imagine

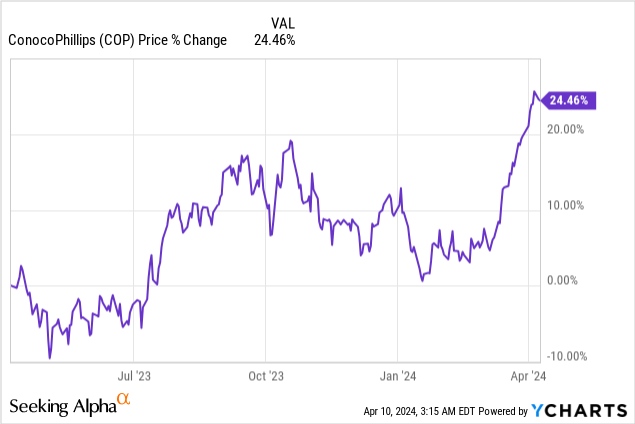

ConocoPhillips (NYSE: COPShares have soared so far this year, largely as the U.S. economy is expanding rapidly and OPEC+ members agreed last month to a new round of voluntary supply curbs, pushing oil prices into a price range above $80 a barrel.As operating conditions improve, production-focused energy companies Companies like ConocoPhillips are also highly attractive to investors and have the potential to increase their returns on capital. I believe ConocoPhillips will report very strong Q1’24 earnings in early May, and although the company’s valuation has grown strongly year-to-date, I still see a favorable risk profile!

Previous rating

I have a Strong Buy rating on ConocoPhillips in December 2023 because I see an attractive dividend outlook for this energy company.Oil prices at the time were also stable in the $70 per barrel range, improving risk/reward My point, especially from a dividend growth perspective. As oil prices enter a new upward phase after OPEC+ extended production cuts into the second quarter, I believe ConocoPhillips has room to rise, with the company set to report a strong profit report in May.

Good business environment and rising prices

OPEC+ (OPEC members plus Russia) decided in early March voluntary extension Their cuts deepened simultaneously. In early March, OPEC+ said it would cut oil production by 2.2 million barrels per day, while Russia said it would increase voluntary supply limits by an additional 471,000 barrels per day in the second quarter.

OPEC+’s decision to restrict oil supply has had a positive price impact on the oil market, which in turn means higher average prices for producers such as ConocoPhillips. In fiscal 2023, oil prices fell and entered a downward phase as supply concerns related to the war in Ukraine receded.Therefore, ConocoPhillips’ average price per barrel of oil between fiscal year 2023 and fiscal year 2022 down 27% Only $58.39. ConocoPhillips will report a sharp rise in its average oil prices when it releases first-quarter results, after oil prices soared to $85 a barrel in March following the OPEC+ supply announcement. Current oil prices (WTI) are 45% higher than ConocoPhillips’ average realized price in fiscal 2023, meaning the company will also see stronger returns on capital.

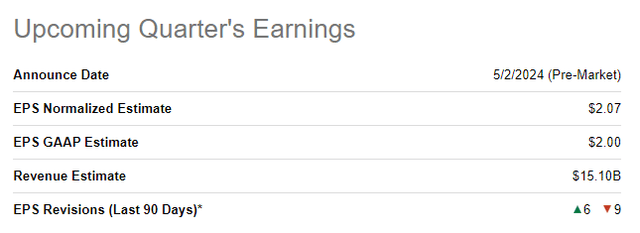

ConocoPhillips’ earnings per share potential in May is huge, with analysts currently expecting first-quarter 2024 earnings of $2.07 per share, compared with first-quarter earnings of $2.40 per share. Rising oil prices may also lead to positive EPS correction momentum for the remaining three weeks of April.

Seeking Alpha

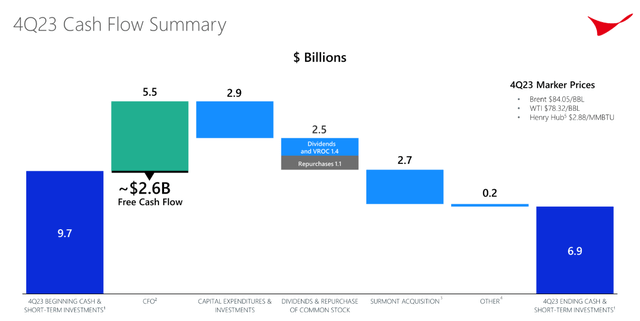

ConocoPhillips will also see higher free cash flow as earnings are expected to get a boost. In the fourth quarter, ConocoPhillips generated $2.6B in free cash flow, down 35% year over year. ConocoPhillips is likely to post an uptick in free cash flow in 1Q24 amid a nice rebound in oil prices due to OPEC+ supply measures, which could pave the way for higher capital returns.

