peeterv/iStock Not published via Getty Images

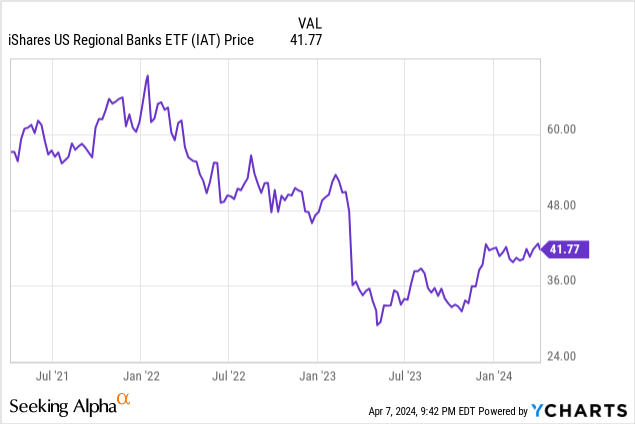

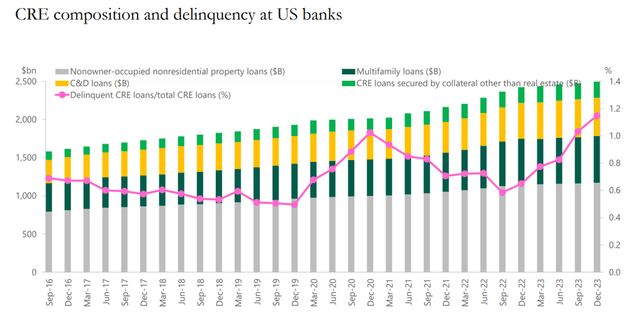

I’m very cautious about banks as a whole (with the exception of Citigroup (C) , which trades at a much deeper discount to peers), and regional banks in particular. Just a little while.Although the group is The Fed’s fourth-quarter turnit’s worth noting that regional bank ETFs like the iShares US Regional Banks ETF (NYSE:IAT) has yet to fully recover to pre-Silicon Valley Bank (SVB) levels. ongoing trouble In the New York community (New York City Commercial Bank), this time due to commercial real estate (“CRE”) (a very real risk for most other regions as well) doesn’t help matters either.Given that we are still in the early stages of the commercial real estate cycle (and are already seeing delinquency rates rise), we are likely to see more downside surprises Group horizon.

Apollo

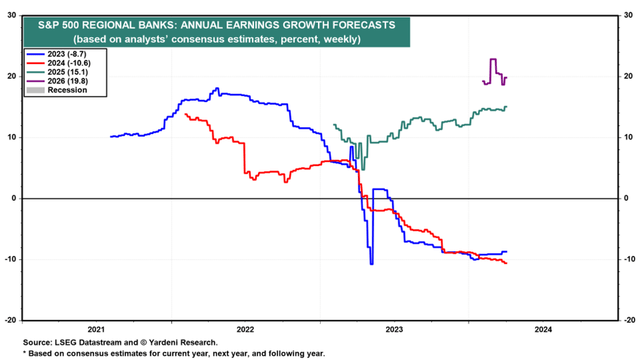

To be clear, I’m focusing more on the income statement here than the balance sheet, as regional and mid-cap banks are well capitalized and certainly diversified enough overall that this does not threaten the group’s solvency. Nonetheless, higher provisions will impact earnings given current consensus expectations (+15%/+19% net profit growth in 2025/2026). S&P 500 Regional Index), the stock may still depreciate significantly. Additionally, there is a growing risk that the “Basel Endgame” – upcoming rules governing banks’ capital buffers against potential risks – will not be watered down in regional markets following NYCB’s recent troubles. This will result in a structural decline in the group’s profitability (mainly through more onerous capital requirements) and put pressure on future profit forecasts.

