Grigorenko/iStock via Getty Images

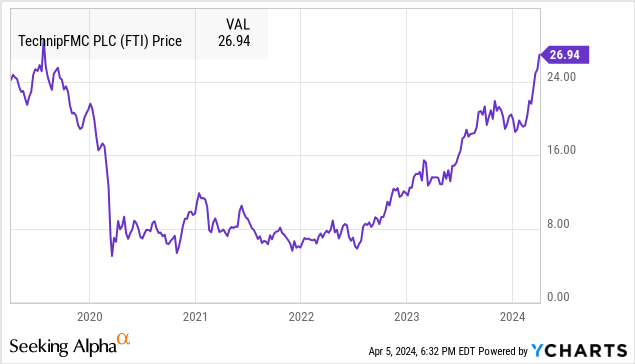

TechnipFMC Plc (NYSE:FTI) has gained momentum, with shares up more than 25% in the past month alone and currently trading near a five-year high.

In addition to the recovery of the energy industry, Oil prices began to rise at the start of the year on the back of strong operating and financial trends.we were Bullish on the stock Highlighting the company’s impressive multi-year turnaround strategy, it delivers on its promise of profitable growth.

While FTI is no longer the beaten-down value stock it was in 2022, we think the stock has room to rise further thanks to overall solid fundamentals. We highlight key points to watch ahead of the company’s upcoming quarterly report.

FTI first quarter earnings preview

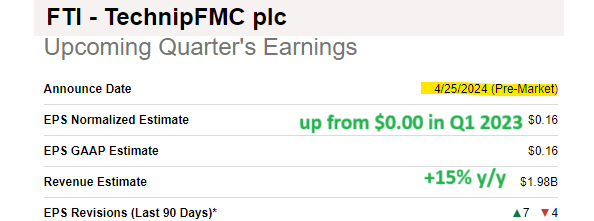

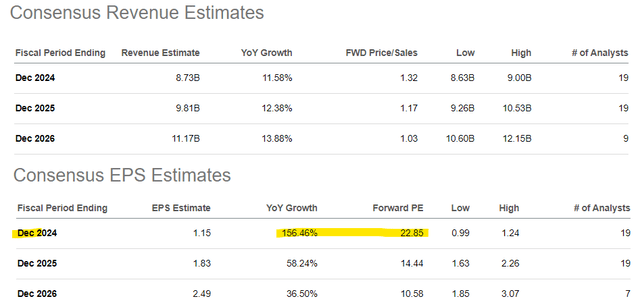

FTI will release its first-quarter earnings on April 25. The market is open. The current consensus is for earnings of $0.16 per share, compared with a breakeven point of $0.00 in the year-ago quarter.

Revenue is expected to reach $1.98 billion, up 15% year over year, a continuation of a theme that has gained traction in the second half of 2023.

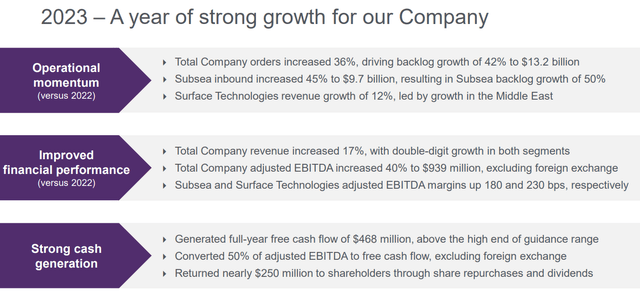

Source: Company IR

The company last reported its Fourth quarter results Revenue in February increased 22.6% year-on-year. Management noted strong growth in orders for subsea services and surface technology, with the year-end order backlog reaching $13.2 billion, a 42% increase from the same period last year. This dynamic provides good visibility into sales conversions in the coming quarters.

Financial performance improved significantly compared with supply chain disruptions and inflationary cost pressures in 2022, with company-wide adjusted EBITDA margin climbing to 10.5% in the fourth quarter compared with 7.1% in the same period last year.

turn out Profitability significantly improved Free cash flow reached $468 million over the past year. At the end of 2023, TechnipFMC had net debt of only $116 million. We view the underleveraged balance sheet as a strength of the company’s investment profile.

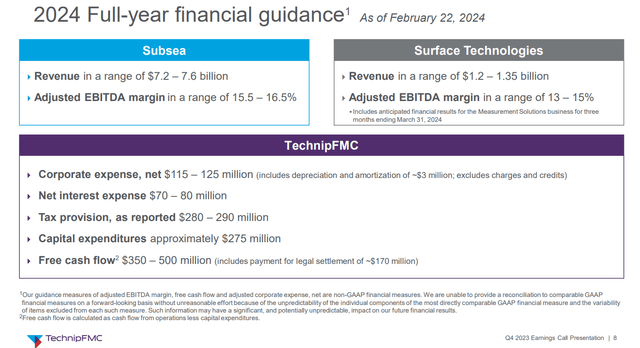

Source: Company IR

Management expects revenue in 2024 to be between $8.4 billion and $8.95 billion, an 11% annual increase. Within this amount, sequential stabilization of adjusted EBITDA margins should drive earnings per share higher.

