worapt

introduce

I recently created a screener on SA for microcap stocks trading below 6x EV/EBITDA, and one of the names that caught my eye was FONAR Corp.NASDAQ: FONR).The company has a strong balance sheet and I think Q2 Financial results were strong in fiscal 2024, with TTM EBITDA reaching $22.8 million. However, its market capitalization has fallen by more than 20% in the past month, and its EV/EBITDA ratio is just 4.2x as of this writing. Fonar is starting to look oversold in my opinion and I rate the stock a Speculative Buy. Let’s review.

Business introduction

Fonar was founded in 1978 by Raymond Damadian, the inventor of the nuclear magnetic resonance (NMR) scanner.The company went public in 1981 and calls itself The oldest MR manufacturer in the industry.Fornal sells its The company also supplies products to private diagnostic imaging centers and hospitals, and has a diagnostic facility management services division called Health Management Corporation of America (HMCA), which was founded in 1997. The latter owns 70.8% of Health Diagnostics Management (HDM). A network of more than 25 diagnostic imaging centers in New York and Florida. They have a total of 42 MRI scanners, most of which are Fonar Stand-Up MRIs. HDC has approximately 400 full-time employees.

flashlight

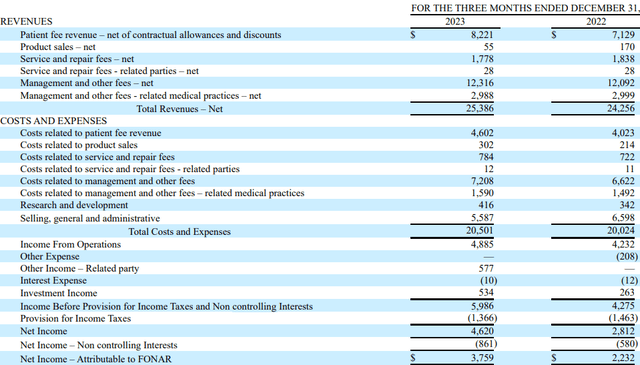

HMCA currently accounts for more than 90% of revenue, with almost all the remainder coming from MRI product services (maintenance and repair). MRI product sales in the second quarter of fiscal 2024 were only $0.22 million, which can be attributed to lower reimbursement rates for MRI scans in the United States (page 25 of first half fiscal 2024 financial report).

Overall, Fonar’s business has low capital expenditure requirements (generally less than $5 million per year) and low R&D expenses (generally less than $2 million per year).

Financial Performance

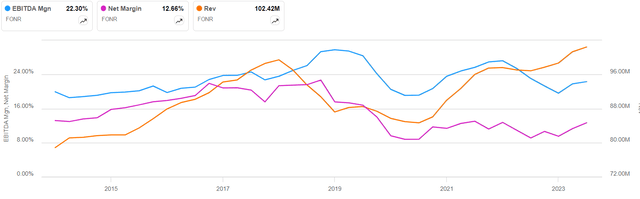

Turning our attention to Fonar’s financial results, we can see that the company’s business is stable and growing, having resumed its upward trajectory after being negatively impacted by the COVID-19 pandemic lockdowns. Revenues have returned to pre-COVID levels, but economies of scale appear to be irrelevant as EBITDA and net margins have barely improved over the past three years.

Seeking Alpha

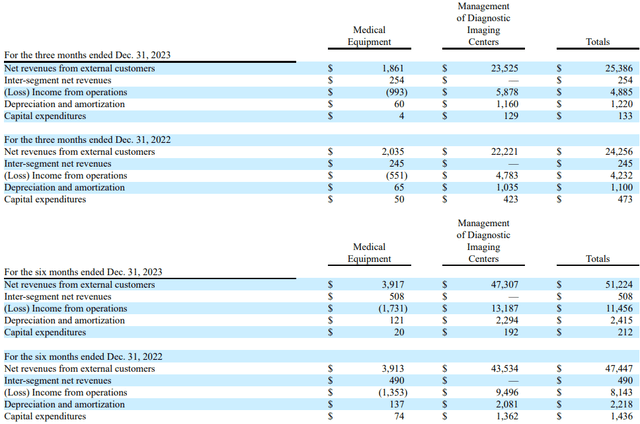

Looking at the latest quarterly financial performance, we can see that the company performed strongly in the second quarter of FY24, with revenue growing slightly by 4.7% to US$25.4 million, while attributable net profit soared by 68.4% to US$3.8 million. Revenue grew as a result of the opening of a new diagnostic imaging center in Florida and the return to full operations following a technician staffing shortage. This was partially offset by shrinking medical equipment revenue.