Yardni

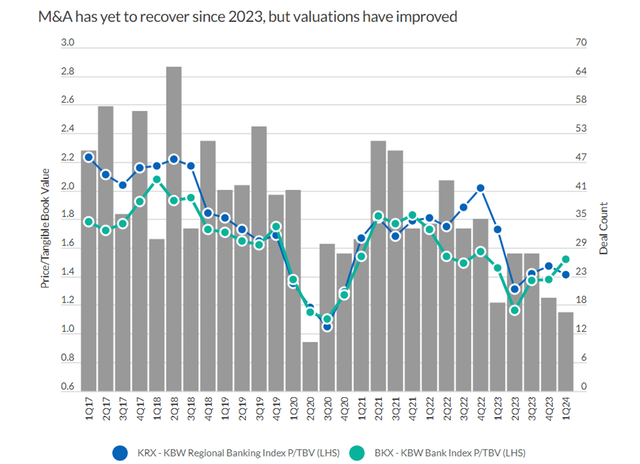

Booking premium is approximately 15% (or ~40% premium Using the KBW Regional Banks ETF (KBWR) as an agent’s tangible book) may look cheap from a historical perspective, but in a region where banks maintain “long-term lower” ROEs relative to higher costs of equity, In the world (higher rates through longer terminals), this discount seems fair. Expectations for an earnings rebound (albeit from a lower base in 2024) are also already priced in, so I The low-cost regional bank exposure invested through the iShares U.S. Regional Banks ETF does not offer a particularly compelling risk/reward.

Fitch

IAT Overview – Competition among U.S. regional banks becomes more concentrated

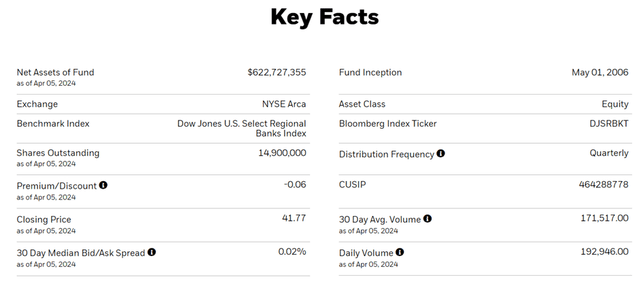

The iShares U.S. Regional Banks ETF tracks (net of fees) market cap-weighted total return performance. Dow Jones The U.S. Select Regional Banks Index is a subset of the bank stocks within the Dow Jones U.S. Bank Index, accounting for less than 5% of total industry assets. Like the index it tracks, the IAT portfolio is regularly rebalanced.

Notably, this ETF has $623 million in assets under management and charges a 0.4% expense ratio; in comparison, the largest and most liquid U.S.-listed regional bank ETF, the SPDR S&P Regional Banking ETF (KRE), manages With $2.8 billion in funding, the expense ratio is slightly lower at 0.35%. IATs also have much lower trading volumes and are therefore less liquid regional banking instruments. While the bid-ask spread is still impressively narrow at 2 basis points, IAT’s overall cost (fees + spread) still lags behind KRE.

Anshuo

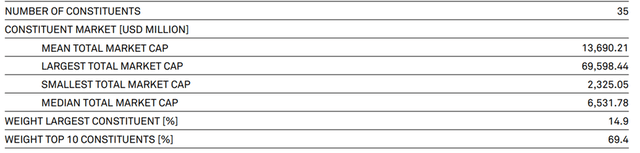

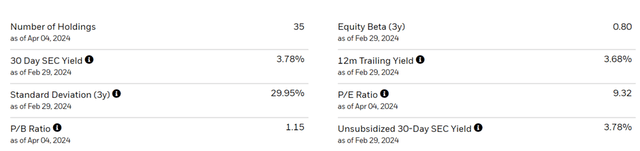

While IAT is not a top regional choice, its approach to asset allocation does stand out. First, the fund’s portfolio contains far fewer individual names (holding 35 stocks), many of which have market caps at the larger end of the regional bank range – on the other hand, the portfolio tracked by KRE contains 141 stocks , priced much lower at an average market cap of $6.8 billion (IAT of $13.7 billion).

Dow Jones

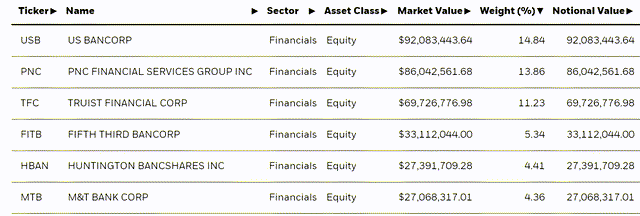

IAT’s narrower portfolio naturally means it is naturally much more concentrated, as evidenced by its allocation to top bank holdings. In contrast to KRE’s equal-weighted approach, IAT has three holdings above the 10% threshold: US Bancorp (USB) at 14.8%, PNC Financial Services (PNC) at 13.9%, and Truist Financial (TFC) at 11.2%. Since IAT’s top five and top 10 holdings also make up around 50% and 69% of the portfolio respectively, fund performance will continue to be closely tied to the fortunes of its major holdings.

