JHVE photos

generalize

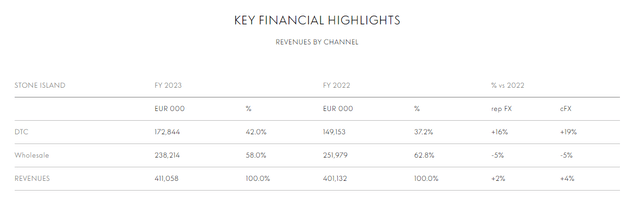

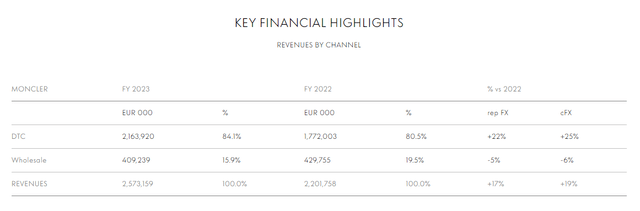

Moncler (OTCPK: MONRF) is a luxury brand retailer serving a global customer base. The products they offer include several categories such as outerwear, shoes, accessories, etc. for women and men. Currently, MONC has two main brands: Stone Island and Moncler.financial contributions between the parties The main difference between the two is the division between DTC (direct-to-consumer) and wholesale. Stone Island focuses more on wholesale, while Moncler focuses more on DTC. I recommend a Buy rating on MONC as I expect future performance to follow the same strong momentum seen in FY2023/Q4FY23.

munch munch

Comment

MONC will report its first-quarter 2024 results in two weeks, and I believe MONC will report a strong quarter (and fiscal 2024). My confidence stems from the strong momentum MONC is seeing in Q4 2023, with sales accelerating to 16% sequentially (900 basis points acceleration compared to Q3 2023).go through Data show that sales in the fourth quarter of 2023 grew to 1.178 billion euros. This effectively pushes organic sales growth (OSG) to 74% (or 18.5% on average) on a 4-year stacked basis (4 years, as it compares to pre-COVID-19 in FY19). Importantly, this growth was driven by MONC’s core brand Moncler, whose retail performance increased 20% in Q4 2023 (an acceleration of 200 basis points compared to Q3 2023). I think what’s more important here is that growth momentum is seen in all the growth drivers in the equation:

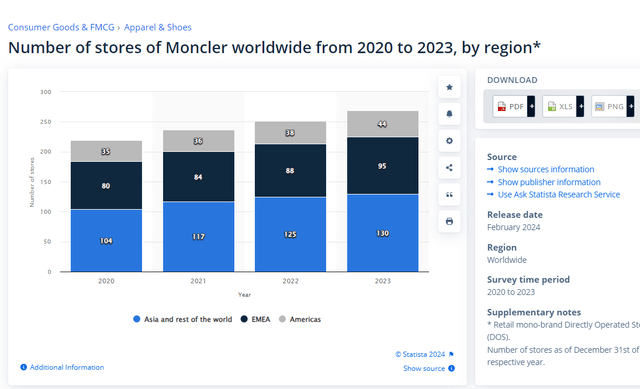

- MONC manages to continue increasing store space (+2% in FY23).

- MONC successfully drove double-digit traffic growth in fiscal year 2023.

- MONC successfully converted traffic growth into transactions (of higher value), both of which also achieved double-digit growth in fiscal 2023.

- This resulted in a record sales density of 38,000 euros/m²

What I can infer from this is that MONC has products that fit current fashion trends at the right price, which allows it to capture a share of the luxury market. Based on management’s comments, they noted that they’re off to a very solid start to the year and are very pleased with all regions, which basically tells us that the growth momentum continues (at least) into the first quarter of 2024.Considering Kering actually sees Sales fell 4%pulled by Gucci, the tone of confidence from management is very encouraging, leading to belief that it should be able to expand space volume in line with guidance (guidance is to open 10-15 new stores in fiscal 2024).

Dig deeper into potential growth drivers and paint a more positive outlook for MONC. The biggest debate in luxury retail is the impact China’s economic weakness will have on discretionary spending, and we can see this with Gucci’s performance (Being dragged down by China). However, this is not the case with MONC. Mainland China’s revenue grew by 21.4% at constant exchange rates and 22.7% at reported rates, a significant difference compared with leading brand Gucci. More notably, management is seeing improved customer base retention and continued onboarding of new customers, supported by a resurgence in travel. Keep in mind that MONC released this update on February 28, 2024, which means they already have 2 months of Q1 2024 data, effectively telling us that Q1 2024 demand is not slowing down.