flashlight

The improvement in operating margin was driven by lower selling, general and administrative expenses and a one-time gain of $0.6 million from the sale of MRI scanners. The company also appears to have benefited from higher interest rates, with investment income doubling to $500,000.

flashlight

Turning our attention to the balance sheet, Fonar had US$17.4m in net cash as of December 2023. If operating leases are excluded from the net debt calculation, this figure increases to $52.4 million. Leveraged free cash flow (FCF) on a TTM basis was $8.7 million, ranging between $5.9 million and $11.5 million annually over the past decade. Overall, I think Fonar has a solid balance sheet and solid free cash flow.

Having said that, I am not a fan of this capital allocation strategy. The company has not distributed a dividend since 1999 and has not invested in inorganic growth. In September 2022, the company approved a $9 million stock repurchase plan, but progress has been slow. Only 116 shares were repurchased in the first half of fiscal 2024, compared with 16 shares in the same period of the previous fiscal year (page 21 of the financial report for the first half of fiscal 2024).

Cash has been piling up on the balance sheet for years, with cash and cash equivalents soaring to $53.2 million in December 2023. This compares with $13.9 million at the end of fiscal 2019.

The future of the company

I expect Fonar’s revenue to grow at a compound annual growth rate (CAGR) of about 3-4% over the next few years. If the medical device business shuts down, EBITDA margins could exceed 25%, but there’s no sign that’s about to happen. The latter is likely to continue to weigh on Fonar’s financial performance in the coming years. Overall, I think fiscal 2024 revenue could be around $102-105 million and EBITDA around $20-23 million. I don’t see the company changing its capital allocation strategy in the near future, with cash and cash equivalents likely to exceed $57 million by the end of FY24.

Valuation

As you can see from the chart below, prior to the COVID-19 pandemic, Fonar’s EV/EBITDA ratio typically ranged between 4x and 8x. While the ratio dropped to just 2.9x in September 2022 as the net cash position increased, it then began a steady but uneven climb to 6x. In my opinion, a sell-off like the one over the past month opens up buying opportunities here, as something similar happens between September and November of 2023. Fonar is starting to look cheap here, in my opinion, with an EV/EBITDA ratio that could return to over 5x within a few months.

Seeking Alpha

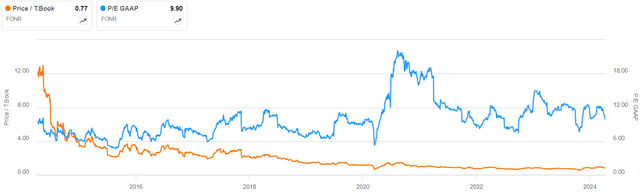

If you don’t like EV/EBITDA and prefer other classic valuation metrics like P/E or P/E to tangible book value, then the company is starting to be undervalued here, too.

Seeking Alpha

risk

Looking at downside risks, I think it is mainly due to lack of liquidity, with daily trading volume rarely exceeding 20,000 shares. In my opinion, thin trading volume may drive away many institutional and retail investors, and the company’s market cap may remain below $150 million in the coming months. The lack of a growth-oriented or shareholder-friendly capital allocation strategy doesn’t help either.

Investor takeaways

Fonar has pivoted to managing diagnostic imaging centers, a stable and lucrative business. The company has slow and predictable revenue growth, a solid balance sheet, and I think EV/EBITDA could return to over 6x by the end of 2024. In my opinion, the sell-off of the past few weeks has opened up a good buying opportunity here. That being said, due to thin trading volumes, risk-averse investors would be wise to avoid Fonar shares, as this could lead to significant share price movements.