hamzaturkol

In this article, I will discuss various inflation scenarios in the United States, in which I assume that there will be no Any war or other event that could disrupt global oil supplies.I will follow up on this The article discusses what might happen to U.S. inflation and GDP if a war or other event in the Middle East seriously disrupts global oil supplies.

In this article, we examine what happens to U.S. core inflation between now and October 31, 2024, on a 6-month annualized basis and a 12-month annualized basis under four different scenarios. These scenarios, which assume major disruptions to global oil supplies, assume WTI crude oil prices stabilize in the $80 to $100 range from current levels.

To understand the current inflationary environment that forms the backdrop to this article, readers are encouraged to view our detailed analysis of March CPI, published on April 10, 2024.

Four non-oil shock scenarios

In this article, we consider four non-oil shock scenarios for the average monthly CPI growth rate from April to October.

Scenario 1: Low. Very optimistic. The average core consumer price index (CPI) was 0.25%. Core CPI month-on-month (MoM) growth has only occurred once in the past 6 months, and there is relatively little evidence to support this scenario.

Scenario 2: Middle: Moderately optimistic. The average core CPI is 0.30%. Since October 2023, core CPI quarterly growth has fallen below that level twice in six months. While this scenario is reasonable, it is relatively optimistic.

Scenario 3: 3-month average: Moderately pessimistic. The average core CPI is 0.37%. In this case, core CPI only continued the trend of the past three months – a month-on-month increase of 0.37%.

Scenario 4: Pessimism. The average core CPI is 0.40%. In this case, there is a modest acceleration to 0.40% from the recent 3-month trend of 0.37%.

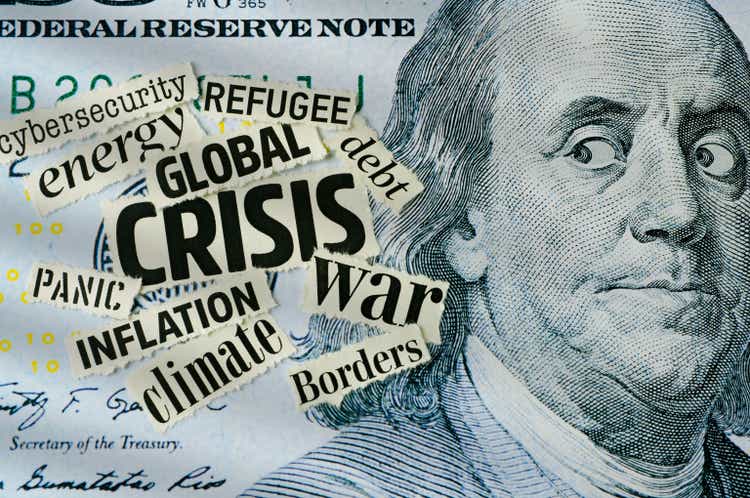

6-month annualized CPI inflation: 4 scenarios

Now let us take a look at the performance of the 6-month CPI annualized rate under the above four scenarios.

Figure 1: Six-month annualized CPI growth under four scenarios

Four inflation scenarios – annualized 6 million (Bureau of Labor Statistics and Investor Acumen)

As can be seen from the chart above, even under the most optimistic scenario, the six-month annualized growth rate of inflation in October will remain above 3%, which is not significantly lower than in October 2023 and November 2023. . Under a moderately optimistic scenario, the inflation rate in June will remain above 3%. The annual core inflation rate in October will continue to accelerate for three months, basically reaching 3.66% in October, which is not far from the current level.Unless U.S. economic growth deteriorates significantly during this period, it will be difficult for the Fed to justify cutting interest rates in either of these “optimistic” inflation scenarios.

In the third scenario, core CPI only stays on the trajectory of the past three months, and the Fed will have to seriously consider raising interest rates because core inflation will accelerate to 3.94% from the current 3.94%. 4.53%.

In Scenario 4, which we label “pessimistic” but very likely, core CPI will accelerate sharply to 4.91% from the current 3.94%. In this scenario, the Fed would almost certainly be forced to raise interest rates and/or otherwise seek to significantly tighten financial conditions.

