On May 2, 2013, Sergio Ermotti, CEO of Swiss banking giant UBS, spoke at the group’s annual shareholder meeting in Zurich.

Fabrice Coferini | AFP | Getty Images

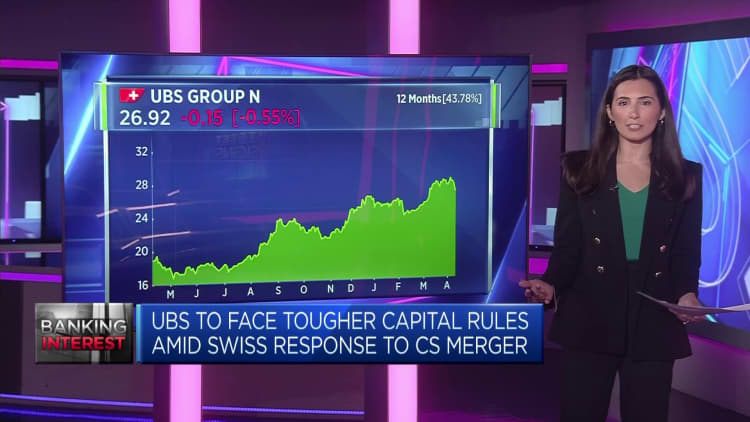

Switzerland’s tough new banking regulations create ‘lose-lose situation’ UBS That could limit its potential to challenge Wall Street giants, said Beat Wittmann, a partner at Porta Advisors in Zurich.

In a 209-page plan published on Wednesday, the Swiss government proposed 22 measures aimed at tightening supervision of banks deemed “too big to fail”, a year after authorities were forced to mediate Banks launch emergency rescue for Credit Suisse.

The government-backed takeover is the largest merger of two systemically important banks since the global financial crisis.

UBS Group AG’s balance sheet now stands at $1.7 trillion, twice the country’s annual GDP, prompting greater scrutiny of the protection of the Swiss banking sector and the wider economy following the collapse of Credit Suisse.

Wittmann told CNBC’s “Squawk Box Europe” on Thursday that Credit Suisse’s collapse was “entirely a foreseeable failure of government policies, central banks, regulators and especially the finance minister himself.”

“Certainly Credit Suisse has a failed, unsustainable business model and incompetent leadership, all demonstrated by the falling share price and credit spreads across (20)22, (which is) completely ignored , because there is really no institutionalized expertise at the policymaker level to look at capital markets, which is critical for the banking industry,” he added.

Wednesday’s report proposed giving Switzerland’s Financial Market Supervisory Authority additional powers to impose capital surcharges and strengthen subsidiaries’ financial positions, but stopped short of recommending a “blanket increase” in capital requirements.

Whitman said the report would do little to ease concerns about the ability of politicians and regulators to supervise banks while ensuring their global competitiveness, saying the report “creates a lose-lose situation for Switzerland as a financial centre, while Switzerland Silver cannot develop its own banking industry.” Potential. “

He believes that if UBS is to exploit its new scale and eventually challenge banks such as Bank of America, regulatory reforms should take precedence over tightening oversight of the country’s largest lenders. Goldman Sachs, JPMorgan, Citigroup and Morgan Stanley –Similar balance sheet sizes, but much higher transaction valuations.

“It depends on the competitive environment at the regulatory level. Of course, it’s about capabilities and then it’s about incentives and regulatory frameworks, and regulatory frameworks like capital requirements are global-level activities,” Wittman said.

“There’s no way Switzerland or any other jurisdiction would have very, very different rules and levels in place there – it doesn’t make any sense and then you can’t really compete.”

For UBS to reach its full potential, Wittmann argued that Switzerland’s regulatory regime should be aligned with those in Frankfurt, London and New York, but he said Wednesday’s report showed “no appetite for any relevant reforms” to protect Swiss bank interests. The Swiss economy and taxpayers, but allowed UBS to “catch up with global players and U.S. valuations.”

“The record of Swiss policymakers is that we had three global system-relevant banks and now only one remains, and these cases are a direct result of inadequate supervision and regulatory enforcement,” he said.

“FINMA had all the legal background and tools to deal with this situation, but they didn’t apply it – and that’s the point – and now we’re talking about fines, which to me sounds like a mix of cleverness and stupidity.”