We are /DigitalVision via Getty Images

introduce

As a young investor who did not enter the market during the dot-com bubble or the global financial crisis, I have only experienced markets dominated by the technology sector and a world dominated by technology. All these companies have produced it.

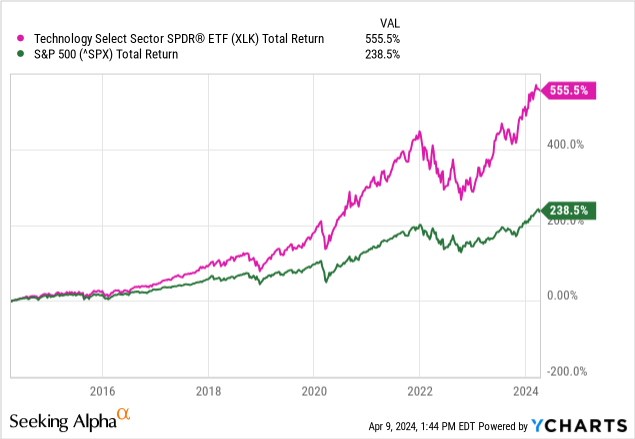

Just look at what the Technology Select Sector SPDR ETF has done over the past decade (NYSE:XLK) to obtain visual evidence.

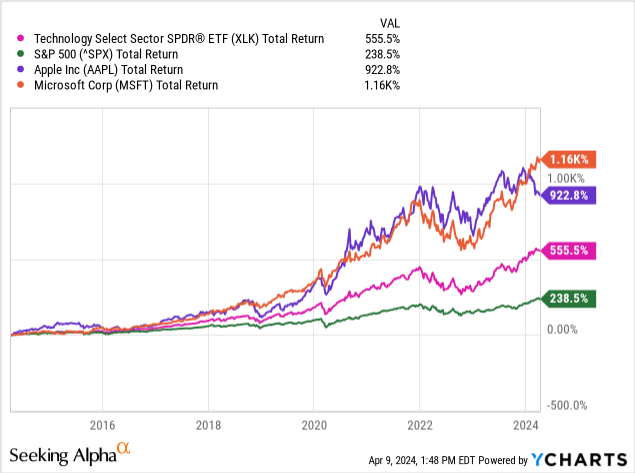

Today’s largest constituents, two of the largest public companies in the U.S., Apple (AAPL) and Microsoft Corp. (MSFT), have also been public favorites for some time, even outperforming XLK over the past decade.

If the fund is so hot and big-name leaders are pushing it further, why should investors look elsewhere?

Large-scale transmission has occurred

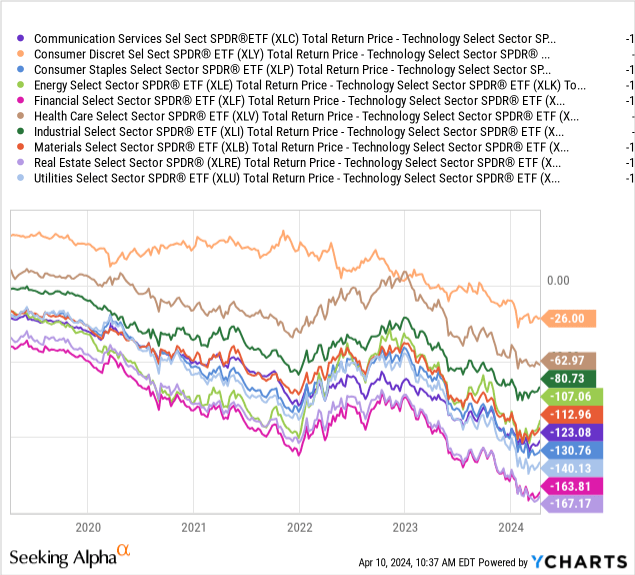

When we look at the return differential between tech and technology Spreads in other sectors have ranged from 26 points to 167 points over the past five years.

This leaves a lot of room for those departments to return to average if a rotation occurs. The most mature industries are the worst performing ones, such as real estate, financials, and utilities.

