Klaus Vedfelt/DigitalVision via Getty Images

I published a “Strong Buy” paper for Uber (NYSE:Uber) in January 2024, highlighting their improvements in acceptance rates and operating profits.I still think Uber stock is undervalued and the market has yet to fully appreciate Uber One membership Growth and its potential for margin and free cash flow growth. Therefore, I give the stock a Strong Buy rating and a fair value of $103 per share.

Uber One membership growth

Uber Deals Uber One Subscriptions are priced at $9.99 per month or $99.99 per year. Members receive $0 food and grocery delivery fees, 5% off qualifying delivery and pickup orders, and other ride discounts.

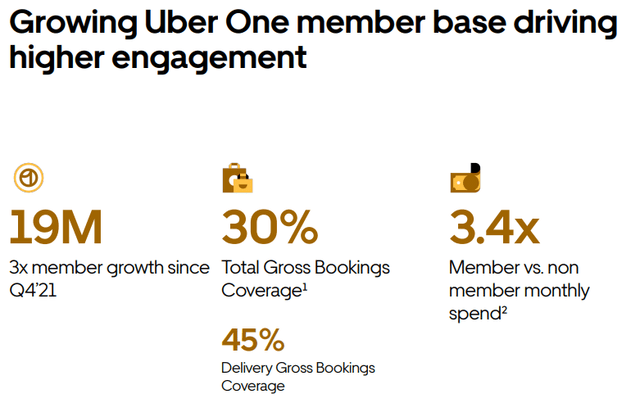

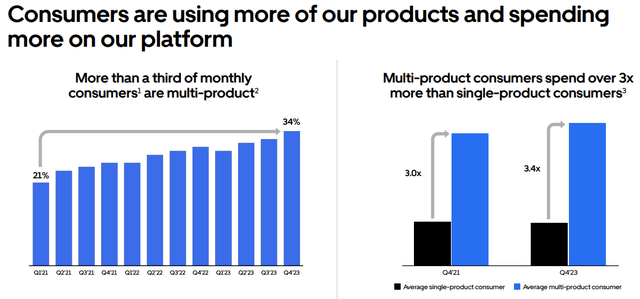

since Q3 FY21Uber’s membership tripled to 19 million Fourth quarter fiscal year 2023.As shown in the slideshow below, members’ consumption frequency is nearly 3.4 times higher than that of non-members. Currently, members Accounting for more than 30% of total bookings and more than 45% of total delivery bookings.

Initially, Uber tried to offer monetary incentives such as free trials to attract new members, but now they are turning to non-monetary incentives such as customized services and matching rides to improve retention and increase profit margins.

Uber Investor Profile

I think Uber One is critical to Uber’s future success. Since Uber has both ridesharing and delivery services, their platform can offer a variety of services to their members. They are still in the early stages of growing their membership base. By comparison, Costco (COST) has 128 million members and Amazon (AMZN) has about 167 million Prime members. Although Uber One is only three years old, it already has 19 million members. I think they have a huge runway for future growth, especially compared to Costco and Prime.

In addition, Uber One can enhance interactions with its platform and services. For members, the more frequently they use Uber’s services, the more value they get from their membership. To improve its value proposition, Uber needs to continue to expand its offerings in the ride-hailing and delivery markets. I’m excited to see Uber launching new services like Uber Reserve, Uber for Business, and grocery delivery.

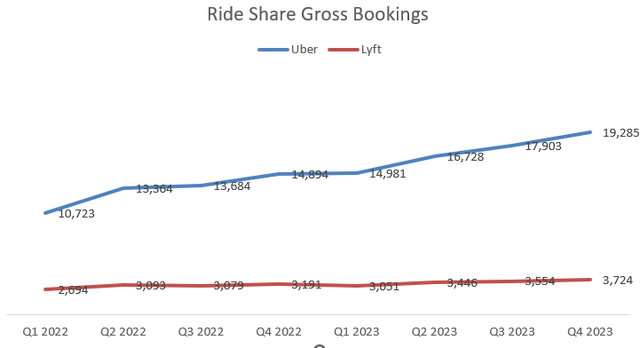

As the chart below shows, Uber’s travel business has seen strong growth in gross bookings, while its main competitor, Lyft (LYFT), has grown at a much slower pace.

Uber, Lyft quarterly earnings

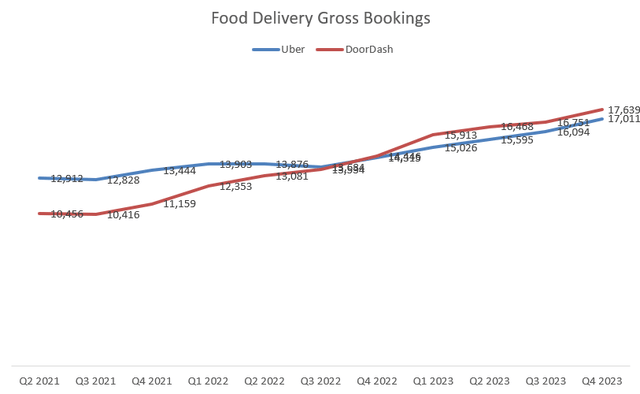

DoorDash (DASH) is the current leader in the food delivery market, and Uber is steadily closing the gap. Both companies have similar levels of gross bookings. In my opinion, Uber has a competitive advantage in offering ridesharing and delivery services on a single platform, and no other company can replicate this model.

