Thomas Barwick

investment thesis

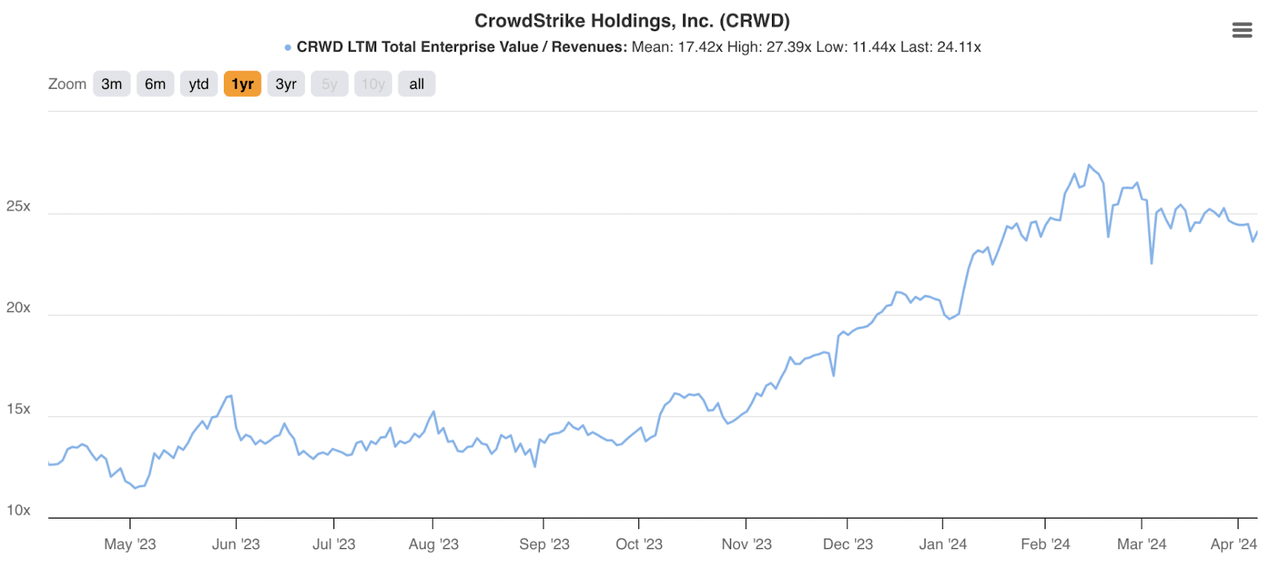

Since my last article in December 2022, CrowdStrike (NASDAQ:CRWD) delivered impressive results in fiscal 2024, driven by strong new customer acquisitions and increased module adoption.Additionally, the company’s trajectory to GAAP profitability in fiscal 2025 highlights Its profitable business model. With CRWD’s continued sales momentum, I expect revenue growth of 24% over the next 3 years, placing its expected FY2027 EV/sales at 12.4x. This valuation is below the average P/E ratio of 17.4x over the past year, reinforcing my Buy rating on CRWD.

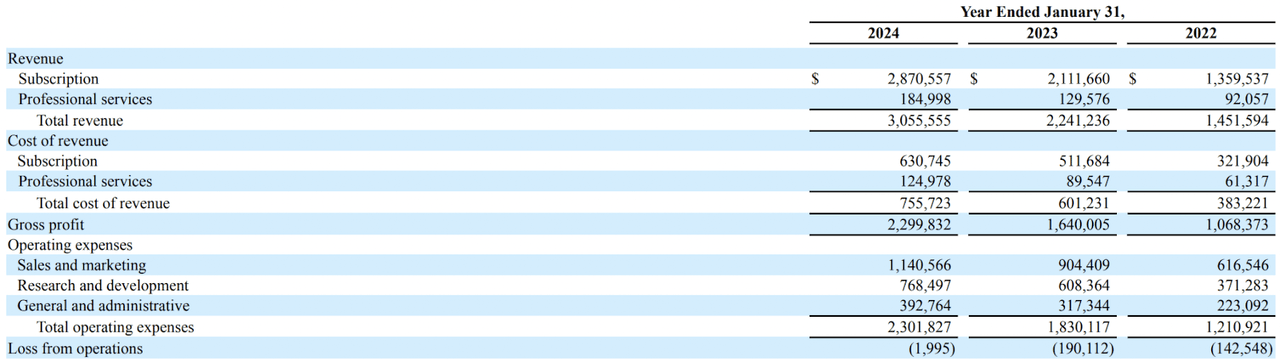

finance

CRWD FY24 10-K

In FY24, CRWD’s subscription revenue increased 36% year-on-year to $2.87 billion. This was primarily driven by new customer acquisitions as well as increased spending by existing customers. Customer adoption of six or more modules has increased from 43% in fiscal 2024 to 64% in fiscal 2023, according to CRWD.