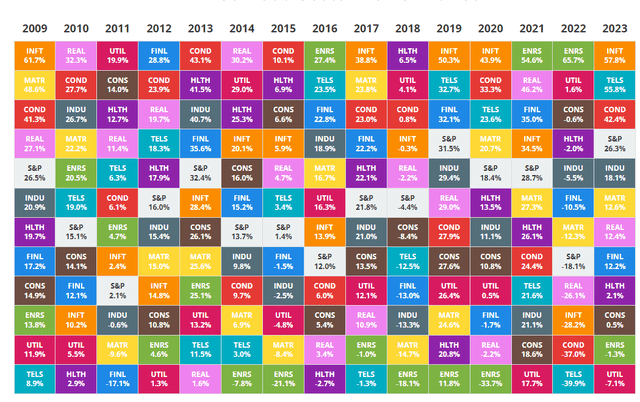

As the annual return comparison chart shows, these industries don’t always underperform.

figure 1 (new investor)

overvalued

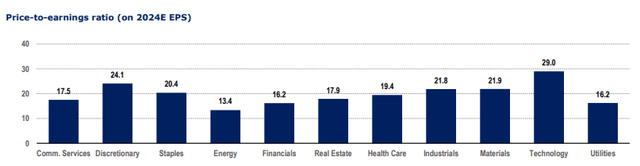

There are also large differences in price-to-earnings ratios, although these ratios have greater staying power due to differences in growth expectations, so we might expect these ratios to not change without significant disruption to industry profitability.

figure 2 (Alta Vista Research)

It does show us the risks of owning these sectors if a “valuation hunter” comes to pop the bubble. If a crash occurs, industries with lower P/E ratios are likely to be more resilient and better able to weather a downturn.

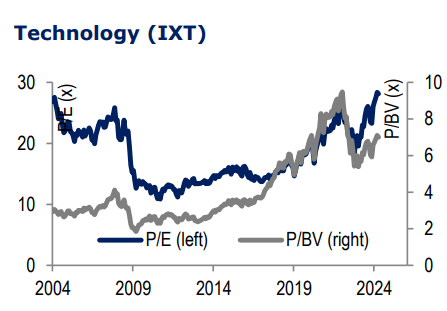

But can the tech stock justify its insanely high price-to-earnings ratio of 29? Recently, we’ve seen the P/E ratio rise above the P/E ratio again, leading to another spread in the P/B ratio. Over the past few years, since 2019, we have seen a reversal in the spread. The stagflation episode and the market downturn in 2022 have led to a return to higher P/E ratios.

image 3 (Alta Vista Research)

The industry’s price-to-earnings ratio has not been this high since 2004 and has never exceeded this level historically. This could be a warning to investors that technology is overextended and overvalued at current levels.

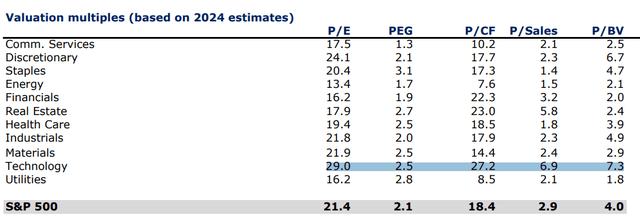

It has the highest valuation metrics in terms of P/E, P/E, P/E, P/E, P/E, and P/E.

Figure 4 (Alta Vista Research)

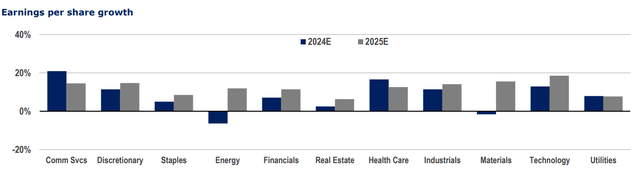

Still, consensus estimates suggest their EPS growth will be in line with or lower than other industries such as healthcare and communications services.

Figure 5 (Alta Vista Research)

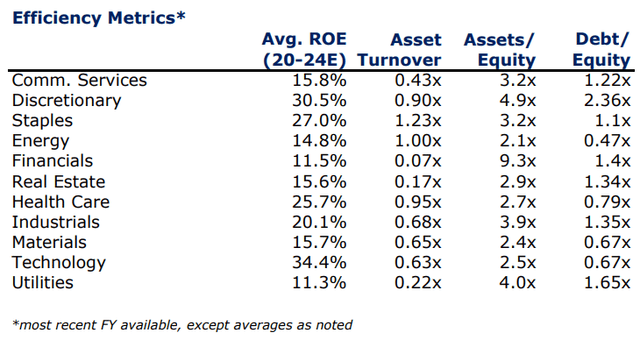

Having said that, tech stocks have had the highest average return on equity over the past few years, proving the point. These companies are very efficient.

Figure 6 (Alta Vista Research)

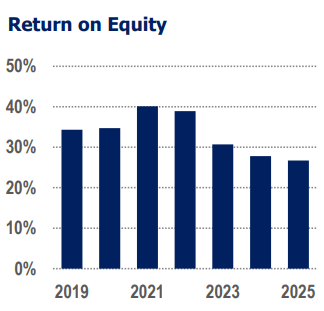

But ROE is declining and has been declining since 2021. The consensus estimate is that the technology industry is expected to continue this trend through the remainder of this year and into 2025.

