FabrikaCr/iStock via Getty Images

When should a company cease operations and be liquidated? There comes a time when some companies no longer seem to have a realistic path to creating shareholder value.In this case, the best way to handle it is It might just be about shutting down operations and giving the remaining cash back to shareholders.

Arguably, this could be the case for online gaming companies Skill (NYSE: SKLZ). Skillz is a platform looking to revolutionize the online gaming space. The idea is for players to compete in skill-based competitions to win real money prizes.

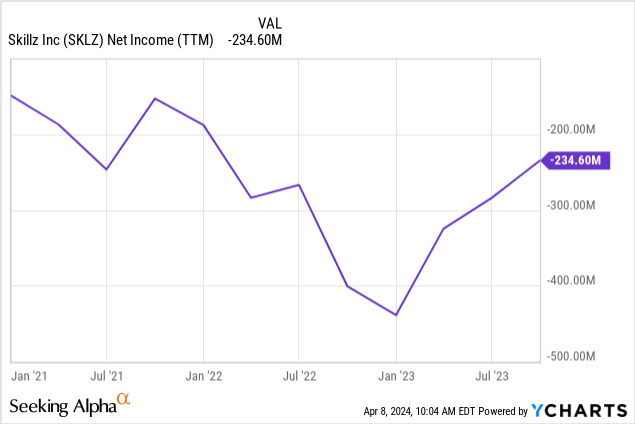

The company went public through a SPAC deal, and the stock was initially very popular. Skillz has attracted high-profile investors such as Cathie Wood. However, Skillz always have to spend a lot of money to bring in new players. The cost of acquiring customers is higher. churn rate, Skillz worked hard to hone its marketing strategy. As a result, the company never became sustainably profitable. In fact, it’s lost over $100 million a year since going public:

Skillz’s stock price plummeted as the SPAC boom ended and investors began to focus more on profitability and cash flow generation. In addition to the company’s core monetization challenges, I believe the rise of sports betting apps has poached many potential customers from Skillz’s product.

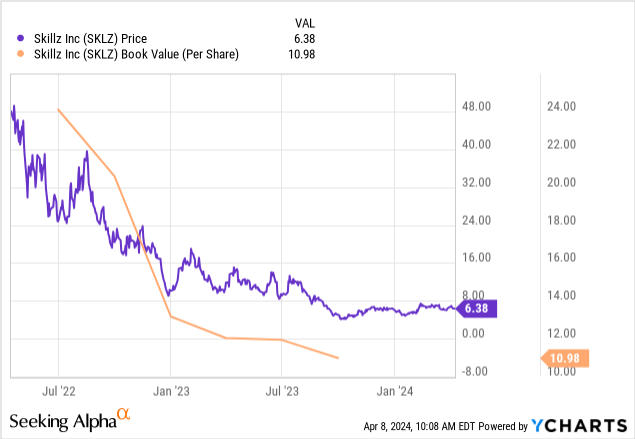

I last covered the company in 2022, writing at the time that while the stock had fallen significantly, I still didn’t see any value. In fact, I’d like to see the share price drop another 70% and well below cash value per share to find room for upside in the stock.

Fast forward to today, and Skillz stock is down 68% from my previous report. So it’s time to take another look at the company, with Skillz currently trading at a significant discount to its most recently reported book value per share.

Back in 2022, Skillz stock was trading around $30 (reverse split adjusted) with a book value of about $20 per share. Now, while the book value continues to decline, the stock price has fallen even faster, to less than $7, leaving considerable room for theoretical upside from stock price to book value.

Is there a reason to be long on SKLZ stock today?

So is there finally reason for optimism for the troubled online gaming company?

There are two answers to this question.

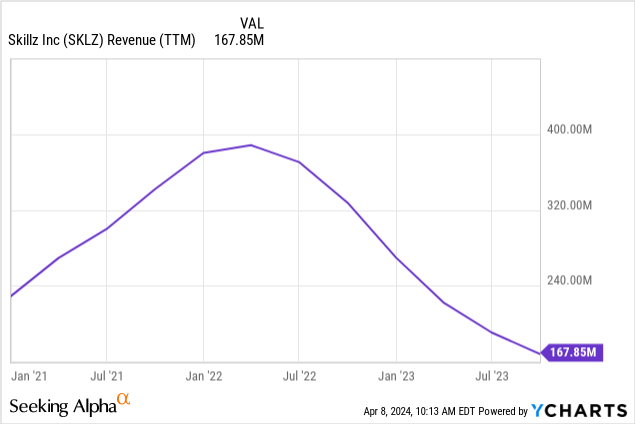

The first is to look at shrinking, seemingly irrelevant operating businesses and say, “No, there’s no bull market here.” The company’s revenue continues to decline at a double-digit rate annually and quarter-on-quarter. Here’s an ugly graph:

The company’s current revenue has dropped by nearly 60% from its peak. Revenue fell 38% year-over-year in the most recent quarter, suggesting the downward trend isn’t over yet. Additionally, the company’s number of monthly paid active users continues to decline, suggesting that much of the more casual portion of the company’s user base is disappearing.

Skillz no longer seems willing to invest in unprofitable growth. It cut marketing spending. Without incentives for gamers to increase their spending, the player base will continue to shrink.

In addition, the company also reduced research and development expenses by 50% annually to only US$3 million per quarter. Analysts have expressed concerns about the relatively poor quality of the company’s gaming experiences in terms of graphics and gameplay compared to peer gaming companies. As Skillz cuts R&D spending, it doesn’t look like there will be major improvements to the company’s existing gaming ecosystem.

Skillz is working hard to reduce monetization, which is a reasonable and laudable goal. That said, with revenue already down to $150 million by 2023 and now less than $120 million annualized based on last quarter’s results, it’s hard to see the value of this as a steady-state business given that The company is still far from a breakthrough. That’s true even on an adjusted EBITDA basis. How much more can the company cut costs and still remain a viable business? At some point, once a company is small enough that listing fees, audit fees, legal fees, and all other such costs associated with being a public company in the United States consume a significant portion, then becoming a public company is not worth it. . Top line revenue.

But, back to the original question: Is there a bull market here? right here.

This is from the balance sheet. Skillz trades at a sizable discount to both its book value and its net cash per share. Specifically, Skillz had $302 million in cash and equivalents at the end of 2023, compared with $124 million in total outstanding debt. This means Skillz has about $178 million in available net cash, while its market capitalization is about $125 million.

The company is also involved in a legal dispute with a competitor it believes has infringed on its intellectual property rights. Skillz appears to be able to recover $42.9 million from the incident.

In theory, Skillz could suspend operations and return its cash reserves and potential legal gains to shareholders. This could generate significant returns from today’s prices. Alternatively, Skillz could try to sell its gaming platform to another operator while using the cash to make a shareholder distribution or move into a different business entirely.

If you’ve been bearish on SKLZ stock, I think you have to keep this in mind. At this point, Skillz does have the option to abandon its core business and use its substantial cash reserves for more enriching purposes. However, from the latest call transcript I’ve read, I’ve seen little indication that a business pivot might be on the table. And, as Skillz buys back stock, that will eat into the company’s cash balance over time and narrow its strategic options.

Perhaps activist investors will join in and push the company to return cash to shareholders. In fact, it might be a fun thing for an activist shop to do.

In the meantime, it looks like Skillz will continue to work on narrowing the path to success. The company is continuing to fine-tune its VIP customer monetization and engagement efforts in an effort to drive additional performance from its existing customer base.

If you think the company has the potential to stem the revenue decline, perhaps it can break even, at least on an EBITDA basis. From that point on, you could argue that a breakeven business tied to a large cash balance should be worth some real upside compared to today’s prices. It’s not enough to get me excited, but it’s better than nothing.

On the other hand, if you were short SKLZ stock before, the trade appears to be over and it may be time to move on. Given its large cash balance and the company’s shrinking operating losses, SKLZ stock is likely to stabilize around its current share price. As long as a stock trades below its cash value, an upward trend is likely, with further downside limited in the short term.

That said, Skillz serves as a reminder of the dangers of the sunk cost fallacy when investing. Skillz stock has lost almost all its value from its 2021 peak. But as long as revenue continues to decline and the company continues to lose money, it can, and in fact has, further eroded shareholder value since my last article about the company.

Going forward, it seems likely that Skillz will find itself in a dead money situation. The company has a large cash balance, but that will gradually be eroded as the company continues to operate its hitherto unsuccessful gaming platform. Over time, the stock may trade flat or slightly lower as investors lose hope that something positive will eventually happen.