3alexd/iStock via Getty Images

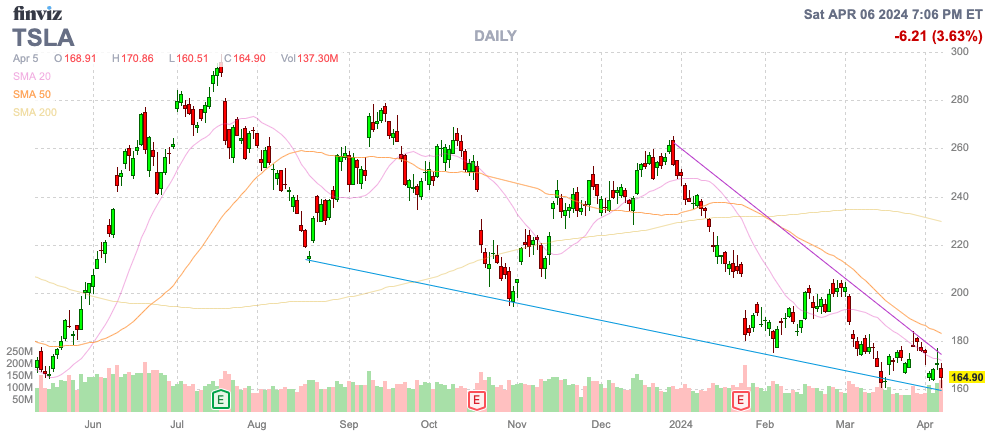

Tesla (NASDAQ: Tesla) faces a tough year, with U.S. electric vehicle demand slowing and Chinese competition intensifying.Shareholders’ best hope is that Elon Musk can fulfill his promise to become a Converting Tesla’s fleet into robotaxis earns the company significant fees. My investment thesis is overall bullish on the stock, but the catalyst for robo-taxis may be far away.

Source: Finviz

Robotaxi released

Elon Musk promises Tesla will launch robotaxi service, progress is going well Back to 2016. The electric vehicle company currently offers FSD (Fully Self-Driving) software, which can provide up to Level 2 services, but a true robo-taxi service will involve Level 5, where there is no driver and the vehicle fully controls driving functions.

After a dramatic day, Musk announced on X that Tesla will launch a robotaxi service August 8th, about 4 months later. While the CEO didn’t actually list the year, the assumption was clearly this year.

Source: Twitter/X

Tesla has already held several robotaxi events, so investors probably shouldn’t get too excited about this news.Cruise Ship Automation, Owner General Motors (General Manager) Recently closure Their robo-taxi business provides services in multiple cities. The company’s license in San Francisco was restricted after an accident involving a human driver and a pedestrian towing a woman into a Cruise vehicle during a robo-taxi service.

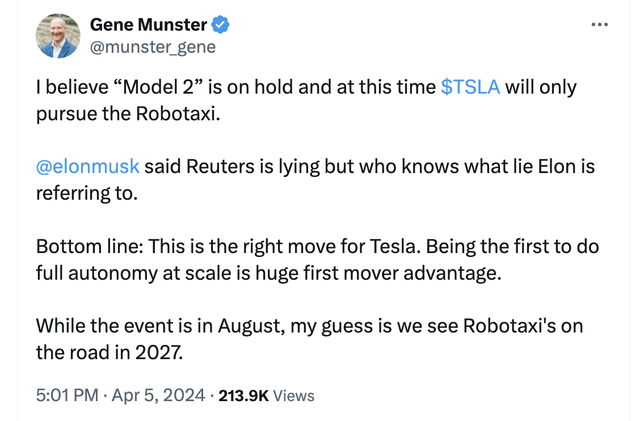

As Deepwater Asset Management’s Gene Munster discussed, even if Tesla has full Level 5 robotaxi technology, the service is unlikely to receive regulatory approval before 2027. The biggest hurdle is likely to be state approval, not technology.

