Greenvalds

I cover Etsy (NASDAQ: ETSY) Six months ago, the outlook was neutral. At the time, I thought the stock was likely oversold after plummeting 80%, and its price-to-earnings valuation was much higher than it had been in the past.I believe there is a clear bubble in ETSY’s trading From 2020 to 2022, investors overestimated its growth rate based on the temporary impact of the COVID-19 lockdown, encouraging more people to start businesses on the platform.

Therefore, my view on Etsy is consistent with that of Fiverr (FVRR). I think both companies are essentially supply-driven companies. As more and more people want to become sellers on the platform, more and more people will come to buy these products and services. This is the “Say’s law”, juxtaposing the more common demand-driven view. Of course, with Etsy, I was previously neutral because I wasn’t sure Its demand outlook stems from the relatively high cost of products on the platform, which exposes it to some negative inflation risks.

However, since October, we have seen ETSY’s stock rise in value and reverse those gains. It’s now trading a few points away from when I last reported. Additionally, I believe Etsy’s underlying demand and supply outlook have improved significantly. Consumer credit and retail spending trends certainly don’t support a demand boom. However, Etsy’s supply trends are more critical and remain strong. The company has also shown a large degree of demand stability, with traditional “big box” retailers showing more negative headwinds on the consumer side.

Of course, Etsy’s valuation today is also very low compared to historical norms and the typical range for growth stocks. Like Fiverr, I think this stems from short-sighted expectations on the part of most investors and a misunderstanding of how markets will change during the COVID-19 lockdown. Since Etsy is now back at an attractive price and has some signs of technical support at current levels, I think now is a good time to analyze the company to determine whether it could become one of the few discount stocks today.

Lockdown era accelerates future trends

Overall, it’s fair to say that existing trends accelerated significantly from 2020 to 2022. Working from home, supply-driven inflation (due to a chronic lack of capital investment in the U.S.), and the shift to e-commerce are all trends heading into 2020. However, the volatility of that period significantly accelerated these patterns, effectively driving future developments.

In almost every stock I’ve seen (except for the very stable ones), the company has seen significant increases or decreases in sales and earnings per share between 2020 and 2022, and has not seen those changes reverse. However, as the rest of the world catches up with these changes, this trend has stalled and may not be as pronounced as it was before 2020.

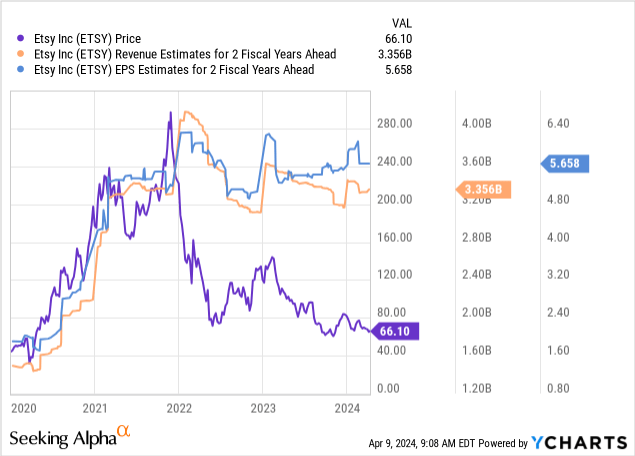

For example, Etsy saw huge sales and revenue growth from 2020 to 2022, driven by an increase in the number of Etsy sellers. As people lost their jobs or realized they preferred working for themselves, they started Etsy businesses, causing the company’s sales to rise significantly. 2019, The company has 2.7 million sellers. It sold 7.5 million units in 2021, meaning it had more sellers than ever before during this period. This has a significant impact on its earnings and revenue expectations. see below:

Looking at Etsy’s stock price, investors might think the company is on the verge of failure.About 13% Its outstanding shares were shorted today, meaning many investors expected the company to fail. If these short sellers are proven wrong, ETSY’s stock price should surge higher as they race to cover their positions.

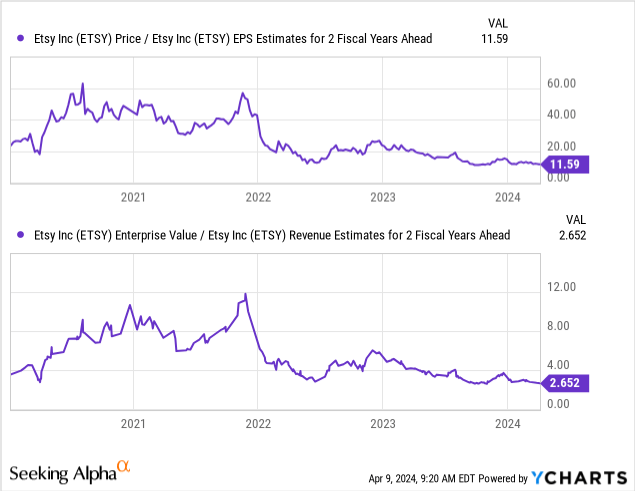

However, I believe Etsy’s problem today isn’t its fundamentals; this Investors’ short-sighted expectations. In 2021, investors are treating ETSY as if it will continue to grow at a breakneck pace. The same is true for most smaller growth stocks, which given my historical focus on bearish stocks has probably been detailed in over a hundred of my articles over that period. Today, as in Fiverr, I think the opposite question is true; investors are pricing these stocks as if they will never grow again. see below:

Today, Etsy’s forward “price-to-earnings ratio” based on its two-year EPS outlook is 11.6 times, which is extremely low for a growth stock and a retail stock. Even though Target (TGT) and Best Buy (BBY) can’t compete with e-commerce and have seen significant revenue declines recently, valuations are significantly higher, with TGT in particular at 18x. The sharp decline in Etsy’s “EV-to-sales” also suggests that investors are significantly reducing their growth prospects for the company.