CRWD’s integrated platform combines a comprehensive suite of services from endpoint security to threat intelligence, data protection, SIEM and more to provide customers with exceptional value. By streamlining operations and streamlining the deployment of multiple solutions, CRWD significantly reduces complexity while potentially lowering customers’ total cost of ownership. During the Q4 2024 earnings call, when asked about the potential impact of competition on CRWD’s go-to-market strategy and pricing, CEO George Krutz emphasized that they will continue to maintain stable pricing, emphasizing the company’s priority in the market A competitive strategy that considers value rather than price. market. In addition, management has won significant deals with Fortune 100, 500 and 1000 companies.

Gross profit increased 40% annually to US$2.3 billion, and gross profit margin expanded from 73% in fiscal 2023 to 75% in fiscal 2024. Coupled with a focus on achieving profitability, operating losses decreased by 98% year-on-year, and profit margins improved significantly from -8.5% in fiscal 2023 to -0.07% in fiscal 2024.

CRWD also has a strong balance sheet, with $3.5 billion in cash and $742 million in long-term debt. Full-year operating cash flow was US$1.2 billion, an increase of 28% compared with fiscal 2023, and free cash flow margin was 31%.

Projected growth and valuation – buy, hold or sell?

Management guided for fiscal 2025 revenue of $3.92 to $3.99 billion, with the midpoint of $3.96 billion, implying revenue growth of 29.5% annually. Assuming CRWD continues to add similar revenue increments of approximately $900 to $1,000 over the next 3 years, CRWD will generate revenue of $5.8 billion in FY27, which also implies a revenue CAGR of 24% in FY24.

I think this projected growth is reasonable given CRWD’s continued sales momentum in customer acquisition, increasing customer adoption of modules, and the continued need for cybersecurity.

