Afternoon pictures

After narrowly missing a recession in 2022/23 and following an unprecedented 525 basis points of interest rate hikes in 16 months, 2024 is off to a strong start with major indexes up nearly 10% year to date.

Historically, during election year In the United States, the S&P 500 Index (SP500) has an average return of 11.28%, with positive performance in 19 of 23 years (or 83%), meaning the index still has some room to run if 2024 proves to be an average election year.

With no recession in sight, falling inflation and a strong labor market, there appears to be little to worry about in today’s market, which has led to some stocks being overvalued by historical standards:

- S&P 500 Index (SPY): Blend P/E of 23.7x, 15-year average.19.05 times in total

- Nvidia (NVDA): The blended price-to-earnings ratio is 57.7 times, 15-year average. 35.8 times

- meta platform (META): The blended P/E ratio is 31.5 times, with an average of 13 times. 29.3 times

- Microsoft (MSFT): Blended P/E ratio of 37.3x, 15-year average. 22.4 times

- costco (Cost): The blended price-to-earnings ratio is 46.2 times, 15-year average. 31.5 times

While there is artificial intelligence-driven optimism in the market right now that is boosting many of these great growth stocks, we have to keep our feet on the ground and make sure we don’t overpay for these quality businesses. Buying a good but overpriced business is just as bad an idea as buying a bad business at a fair price.

While the valuations of most quality stocks have been driven up by conventional thinking, I’m still a big buy of two growth stocks this month, let me show you.

1. Free Market Corporation (Honey)

MercadoLibre is generally called the Latin version of the e-commerce giant Amazon (Amazon). The company’s market capitalization is roughly 20 times smaller than that of the U.S. giant, and its domestic shares trade in Buenos Aires, but international investors can buy ADRs listed on Nasdaq.

Although MercadoLibre is usually thought of as an online marketplace, the company has become a fintech giant in recent years. Mercado Pago, similar to Venmo, provides services Paypal (PYPL) has become a popular way to process payments in South America, with more than 53 million active users and transaction volume exceeding $135 billion in 2023.

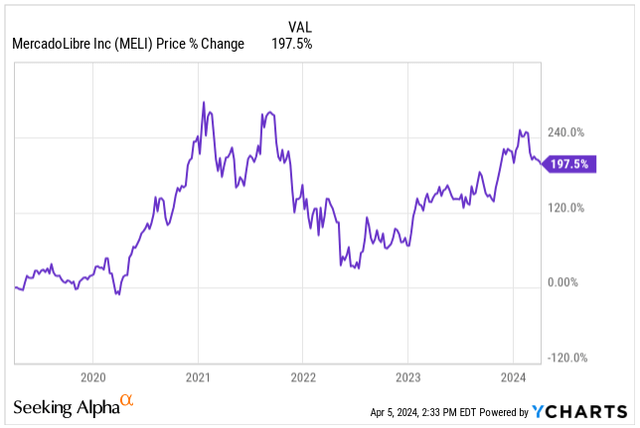

Over the past five years, MELI’s stock price has risen 197% and revenue has grown 681%, in part because many e-commerce and fintech companies have experienced tailwinds during COVID-19 and the general shift to online retail.

meli price (Seeking Alpha)

MELI’s online marketplace is very similar to eBay (EBAY), creates a platform that connects potential customers and sellers in one place and takes advantage of its own integrated payment system, advertising and logistics.

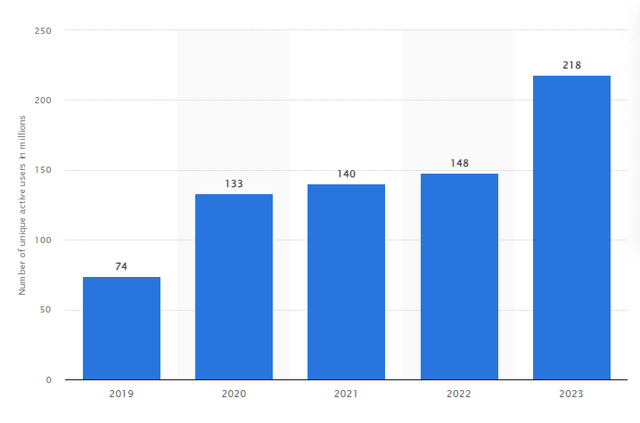

By 2023, MELI’s services had more than 218 million unique active users, representing approximately 31% of the approximately 700 million people in the markets in which the company operates, such as Argentina, Brazil and Mexico.

