Delpixart/iStock Editorial via Getty Images

introduce

About a year ago I published an article Tritax Big Box REIT plc (OTCPK:TTBXF) claimed that “the worst is over.”I’ve warned about this before As interest rates in financial markets rise rapidly, real estate assets appear to be overvalued, which traditionally means REITs need to consider higher capitalization rates.

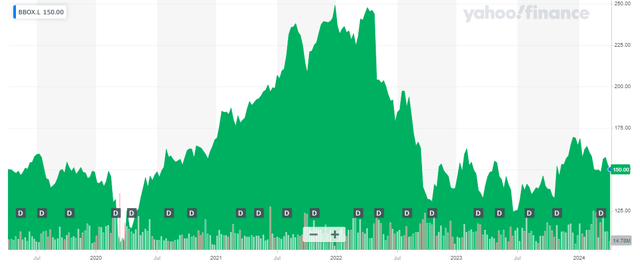

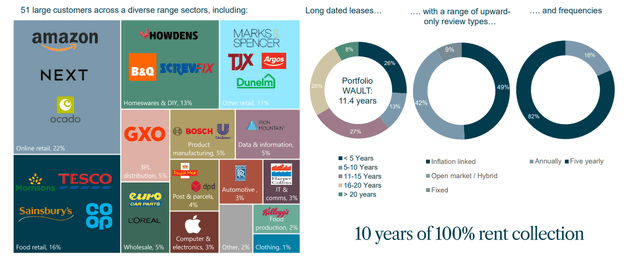

Tritax Big Box focuses on warehouses and distribution centers in the UK (its largest tenant is Amazon (AMZN), accounting for nearly 15% of annual rental income). While the REIT isn’t out of the woods yet, its shares are currently up about 5% from last year.

Yahoo Finance

Tritax has approximately 1.9B shares outstanding, with a current stock market capitalization of approximately £2.85B The price is 150p (price at Wednesday’s close). The REIT is part of the FTSE 250 index and trades as average daily trading volume in London (Nearly 9 million shares per day) is far superior to any secondary listing and I highly recommend using the London listing to trade Tritax shares. London’s stock code is BBOX.

2023 results now out

There are a few main things I need to be sure of when considering REITs. First, from a profit perspective, the current stock price needs to be reasonable. Second, LTV ratios should be relatively conservative to avoid balance sheet concerns in the event of an economic shock (such as a rapid increase in capitalization rates). Finally, stocks should not trade above underlying book value.

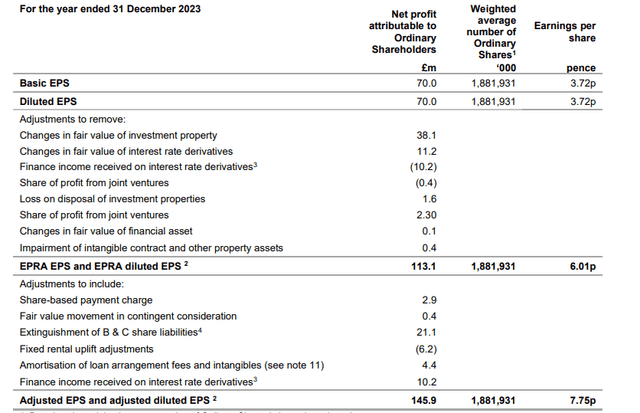

Just like in North America (and pretty much everywhere else), a REIT’s net income results are irrelevant in judging the attractiveness of its valuation. In Europe, EPRA earnings are comparable to FFO calculations. As shown below, the starting point is net profit, and in the first series of adjustments, EPRA gains £113mbased on a weighted average share count of just over 1.88 billion shares (as mentioned in the introduction, the share count has now increased to just over 1.9 billion shares), the price per share is approximately 6.01 pence.

BBOX Investor Relations

In the second step, REIT needs to adjust some projects.Its underlying revenue is around £146m, which works out to 7.75p per share. That’s down 0.5% from fiscal 2022, but during 2023 the REIT eliminated liabilities related to its B and C shares.

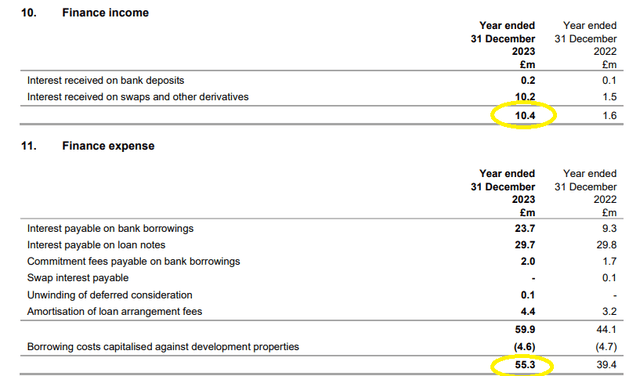

Relatively flat profits in 2023 should be considered a “success.” After all, Tritax had to contend with interest rates starting to rise in financial markets. As shown in the chart below, net finance charges increased from less than £37 million to almost £45 million.