Anshuo

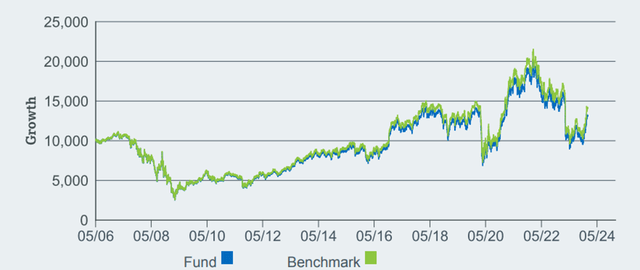

IAT Performance – Stable revenue, but note poor total return performance

The Fed’s policy focus in the fourth quarter of last year generally boosted risk assets, and IAT naturally benefited from a substantial revaluation given the prospect of relief for interest rate-driven regional bank balance sheets. As a result, the fund’s one-year return is currently an impressive +26.5%. On the other hand, if you zoom out a little more, IAT’s annualized return drops significantly. For example, over the past three years, the fund has declined -5.6% on an annualized basis – the result of two consecutive years of declines in 2022 (-20.6%) and 2023 (-8.5%).

Anshuo

That said, at least relatively speaking, the IAT has a positive side. Notably, the fund has outperformed the more diversified regional alternative KRE over all relevant timelines, with the gap being particularly wide last year. Essentially, the IAT’s focus on regional names at the top end of the quality spectrum appears to be paying off. Also commendable is the fact that the fund keeps overall tracking error (i.e., the gap between the fund’s performance and the index’s performance) to a minimum, net of fees, relative to its benchmark, the Dow Jones U.S. Select Regional Banks Index.

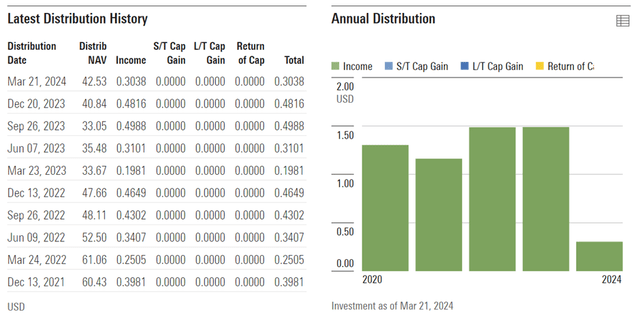

IAT is perhaps better viewed as a steady source of income throughout the cycle than outright capital gains – note that the fund’s allocations have remained remarkably consistent even as the banking sector struggled last year. Compared with KRE, the fund’s return over the past 12 months has also remained slightly higher at 3.7% (30-day SEC return of 3.8%). Since March distributions are already well ahead of last year ($0.30/share in Q1 2024 vs. $0.20/share in Q1 2023), IAT yields should rise further – at least this year.

Morningstar Corporation

However, my main concern is whether regional players will be able to sustain this pace of capital returns (including buybacks) over the long term, given the growing regulatory headwinds (e.g., “Basel Endgame”). However, the market appears to have become more optimistic about the group’s prospects, with consensus forecasts for a strong rebound in regional bank earnings after this year (+15% in 2025; +20% in 2026) (-9% in 2023; +20% in 2024) -11%). In my view, the group’s historical discount multiple of ~1.15x book value may not be that cheap, especially if we see more downward revisions ahead.

Anshuo

Regional banks still need to be treated with caution

Regional bank stocks may have gotten a boost from last year’s fourth-quarter gains, but fundamentally the group remains as troubled as ever. NYCB may be an early warning, but if forward profit expectations are anything to go by, the consensus has yet to fully reflect CRE risk. Asset quality issues aside, the increase in provisioning is noteworthy in the short term, especially given that U.S. office prices per square foot are well below peak levels. Elsewhere, regulatory scrutiny will only intensify in the wake of NYCB, which could mean higher capital requirements and structurally lower returns on equity (most likely through a “Basel Endgame”). Against the deteriorating backdrop, IAT isn’t that cheap – even though it’s trading below its historical average (although still at a ~40% premium to tangible books). Barring a rate wildcard, regional bonds appear to be underperforming.