Kanchit Kirisuchalal

monday.com (Nasdaq ticker: MNDY) is a relatively new position in my portfolio.After updating my valuation at the December 2023 Investor Day and the guidance provided in the February 2023 Q4 earnings call, I rate the stock as purchase The 1-year price target is $277/share (1-year upside potential of +29%).

On these levels, the company is a compelling investment due to strong management execution on continued growth and profitability of its Work OS platform, as well as strong momentum with large enterprise customers.

Here are my quick thoughts on the Q4’23 earnings call and my latest valuation.

focus

On February 12, monday.com reported 4Q23 earnings that exceeded analysts’ expectations. Fiscal 2023 revenue increased 41% annually, driven by strong customer adoption and expansion, especially among large enterprise customers.

Things I like:

- Revenue growth remains Strong, especially in the enterprise space. Despite geopolitical uncertainty, revenue growth in fiscal 2023 remained strong, up 41% year-on-year to $729.7 million. Looking forward, the company expects Q1-24 revenue to grow by 28% – 30%, and FY24 revenue will be in the range of US$926 million – US$932 million, an annual increase of 27% – 28%. The total number of customers in fiscal year 2023 increased by approximately 21% compared with the same period last year, reaching approximately 225,000. During the year, the company added 821 new customers with annual revenue of more than $50,000, up from 681 new customers last year, as it continued to focus on strengthening its enterprise-wide solutions. Customers with ARR over $50,000 now account for 32% of ARR, up from 27% a year ago. Customers with ARR over $100,000 accounted for 20% of ARR, up from 17% last year, again highlighting the fact that monday.com’s products are resonating well with enterprise customers.

- Be more efficient and have a strong commitment to profitability. In addition to strong top-line growth, the company continues to improve efficiency, with non-GAAP operating margin and free cash flow hitting record highs. Non-GAAP operating income for fiscal 2023 was $61.6 million (margin 8%), compared with an operating loss of $47.1 million the prior year. For fiscal 2024, management is calling for non-GAAP operating income in the range of $58 million to $64, which equates to a 6% – 7% margin. Free cash flow remains strong, with non-GAAP free cash flow of $204.9 million in fiscal 2023 (margin 28%), compared with $8.1 million in fiscal 2022 (margin 2%). Management calls for free cash flow to slow slightly as the company continues to reinvest in the business, but still expects FY24 cash flow to maintain a healthy 22% margin (mid-point of $203 million).

- The multi-product strategy is working well and the company continues to focus on innovation and product development. Over the past year, monday.com has introduced new features and delivered new features such as Monday AI and Monday Workflow. The company launched MondayDB in fiscal 2023 and is currently entering the 2.0 phase of development to focus on more complex use cases. Starting last year, the company started opening its Monday sales CRM to select customers. Demand for CRM products remains strong (CRM customer sales grew 21% in fiscal 2023), with general availability expected by the end of the first quarter of 2024 on Monday. The Monday development tool, which is expected to be generally available by the end of the first quarter of 2024, is a tool designed to simplify the software development process. There was a lot of cross-selling between products on Monday, a trend that continued in Q4’23 and Q1’24. Management anticipates a significant increase in cross-selling in the future, which may occur as a result of a reorganization of the sales organization. Currently, there are teams on Monday working on the sales process, but management has hinted there may be more representatives dedicated to selling different products.

Things I’m looking at:

- Net dollar retention ratio (NDR) decrease. Net dollar retention fell to 110% in Q4 2023 from 121% a year ago due to continued macro headwinds. However, management expects NDR to start recovering in the second half of fiscal 2024. NDR remains high for large enterprise customers (115% for the $50K+ ARR customer base and 114% for the $100K+ ARR customer base), which is a positive A sign that the company is moving upmarket.

- Price increased. After months of testing, the company has raised prices for its product suite, and management expects the price adjustment to contribute $15 million to $20 million to fiscal 2024 revenue. The price increase was originally planned for June 24/H2-24, but the company completed the A/B test earlier than expected. So far, management hasn’t seen a significant impact on ARR, and there has been very little change in customer churn and seat expansion (which has mostly happened with smaller customers). However, this is the first time Monday has implemented a price increase that affects its existing customer base, so I will continue to track any significant changes in customer churn and the potential impact on NDR in the short term.