In my opinion, it’s unlikely that we’ll see huge growth from Etsy in 2024 or even 2025. In the meantime, Etsy is still filling in the larger share it gained in 2021. The company has to adapt, which takes much longer than it takes to grow. Its sales or stock price as it changes its focus on employees and operations. In other words, Etsy grew faster than it could handle from 2020 to 2022, so it had to stall to adapt before it could continue to grow. This is natural, but that doesn’t mean Etsy won’t grow or fail again.

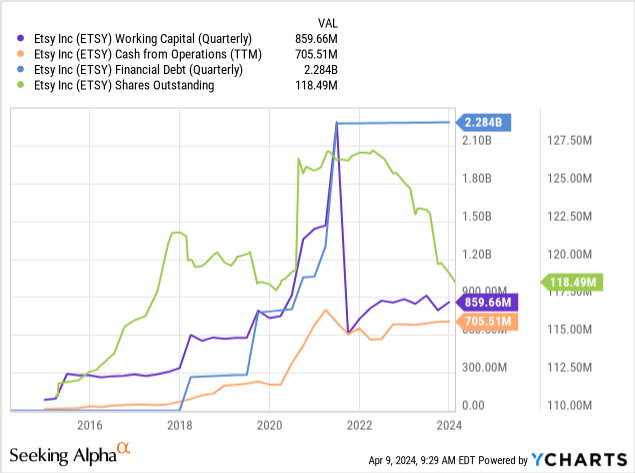

Etsy has a solid working capital base of approximately $860 million. It also has a positive CFO of US$705 million and a low TTM “P/CFO” of about 11 times. It has about $2.3B of debt, all in ultra-low interest rate convertible notes. The company is also actively repurchasing shares today to increase shareholder value. see below:

Etsy’s debt isn’t necessarily high compared to its market cap and positive cash flow.Its debt will be 2026 to 2028but it will likely use its chief financial officer to make those payments, or even refinance through traditional debt, given its relatively high revenue.

The movement in ETSY’s stock price and its relatively high short interest levels could represent a risk of failure, but that’s simply not supported by its fundamentals. The company has a very strong balance sheet, strong profit margins, and strong cash flow. In many cases, I’m tired of stocks that are actively repurchasing shares. However, in the case of Etsy, which is valued at such a low valuation, it’s a very logical choice, and one that could enhance shareholder value.

Finally, Etsy’s R&D expenditures are approximately $470 million, while revenue is expected to be approximately $670 million over the next two years. Fundamentally, R&D spending is value-added to the company, similar to capital expenditures. Companies can also reduce R&D if necessary. Add these together and we see revenue potential of over $1 billion. Of course, it won’t make as much money because it won’t be cutting back on R&D, but it shows how profitable this company is and how low its valuation is compared to its potential.

bottom line

The most significant risk to Etsy remains a consumer-driven recession. In the past, this is why I’ve been neutral on the stock. However, my opinion has changed recently. Based on a wealth of data, it’s clear that American households are disadvantaged due to low full-time wage growth, rising credit card debt, low savings rates, declining retail sales, and more. So any retail-focused company is at significant risk today because credit card debt drives spending and that debt isn’t sustainable.

Still, one of Etsy’s best years came during the recession (2020). Retail sales initially fell in 2020 but were strongly boosted by stimulus measures. Still, Etsy’s strong performance during the period stemmed primarily from an increase in the number of sellers on the platform, driven largely by secondary or primary self-employment.

As noted recently, the number of full-time jobs today is rapidly decreasing, while the number of full-time workers holding second part-time jobs is increasing. Platforms like Etsy can benefit from this, as some are looking to start a side hustle. As full-time jobs continue to decline, I expect more and more sellers to flock to the platform. If supply grows faster than demand, many people will have a hard time making money. However, people will always find new markets that work and bring new customers to the platform.

So I think Etsy is a recession hedge compared to many retailers. It’s more about how a recession can improve a platform’s supply, offsetting the inevitable drop in demand that comes with a recession. Overall, the recession should temporarily hurt Etsy’s platform but encourage its long-term growth, similar to the pattern seen in 2020-2022, when the platform initially collapsed but quickly reversed those losses. Even if that happens, Etsy has the benefit of not selling products but collecting royalties on sales and cutting back on R&D if needed, so I don’t expect the company to be at risk of long-term negative cash flow. Of course, it also has enough working capital to deal with such a situation.

Overall, I’m bullish on ETSY today and believe it’s a stock with great growth at a reasonable price.In fact, I would say this is “based on unreasonably A “bargain” stock today considering its valuation is lower than that of a retailer that is actually at risk of failure. Now that it’s back to support, I believe ETSY is likely to bounce back. Having said that, caution is advised for Etsy, which could break below its support levels and continue lower for the time being as short sellers turn against it. In this case, I would be more bullish as the risk of failure appears to be extremely low. Of course, if consumer demand collapses, ETSY could decline for some fundamental reasons, nonetheless, I believe this scenario will encourage long-term growth regardless of the increasing number of people looking to sell on the platform for additional revenue potential .