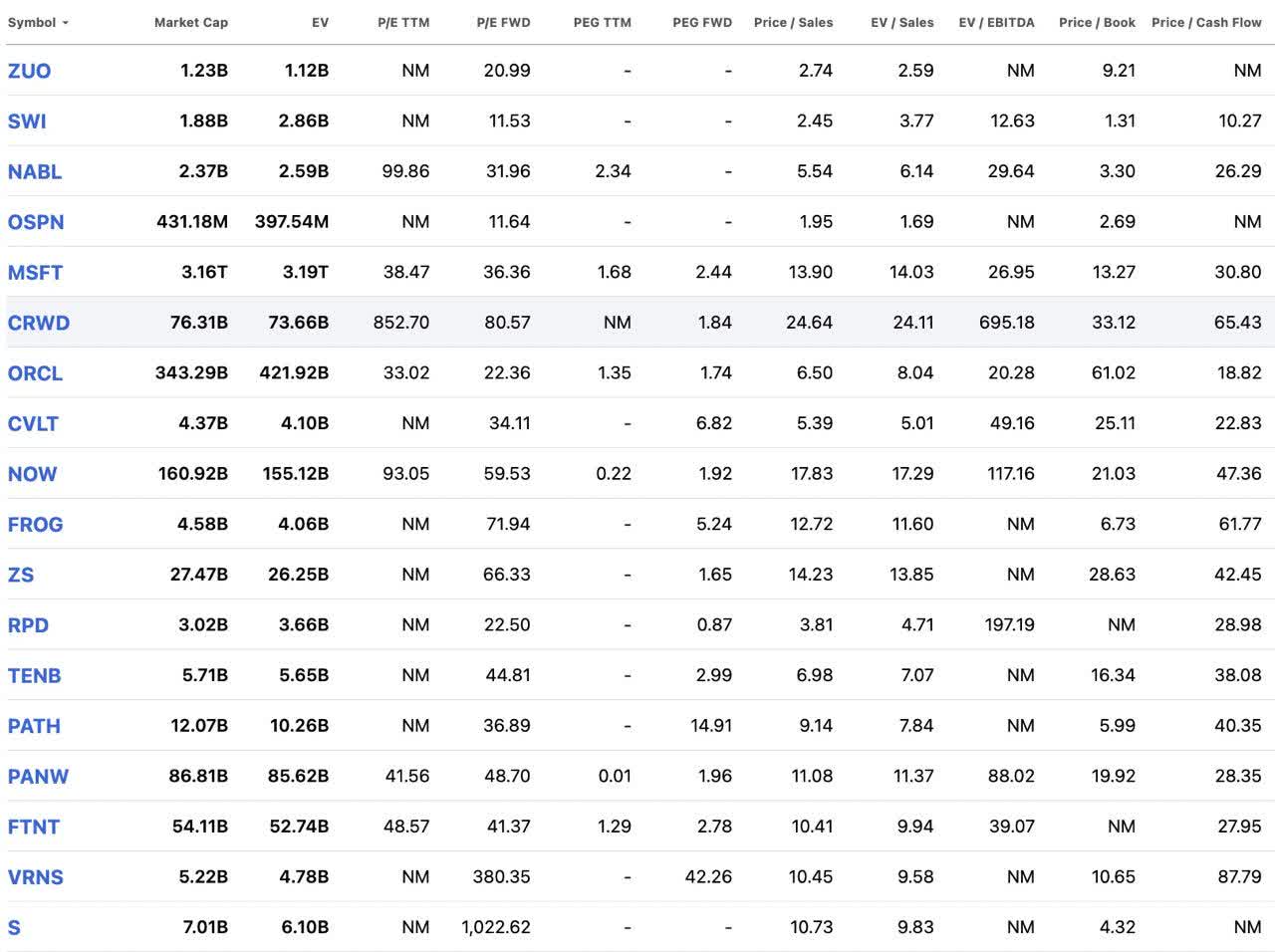

CRWD Peers – Valuation

This gives it a current EV/sales ratio of 24x and a fiscal 2027 EV/sales ratio of 12.7x. Compared to its peers, it’s easy to see that CRWD is priced at a significant premium based on EV/sales.

