Daniele Schneider/Photononstop via Getty Images

iShares MSCI South Africa ETF (NYSE: No) tracks the MSCI South Africa 25/50 Index, targeting the performance of major large and mid-cap stocks in South Africa. With $300 million in assets under management, EZA is the world’s largest A handful of ETFs focus on African markets. EZA offers value in terms of earnings and price-to-book ratio, but very tough economic realities make South African stocks one I would avoid at the moment.

Depressing economic backdrop

South Africa’s economic landscape continues to face challenges under President Cyril Ramaphosa.this official unemployment rate It hovered around 33% in the fourth quarter of 2023. Last year, long-standing energy supply problems intensified.South Africa plagued by rolling blackouts due to insufficient energy supply Unable to meet demand For this country of 62 million people.reserve bank South Africa is expected to continue to have power outages knee growth rate It will increase by 0.6% in 2024.

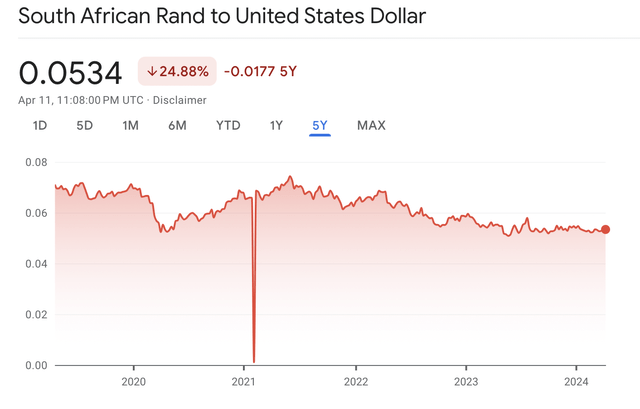

From a macro perspective, the headline news is the depreciation of the rand. Against the backdrop of rampant inflation, the RMB has depreciated 25% against the US dollar over the past five years. This has a negative impact on domestic consumers as import costs rise and purchasing power decreases.

Google Finance

this base interest rate After the tightening cycle begins in 2022, the inflation rate remains at a high of 8.25%. Although inflation climbed to 5.6% in February, it remained within the central bank’s target range.

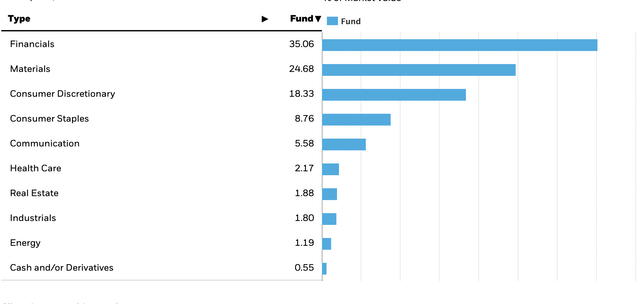

Broad exposure to South Africa’s economic drivers

EZA is an ETF focused on financials and materials, with a total of 60% of the fund allocated to these industries. As noted above, currency depreciation could have a negative impact on EZA’s mining-focused materials industry, as commodity prices are typically denominated in U.S. dollars. A stronger dollar against the rand could have a negative impact on local suppliers. EZA is also susceptible to the boom and bust cycles associated with commodities. Given currency conditions, the combined impact of an oversupply of key mining exports or a collapse in prices could pose a challenge to the fund.

Anshuo

As of this writing, there are 39 individual holdings in EZA. Despite the small number of individual holdings, the fund is reasonably well diversified, with the top 10 holdings accounting for only 62% of assets. The largest single holding company is Naspers Limited (OTCPK:NPSNY), a multinational technology and multimedia company. Naspers is perhaps best known for its massive investment in Chinese tech giant Tencent ( OTCPK:TCEHY ), which, it turns out, high profit.