MELI active users (politician)

South America, made up of developed and emerging countries, is facing major challenges such as political instability, hyperinflation in Argentina, the reliability of a strong U.S. dollar, and potential stagnant economic growth and poverty.

So far, these issues have not caused any harm to MELI’s growth. Instead, the company has benefited from countries in the region becoming richer, as well as widespread digitalization in remote parts of the world, a trend that I think will drive MELI in the coming years. growth, providing investors with opportunities to diversify their portfolios and take advantage of strong economic growth in emerging markets.

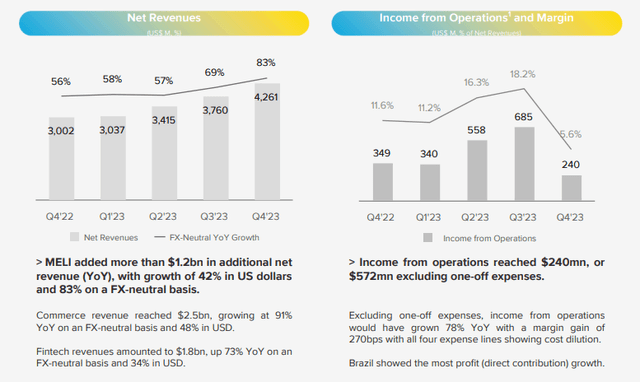

Back in February, MELI reported Fourth quarter financial report Revenue increased 42% year over year to $4.26 billion. Earnings per share were $3.25, compared with analysts’ expectations of $7.02, due to non-recurring cash charges of $351 million in 2014 related to unpaid taxes.

MELI fourth quarter financial report (Meli Infrared)

This major one-time tax charge caused the stock to plummet and is currently trading 18% below its all-time high, giving long-term investors a reason to celebrate and buy quality shares at a discount.

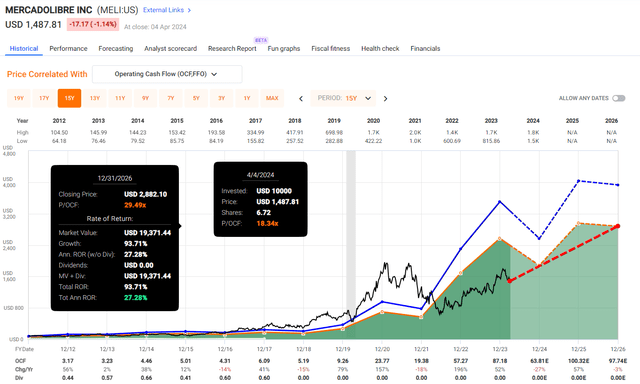

When evaluating a business like MELI or AMZN, I always think that rather than looking at the traditional P/E ratio, it’s better to consider operating cash flow versus price or OCF/P, given that the business reinvests heavily in its capabilities and looks at cash. . – Power generation capacity better reflects the true value of the business.

Since 2011, MELI has proven to be an outstanding compounder, with average annual OCF growth of 29.5%.

One would think that as the company scales and the market becomes saturated, growth will fall off a cliff, but the opposite is true, and MELI has successfully re-accelerated its growth, with annual OCF growth reaching 36.1% since 2017.

MELI’s OCF growth has historically been erratic, expanding significantly after a few years, and analysts surveyed by S&P Global expect this to continue:

- 2024: OCF is $63.81, annual growth -27%

- 2025: OCF is $100.32E, an annual growth rate of 57%

- 2026: OCF is $97.74, annual growth -3%

Currently, the stock’s price-to-earnings ratio is “only” 18.34 times, well below the normal price-to-earnings ratio of 40.2 times over the past 15 years.

