lemanna

In February 2024, the median new home sales in the United States fell to $400,500.While this preliminary estimate will go through three rounds of revisions before being finalized, so far it represents the lowest median new home record since June. 2021. Between then and now, the typical new home sold in the United States has exceeded that threshold.

Unfortunately, this doesn’t do much for the typical American family. Even the lowest median new home sales price since June 2021 remains out of reach for the typical American household.

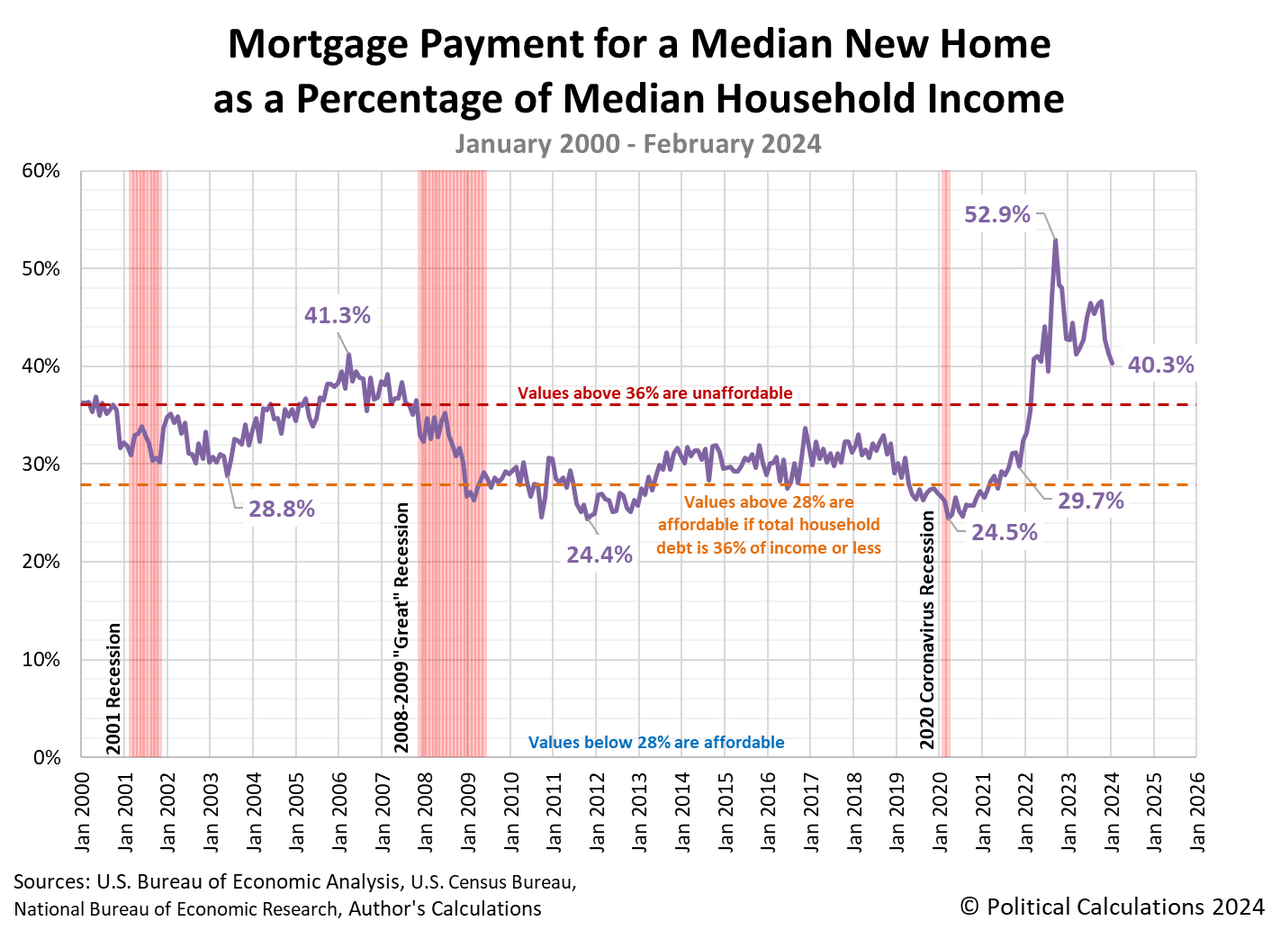

In February 2024, the average conventional 30-year fixed-rate mortgage rate was 6.78%, so the monthly mortgage payment for a median new home sold would consume 40.3% of the income of a middle-income American household.

The chart below shows how the relative affordability of a typical new home sold in the United States has evolved throughout the 21st century from January 2000 to February 2024.

The metric remains well above the 28% mortgage debt-to-income ratio and 36% total debt-to-income ratio thresholds, Set up mortgage lenders for borrowers To ensure they can afford their mortgage payments.

The median mortgage payment for new homes sold has been above the base affordability threshold of 28% since February 2021 and the higher affordability threshold of 36% since March 2022.

refer to

U.S. Census Bureau. New home sales historical data. The house has been sold. (Excel Spreadsheet). Date viewed: March 25, 2024.

U.S. Census Bureau. New home sales historical data. Median price and average sales price of homes sold. (Excel Spreadsheet). Date viewed: March 25, 2024.

Freddie Mac. 30-year fixed-rate mortgages since 1971. (Online database). Date of visit: April 1, 2024. Note: Starting in December 2022, projected monthly mortgage rates are the average of the weekly 30-year conventional mortgage rates recorded that month.

Political calculation. Median household income in February 2024. (Internet articles). April 2, 2024.

Editor’s Note: Highlights of this article’s summary were selected by Seeking Alpha editors.