Pgiam/iStock via Getty Images

Welcome to another installment of our weekly preferred stock market review, where we discuss preferred stock and baby bond market activity from the bottom up, focusing on individual news and events, and from the top down, providing a broader market overview.us Also try to add some historical context and related themes that appear to be driving the market or that investors should be aware of. This update covers the period during the last week of March.

Be sure to check out our other weekly updates covering the business development company (“BDC”) and closed-end fund (“CEF”) markets for a broader perspective on the income space.

market action

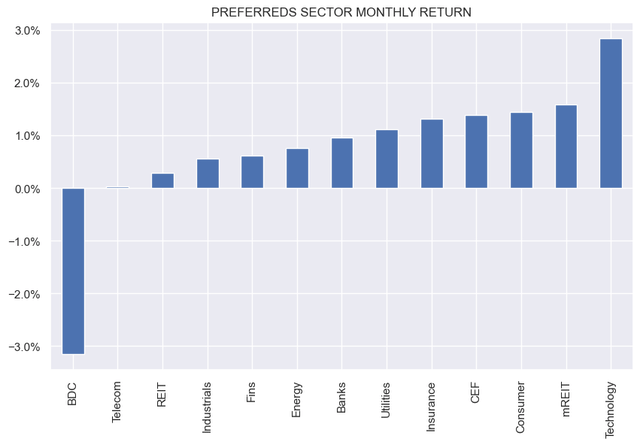

Preferred stocks underperformed this week, largely due to REITs, but the broader space still managed to post positive total returns in March. In the past month, except for one industry ( Single-issuer BDC sector) rose.

systematic income

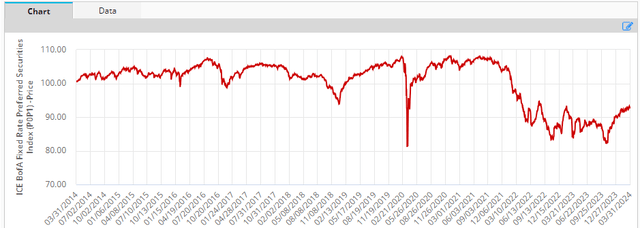

The preferred stock sector is enjoying its longest rally of 2021 but remains well off its 2021 highs. This highlights that yields remain well above 2021 levels.

ice

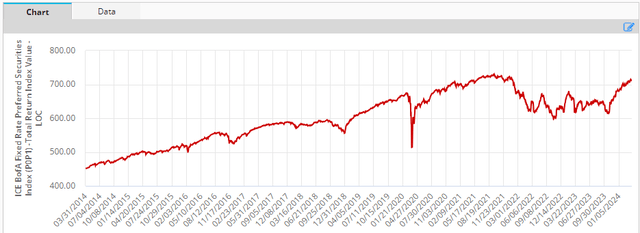

From a total return perspective, preferred stocks are almost back to their 2021 highs thanks to massive dividends received over the past 2-3 years.

ice

market theme

Two recent issuances illustrate the general pattern of new issues becoming more affordable, that is, yielding higher returns, than existing securities from the same issuer. The reason is fairly intuitive – if new releases are priced higher, they won’t attract as much demand. Second, the higher yields on existing issuances provide bookrunners with a margin of safety on mortgage securities.

This week there were two examples of issuers pricing securities above existing bond yields. First up is CLO CEF Eagle Point Income Company (EIC). It is issuing 8% 2029 senior notes (EICC). The fund also has two other issued preferred shares – EICA and EICB, with maturities in 2026 and 2028 respectively, and yields of approximately 7.7%.

EIC is a lower-octane CLO CEF than OXLC, ECC, and OCCI because of its considerably larger CLO debt allocation. This is one reason why EIC preferred stocks (such as XLFT.PR.A) tend to trade at lower returns than CLO stocks, CEF preferred stocks.

The second example is a bond issued by BDC Trinity Capital (TRIN), which announced the issuance of a new 7.875% 2029 bond (TRINZ) with a first call in 2026. The company’s other baby bond – the 7% 2025 TRINL – is trading at a premium. The yield is low, currently 7.08%, and is rarely below par. Compared to existing bonds, the yield is up 0.8%, which is one of the largest yields we’ve seen.

Use of proceeds mentioned redemption of the KeyBank credit agreement and possible 2025 bonds. It might make sense to refinance the credit facility because it costs about 0.65% more than the new bonds and it has additional covenants that the new unsecured bonds don’t have. Refinancing the 2025 bonds is a bit odd, considering they have a 7% coupon and a 10-month maturity. Maybe the company is looking at tight credit spreads and thinks that’s the best it can get if Treasury yields aren’t that low.

Between these two issues, we would consider adding TRINZ above par, as it could rebound to yields comparable to TRINL, especially if TRINL is partially or fully redeemed. For EICC, we continue to favor OXLC bonds in the broader CLO CEF senior securities universe as they offer yields comparable to EIC preferreds and have stronger asset coverage, despite the higher beta nature of OXLC CEFs.

The key takeaway here is that investors should keep a close eye on new issues, either as a tactical opportunity or as a way to upgrade existing holdings.

Check systematic income and explore our income mixdesigned with return and risk management in mind.

Use our powerful Interactive investor tools Navigate the BDC, CEF, OEF, senior bond and baby bond markets.

read our Investor Guide: CEFs, Preferred Stocks and PIMCO CEFs.

Check us out on a risk-free basis – Sign up for a 2-week free trial!