George Passantoulis/Getty Images The Moment

Sometimes, setting up a company can be difficult. Some are just plain attractive, while others are decidedly unattractive. But every now and then there are companies that fall somewhere in the middle.One company I can point to That’s it, at least for me, it’s Long Island First Company (NASDAQ: FLIC). For one thing, the stock is very cheap relative to book value. But on the other hand, there are other aspects of the business that are underwhelming. It also has a high risk of uninsured deposits, and its recent financial performance has been anything but stellar. When faced with a mixed opportunity like this, the best thing I can do is err on the side of caution and err on the side of caution. In this case, that leads me to a Hold rating on the business.

The bank I will pass on

According to First of Long Island’s management team, the institution’s history dates back to Founded Founded in 1927. Since its founding, it has grown into a diversified enterprise with 41 locations, primarily in Nassau and Suffolk Counties on Long Island, and in the five boroughs of New York City. Like most regional banks, the business offers a wide range of services to its customers. Products offered include deposit accounts, small and medium business loans, home equity lines of credit, residential mortgages, construction and land development loans, consumer loans and more. The bank also provides other services such as investment management services, trust services, real estate and custody services, among others.

Author – SEC EDGAR Data

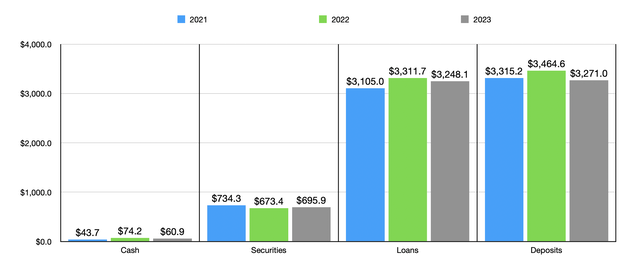

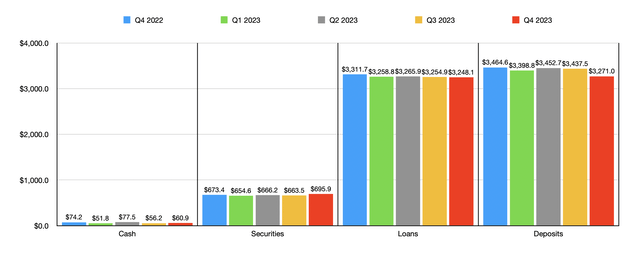

The bank’s recent financial performance has been mixed and in some respects disappointing. For example, consider the value of deposits on your books. Deposits will grow from $3.32 billion in 2021 to $3.46 billion in 2022. After a small decline in deposits in the first quarter of 2023, there was a rebound in the second quarter. But that was short-lived. By the end of 2023, deposits had fallen to $3.27 billion. The good news is that uninsured deposit exposure has fallen from 58% at the end of 2022 to 38% today. But that’s still above my 30% threshold, which is the maximum I generally like in this area.

Author – SEC EDGAR Data

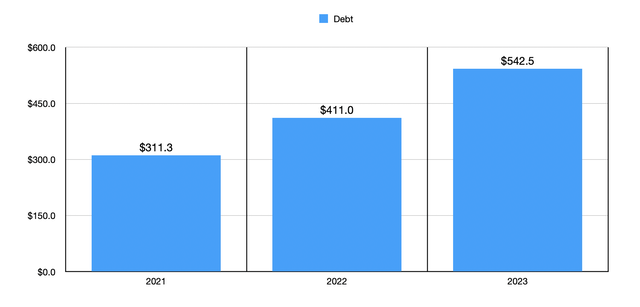

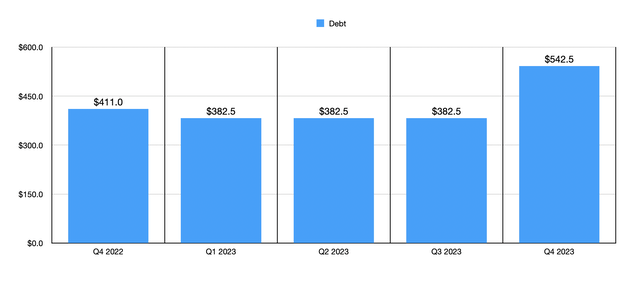

On the lending front, things followed a similar trajectory. Loans increased from $3.11 billion in 2021 to $3.31 billion in 2022 before falling to $3.25 billion in 2023. The agency has shown mixed results elsewhere. For example, the value of the securities on its books did rise from $673.4 million in 2022 to $695.9 million in 2023. This is a positive factor. But that’s still down from the bank’s $734.3 million in 2021. Cash values have remained within a fairly narrow range, especially over the past few quarters. But the debt actually increased. In 2021, the figure was $311.3 million. By the end of 2023, that number had grown to $542.5 million. The vast majority of growth from 2021 occurred in the third to last quarter of last year.

