onur dongle

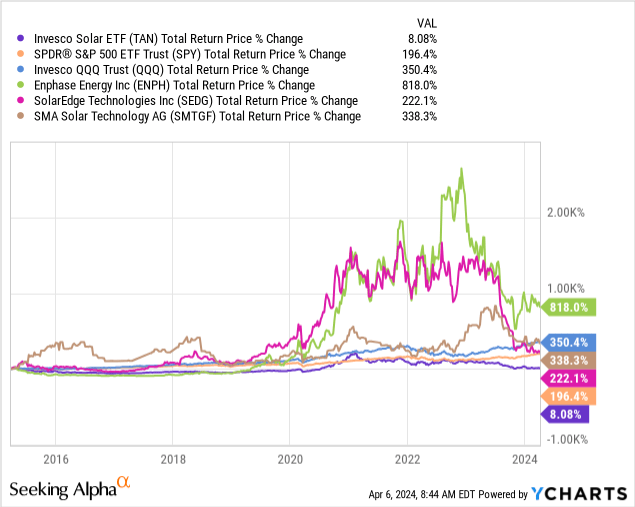

Despite its tremendous growth as an industry, the solar industry has not been particularly investor-friendly. For example, the Invesco (IVZ) Solar ETF (TAN) has significantly underperformed the S&P 500 Index (SPY), The very popular Invesco Technology Trust ETF (QQ). Still, investors who focused solely on companies specializing in solar inverters were rewarded handsomely. Companies such as Enphase Energy (ENPH) and SolarEdge Technology (SEDG) has been one of the best-performing companies of the past few years. That’s why we think investors looking to participate in the growth of the solar industry should probably focus on this part of the industry and avoid the largely commoditized solar panel manufacturers.

We previously compared SMA Solar Technology (OTCPK:SMTGF) to Enphase Energy, and now we’re updating our report after the company report Earnings results for fiscal 2023 and providing guidance for 2024.

There is a lot of debate about which inverter is best, and after spending a lot of time researching the subject, the answer seems to be “it depends.” Overall, SMA Solar inverters are very reliable and generally less expensive than competitors that specialize in microinverters. However, microinverters have advantages and allow for better monitoring when partial shading occurs or certain panels fail. Still, demand for SMA Solar’s inverters clearly remains, as the company’s sales continue to increase. They seem particularly suited to large-scale installations because this is their largest segment and the fastest-growing segment.

Fiscal Year 2023 Results

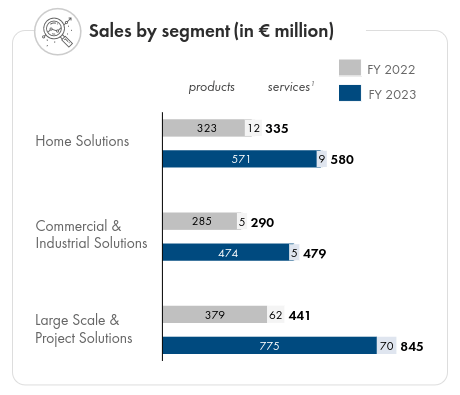

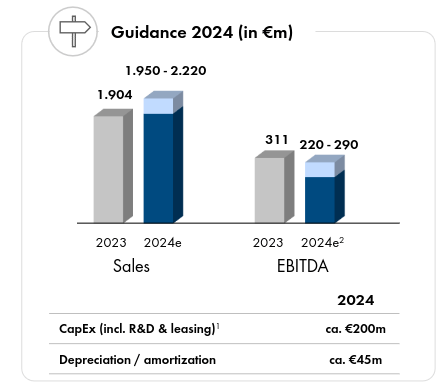

The company’s financial performance in fiscal 2023 was very strong, with group sales growing 79% to 1.904 billion euros and EBITDA margins expanding to 16%. The company achieved solid operating results in all segments, with the Large and Project Solutions segment growing by an impressive 91.8% to €845 million.

SMA Solar Investor Presentation

Net profit roughly quadrupled to 225.7 million euros, while inverter sales reached 20.5 GW in 2023, up from 12.2 GW in 2022. SMA Solar also ended the year with a substantial net cash position of €283.3 million, which provides the company with resources to invest in future growth.

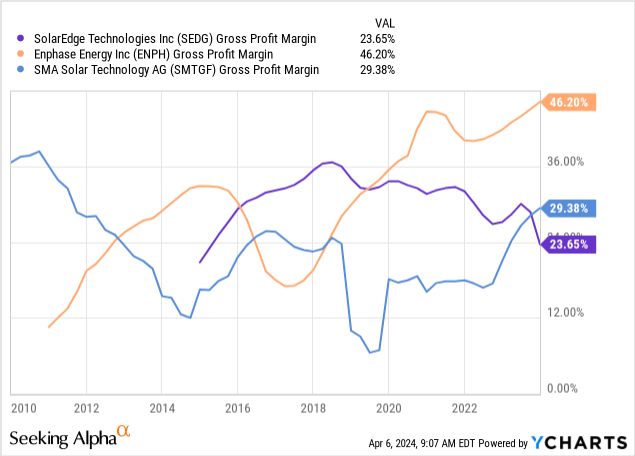

Gross profit margin increased significantly to 29.4% compared with the same period last year, mainly due to improved profitability in the home solutions field. Still, Enphase Energy’s gross margins are much better.

