Richcano

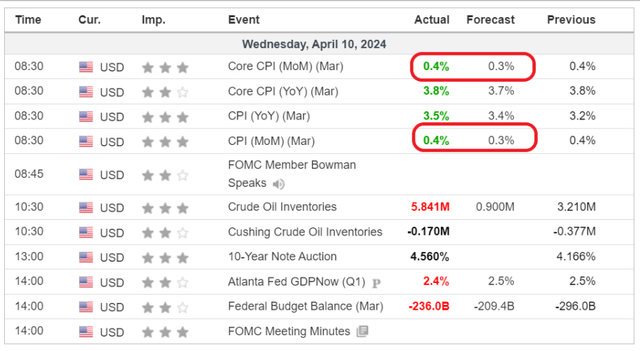

On this day (April 10, 2024), both the headline and core Consumer Price Index (“CPI”) data surprised forecasters (Figure 1), and investors would naturally be inclined to seek Treasury inflation-protected securities. security (“tip”).

Figure 1-March CPI unexpectedly rises (Investment Network)

Treasury Inflation-Protected Securities They are Treasury securities issued by the U.S. government that provide principal and coupon protection against inflation. The principal of TIPS increases/decreases with CPI inflation/deflation, so when the TIPS bond matures, investors will receive the greater of the adjusted principal or the original principal. TIPS bonds also pay fixed-rate semiannual interest calculated on adjusted principal, so interest payments are also protected from inflation.

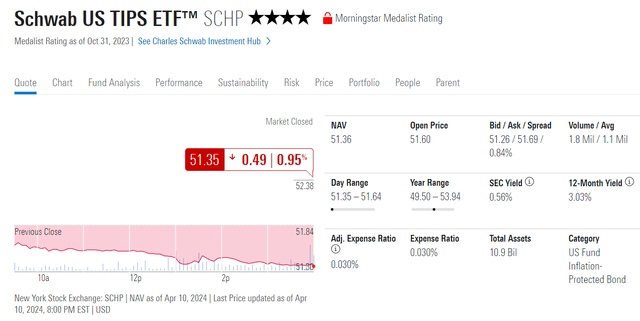

However, holders of TIPS funds like the Schwab US TIPS ETF (NYSE: SCHP)most likely Market reaction to these ETFs on April 10 sent SCHP down 0.95% (Figure 2).

Figure 2 – SCHP fell 0.95% on April 10, 2024 (Morning Star Network)

Is this just a panic sell-off, or is there an underlying reason behind the weakness in SCHP and TIP?

TIPS funds have duration risk

As I’ve written in previous articles on SCHP and TIPs, April 10 was a good reminder that TIPS funds have interest rate duration risk that analysts and investors don’t often discuss.

Unlike a single TIPS bond, if hold until maturitywill effectively protect investors from inflation and interest rate risk, and a TIPS bond portfolio like the SCHP ETF introduces unhedged portfolio interest rate risk.

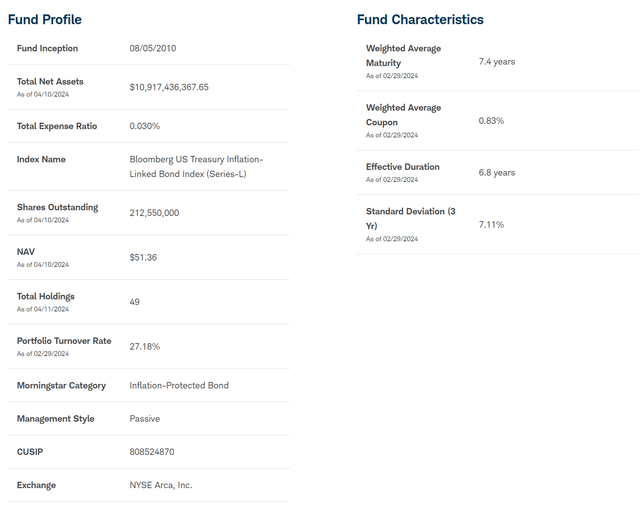

For example, SCHP’s portfolio contains 49 TIPS bonds with an effective maturity of 6.8 years (Figure 3).