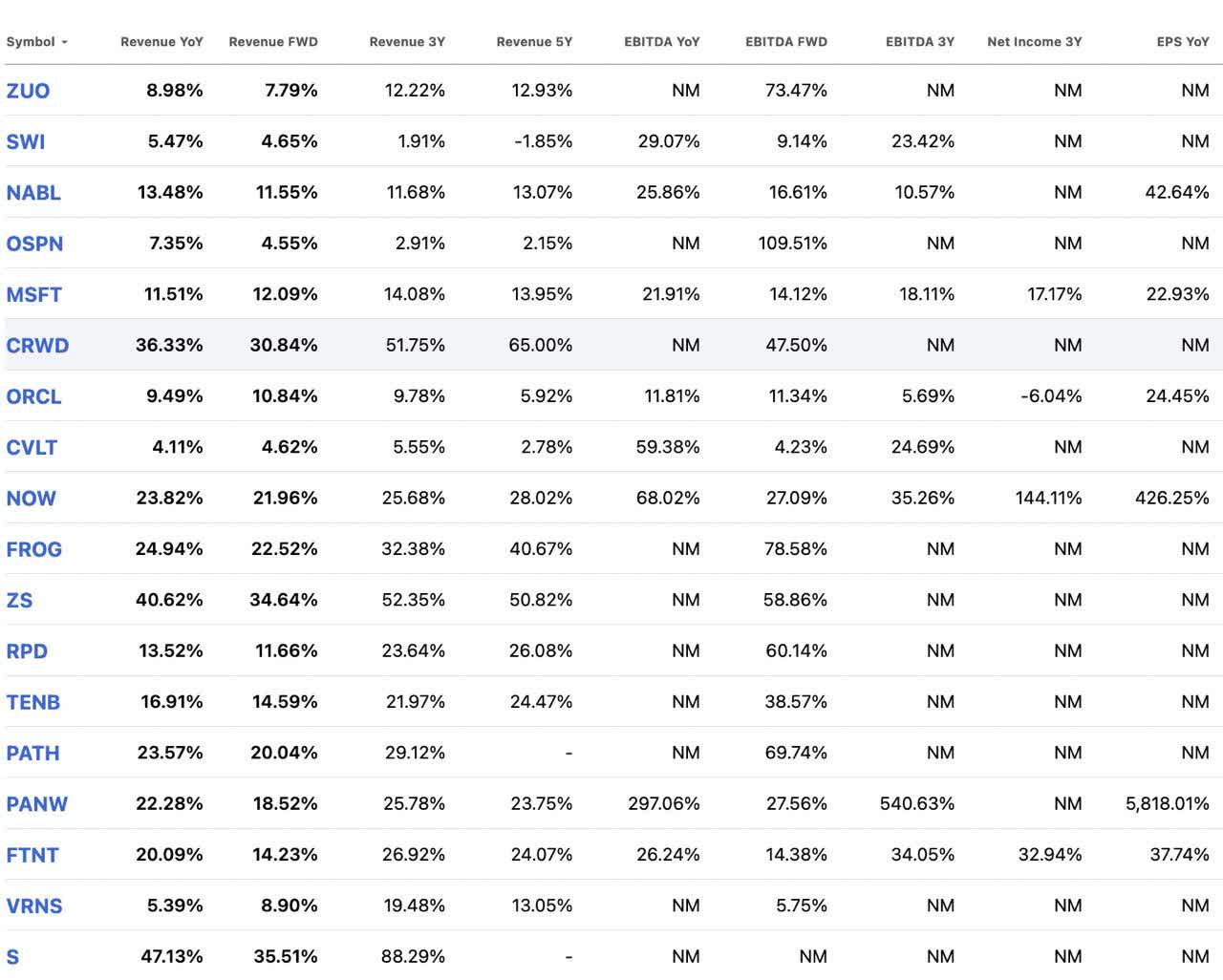

CRWD Peers-Growth

However, when comparing CRWD’s size to its smaller peers (excluding industry giants like Microsoft (MSFT) and Oracle (ORCL)), its 3-year revenue growth rate of 52% exceeds that of most of its peers growth rate.