- FY24 revenue guidance in line with analysts’ expectations, management calls for lower free cash flow margins. The 27% revenue growth guidance was in line with analysts’ expectations, but the number benefited from a short-term revenue boost from rising prices. Excluding the impact of price increases, real revenue growth will be close to 25% annually, which is the minimum level for base case management established by investors during the period. Free cash flow margins are also expected to decline year over year: While management is calling for 27%-29% free cash flow margins in 1Q24, margins in FY24 are expected to be around 22% (FY2023 was 28%). Management attributed the difference between first-quarter fiscal 2024 and fiscal 2024 margins to cash bonuses the company typically pays its quota representatives in the second and fourth quarters.

Guidance and impact on valuation

Here’s how to consider management guidance/long-term goals in valuation:

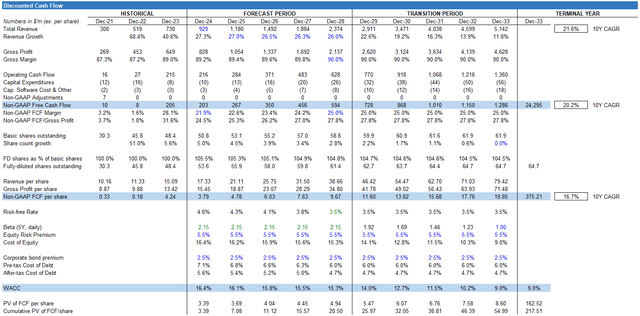

- revenue growth: The company expects fiscal 2024 revenue to grow 27.3%, or a mid-point of $929 million. During its investor day on Dec. 23, management laid out a base case of revenue growth of 20% high – 30% low over the medium term (FY2024 to FY26). I expect revenue to grow 26% – 27% through fiscal 2028, which is consistent with what the company announced at its investor day. After experiencing rapid growth of up to 20% from fiscal year 2024 to fiscal year 2026, I expect revenue growth to slow to 26.3% in fiscal year 2027 and to 26.0% in fiscal year 28.

- free cash flow: During its Q4 ’23 earnings report, the company updated its fiscal 2024 free cash flow guidance to the midpoint of $203 million non-GAAP free cash flow (or a margin of approximately 22%), while at its investor day , the company called for a mid-term base case of FCF margins of around 20%. Management is calling for approximately $1 billion in free cash flow between fiscal 2023 and fiscal 2026. I expect fiscal 2024 non-GAAP FCF margin to be approximately 22%, consistent with the guidance provided in Q4 2023. Margins are expected to stabilize at around 25% in fiscal 2028, which is consistent with management’s mid-term profit margin target of 20%. My estimate of free cash flow is also in line with management’s call for generating approximately $1 billion in cumulative free cash flow between fiscal 2023 and fiscal 2026.

- Equity dilution: The company did not explicitly forecast the share count. However, during the investor day, management called for SBC’s percentage of revenue to be in the low to mid-teens. I expect share dilution in fiscal 2024 to be 5.0%, equivalent to 50.8 million basic shares outstanding and 53.6 million fully diluted shares outstanding.

Valuation

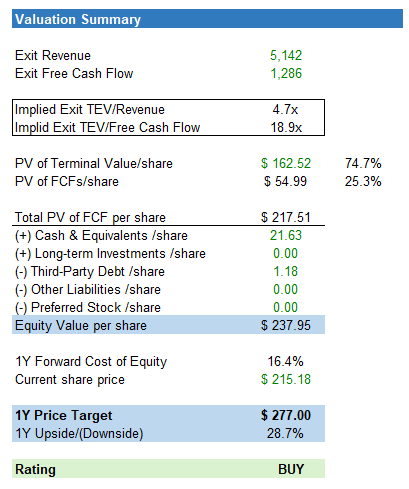

My current valuation implies a fair value of $238/share, equivalent to a 1-year price target of $277/share (29% upside from current levels), driven by continued top-line growth and free cash flow generation . I rate the stock a Buy.