Source: Company IR

What’s next for FTI?

The biggest takeaway when looking at FTI is that recent results and 2024 trajectory mark a new phase in the company’s transformation toward increasing global scale, deleveraging its balance sheet, and more sustainable growth.

Earnings per share are expected to rise 156% this year to $1.15, according to consensus estimates, coming on the back of an earnings slump in early 2023 and just recovering from a net loss in 2022. With profit margins structurally rising, the market expects earnings per share to grow 58% in 2025 and another 37% in fiscal 2026.

Seeking Alpha

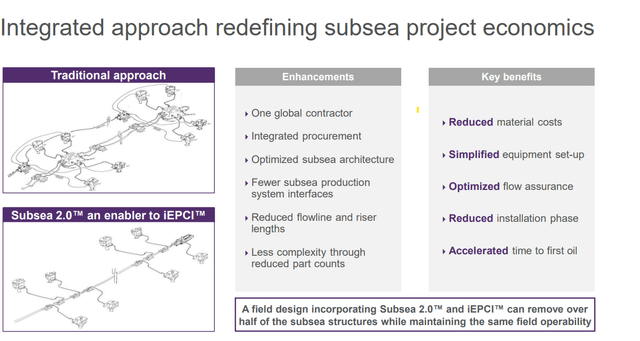

A large part of the company’s strength is based on the demand for its expertise and unique engineering, procurement, construction and installation of “iEPCI” systems.

The idea here is that iEPCI consolidates many of the steps in a subsea project that traditionally require the involvement of multiple vendors. The ultimate key benefit is more efficient capital allocation and improved economics.

Source: Company IR

TechnipFMC’s opportunity is to gain incremental market share as its system becomes the new industry standard. Global oil majors are incentivized by the energy pricing environment to seek to expand production or modernize existing operations, a key driver for the company’s continued growth.

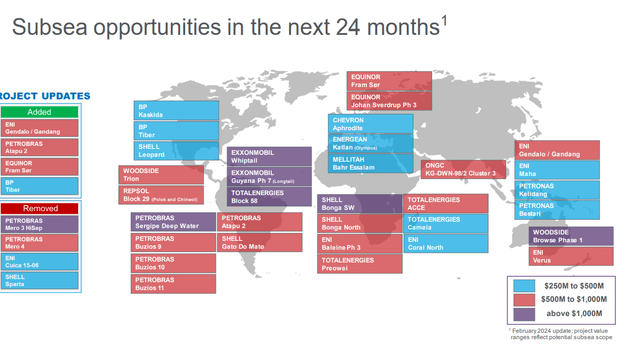

Nearly $14 billion in subsea opportunities have been identified over the next 24 months, one factor being that rising oil prices make these projects more likely to be a tailwind for the stock.

Source: Company IR

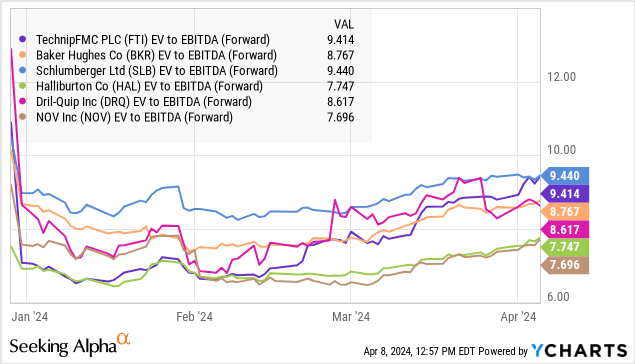

In terms of valuation, we believe FTI remains attractively trading at 9.4x EBITDA multiple. This level is in line with industry peers such as Schlumberger Ltd. (SLB) and Baker Hughes Co. (BKR), considered competitors, trading at around 9x.

At the same time, we believe FTI’s higher earnings growth levels and stronger balance sheet justify a larger premium for the group as part of a bullish case for the stock.

FTI’s current share price is about $27.00 per share, at its highest level since 2018. We believe the company’s prospects are stronger than ever today and support a higher share price.

Seeking Alpha

final thoughts

The message here is to continue to be optimistic about FTI, and earnings growth is expected to accelerate this year. The stock’s price target of $32.00 implies an EV forward EBITDA multiple of 11x or 17x projected 2025 earnings of $1.83 per share.

On the downside, the main risk to consider is declining confidence in the energy industry for a number of reasons. While the company is not directly exposed to the impact of oil prices, a deeper correction could weigh on project activity in the sector and force a recalibration of growth expectations.

Heading into the upcoming Q1 earnings, we’d like to see those margins remain elevated and some positive color emerge in terms of inbound orders and backlog. The company’s potential to exceed expectations should be a catalyst for the stock.