Stocktrek/DigitalVision via Getty Images

Overview

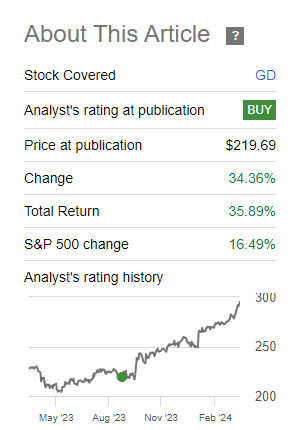

General Dynamics (NYSE:GD) is a defense and aerospace company with global operations.Their I covered this Dividend Aristocrat back in September 2023, and it has outperformed the market in total returns since then S&P 500 Index (spy) times double. However, due to the company’s strong financial position, I still believe there will be plenty of growth despite the new all-time high.

Seeking Alpha

The current dividend yield is only 1.92%, but GD has increased dividends for 29 consecutive years and is recognized as a dividend aristocrat. The dividend has been raised 7.6% since I last reported, continuing that trend. It’s also undervalued based on my dividend discount calculation, with additional room for upside.

While I generally like to focus on companies with higher starting yields, I believe GD Be one of the companies that still deserves a spot in a dividend growth portfolio. Continued price appreciation and dividend increases make it a good neutralizer, adding ample total returns to your portfolio. The company is also very diversified and actively growing different revenue streams.

record revenue

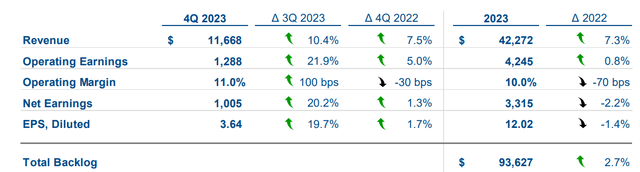

As of GD’s fourth quarter financial report, their total revenue for fiscal year 2023 hit an all-time high of $42.3B. In the fourth quarter alone, revenue reached $11.7B, a significant increase of 7.5% from the previous year’s fourth quarter. Operating profit also increased to $4.2B, but the increase was much smaller, up 0.8% from the previous full year. Net profit and EPS (earnings per share) were down slightly, but there’s no need to worry as I believe the large contract backlog should support these numbers in 2024.

GD Q4 Demo

For example, GD was recently awarded a $311 million contract for the maintenance, modernization and repair of the USS Bataan. This work is expected to be completed by May 2026, which will mean additional revenue for GD of approximately $155 million per year over the next 2 years. This contract is just one of many, and GD has a massive backlog of future revenue streams. The total 2023 backlog across all business units reaches $93.6B.For context, General Dynamics’ business scope covers 4 main parts.

- aerospace

- Combat system

- ship system

- science and technology

Each of these segments achieved revenue growth, which means the business is expanding and expanding its presence on all fronts. In the aviation and aerospace sector, aircraft service revenue grew by 8%, with orders exceeding $10B for three consecutive years. The combat systems segment’s revenue and profits reached their highest levels in the past decade, with over $9B in orders and more than $595 million earned across different categories in the fourth quarter. Marine Systems revenue reached a record $12.5B, up 12.9% from the previous year. Finally, the Technology sector was the most modest, but still experienced low single-digit growth, with full-year revenue increasing to $12.9B.

I realize the current price is at an all-time high, but that’s while the company is simultaneously generating historically high levels of revenue. Revenue will likely continue to grow as contract backlog increases. This backlog basically tells us that they have a lot of work to do and continued interest in future services. This is essentially like a guarantee that you will be employed for another year. For example, their aerospace division has so many backlogs that totaled $3.2B in Q4. Since last year, backlog activity has increased 4.8%.

dividend

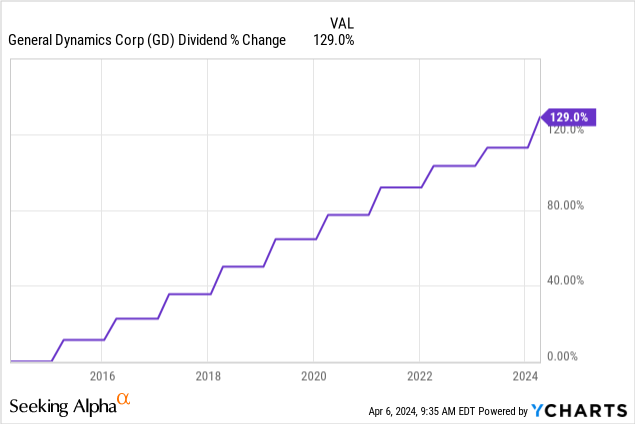

As of the latest announced quarterly dividend of $1.42 per share, the current dividend yield is still quite low at 1.9%. As I mentioned before, I typically shy away from low-yielding stocks like this, but the dividend growth and total return potential here are so strong that I believe it deserves a spot in any dividend investor’s portfolio. The dividend has been increased for 29 consecutive years, making it a veteran dividend aristocrat. We can see that the dividend has increased by 129% over the past decade.