Seeking Alpha

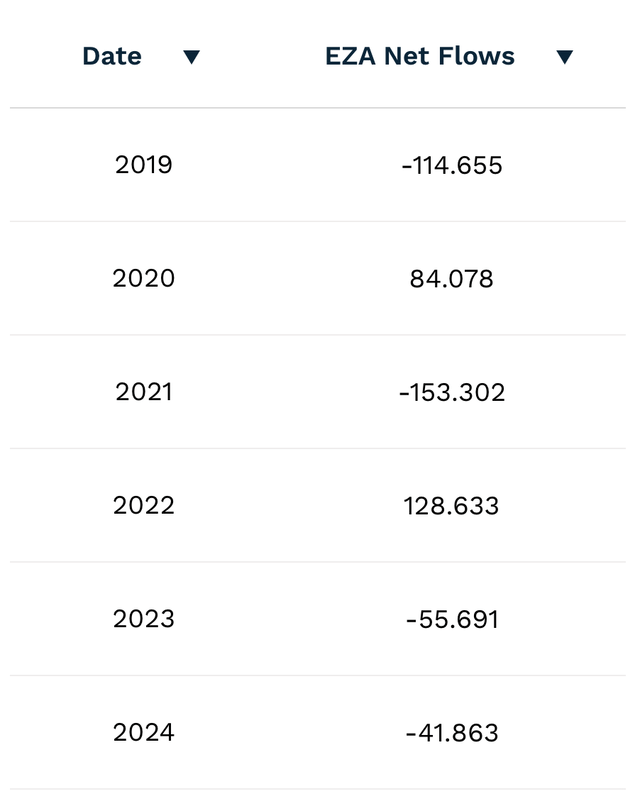

Outflow patterns in 2023 and 2024

EZA’s flow patterns have been inconsistent. We have seen large net inflows as recently as 2022, following large net outflows during the COVID-19 pandemic. Given the level of concentration in the fund, it seems likely that another round of large outflows like the one seen in 2021 could put negative price pressure on South African equities, leading to further selling.

ETF.COM

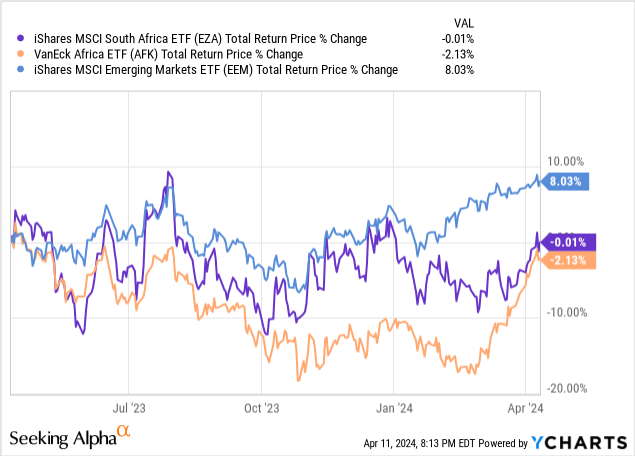

Continuous fluctuation

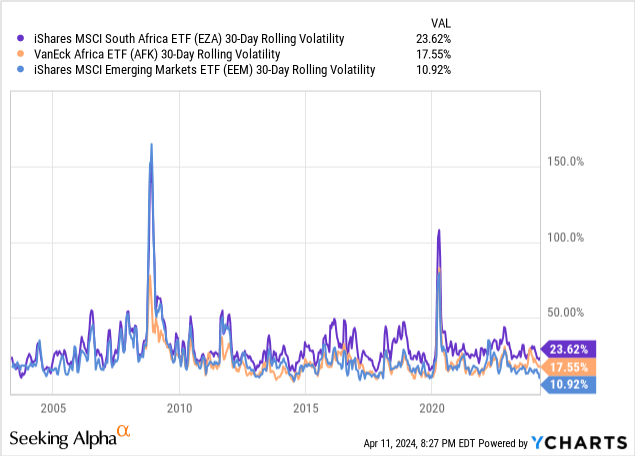

When comparing EZA to the broader African market, represented by the VanEck Africa ETF (AFK), it has performed better over the last year; however, its performance has lagged far behind the broader emerging markets (EEM). South Africa accounts for about 3% of the EEM (which is tilted mainly towards China) and 36% of the AFK allocation.

I’d like to take a look at the volatility story here to get a more complete picture of EZA’s risks beyond those mentioned above. EZA’s rolling volatility is as high as 23%, far exceeding the African region and broader emerging markets.

Attractive multiples and constant highlights

EZA is relatively cheap, with a price-to-book ratio of 1.6 times and a price-to-earnings ratio of nearly 12 times. Its TTM period dividend yield is about 3%, which is lower than many emerging market-focused ETFs, especially those with financial sector allocations.

Risks and closing thoughts

South Africa faces significant economic headwinds, including high unemployment, energy supply issues and the depreciation of the rand, which could reduce the profitability of EZA’s holdings. Political uncertainty under President Ramaphosa increases governance risks to the country’s long-term stability. EZA itself is a volatile ETF, and when looking at its returns and forward outlook, this level of volatility is unbearable for me.

South Africa has the most developed economy on the African continent. As personal income increases and domestic consumer demand picks up, there is still a long way to go for future growth. Structural economic reforms, infrastructure and growing trade with partners in Europe, China and elsewhere will be strong drivers of South Africa’s stock market over the coming decades. However, I find it difficult to justify this being a worthwhile purchase at the moment.