Afternoon pictures

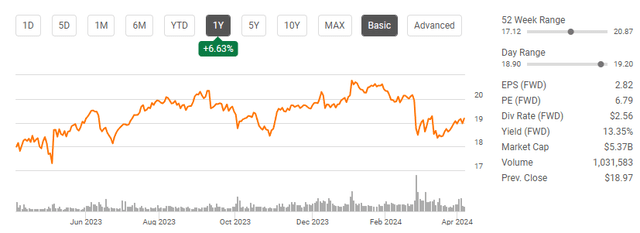

FS KKR Capital Corp shares (NYSE code: FSK)’s performance declined in its fourth-quarter 2023 financial report and sold off sharply after the fourth-quarter data was released. Since January 4, FSK shares have fallen -$1.14 (-5.49%)th As of February 26thFollowing the release of Q4 earnings, shares fell another -$1.15 (-5.86%) over the next two days to $18.48. Shares attempted to rebound before falling back to mid-$18 over the next two weeks before bouncing back above $19. The market doesn’t seem too excited about the decline in net investment income (NII), especially since we are in a high interest rate environment. After looking at the data and looking at the fiscal 2023 performance of many large business development companies (BDCs), I remain bullish on FSK.The dividend looks good and after considering my personal investments, I plan to increase to my location. I started acquiring shares in April 2023 at $19.24 per share. I have made 7 purchases since April 2023 and have earned 11.97% of my initial investment from their distribution income. I believe FSK represents an opportunity for income investors because the underlying assets of FSK’s portfolios are trading at a discount. I plan to add to my position in FSK ahead of its first quarter earnings, as I feel there is an opportunity for capital appreciation and significant income generation.

Seeking Alpha

Continuing my previous article about FSK

In my last post on January 29thday, 2024 (which can be read here ) I discussed why I thought the stock looked undervalued in the fourth quarter earnings report. Since then, FSK shares have fallen -6.87% compared to the S&P 500’s gain of 6.36%. If distributions are taken into account, FSK’s share price has fallen -3.67% since January 29th. I’m not a trader or short-term investor, so seeing the stock price drop after an earnings report doesn’t bother me if I think the investment thesis is still intact. While FSK shares have been profitable over the past year, they have yet to reach pre-pandemic levels and are down -3.42% in 2024. I want to continue my previous article discussing why I think the stock will sell off following the Q4 report and provide an update on my investment thesis on why I remain bullish and plan to add to my current position.