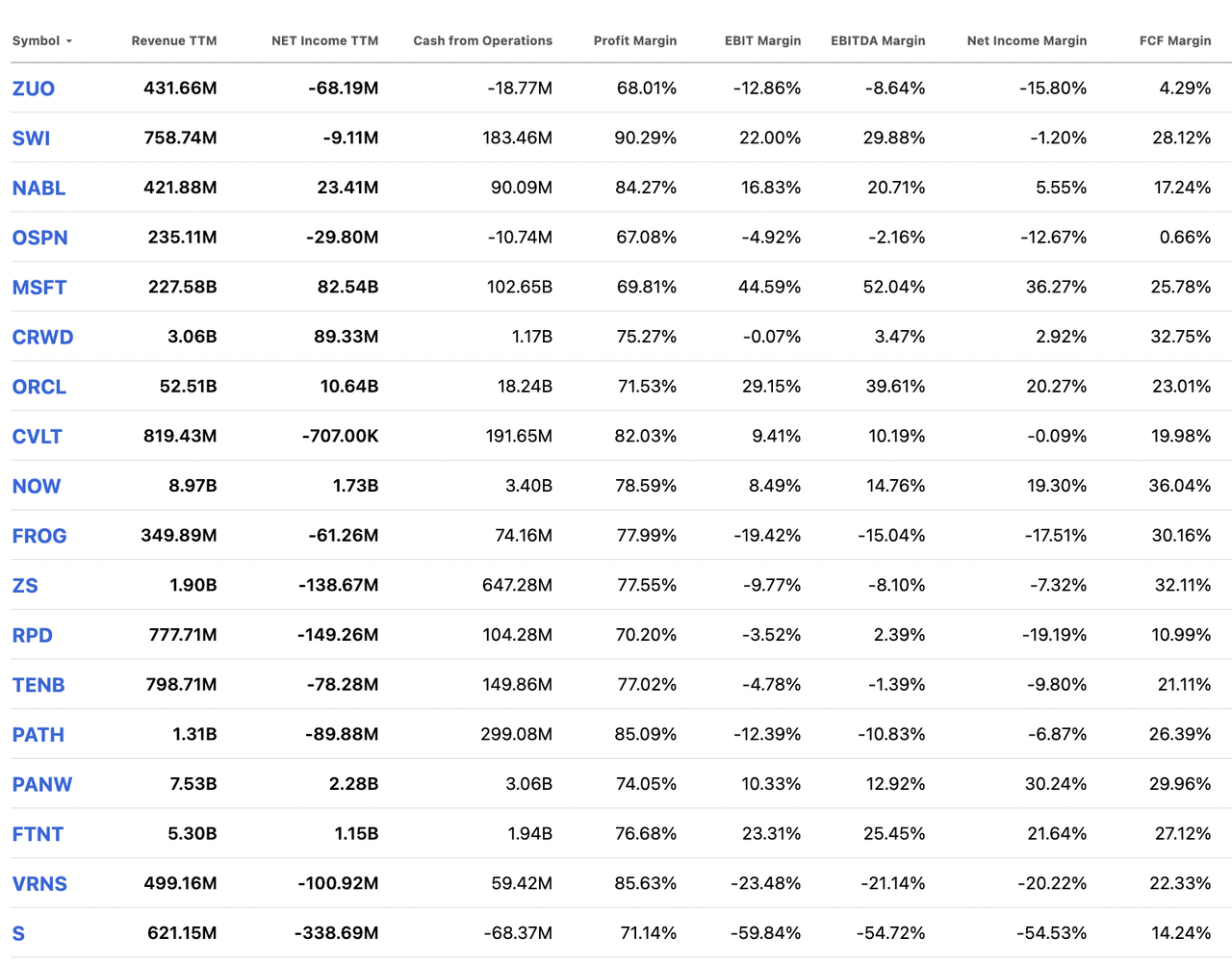

CRWD Peers – Profitability

In terms of profitability, CRWD’s operating margins are significantly lower than those of its peers. This is largely due to its strategic focus on prioritizing growth and capturing market share, even at the expense of direct profitability. Furthermore, it has proven its ability to operate sustainably as it will become GAAP profitable in fiscal 2025. It also generates a best-in-class free cash flow margin of 31%, one of the best among its peers. No wonder the market places a premium on its valuation.

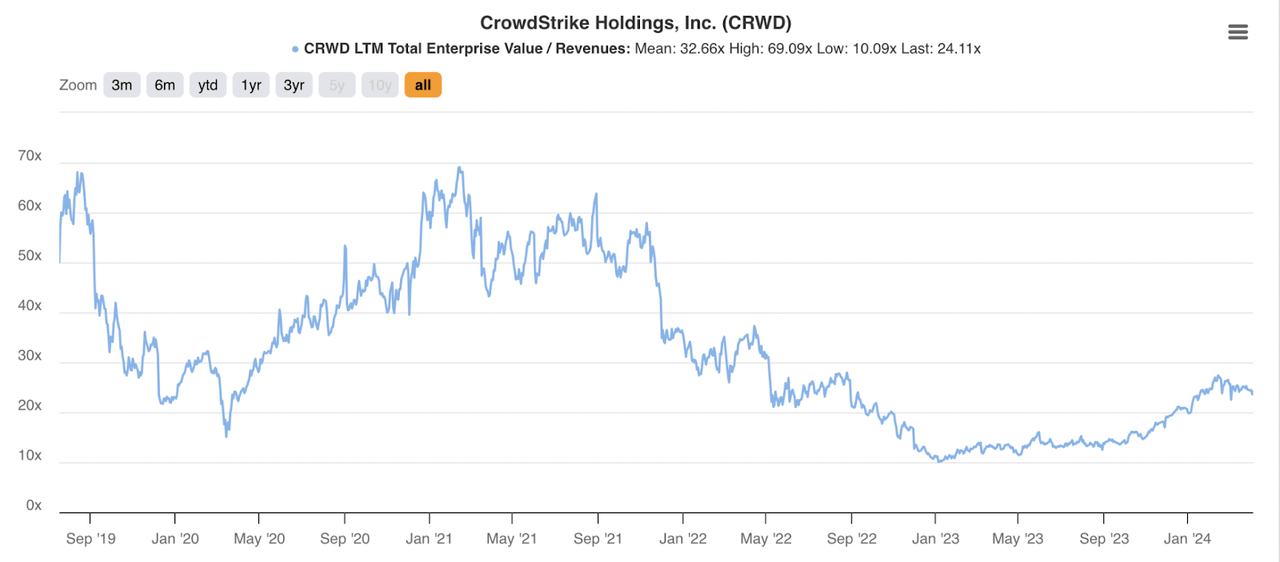

TIKR – CRWD Valuation TIKR – CRWD Valuation

Looking at the bigger picture, we can see that the average P/E ratio is 32.7x, which means the market has been valuing the company at a premium. The average price-to-earnings ratio over the past year was 17.42 times. With an estimated FY2027 EV/sales of 12.4x, I believe CRWD is reasonably valued. Therefore, I give it a “Buy” rating.

risk

As with any company, there are execution risks and risks beyond the company’s control. Continued extended rates could impact the company’s ability to win sales and could also lengthen CRWD’s sales cycle as the company continues to focus on profitability, thereby reducing its go-to-market efficiency. Increased competitive pressure from peers (such as deep discounts) may affect CRWD’s sales execution in some way. These may impact its revenue growth in some way, and my predictions may not materialize.

in conclusion

Overall, CrowdStrike delivered strong financial results in fiscal 2024, characterized by impressive subscription revenue growth, gross margin expansion, and significant improvement in operating losses. The company’s integrated platform continues to attract new customers and drive increased module adoption, making CRWD a leader in the cybersecurity market. Going forward, the company will be GAAP profitable in fiscal 2025.

Despite trading at a premium compared to peers, CRWD’s strong growth trajectory and sustainable operating results justify its valuation. Based on my valuation, I expect FY2027 EV/Sales to be 12.4x, which is lower than CRWD’s average P/E over the past 1 year, and I rate the company a “Buy”.