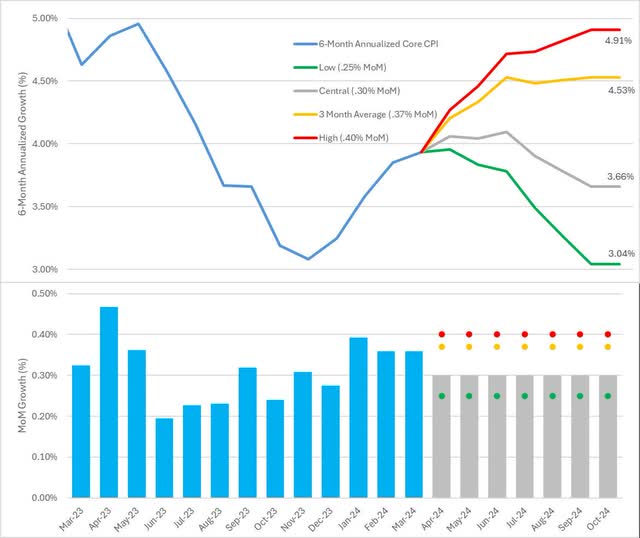

12-month annualized CPI inflation: 4 scenarios

Let us now consider the performance of 12-month CPI growth under four non-oil shock scenarios averaging monthly inflation between now and October 2024.

Figure 2: 12-month annualized growth rate of CPI under four scenarios

Four inflation scenarios – annualized 12 million (Bureau of Labor Statistics and Investor Acumen)

On a 12-month annualized basis, core inflation will remain unacceptably high under our two optimistic scenarios: 3.86% in the moderately optimistic scenario and 3.5% in the very optimistic scenario. Unless the economy is in recession or very close to one, how could the Fed possibly justify a rate cut in either scenario?

In our two more pessimistic but highly likely scenarios, in which core inflation accelerates to 4.37% or 4.59%, the Fed would be faced with raising the federal funds rate and/or otherwise seeking to significantly tighten financial conditions. huge stress.

situational assessment

We believe that the most likely outcome is somewhere between Scenario 2 and Scenario 3. There are three main forces at work when forecasting core CPI.

First, we expect housing inflation (which lags actual rental market inflation by more than 12 months) to fall to a range of 4.0% to 3.5% from the current 6-month annualized rate of 5.47%. This will put considerable downward pressure on core CPI for the remainder of 2024.

Second, we expect this impact to be largely offset by a sharp acceleration in commodity sector inflation. We expect annualized inflation to rise sharply to about +1.5% to 2.5% over the next six months from -1.34% in the past six months. The acceleration in commodity inflation simply represents a “return to normalcy” from the current extraordinary post-COVID-19 “whiplash” conditions. Temporarily abnormally high commodity inflation rates in 2021 and 2022 due to unusually large supply chain disruptions caused by the COVID-19 pandemic and other factors are currently partially compensated by abnormally high deflation rates.

Third, we expect core services inflation, excluding housing, to slow down from the current annualized growth rate of 6.26% to about 5.5% to 4.5% in the next six months. We expect this to broadly follow the path of services wages, which are currently growing at around 5%, but we expect this to slow to just below 4%.

As we can see above, the combined impact of these developments will see the core CPI 6-month annualized rate at the end of October in a range of 3.66% to 4.53%. The 12-month CPI increase will be between 4.37% and 3.86%.

This core inflation rate will be an extremely difficult problem for financial markets to deal with. Not only does the possibility of the currently expected Fed rate cut in 2024 become very slim, but the currently expected path of inflation and interest rates in 2025 will have to be adjusted quite significantly.

in conclusion

Even without a war or any other event that causes major disruptions to global oil supplies, we don’t think U.S. inflation will warrant a cut in rates anytime between now and October 2024 – unless the economy A serious decline in the growth rate indicates that the economy is actually entering a recession or is about to enter it.

Portfolios from our Winning Portfolio strategy performed well in any of the four “no oil shock” scenarios discussed in this article. These scenarios strongly suggest a moderate to severe tightening in overall financial conditions. Note that in order to tighten financial conditions, the Fed would not need to raise interest rates; for financial conditions to tighten significantly, the market would only need to price in currently expected rate cuts.

But what if there is an oil crisis? Our view is that the likelihood of global oil supply disruptions over the next six months is actually quite high. In fact, our portfolio performs well in any scenario involving severe disruptions to global oil supplies and a sustained rise in oil prices above $100. We started positioning for this type of scenario a few months ago.

Later in this article, we will review various “oil shock” scenarios for U.S. economic growth and inflation, including the very realistic scenario in which WTI crude oil prices could rise to various levels between $110 and $225.