Seeking Alpha

What went wrong in Q4 and what’s at stake for my investment thesis on FSK

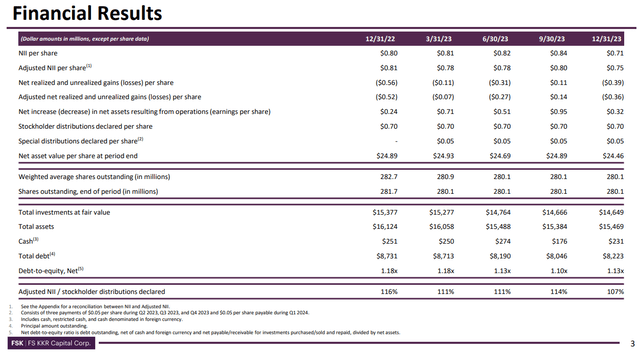

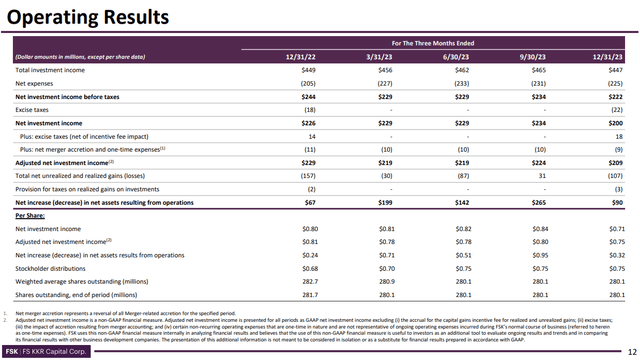

For a BDC, NII is one of the most critical numbers because it is the profit its investments generate after fees. NII can include interest received, dividends or distributions paid to the company, rental income, and capital gains. In the fourth quarter, FSK’s NII decreased by -11.25% year-on-year to $0.71 per share. This is also the reason for the quarterly decrease of -15.48%, as FSK generated NII per share of $0.84 in Q3 2023. On the Q4 conference call, Brian Gerson (FSK Co-President) discussed how FSK made five investments in non-accrual earnings, with a combined cost of $654 million and a fair value of $422 million.When a company classifies a loan as non-accrual This is because entities that issue capital in the form of debt have not made payments for at least 90 days. This can have a negative impact on short-term performance and the lender’s long-term financial position, as their investment does not generate the agreed-upon interest. Non-accrual loans are typically unsecured, and if payments are not made, they become non-performing loans. Non-accrual loans can remain on the books as cash, in which case the lender (FSK) typically adjusts its reserves to account for potential losses on bad loans. When these situations occur, lenders will typically work with the borrower because it is in their best interest to agree on a plan to meet their financial obligations. When a non-accrual loan returns to accrual status, the delinquent principal is repaid along with interest and fees, and then normal payments resume.

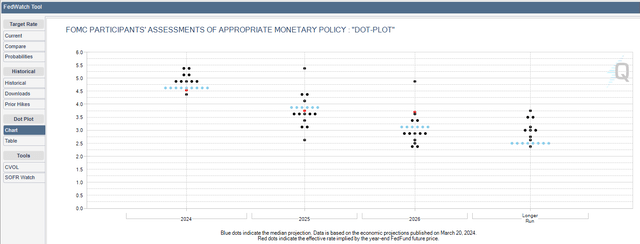

This has caused a bit of panic in the market, as the correlation between 5 investments in non-accrual status and declining NII in a high interest rate environment cannot be ignored. It certainly doesn’t help that the Fed has closed the door on a rate cut in March.in the recent Federal Open Market Committee Press ConferenceFederal Reserve Chairman Powell said that a higher long-term interest rate environment is entirely possible. Although the dot plot reiterates the median of 4.6% in 2024, 3.6% in 2025 and 3.1% in 2026, there is no guarantee that the Fed will The Fed will cut interest rates on this schedule. Personal consumption The United States grew 0.8% in February from the previous quarter, while U.S. personal consumption expenditures price index Personal consumption expenditures (PCE) increased 0.3% month-on-month in February. The economy is still overheating, and there are few reasons for the Federal Reserve to cut interest rates in the first half of 2023. CME Group’s FedWatch Tool Current indications are that the probability of interest rates remaining unchanged at the May meeting is 95.2%, while the probability of interest rates remaining unchanged at the June meeting is 46.8%. If it cuts interest rates while the economy is hot, the Fed will face the risk of a rebound in inflation, which is the last thing the Fed wants to happen, because it is likely to lead to a reversal of the Fed’s policy and ultimately lead to higher interest rates.

This is a negative for FSK because its business model revolves around lending and acquiring stakes in smaller companies that typically operate in the lower middle market. While higher interest rates can be a catalyst for issuing high-interest loans and charging more interest, it also creates a tougher operating environment for businesses, as we are now seeing with some from FSK having trouble repaying their debt. This poses a significant risk to my investment thesis, as if more FSK originates loans on a non-accrual basis, quarterly NII could worsen further and the probability of default on a larger portion of the portfolio would increase. This could put FSK’s allocations at risk, potentially causing the net asset value (NAV) to fall, and thus the share price, if the loans begin to default.

