company neglected to return capital to shareholders. Over the past few years, management has done just that. In 2023 alone, the company spent $112.2 million on dividends, in addition to $144.7 million on share repurchases. There hasn’t been a year since at least 2014 that dividends and buybacks have been ignored.

Gentai

take away

From what I can tell, Gentex is and will probably remain a solid business in the areas in which it operates. Management has done a great job so far, and the stock’s massive gains to date are well-deserved. However, all good things must come to an end. While I wouldn’t say the shares are overvalued by any means, they do look expensive relative to similar companies while being more or less fair on an absolute basis. Of course, the stock price could rise further. But as a value investor who prioritizes a large margin of safety in investment decisions, I believe there are better opportunities available today.