Figure 7 (Alta Vista Research)

concentration risk

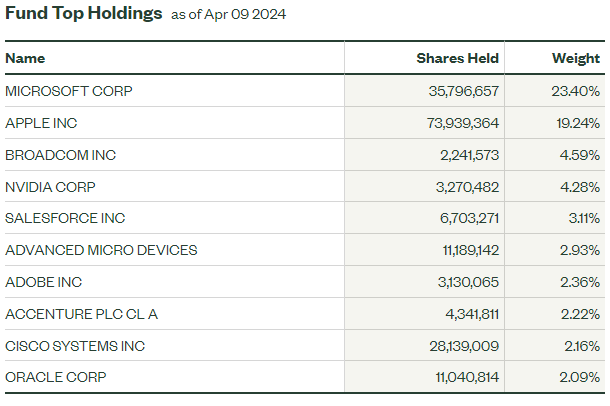

The most lethal part of XLK itself is its ingredients.Because it focuses on technology Defined by GICSIts holdings don’t look like a “diversified ETF,” even though it holds 65 stocks, and its top two stocks account for nearly 43% of the index.

Figure 7 (SPDR)

This is a significant risk because it means the index’s direction is vulnerable to idiosyncratic changes in Apple and Microsoft. This concentration risk is generally unpopular with ETF buyers, especially those interested in owning entire industries.

Legal Risk

since Apple v. Pepper (2018) The Supreme Court held that Apple was responsible for the conduct of its internal apps (those hosted on the Apple App Store) and that trust could be breached due to anti-competitive pricing of said apps, something that there is legal precedent surrounding targeting Antitrust case involving modern technology company’s online business.

This new focus is unwelcome for the tech industry and could cause significant disruption to practices that ensure its overvalued growth rates.

In short: We expect some growth from Apple, Microsoft, and others. It could be due to the anti-competitive behavior currently being cracked down on.

Last November, Google was asked Fork $26.3B fines to maintain its search and advertising monopoly, but still faces the risk of undermining trust in the future.

Around the same time, Amazon also targeted The government has been criticized for using anti-discounting measures to prevent sellers from selling Amazon Basics products at low prices, forcing sellers to purchase Amazon-owned storage solutions for their goods, among other fees.

March 21, 2024 antitrust complaints Apple was sued for abusing the cross-compatibility between the Android platform and iOS. This includes artificially limiting compatibility for Android and iOS users when sending messages, files, etc. The complaint began with an anecdote about the anti-competitive culture that has existed at Apple since the days of Steve Jobs.

In 2010, an Apple executive sent an email to then-Apple CEO asking about advertising for the new Kindle e-reader. The ad begins with a woman using her iPhone to purchase and read books on the Kindle app. She then switched to her Android smartphone and continued reading books using the same Kindle app. The executive wrote to Jobs: “A message that cannot be ignored is that switching from iPhone to Android is easy. It doesn’t look fun.” Jobs’ response was clear: Apple will “force” developers to use its payment system to target developers and users on its platform. Over the years, Apple has repeatedly responded to such competitive threats by making it harder or more expensive for users and developers to leave, rather than making it more attractive for them to stay.

As the complaint goes on to allege, there is more damning evidence of an anti-competitive sales culture at Apple.

Apple’s actions also stifle new paradigms that threaten Apple’s smartphone dominance, including cloud computing, which could make it easier for users to enjoy high-end features on less expensive smartphones or make them completely device-agnostic. As one Apple manager recently observed, “Imagine buying an (expletive) Android at a garage sale for $25, and it runs great… and you Have a reliable cloud computing device. Imagine how many cases like this there are.” In short, Apple is worried about the disintermediation of its iPhone platform and has taken a series of actions to lock in users and developers while protecting its profits.

The risk of the App Store becoming decoupled from iOS is a serious risk to Apple’s profit margins, as it relies on its dominance of the smartphone market. This is a serious risk for XLK investors who primarily buy 20% of the fund’s shares of Apple stock.

in conclusion

The tech sector has become less attractive because its prices and price-to-earnings ratios are at record highs and its valuations are stretched even as it faces legal troubles. Technology Sector SPDR ETF (XLK) has significant concentration risk in its top two names, which account for more than 40% of the fund’s net asset value. On top of that, it also creates the risk of government legal action against these companies for their monopolistic behavior, which could lead to slower growth in the future, which is a significant threat to an industry with above-average valuations.

For these reasons, I have a “hold” rating on the technology sector. If valuations fall back to historical averages and trust-busting legal troubles are thwarted, I’d consider taking a position in the tech sector again. Until then, I’m more interested in sectors that took a beating in the last bull market, such as real estate, financials, and utilities. They promise to serve as contrarian bets in a world long dominated by the tech industry.

thanks for reading.