Source: Twitter/X

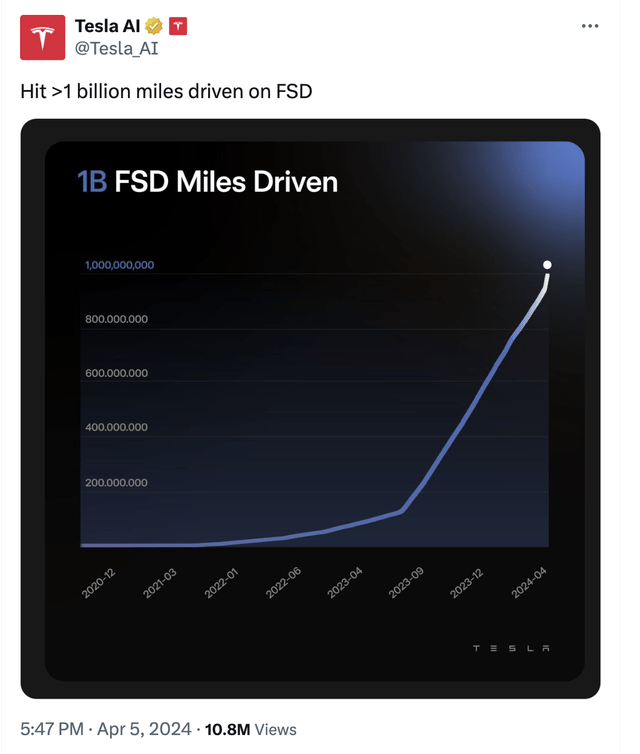

While Tesla has long discussed full self-driving, FSD service is only Level 2 due to driver supervision requirements.The company announced that the FSD service has now traveled 1 billion miles, has grown significantly over the last year, and has seen a hockey stick change following its recent offering 1 month free trial.

Source: Twitter/X

FSD costs $12/K, or Customs can start a subscription at $199/month, which seems overpriced considering the service is only level 2. The problem with these FSD miles is that regulators won’t consider them autonomous for testing purposes because the driver is supposed to keep their hands and eyes on the car.

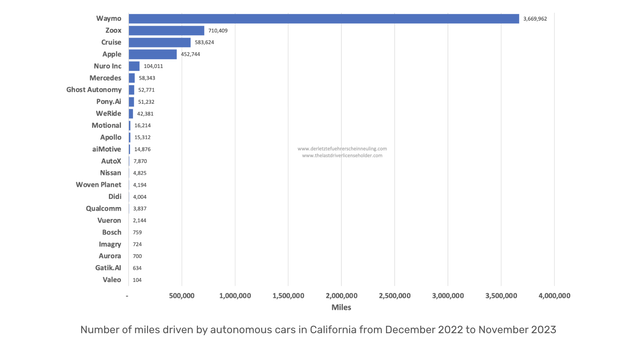

FSD miles will certainly help Tesla build the platform and update the service, but robo-taxi services require regulatory approval to get a license without a driver on board, and each city/state has its own regulations.according to California DMVLast year, Tesla’s test mileage was 0, while Waymo’s was 3.7 million miles.

Source: Last Driving License Holders

Big investment forecast

Ark Investment (ARKK) is a buy on the Robotaxi concept, predicting that Tesla will be worth $2,000 by 2027 based on the launch of the service. The key is to transform EV companies from EV manufacturers to self-driving service providers.

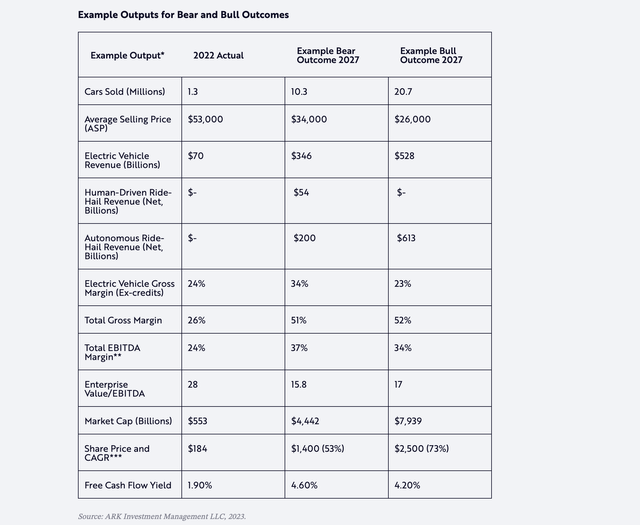

Tesla expects to halve the average selling price of its vehicles to just $26,000, while significantly increasing sales from 1.3 million vehicles in 2022 to 20.7 million vehicles in 2027. EV revenue will still surge from $70 billion to $528 billion during that period, but the company will more than double its robo-taxi business alone, which generated $613 billion in revenue.