frequency shift keying

Why I’m bullish on FSK in 2024

FSK’s management team has shown they can adapt to adverse situations. The non-accrual charges incurred are not optimal for FSK and how the management team classifies them is critical. FSK restructured its $125 million first-lien term loan with Reliant into a $62.5 million cash-first-out term loan and a $62.5 million second tranche non-accrual loan. KBS, a facilities maintenance company, provided a $366 million first-lien loan to FSK. The loan has been restructured into a $166 million senior loan and a $200 million subordinated term loan. The $200 million loan is non-accrual. While FSK’s investment income decreased by $18 million sequentially, resulting in five non-accrual investments, this demonstrated management’s ability to respond to a difficult business environment and work with operators to find solutions to common problems.

Despite some issues in the fourth quarter, FSK’s operating standards remain quite attractive. For the full year 2023, FSK generated $3.18 in NII per share, of which $2.95 was distributed to shareholders through regular and special distributions. Management expects FSK’s NII to increase to $0.73 on a per-share basis in Q1 2024 as they expect to generate $348 million in recurring interest income, $51 million in recurring dividend income, and $30 million in other expenses and dividend income. Management is confident it will distribute $2.90 per share in earnings during 2024, with $2.80 coming from regular distributions and $0.10 coming from a special distribution in the first half of 2024. This would be a forward yield of 15.12% on FSK’s current share price. 19.18.

frequency shift keying

have $6.36 trillion sit on the sidelines money market account, can still reach a yield of 5.3%. Although Fed Chairman Powell has left the door open to a longer-term higher interest rate environment, I think we will see the first rate cut in June. While the Fed doesn’t want inflation to rise, they also don’t want massive loan defaults that could weaken regional banks. After what happened in March 2023, I don’t believe they will take the chance. I think the Fed is preparing for a slow decline in interest rates, so the refinancing market in 2025 will be beneficial to both parties. While FSK is able to issue loans at higher interest rates, the loan market has tightened due to low capital costs. This is as attractive as ever for company expansion. Based on the Fed’s forecasts, I think we will reach a stage where default risk and debt issuance on a non-accrual basis will decline, and the appetite for taking on debt will increase because the ability to finance debt will be greater. Interest rates are not going to reach 2% or lower anytime soon, and even in an environment where terminal rates are between 3.5% – 4.5%, FSK is able to issue new loans at attractive rates. FSK may actually do better because the volume of loans they are able to issue may exceed the amount of interest accrued on smaller loans issued at higher interest rates.

CME Group

When I compare FSK to their peers, a new investment in FSK remains attractive to me. The peer groups I compare FSK to are:

- Ares Capital (ARCC)

- Main Street Capital (MAIN)

- Prospect Capital Corporation (PSEC)

- Barings Bank BDC (BBDC)

- Blue Owl Capital Corporation (OBDC)

- Medium Financial Investment Company (MFIC)

- Goldman Sachs BDC (GSBD)

- Oak Tree Specialty Lenders (OCSL)

- Golub Capital BDC (GBDC)

- Gladstone Capital (GLAD)

- Sixth Street Specialty Lending (TSLX)

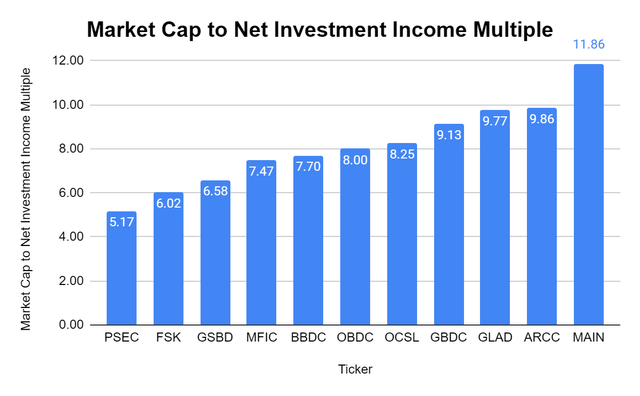

I’ve been looking to buy the BDC NII at a reasonable price, and if I can get it at a discount, even better. FSK trades at 6.02 times its NII, while peers trade at 8.17 times. FSK is discounting heavily, especially as its NII is expected to increase sequentially in the first quarter. FSK also produces 2ND On an annualized basis, the NII amount is the largest among its peers, and paying 6.02x is a bargain in my opinion.