Dividend growth has also been quite solid, with a five-year average compound annual growth rate of 7.26%. This means that if you had held the bond over the past 5 years, your yield on cost would now be above 3%. Suddenly, low starting rates of return don’t seem so bad! Zooming out to a longer time period still shows solid growth. The ten-year compound annual growth rate of dividends is 8.95%.

When you factor in all the backlog and record revenue, the dividend can absolutely continue to grow at this rate. The current dividend payout ratio is only 44%, which is indeed higher than the industry median of 24.35%, but it is not a cause for concern. This is because their interest coverage ratio is 9.29x and operating cash totals $4.7B. I imagine that as their revenue continues to grow over time, the payout ratio will decline over time and become more in line with the industry median.

Cash generated from operations totaled $4.7B, equivalent to 142% of net income, demonstrating GD’s ability to convert revenue into cash efficiently. Free cash flow also increased to $3.8B last quarter due to their cash management, so it’s safe to say that I’m not worried about continued dividend growth or any threat of a dividend cut.

Valuation

The stock is currently trading around fair value, based on Wall Street’s average price target of $298.74. However, as the company continues to generate stronger revenue than ever before, I expect an upgrade in the company’s ratings. The already high backlog continues to grow and free cash flow continues to grow. This free cash flow can be used to research and develop new products and services, leading to more revenue.

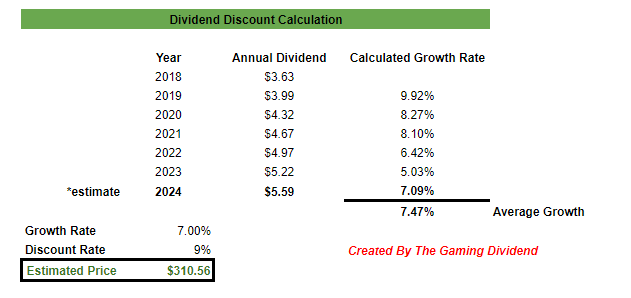

I thought this would be a good opportunity to do a dividend discount calculation to get my own estimated price target. I started by compiling all dividend data from 2018 onwards. I then used the projected annual dividend payment of $5.59 for 2024. I entered a projected growth rate of 7% because that’s revenue growth as of last quarter, which is also consistent with the average dividend growth rate since 2018.

The authors create a dividend discount model

Therefore, I believe the target price of $310.56 per share is reasonable based on these metrics. This price target represents approximately 6% potential upside from current levels. When you combine that with the 1.9% dividend yield, you see a growth rate of about 8% from current price levels. While this may not seem like a huge advantage, we have to remember that GD is currently generating record revenue across all segments and its backlog continues to grow. If this growth continues in the coming quarters, the financials and valuation may change and improve.

risk

The risk for GD remains that most of its revenue comes from government contracts awarded. If we enter an era of slowing global conflict, we will see record-breaking revenue declines and fewer contracts awarded. As a result, General Dynamics remains vulnerable to changes in government spending on maintenance, repairs and supplies. Although there always seems to be some kind of conflict around the world, longer periods of peace are likely to occur when demand for GD services and military defense contracts is not high.

Second, with prices near all-time highs, caution is justified. Any downward momentum in revenue growth over the next few quarters could lead to a pullback in prices. If you don’t believe GD can maintain the same momentum, it’s fair to wait and see to get a better price entry.

take away

General Dynamics (GD) is an excellent choice for investors looking for superior total returns. Although the starting yield is as low as 1.9%, continued dividend growth is where its value lies. Dividends have been increased for more than 29 consecutive years, making it a recognized Dividend Aristocrat. Dividends grow at an average rate of 7%, which has the power to significantly increase your yield on cost over time. Their cash management leads me to believe the dividend can continue to grow over a long period of time.

In addition, the company’s revenue hit all-time highs in all four business areas. This is due to increased contract awards, increased global demand and a growing backlog of work requiring repairs in the coming years. Even though prices are near all-time highs, I believe there is still some room for modest upside based on my dividend discount model.

However, GD remains vulnerable to government spending as most of their revenue comes from government contracts. Any reduction in the defense budget and shift in priorities will result in a reduction in our revenue.