Source: Ark Investment

The model suggests Tesla has a 63% chance of launching a robotaxi service in 2024 or 2025. ARK Invest is very unlikely to launch the service after 2025.

The entire value comes from turning a cheap car that costs an estimated $25,000 to make into a money-making robotaxi. A big focus in the market on Friday will be whether Tesla still plans to produce Model 2.

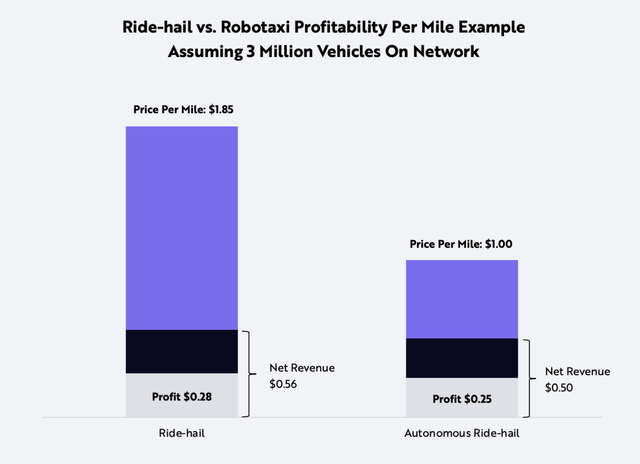

this Pre-COVID model Tesla aims to reduce the cost of travel for ride-hailing services, e.g. Uber (UBER) reduced prices by 50% to about $1 per mile. Trip volume will increase as costs decrease and the need for robotaxi-owned vehicles decreases.

Source: Ark Investment

A large part of the cost of a ride-hailing service is the driver. One of the holy grails for the industry is to eliminate this cost from the structure, and Tesla actually expects to be able to produce vehicles with additional self-driving technology at a very low cost, while many fear vehicle costs will skyrocket.

According to Ark Invest’s model, Tesla will generate about $0.50 in revenue per mile and $0.25 in profit. Many of the financial details must be worked out based on the service’s timeline and the EV company’s ability to produce low-cost electric vehicles with a robotaxi service that can travel 90,000 miles per year and 1 million miles over a lifetime. There’s also a big question as to whether Tesla remains focused on selling cars to asset owners who sign up for its robo-taxi service. Tesla will now receive revenue from the purchase of FSD services for $12,000 and share platform revenue 50/50 based on the model mentioned above.

If anything, the cost of taking a ride has only risen in the past four years.According to a study by AAA, the cost of ride-hailing services $2+ per mile In big cities, owning a car only costs about $1 per mile.

Investors should definitely pay close attention to the Robotaxi unveiling event on August 8th. Interestingly, the stock is down nearly 60% from its highs more than two years ago. Musk is always doing something that adds value to Tesla, and his determined leadership could help push Cruise Services past some regulations.

The stock isn’t cheap right now as the EV market slows, with its 2025 earnings target of $4 per share 4 times that and more than 4 times its sales target. Robo-taxis are the absolute holy grail of the automotive industry, and Musk seems more determined than anyone else, and from that perspective, Tesla is attractive, even if the business is unlikely to launch anytime soon.

take away

The main takeaway for investors is that investors generally do poorly against Elon Musk. Tesla’s launch of a robotaxi service could provide the stock’s next big upside, with ARK Invest predicting the stock could rise to $2,000 from its current price of just $165, a gain of more than 1,100%. The problem is that Musk has long promised full self-driving, and Tesla has yet to offer anything close. Not to mention, the electric vehicle company appears to be taking no steps to allow regulators to license robo-taxi services in any state.

The stock’s sharp decline is interesting, but investors need to understand that it’s highly unlikely that robo-taxi services will be fully rolled out in the next few years. Buy Tesla, but not self-driving car stocks.