Here is a summary of the valuation:

Q4’23 earnings call, investor day, CapIQ forecast, own forecast

Under these assumptions, I expect a 5-year revenue CAGR of approximately 27% and a long-term free cash flow margin of 25%. This means that by fiscal 2028, monday.com will generate approximately $594 million in free cash flow and revenue of approximately $2.4 billion.

Under these assumptions, what would future free cash flow look like:

Q4’23 earnings call, investor day, CapIQ forecast, own forecast

I look forward to adjusting. Free cash flow per share will grow to $19.85 over 10 years from $4.24 as of December 23, a compound annual growth rate of approximately 17% (Note: Adjustment. FCF/share is calculated on a fully diluted share basis).

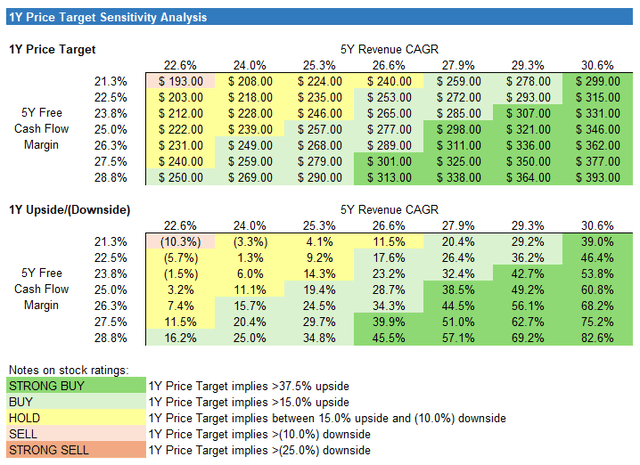

Here are the 1-year price target sensitivities:

Q4’23 earnings call, investor day, CapIQ forecast, own forecast

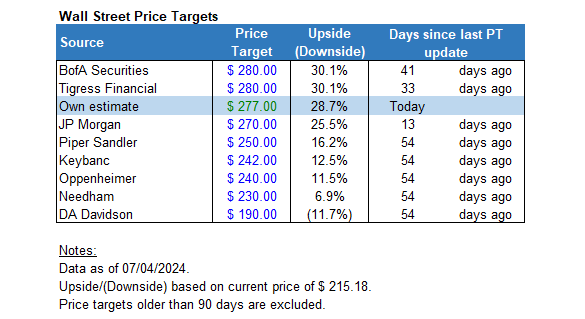

My base case 1-year price target of $277/share falls at the high end of Wall Street’s recent range of estimates (the latest price target update came from JPMorgan 13 days ago, calling for a $270/share price target):

CapIQ estimate, own estimate

Regarding some recent analyst changes, Bank of America Report initiated 26thth A “Buy” rating and a $280/share price target in February, citing the company’s potential to beat consensus estimates, continue to gain market share, provide value compared to peers at current prices, and capitalize on expansion into the enterprise market and launching new products to drive long-term growth. Bank of America expects monday.com to become a 55 company by fiscal 2024; for reference, I expect monday.com’s revenue to grow 27.3% in fiscal 2024 and its free cash flow margin to reach 22.0% (Rule of 49).

JPMorgan Raise target price The price per share was lowered from US$230 to US$270, and the Overweight rating was maintained. The decision to increase PT reflects JPMorgan’s confidence in demand trends for monday.com. After speaking with company leaders, J.P. Morgan analyst Pinjalim Bora believes the company has demonstrated strong execution, which will likely drive superior growth and margins.

No 4th March, Tigress Financial Partners Increased target price from $240 per share to $280 while maintaining a buy rating on the stock. The company cited monday.com’s continued development of its Work OS platform, which is enhancing enterprise management capabilities and driving customer adoption.

However, some Wall Street firms are more cautious. DA Davidson downgraded monday.com to neutral in December 2023 with a price target of $190/share, reiterates its recommendations and a February 2024 price target.