Wang Ma Huateng

generalize

Readers can find my previous reports through this link. My previous rating was Buy because I believed in Entegris’s (NASDAQ:ENTG) Growth has bottomed and gross margins will continue to expand; both factors driving the rise Revision of its multiples. As of April 8, ENTG stock has hit my price target of $139.40; therefore, I think it’s time for an update. I reiterate my Buy rating on ENTG as I remain very optimistic about strong operating results going forward.

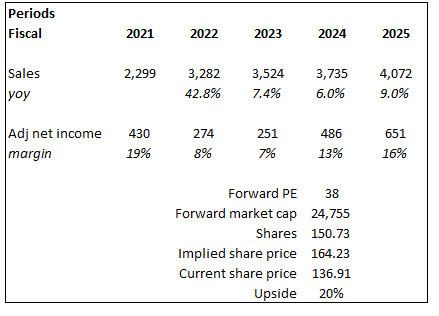

Finance and Valuation

ENTG reported nearly 2 months ago, but for those who don’t know, Q4 2023 revenue was $812 million, down 9% sequentially, down 14% year over year, and adjusted earnings per share of $0.65 . By market segment, Material Solutions (MS) revenue fell 16% month-on-month and 20% year-on-year to $365 million; Microcontamination Control (MC) revenue increased 1% month-on-month and year-on-year to $288 million; Advanced Materials Processing (AMH) revenue fell 6% sequentially and 21% annually to $169 million.However, on a positive note, gross margin increased 100 basis points sequentially to 42.4%. For fiscal 2024, management expects the industry to grow 4%, with ENTG outperforming market growth by 400 to 500 basis points. This translates into fiscal 2024 revenue of approximately $3.5 billion. Management also guided for adjusted EBITDA margin of approximately 29% (implying an improvement of 230 basis points) and adjusted earnings per share of over $3.25. In addition, ENTG plans to spend US$350 million in capital expenditures in 2024, a 23% decrease from FY23 capital expenditures.

Based on the author’s own mathematical calculations

Based on my view of the business, ENTG is expected to grow 6% in fiscal 2024 and 9% in fiscal 2025. My growth forecast has been adjusted to align with management’s guidance.U.S. GDP expected growth ~1.6% 2024, and based on that, based on management guidance, I would adjust the growth rate for fiscal year 2024 to 6%, which is a growth rate of 2 times GDP + 300 to 600 basis points of outperformance.As for fiscal year 2025, I used the historical GDP growth rate of the United States ~3% As a basis, this equates to 6% industry growth, and combined with the midpoint of management’s long-term guidance (300 basis points), I’d expect 9% growth in fiscal 2025. As I mentioned above, margins should expand as volume recovers and profit accretions kick in, driving margin expansion. Historically, ENTG has managed to push net margin into the teens during up cycles and I expect the same, with exit (FY25) net margin assumed at 16% (back to FY20 levels , that is, the peak during the new crown epidemic). Given the strong outlook, I believe ENTG will continue to trade above its historical average as the market looks forward to strong operating results ahead.

First, we expect the semiconductor industry in our core market to grow at twice the GDP growth rate. We then continue to expect to outperform the industry by three to six percentage points.

Looking forward, we expect revenue growth to exceed the industry by 2 to 4 percentage points, and operating profit margin to be around 20.Source: 4Q23 Earnings

Comment

I believe ENTG’s upside potential remains attractive given the expected strong future performance under management’s guidance. My bullish view is supported by a positive view on revenue growth, continued margin expansion, strong free cash flow generation, and business mix optimization. First, in terms of revenue growth, I believe that ENTG will continue to outperform the market, without a doubt. In 2023, they lead the market by 6%. This is because technological changes have led to increased material consumption per wafer and tighter purity standards, especially in the cutting-edge logic/foundry and memory areas.

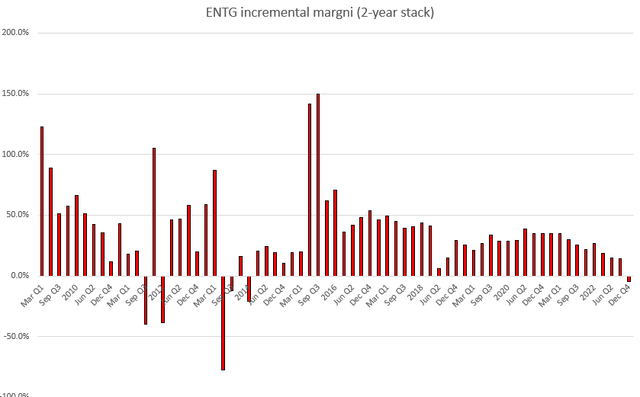

Based on the author’s own mathematical calculations

Second, in terms of gross margin, I expect ENTG’s gross margin position to improve going forward as volume-related headwinds have largely lagged the company (gross margin has dropped from the mid-40% to the low-40%) In a few years, with the increase in sales, it returned to the mid-40% range and came back online. Given the fixed costs embedded in the business, ENTG should gain strong operating leverage from gross margin expansion. Based on my analysis of ENTG’s historical incremental EBIT margins (on a 2-year overlay basis to smooth out any volatility), ENTG typically sees incremental EBIT margins improve during recoveries (again, the reverse is also true) will decrease). In recent history (FY16 to FY23), incremental EBIT margins have been around 20% to 30%. Using a midpoint of 25%, this suggests that ENTG’s EBIT margins could rise to 30% in the near term (which is in line with management’s guidance for operating margins).

Third, management continues to show great emphasis on inventory management. As of the fourth quarter of 2023, the company has reduced inventory on the balance sheet for the third consecutive quarter, down 8% quarter-on-quarter and 25% year-on-year to 6.07 billion, basically exceeding their goal. Set for FY23 (target was $100 million reduction, but ENTG reduced by $135 million). This essentially means a $135 million improvement in FCF (lower working capital requirements). In addition, capital expenditures in 2024 are expected to be $350 million, down 23%, which will further boost free cash flow by approximately $90 million. Just from streamlining inventory and capex alone, ENTG could see a free cash flow tailwind of about $230 million in fiscal 2024, which, coupled with improving EBIT, could accelerate sharply in the coming years.

Finally, I’m encouraged by management’s commitment to optimizing its business portfolio. On March 4, ENTG announced that it had completed the sale of its pipeline and industrial materials (PIM) business for an acquisition amount of $285 million. As background information, PIM’s business primarily sells drag reducing agents (DRA) and various valve maintenance products and services to oil pipeline operators. Management had been vocal about selling the business unit, which they ultimately did, signaling to the market that they were focused on completing this portfolio optimization process. Notably, this also provides ENTG with cash to pay down approximately $4.7 billion of debt on its balance sheet.

risk

At current valuations, if a significant macroeconomic slowdown affects the semiconductor industry (resulting in a slowdown in fab equipment spending), this will impact ENTG’s ability to grow at the pace guided by management. Judging from the current valuation of ENTG (38 times forward price-to-earnings ratio), there is still a lot of room for the valuation to fall back to the historical average of 22 times.

in conclusion

I recommend giving ENTG a Buy rating because I expect strong operating results going forward. My view is that ENTG is poised to benefit from industry tailwinds, particularly the semiconductor industry, which is growing faster than market expectations. This, coupled with margin expansion and improving free cash flow generation, should drive shareholder value.