Of course, we need to adjust the valuation according to the slowdown in growth. The average annual growth in the next three years will be about 15%, so it is completely feasible to expect P/OCF to be around 30 times.

For reference, Amazon is much larger and currently trades at 20.33 times earnings.

Still, expected growth over the next three years is somewhat modest by MELI’s historical standards, as the company grapples with near-term challenges such as COVID-19 borrowing needs and slower economic growth in the countries where it operates in 2022 and 2023. As new products are deployed and market share gains further, I expect OCF growth to return to around 20%.

With growth realized and valuation expanding to 30x OCF from currently depressed levels, long-term investors expect annual returns of up to 27% by the end of 2026, with a price target of $2,880.

Melly valuation (quick chart)

2. Booking.com (BKNG)

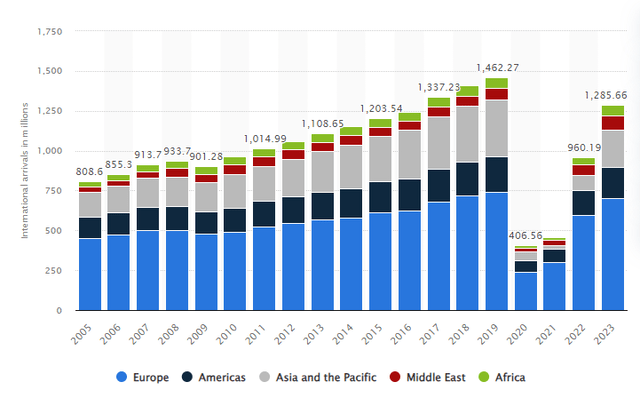

After COVID-19 devastated hotels, airlines, travel agencies and the travel industry, the industry is once again experiencing a “renaissance” with increasing numbers of travelers each year, widespread use of social media and people prioritizing experiences over material luxuries.

As early as 2023, global international tourist arrivals are still below the pre-pandemic peak of 1.46 billion in 2019, but the tourism industry is quickly catching up, and 2024 is widely expected to be a record year with further growth in visitor numbers. -Sight.

global tourist arrivals (politician)

Booking.com, which targets leisure and business travel in 200 countries, is one of the main beneficiaries of this growing trend and offers good investment opportunities, with its diverse portfolio across industries including hotels, experiences, car rentals Waiting for air tickets. Booking currently owns multiple brands, which you may be familiar with:

- Gundam

- kayak net

- cheap flights

- Rentalcars.com

- open table

…and many others.

Its core business model is quite simple. For every booking made through a platform, Booking earns a commission of 10% to 30% of the booking value from the accommodation provider. On top of that, these platforms generate revenue through the ads displayed on their websites.

Personally, whenever I travel anywhere in the world, I always use Booking.com, although their website is usually not the cheapest, gives me one place to make all my bookings, or whenever When issues arise (which is often the case when booking) I can always rely on their excellent customer service to resolve the issue, which is especially helpful in a non-English speaking country. All in all, the company has a very strong moat.

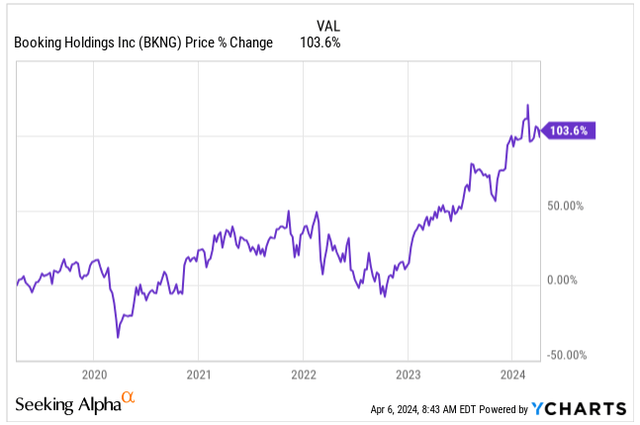

Particularly strong in 2023, driven in part by industry recovery, Booking grow Their EPS grew 52% to $152.22, and we should expect normalization levels but still strong mid-double digit growth.

