Jonathan Kitchen

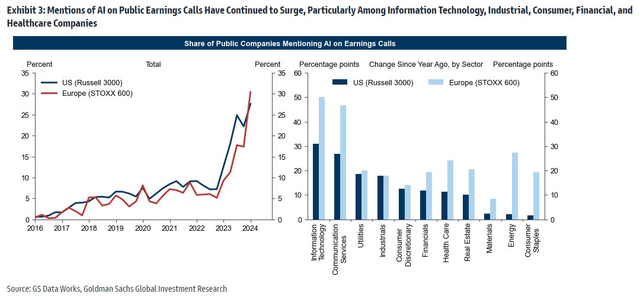

The first-quarter earnings season is approaching. The big banks kicked things off on Friday with earnings results from JPMorgan Chase (JPM), Wells Fargo (WFC) and Citigroup (C).Big tech companies don’t report Until late April. Of note across all industries is the frequency with which “artificial intelligence” is mentioned on earnings calls. Goldman Sachs noted last week that a continued surge in interest in artificial intelligence dominated the corporate landscape earlier this year.

Both growth and value companies are participating, and there’s even data showing that citations lead to better stock price performance. Although the AI theme has cooled off recently as cyclical stocks have experienced alpha effects since mid-February, it remains a key driver of growth in 2024.

I reiterate WisdomTree Artificial Intelligence and Innovation Fund ETF has a Buy rating (Bat: WTAI). I began covering the fund last summer, outlining a “buy the dip” strategy that worked well given the market’s correction from July to October. Today, momentum has slowed and there are technical risks, but this disciplined strategy looks solid in the long term.

Businesses Still Concerned About Artificial Intelligence

Goldman Sachs

according to wisdom TreeWTAI tracks the price and yield performance of the WisdomTree Artificial Intelligence & Innovation Index (before fees and expenses), which identifies companies primarily involved in the artificial intelligence and innovation investment theme. This ETF provides investors with exposure to companies that provide artificial intelligence technology and companies that contribute to the development and deployment of artificial intelligence innovations. ETF The growth allocation can be supplemented by diversifying the allocation of artificial intelligence companies with high growth potential to meet the needs of all-round and multi-industry entry into the general trend of artificial intelligence.

As of April 5, 2024, WTAI remains a small-cap fund with $242 million in assets under management. Annual expense rate 0.45%ETF payments The dividend yield over the past 12 months was only 0.24%. WTAI features solid Stock Price Momentumbut its rise has stalled since the middle of the first quarter – I’ll detail the full technical view later in this article.

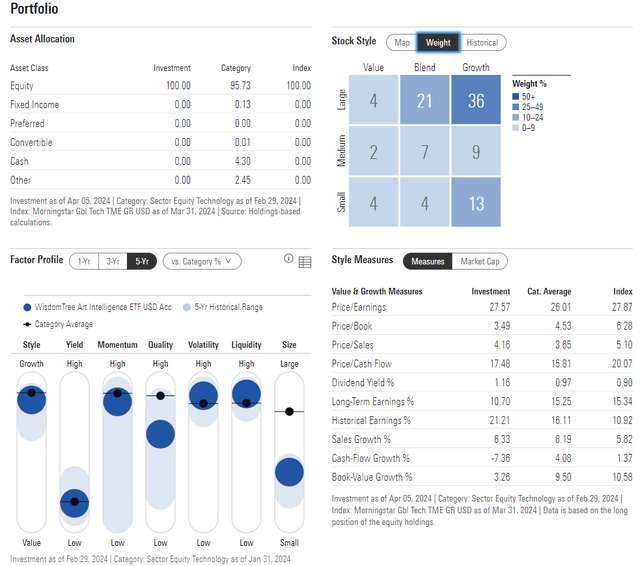

The portfolio is dangerous sideas evidenced by the weaker rating of Seeking Alpha’s D ETF, but Good liquidity. I encourage investors to use limit orders during the trading day, as the fund’s 30-day median bid-ask spread averages 10 basis points and trading volume is typically around 200,000 shares per day.

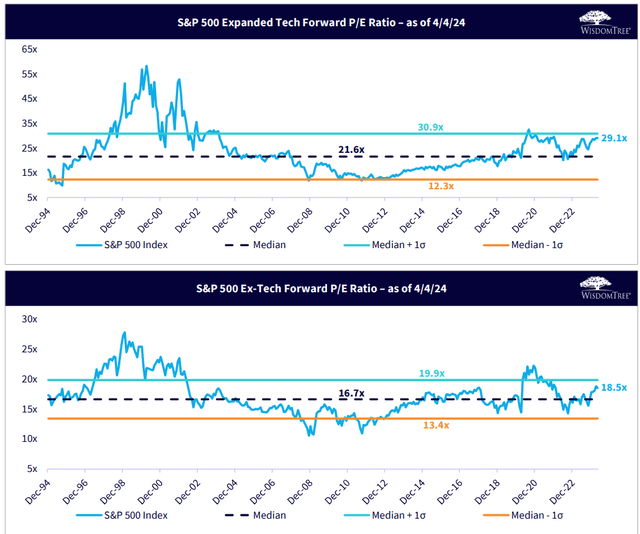

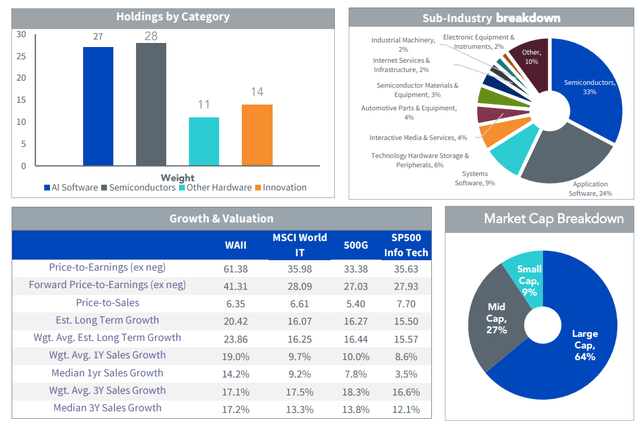

Morningstar’s three-star and bronze-rated ETFs offer some style diversification. Of course, there’s a heavy tilt toward growth stocks, but since about 40% of the allocation is in the small- and mid-cap space, there are also investments outside of mega-cap tech stocks.The forward price-to-earnings ratio is as high as 27.6, but this is only comparable to the market level. S&P 500 expands on tech stocks Earnings multiple.