BBOX Investor Relations

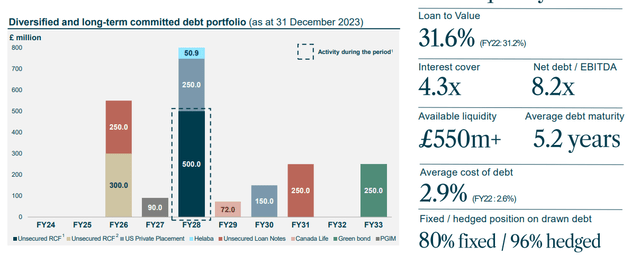

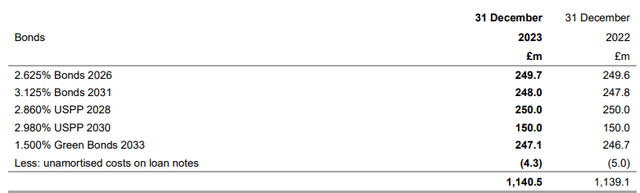

In fact, Tritax Big Box REIT’s chief financial officer plays the interest rate game well. The REIT’s borrowings stood at just over £1.6B at the end of 2023, but only £475M was made up of bank borrowings, with the majority (£1.14B) made up of fixed-rate debt.

BBOX Investor Relations

This helps control the growth of debt costs. The average cost of debt is just 2.93% at the end of 2023, and while that’s a considerable improvement from 2.57% at the end of 2022, Tritax feels very fortunate for its historical decision to issue debt.

BBOX Investor Relations

Having said that, at 150p per share, the stock trades at just under 20 times earnings. It’s still a little too rich for my blood.

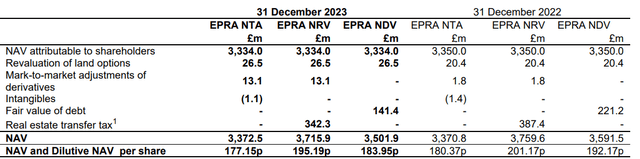

From a fair value perspective, European REITs always offer three different types of NAV calculations. As shown below, net tangible assets are estimated at 177p per share, while net disposable value is just under 184p per share.

BBOX Investor Relations

While the current share price of 150p represents a 15% discount to the official NTA, it’s also important to understand the capitalization rate being used.

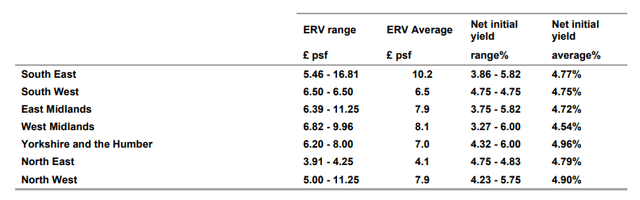

As shown in the chart below, REIT’s independent appraisers use a weighted average net initial yield of around 4%.

BBOX Investor Relations

Net rental income for financial year 2023 was approximately £222 million, of which £113 million was generated in the second half ( H1 NRI is 109M GBP). Applying the required net rental yield of 5.5%, based on an annualized yield of £226m, would result in a fair value for the asset of approximately £4.1B. Adding £260M to assets under development would result in a fair value closer to £4.4B, or around £450M lower than the “official” estimate. Following the split of more than 1.9 billion shares, NTA will be negatively impacted by approximately 23p per share. In this scenario, the underlying price per NTA share would be 154p, excluding rent increases in 2024.

Based on the current 15% discount to NTA, and considering that there will still be a slight discount using higher cap rates, Tritax Big Box REIT is quite attractive based on NTA/share.

At the end of 2023, the LTV ratio was only 31.6%, and even if you applied a 5.5% net rental yield to an income-producing property, the LTV ratio would only increase to the mid-30% range, which is still pretty decently low.

There are also two bonus elements: Long-term weighted average lease term The breakdown of its anchor tenants also tilts my view on Tritax Big Box REIT toward “positive.”

BBOX Investor Relations

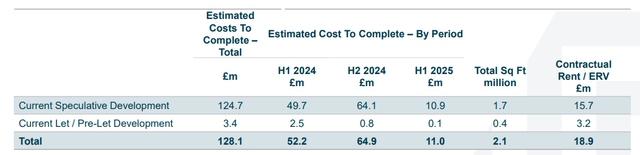

Additionally, Tritax’s pipeline of development projects looks attractive. The Tritax development will cost around £128m to complete between now and summer 2025 but will add more than £18m to rental income if fully let.

BBOX Investor Relations

I’m glad to see REITs becoming more conservative before tackling new major expansion projects. It targets a cost yield of 6-8% for all new developments, which is definitely higher than its cost of capital.

investment thesis

While I’m still not willing to pay ~20x base earnings for a REIT, Tritax Big Box REIT ticks all the other key boxes I look at (NTA, LTV ratio, investment pipeline, sensitivity to higher cap rates), This means I’m becoming more and more interested in the Tritax Big Box. Unfortunately, the dividend (7.3p in 2023, a yield of 4.9% based on the current share price) is subject to the UK’s 20% dividend withholding tax rate.

Tritax Big Box REIT is also focused on acquiring UK commercial real estate.This will create additional economies of scale as the deal will Create the fourth largest REITs in England.

I currently don’t have a position in Tritax Big Box REIT, but I still believe the worst is over. ;

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.