ConocoPhillips

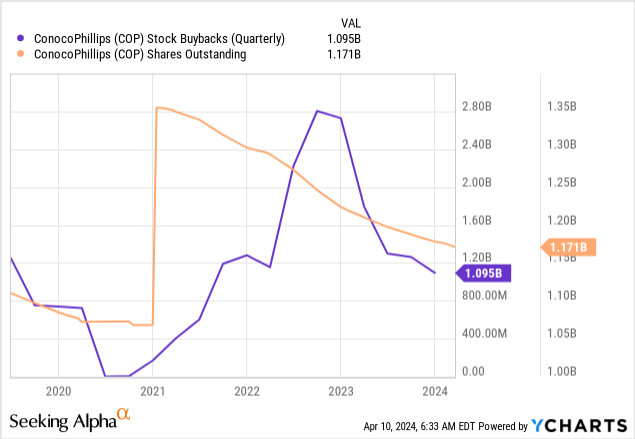

ConocoPhillips, which is already using its free cash flow to buy back stock, has been reducing the number of shares outstanding over the past three years. Additionally, ConocoPhillips will increase its variable cash rate (VROC), which depends on the price of oil. By paying VROC quarterly, the company introduces a way to distribute more free cash flow to shareholders as a variable component of total returns. ConocoPhillips’ VROC in 1Q24 was $0.20 per share, but if oil prices remain high, I expect VROC to be closer to $0.60 per share (last year’s quarterly VROC average was $0.625 per share).

ConocoPhillips Valuation

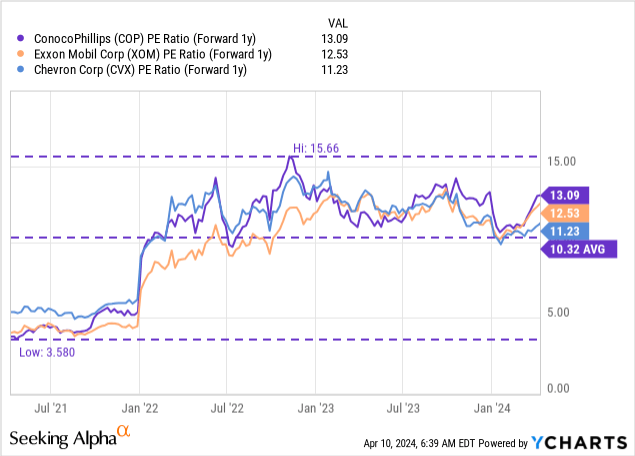

ConocoPhillips stock is more expensive than both companies Exxon Mobil (XOM) or Chevron (CVX), because ConocoPhillips is focused on exploration and production rather than any other business activities that help reduce price risk for energy companies (such as owning refineries).

ConocoPhillips currently trades at a price-to-earnings ratio of 13.1 times, while Chevron’s price-to-earnings ratio is 11.2 times and Exxon Mobil’s price-to-earnings ratio is 12.5 times. However, these two companies are in a bear market due to their more diversified businesses. The profit risk is smaller. Business conditions (including, for example, the refinery segment). ConocoPhillips also trades at a 27% premium to its three-year average price-to-earnings ratio, indicating that the market views the company more favorably in a world of rising prices.

I believe COP can trade at a 15.0XP/E ratio due to its improving free cash flow outlook, which implies a fair value of $152. Despite the higher P/E ratio, ConocoPhillips remains my preferred holding as the company has more attractive capital return potential in fiscal 2024 and COP has substantial earnings surprise potential on May 2, 2024.

ConocoPhillips Risks

ConocoPhillips is a pure-play production company, meaning it has no midstream or downstream operations to offset pricing weakness in its production operations.Less diversified than companies such as Exxon Mobil Or Chevron offers stronger earnings and free cash flow growth prospects in a bullish energy market, but also more downside risk in a bearish market.

final thoughts

ConocoPhillips’ fiscal first quarter has the potential for plenty of earnings and free traffic surprises, with results expected to be released on May 2, 2024. The trend in EPS revisions ahead of the earnings release is likely to become more optimistic as analysts incorporate higher oil prices into their forecasts. An estimate of earnings. I believe OPEC+’s decision last month further improves COP’s free cash flow outlook and total return potential, particularly in terms of the variable return portion of the company’s dividend. Shares do not appear to be overvalued and the risk profile ahead of Q1’24 remains very favorable!