Considering its high long-term earnings growth and historical EPS growth of over 20%, the valuation isn’t as high as you might think. The fund’s momentum scale is high and its profit quality is high. The current consolidation guides investors to find the next favorable entry point. We’ll explore this later.

WTAI: Portfolio and Factor Profiles

Morningstar Corporation

WTAI’s P/E ratio is comparable to S&P 500 Expanded Tech

wisdom Tree

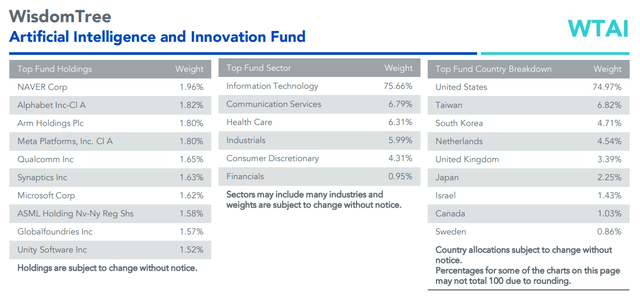

WTAI typically owns about 80 stocks. But artificial intelligence is not limited to the semiconductor industry. WisdomTree captured this big theme and identified stocks across industries and geographies that are poised to reshape how work gets done.

One of the niches focused on is software. The issuer sees natural language processing (NLP) and generative design as elements of artificial intelligence that can accelerate drug discovery developments in healthcare. Smart software, more efficient than previous industry technologies, can provide real value and even save lives by quickly processing studies and flagging symbols for further investigation by doctors and researchers to predict medical outcomes. The healthcare industry accounts for 6.3% of WTAI, complementing the high weighting of the information technology sector.

WTAI: Major Holdings, Industry and Country Weights

wisdom Tree

This ETF takes a flexible, comprehensive approach to holding shares of leading artificial intelligence companies. A combination of quantitative and qualitative research was used in the index selection process. The four target areas are: artificial intelligence software, semiconductors, artificial intelligence other hardware and innovation.

- Artificial intelligence software includes natural language processing and matching translation, speech recognition and audio processing, chatbots and virtual assistants, computer vision and image recognition, knowledge graphs and intelligent search, machine learning and data science, and robotic process automation.

- Semiconductors include storage devices, computing devices, sensors, edge computing, and semiconductor manufacturing software and equipment.

- Other artificial intelligence hardware includes self-driving cars, robots, industrial automation and drones.

- More broadly, innovation can include any disruptive application of the above technologies.

WisdomTree sorts every company owned by the ETF into one of these four categories and assigns subthemes. As of the end of 2023, artificial intelligence software and semiconductors have the heaviest weight, accounting for 33% of the total exposure to the semiconductor industry. At the start of the year, 64% of the fund was considered large-cap stocks.

WTAI: Artificial intelligence software and semiconductor exposure

wisdom Tree

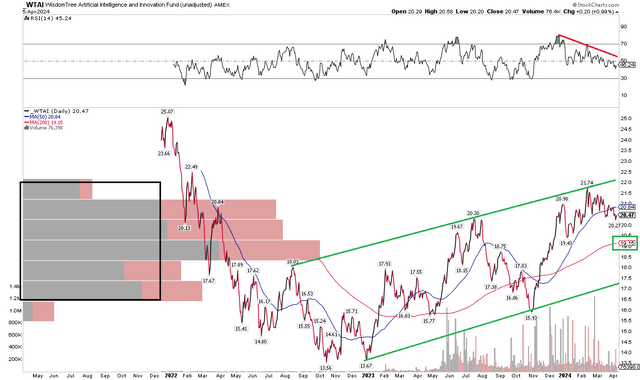

Technical points

WTAI’s rally has stalled due to a high price-to-earnings ratio but excellent EPS growth trends. Note in the chart below that the stock price is well below its highs since mid-February. What’s more, the RSI momentum indicator at the top of the chart has made a series of lower highs and even dipped below a new five-month low near 40. This tells me that the retracement is likely to continue, potentially leading to a move towards the longer-term 200-day moving average. Although the price has fallen below the short-term 50-day moving average, the 200-day moving average still has a positive slope, which is encouraging.

Also check the volume profile. Most of the stock trading has occurred in the past year. This makes the $16 to $22 area even more important. It’s currently at the upper end of that range and will definitely fall back into the teens. I see support at the uptrend line below the late 2022 low of $14. Similar to the trade I outlined last August, a 10% decline would be a solid risk/reward buying opportunity for WTAI, with key support near $17.50. A test of the lower limit of the uptrend channel would be healthy and then a bullish move back to the top of the uptrend would form.

Overall, as the RSI loses momentum and hits its February rising resistance line, further consolidation or a drop to support is likely.

WTAI: Momentum weakens, finding support near $17.50

Stockcharts.com

bottom line

While my near-term view on WTAI’s chart has softened, I see long-term profit potential, and I like the way WTAI is constructed. Momentum is strong in cyclical industries right now, but WTAI shares are consolidating nicely.