Figure 3 – SCHP Product Portfolio Overview (schwabassetmanagement.com)

Inflation unexpectedly hits interest rates higher

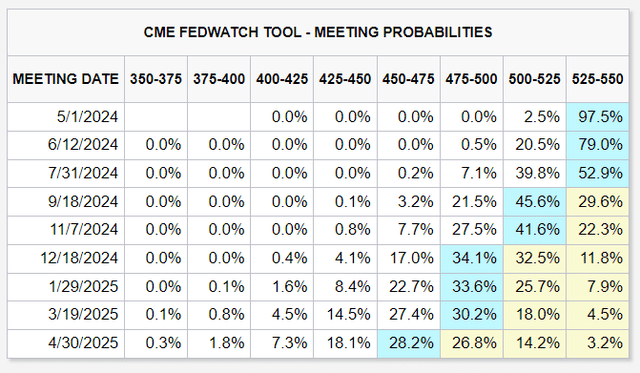

What happened on April 10 was that a third consecutive “hot” monthly CPI surprise caused market participants to effectively postpone their expectations for the Fed’s first rate cut until September (Chart 4). The number of expected layoffs in 2024 has also been reduced to two.

Figure 4 – Market expectations for a rate cut by the Federal Reserve have been extended to September (CME Group)

This change in market expectations shocked rates higher across the interest rate curve, with 5-year and 10-year Treasury yields rising by 24 basis points (Figure 5) and 19 basis points respectively.

Figure 5 – The 5-year government bond yield jumped 24 basis points on April 10 (marketwatch.com)

Therefore, while higher-than-expected CPI increases the principal of TIPS bonds in SCHP’s portfolio, rising interest rates reduce the net present value of the ETF’s cash flows.

Unlike individual TIPS bonds, mark-to-market (“MTM”) value declines in bond funds due to changes in interest rates may not be recouped because SCHP ETFs are managed for a fixed period. Over time, the ETF will sell maturing bonds and replace them with newer bonds, keeping the portfolio’s duration unchanged. This process crystallizes unrealized losses from changes in interest rates.

Uncertainty about inflation path clouds SCHP outlook

The question now is whether the latest inflation data is still consistent with the Fed’s view that inflation is lower but “bumpy,” or whether we have reached a new level of core inflation >3% and inflation may be accelerating again .

If the former, then high but declining inflation should boost principal and interest income on TIPS bonds, while market rates should moderate over time, potentially providing a “Goldilocks” environment for the SCHP ETF .

However, if inflation has stabilized and accelerated again, the Fed may have to keep policy rates higher for longer and may even have to raise the federal funds rate in future quarters to prevent runaway inflation. In this case, long-term interest rates may have to rise, which could put further pressure on the SCHP ETF.

Situational Analysis Favors Buying TIPS Now

For now, I think the Fed will err on the side of inflation because the threshold for raising the federal funds rate after the December public turn may be too high. With the 5-year and 10-year yields around 4.6%, I believe the SCHP ETF offers asymmetric risk/reward at current valuations.

In the base case, moderately high but declining inflation data will continue to increase the principal and coupon of TIPS bonds, thereby increasing the fund’s net asset value. Long-term interest rates are also expected to fall slightly in the coming quarters.

On the downside (or yields upside), I think ~5% may be a quasi-ceiling for long-term rates, as unless inflation suddenly re-accelerates to 4-5% or higher, the Fed is likely to stay on hold.

Finally, on the bright side (falling nominal yields), if the economy deteriorates sharply, the Fed stands ready to cut policy rates to support jobs and the economy. This should result in SCHP’s nominal interest rates falling and its net asset value rising.

in conclusion

With expectations of a Fed rate cut effectively delayed until September, I believe long-term TIPS ETFs such as the SCHP ETF offer an asymmetric risk/reward bet at current valuations.

As long as inflation does not accelerate out of control again (>4%), I believe the Fed is likely to remain on hold even without any progress in inflation, so the long-term downside scenario is around 5% Treasury yields are comparable to current levels of around 4.6% Compare. However, in this case, rising inflation readings should continue to cause positive principal adjustments in the SCHP ETF, so further declines in NAV may be restrained.

On the other hand, the Fed has indicated (“Two-Way Risk Discussion”) that if they see weakness in the economy, they may be willing to cut interest rates to support the economy even if inflation remains above the Fed’s 2% target. This should cause long-term interest rates to fall and boost SCHP’s net asset value.

Due to the asymmetric nature of this bet, I upgrade SCHP to purchase.