BKNG price (Seeking Alpha)

Some investors may point out that investing in discretionary companies is particularly tricky because of its cyclical nature, driven by underlying economic developments and Federal Reserve interest rates that impact household disposable income, ultimately cutting into travel expenses when needed.

I completely agree that despite interest rates reaching their highest level in 22 years, consumers remain strong, especially in the US. Friday, The labor market is hot The data confirmed the strength of the economy, which added 303,000 jobs last month, beating expectations for 205,000 job gains.

A strong economy, falling inflation and eventual interest rate cuts are creating favorable conditions for further growth in the travel industry, from which Booking will also benefit.

While strong momentum and industry tailwinds should continue to lift Booking’s stock price in the coming years, the company’s stock price fell more than 10% on February 22 after the company reported fourth-quarter and full-year 2023 earnings.

The company reported fourth-quarter earnings of $32.0 per share on revenue of $4.78 billion, beating estimates by $1.95 and $70 million, respectively. Net profit increased by 29% compared with the same period last year, and revenue increased by 18%.

Room bookings fell sluggishly during the holiday period as stock prices fell due to military conflict in the Middle East, with fourth-quarter growth of 9.2% missing expectations of 9.7%, dragging down prices such as Airbnb (ABNB) and tripadvisor (Travel) same down. The conflict could temporarily put pressure on the industry, giving long-term investors a chance to snap up shares at cheaper prices as all conflicts are eventually resolved.

Judging from Booking’s huge scale, in 2023, customer bookings on the company’s platform reached a record high of 1 billion room nights.

On its last earnings call, the company also announced an initial dividend of $8.75, or a dividend yield of about 1%, and announced its existing stock repurchase program.

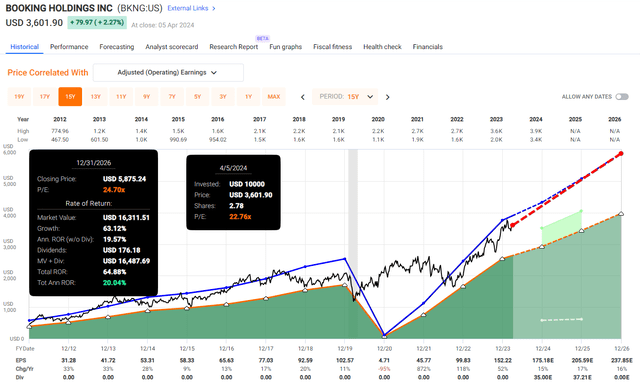

Over the past 15 years, the company’s earnings per share have grown 16.7% annually, and it’s been valued at an average of 24.7 times its earnings.

Today, the stock trades at 22.8 times its blended P/E ratio, implying a slight discount to fair value in anticipation of more growth:

- 2024: EPS is US$175.18, an annual increase of 15%

- 2025: EPS is US$205.59, an annual increase of 17%

- 2026: EPS is US$237.85, an annual increase of 16%

The expectation that earnings per share will grow by about 16% per year over the next three years is very similar to the growth rate the company has achieved over the past 15 years, so it’s very likely to be achieved.

With valuations below historical ranges, investors buying shares today can expect a good margin of safety and a potential total return on investment of 20% annually through the end of 2026 with a price target of $5,875.

But keep in mind that a potential recession or significant slowdown in GDP growth could have a negative impact on stock prices and growth expectations.

BKNG Valuation (quick chart)

take away

Historically, stocks have returned 83% in U.S. election years, with an average annual return of 11.3%, giving 2024 a chance to be one of the better years.

Even though many high-quality growth stocks have become overvalued in the face of optimism, I still buy two high-quality stocks every month first and move them into my own portfolio, both of which are trading below their fair value. The value, coupled with strong double-digit growth expected in the near future, could lead to 20%-plus returns over the next few years.

Both MercadoLibre and Booking.com benefit from strong drivers including e-commerce growth, improving economies in emerging markets, people prioritizing experiences and travel over material luxuries, and strong and resilient consumers.

While a potential recession or slower GDP growth could hurt both companies, these companies remain Strong Buys today, especially in expensive markets.