Uber and DoorDash quarterly earnings

Improve profitability

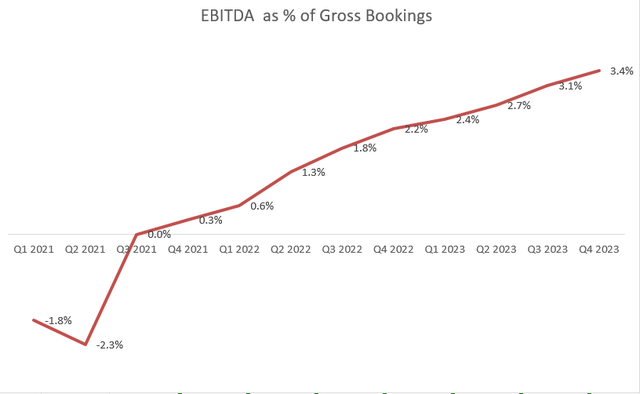

To better understand adoption, I encourage investors to monitor Uber’s EBITDA as a percentage of total bookings. As the chart below shows, monetized margins have improved steadily over the past few quarters. Enhanced monetization explains Uber’s strong margin improvement and free cash flow growth.

Uber quarterly earnings

In my opinion, there are several factors that contribute to higher monetization rates.

As revealed during the investor call, consumers are increasingly using the many products Uber offers and spending more on its platform. Specifically, the average spending of multi-product consumers is 3.4 times that of single-product consumers.

Uber Investor Profile

Since the initial customer acquisition cost is nearly fixed, Uber can generate higher profits from customers who use multiple services. To maximize profitability, Uber has done a good job of attracting these customers by offering more relevant services. It is revealed that 50 million consumers use two or more Uber products every month.

Additionally, Uber has been encouraging customers to switch from monthly to annual subscriptions, which can significantly improve retention rates. Lower churn will have a significant impact on their monetization rates, as Uber won’t need to pay additional acquisition costs for existing customers.

Recent Results and FY2024 Outlook

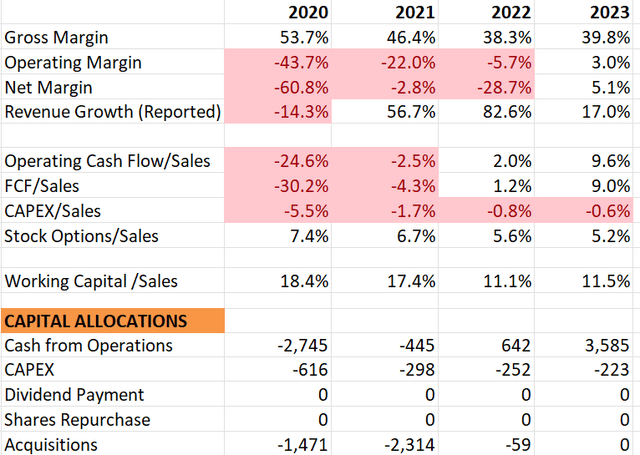

Uber announced they Fourth quarter fiscal year 2023 Results will be released on February 7th Revenue continued to grow by 13%, and total bookings increased by 21%. For the full year, they achieved positive operating margins for the first time in their history. On the balance sheet, they have $6.2 billion in cash and cash equivalents and $9.45 billion in debt, giving them a net debt leverage of 1.7x.

Uber 10K

For growth in fiscal 2024, I am considering the following factors:

-Uber One membership growth: As mentioned earlier, Uber One currently has only 19 million members, and Uber has huge potential for membership growth in the near future. Because members use Uber’s services more frequently than non-members, the growth of the member base will contribute more to the growth of Uber’s total bookings than non-members.

-Mobile Business: Business growth is primarily driven by three variables: number of consumers, number of trips per consumer and total bookings per trip. Uber offers services in different price ranges, including low-cost Uber XShare, standard UberX and Comfort, and premium Reserve, Black, and more. The diversity of services makes it possible for Uber to increase the number of trips per customer and the number of customers. Assuming 2% growth in the number of consumers, 3% growth in total bookings per trip (relative to CPI), and 3% growth in revenue per consumer, the mobile business is expected to grow 18% annually.