The same intensity of demand is not limited to China. Even neighboring countries such as Japan, South Korea, Indonesia, Singapore, Hainan, and Macau also performed well; based on fixed exchange rates, other Asian regions grew by 31.5% in the fourth quarter of 2023. It is worth mentioning here that MONC has successfully diversified demand beyond very wealthy Chinese citizens. The obvious implication is that the volatility of MONC growth has not decreased. I think the larger implication is that this means MONC has successfully penetrated a new customer base (in other words, expanded its target market), giving it more room to grow.

It was initially started by very wealthy Chinese who were very healthy and wealthy, but now it is also expanding, and the fact that different countries facilitate visa issuance obviously helps to restart activities with Chinese outside China.Source: 4Q23 Earnings

Shifting focus to the Western region, Europe and the United States have also improved, laying a good foundation for performance in the first quarter of 2024. For Europe, MONC spending increased, and for the United States, although it was flat in the quarter, sales increased, and given the lower penetration of the Moncler brand, I believe sales will continue to grow in the future. For context, the United States has a GDP of $25.44 trillion, while Europe’s GDP is $19.35 trillion, but in terms of stores, Europe has more than twice as many stores as the United States. MONC is well ahead of its growth path in the Americas.

politician

However, while I’m optimistic about top-line growth, margins should be flat in FY24 as the management strategy going forward is to continue reinvesting in the growth of both brands – opening new stores, product assortments, etc. Considering the current growth momentum in Asia and the long-term development in the Americas, I think investing in this business is the right decision.

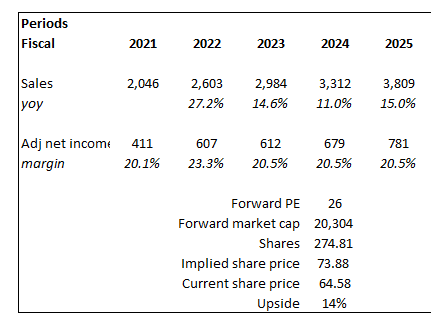

Finance/Valuation

MONC announced very strong fiscal year 2023 results at the end of February, with revenue growing 14.7% to 2.98 billion euros, earnings before interest and tax (EBIT) reaching 893.8 million euros, and profit margins increasing 19 basis points to 30%. This was mainly This was due to an improvement in gross margin (which expanded from 69bps to 77.1%). The main reason for the improvement in gross profit margin is the shift in revenue structure to DTC, which currently accounts for 84.1% of sales. In terms of the balance sheet, MONC continues to maintain a net cash position with approximately €1 billion in cash as of fiscal 2023 and no debt (other than operating leases).

Based on the author’s own mathematical calculations

Based on my view on the business, MONC should continue to post double-digit growth in FY24 and FY25, with FY24 being slightly below the historical average of mid-teens growth given the high base in FY22/23 levels, followed by a return to double-digit growth in fiscal 2024. historical average. As I discuss below, margin expansion is unlikely as management will reinvest excess profits into the business to drive growth, which I think is the right decision. MONC’s main competitors are Hermes International, LVMH, Prada, Kering and Capri, and its current average forward price-to-earnings ratio is 23.5 times. On average, peers are expected to post high-single-digit growth. Given that I believe MONC should post low to mid-double digit growth going forward and perform strongly relative to leading brand Gucci, I model MONC to continue trading at a premium to its peer average (26x) Trading.

risk

On the other hand, the key risk for MONC is identifying the right fashion trends.Fashion trends have a life cycle difficult to predict, if MONC cannot continue this trend of finding the right trends, growth will be severely affected. Margins will suffer a similar fate, as MONC may need to rely more on wholesale to reduce inventory (and therefore no sales due to an inability to meet consumer preferences).

in conclusion

I recommend a Buy rating on MONC. Last quarter saw continued growth across all sales metrics, including store space, traffic and transaction value. Importantly, management’s comments about a strong start to the year instilled confidence as the comments were made in late February. It is worth noting that compared with Gucci, the performance of the Chinese market is a highlight. MOC’s expansion into new customer segments also provides further growth opportunities. Although margins may not increase in the short term due to reinvestment plans, I think investing in growth is the right decision.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.