Author – SEC EDGAR Data Author – SEC EDGAR Data

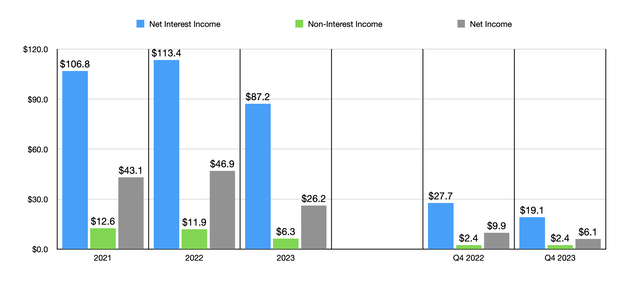

It turns out that this pain on the balance sheet played a significant role in affecting the banks’ profit and loss statements. Net interest income increased from $106.8 million in 2021 to $113.4 million in 2022, but plummeted to $87.2 million last year. The decline is partly due to lower loan values and the need to pay savers higher interest rates to keep their money in banks. Rising debt has also proven to be a problem, especially when you consider the role that higher interest rates fail to play. As the chart below shows, the bank’s other profitability metrics underperformed. Noninterest income fell by nearly half, from $11.9 million in 2022 to $6.3 million in 2023. Net profit plummeted from $46.9 million to $26.2 million.

Author – SEC EDGAR Data

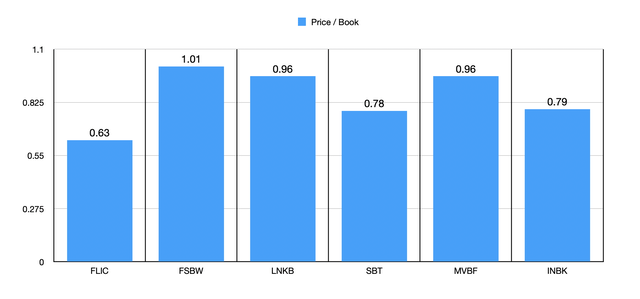

The data we’ve uncovered so far has almost without exception been disappointing. But the advantage of this is that the price of booking bank multiples is quite low. Unfortunately, book value per share has risen significantly over the past few quarters, with no clear trend. This likely factors in the overall price of 0.63x, which is among the institution’s other weaknesses. In fact, as part of my analysis, I compared Long Island First to five similar companies. As shown in the picture below, the price for booking multiple copies at this time is the lowest. All else being equal, this could be a net positive, as it could indicate significant upside potential. But when we start to look at the picture in other ways, things start to look less than ideal.

Author – SEC EDGAR Data

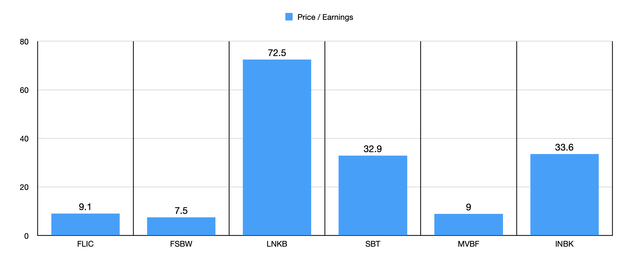

In the next chart, you can see the P/E multiples, not just for First of Long Island, but for these five companies. The body’s reading is 9.1, which is basically on the high end of what I usually like. Some banks still have trading levels between 6 and 9, which is the level I feel most comfortable with. As the chart above shows, of the five companies I compared it to, only two had a P/E ratio lower than its P/E ratio. So it’s in the middle of the pack.

Author – SEC EDGAR Data

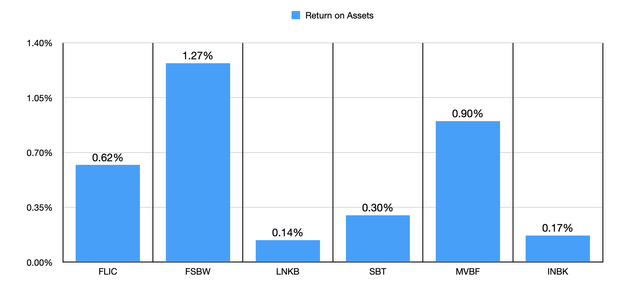

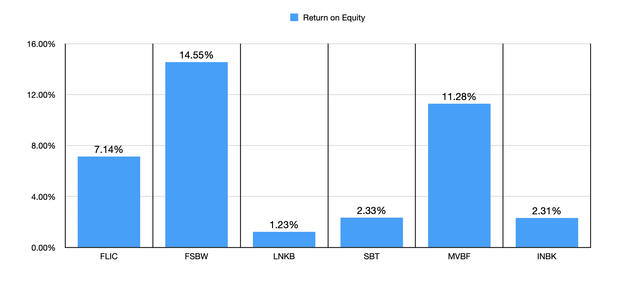

Of course, there are times when institutions should trade where they are. To determine if this is the case, we can look at its returns relative to other metrics. For example, the bank’s return on assets is particularly low at 0.62%. As the first chart below shows, this isn’t the lowest of the group by any means. But I’ve seen readings from multiple institutions at 1% or higher. There is also the topic of return on equity. Once again, Long Island No. 1 seems to be somewhere in the middle of the pack in this regard.

Author – SEC EDGAR Data Author – SEC EDGAR Data

take away

Operationally, Long Island No. 1 is rather unremarkable. What I like about this bank is that its stock is very cheap relative to book value. Some metrics place it in the middle or around the middle relative to other companies I compare it to. But when you start considering other factors, it becomes clear that there is something wrong with this situation. Despite how cheap the stock is, a host of issues such as falling deposits, higher risk on uninsured deposits, falling loan values, and falling revenue and profits lead me to believe a “hold” rating only makes sense at this point. time.