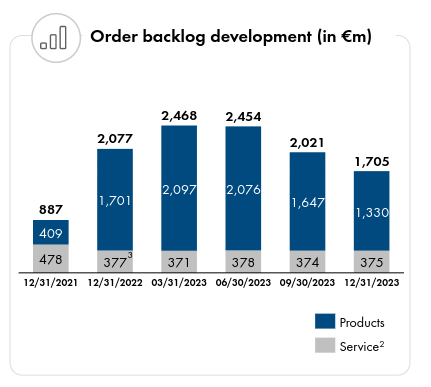

backlog

Backlog levels are down but remain at healthy levels. The company reported that its order backlog totaled 1.705 billion euros at the end of the year.

Notably, the large and project solutions segment’s backlog rose to €914 million, a strong indication of the company’s strong product and competitive advantages in this area.

SMA Solar Investor Presentation

grow

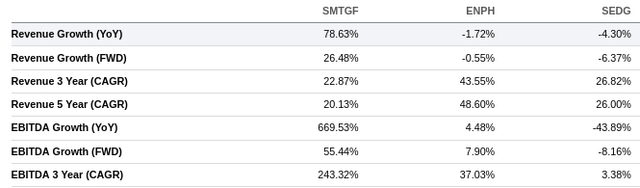

While the company hasn’t participated in the strong growth of rooftop solar like Enphase Energy and Solar Edge Technologies, it is currently benefiting from significant growth in large-scale projects.

Therefore, its revenue growth is expected to significantly outperform the market in 2024.The company is preparing for future growth by investing in the SMA Gigawatt factory in Germany, is expanding its production capacity in Poland, and is considering establishing a new factory production base in the United States

Seeking Alpha

future outlook

Guidance for fiscal 2024 is for sales in the range of €1.95 billion to €2.22 billion and EBITDA in the range of €220 million to €290 million. Sales growth in 2024 is expected to be driven primarily by the large and project solutions segments. SMA’s Home and Commercial & Industrial segments are expected to face headwinds in the first half of 2024 due to higher customer inventory levels. Despite higher expected sales and a one-time positive impact of €19 from the sale of elexon GmbH shares, the company expects EBITDA to fall slightly in fiscal 2024.

Longer term, the company’s prospects are very positive, with some analysts predicting significant growth in utility-scale solar.For example, the morning star is predict Renewable energy sources will triple by 2032, with solar expected to be the fastest growing technology. In particular, they expect utility-scale solar projects to grow severalfold.

SMA Solar Investor Presentation

Valuation

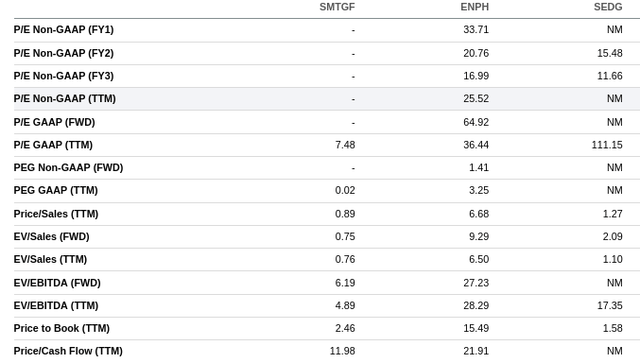

Despite its positive mid- to long-term outlook, the company trades at a very low valuation multiple. We attribute this in part to the company being based in Europe, where valuations are currently generally low. The company is expected to post higher revenue growth this year compared to Enphase Energy and SolarEdge Technologies, but it trades at a fraction of its valuation multiple.

For example, SMA Solar trades at a trailing 12-month EV/EBITDA multiple of less than 5x, while Enphase trades at about 28x and SolarEdge at nearly 17x. As a result, we believe SMA Solar is significantly undervalued and one of the most attractive options in the solar industry.

Seeking Alpha

risk

We see some risks worth considering, including uncertainty about future government and corporate support for renewable energy technologies. There is a risk that competition may intensify and competitors may develop better technologies or find ways to manufacture similar products at lower costs.

So far, inverter companies have been able to offer higher profit margins than solar panel manufacturers, but there’s no guarantee this will continue. Nonetheless, inverter manufacturers have strong intellectual property rights and know-how, as well as strong brands and commercial relationships that mitigate risks.

in conclusion

SMA Solar achieved impressive results in fiscal 2023, with strong revenue and profit growth. The company trades at a much lower valuation compared to its peers, and we think it’s an interesting option considering exposure to the expected substantial growth in solar installations over the next few years. The company has shown particular strength in the area of large-scale projects. Given the very positive outlook and attractive valuation multiples, especially compared to peers, we believe the stock is significantly undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.