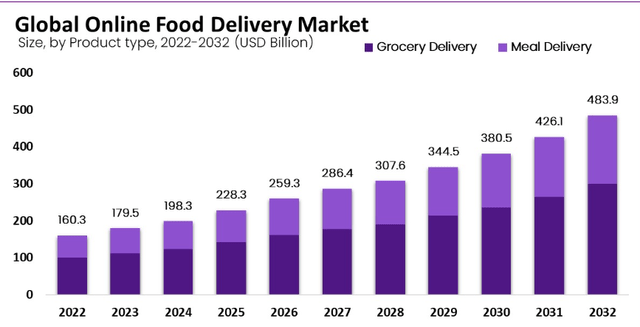

– Delivery business: US market predict The global online food delivery market is expected to grow at a compound annual growth rate of 12% from 2024 to 2033. Uber is well-positioned in both the grocery delivery and food delivery markets. As revealed in the earnings call, their annual grocery delivery revenue reaches approximately $7 billion, an increase of more than 40% year over year. Given Uber and DoorDash’s leadership, I expect these two companies to grow faster than the overall market.

US market

Therefore, I assume that the mobile business will grow by 18% in fiscal year 2024, and the delivery business will grow by 15% annually. According to my calculations, the comprehensive revenue growth rate in fiscal year 2024 is expected to be 15%.

Valuation update

As mentioned above, I estimate that Uber will achieve 15% revenue growth in the near future. They spent $1.8 billion and $1.9 billion on stock-based compensation in fiscal 2022 and 2023, respectively. SBC’s high dividend has led to dilution of its outstanding shares, with the total number of shares increasing by 4.2% and 3.2% in fiscal 2022 and 2023, respectively. Given the absence of any share repurchase program, I forecast that total shares outstanding will continue to grow at 3% per year.

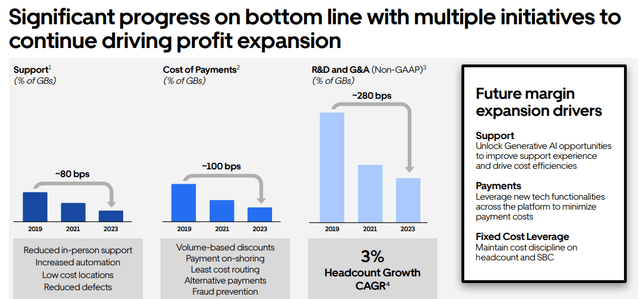

On the profit side, Uber has maintained a disciplined approach to employee headcount growth. As shown in the chart below, total headcount is growing at only 3% per year, which is significantly lower than revenue growth. Additionally, Uber has been investing in back-end automation, resulting in a significant reduction in on-site support over the past few years. As a result, their operating and support expenses as a percentage of revenue fell from 17.7% in fiscal 2019 to 7.2% in fiscal 2023.

Ultimately, I think Uber is past its peak of investing in sales and marketing to build its brand. Sales and marketing expenses as a percentage of total revenue have declined significantly over the past few years. Overall, I predict Uber will achieve 50 basis points of gross margin expansion, 30 basis points of sales and marketing leverage, 10 basis points of support leverage, and 20 basis points of G&A savings.

Uber Investor Profile

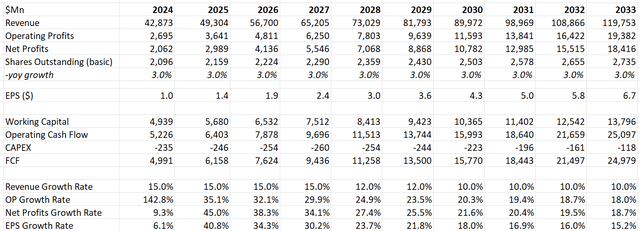

Based on these assumptions, the financial summary of my DCF model is as follows:

Uber DCF – Author’s calculations

WACC is calculated as 10%, assuming the following:

-Risk-free interest rate: 4.25% ((US 10-year Treasury bond yield))

-Beta: 1.25 ((SA’s data))

-Equity risk premium 7%; Debt cost 7%

-Debt US$9.5 billion; equity US$11.2 billion

After deducting all free cash flow, the calculated enterprise value totals $209 billion. After adjusting for total cash and debt balances, the fair value of Uber stock is estimated to be $103 per share.

Main risks

Insurance costs: According to Uber management, auto insurance costs have increased by 20% annually as insurance companies increase premiums to offset rising input costs. Uber is able to pass on the increased insurance costs to riders; however, passing on would place an additional burden on consumers that could impact ride totals. Insurance costs are unlikely to fall in the near future as insurance companies must raise premiums to offset rising costs for replacement parts and repair services.

Oil Prices: Oil prices are expected to rise nearly 15% in 2024 due to concerns about suppliers and geopolitical risks. Rising oil prices may reduce consumer affordability, leading to reduced spending on restaurants, travel and leisure travel. In my opinion, the high oil price environment is not conducive to Uber’s business growth.

in conclusion

I don’t think the market and investors have fully appreciated Uber One’s membership growth potential and Uber’s ability to achieve profit expansion and free cash flow growth in the near future. Uber One can leverage mobile travel and food delivery services to enhance customer interaction with the Uber platform. I have a Strong Buy rating and a fair value of $103 per share.