Steven Fiorillo, “Searching Alpha”

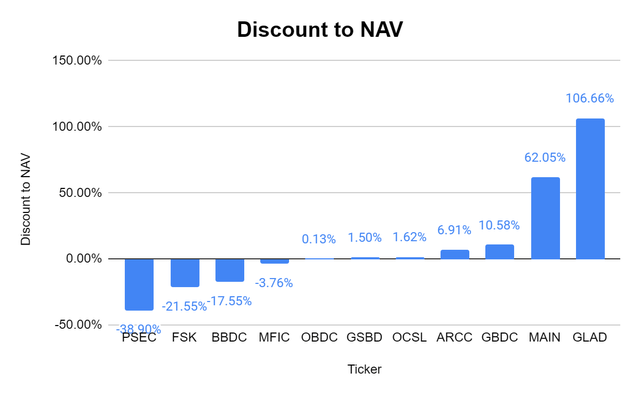

While FSK’s NAV has come under some pressure, the fact is that it’s still valued at $24.45 per share. This means that FSK is trading at a discount of -21.55% to its NAV. Even in the bad scenario where some loans in non-accrual status actually default, there is protection between NAV and FSK’s share price. If management is working with these companies to develop solutions as they enter non-accrual status, I am confident that if we do not see a significant decline in FSK’s NAV, FSK’s discount to NAV in the coming quarters will Will tighten. . Considering its peers are trading at a 9.79% premium to NAV, this could be a solid arbitrage opportunity.

Steven Fiorillo, “Searching Alpha”

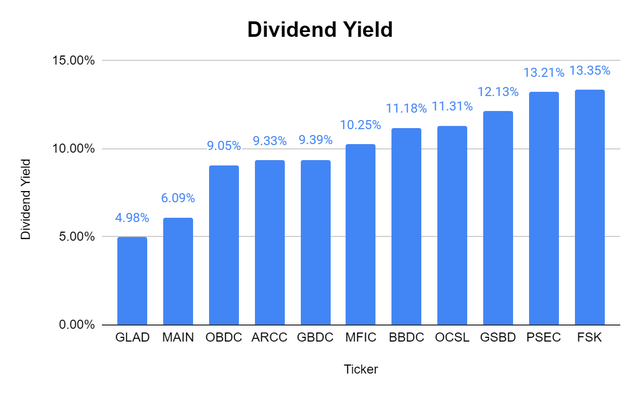

FSK to me is an income investment first and a capital appreciation investment second. Based on the normal distribution in 2023, FSK’s yield is 13.35%, while the average yield of its peers is 10.02%. When I use the data discussed on the Q4 conference call, FSK is expected to generate a distribution yield of 15.12% based on the current share price. That’s a significant yield, about 50% higher than the peer average. From an income perspective, I am excited to be able to increase my position at FSK, considering that my income is high compared to my peers.

Steven Fiorillo, “Searching Alpha”

in conclusion

I think FSK represents the opportunity from lower NII in the fourth quarter of 2023. While FSK has experienced some issues, they are working to correct them and have stated that their NII will grow and will be able to distribute $2.90 per share to investors during 2024. I think the Fed will start cutting interest rates in June, and we will provide a good environment for BDCs in the second half of 2024 and throughout 2025 to make loans and promote larger NIIs. FSK is one of the largest BDCs as it generates 2ND Of the projects I track, NII has the largest amount and the largest distribution benefits. I think investing in FSK has the potential to generate substantial income and modest capital appreciation in the future. I plan to increase my investment in FSK during the first quarter earnings report.