Pgiam/iStock via Getty Images

Welcome to another installment of our weekly preferred stock market review, where we discuss preferred stock and baby bond market activity from the bottom up, focusing on individual news and events, and from the top down, providing a broader overview market. We also try to add some historical context and relevant themes that appear to be driving the market or that investors should be aware of. This update covers the period during the first week of April.

Be sure to check out our other weekly updates covering the business development company (“BDC”) and closed-end fund (“CEF”) markets for a broader perspective on the income space.

market action

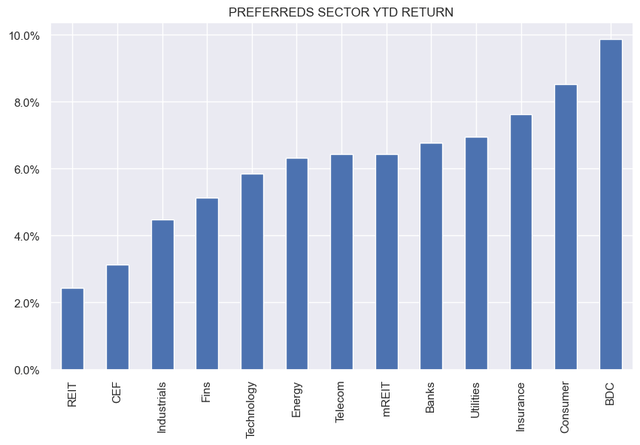

Preferred stocks were flat on the week, outperforming most other income sectors, as credit spreads tightened further. All preferred stock subsectors are higher so far this year.Bank preference is like this We’re not blinking at residual concerns about risks in the commercial real estate industry.

systematic income

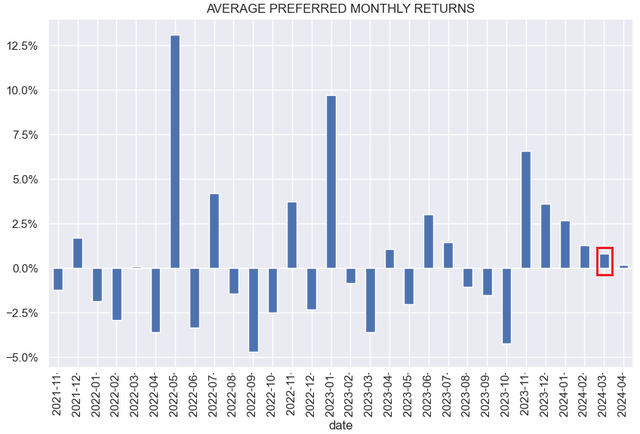

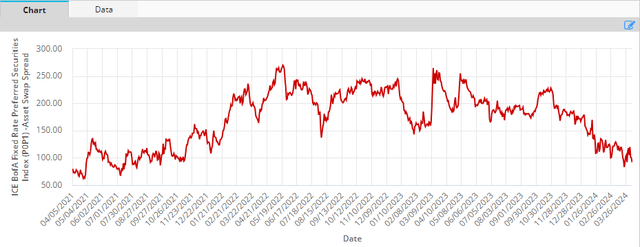

March was the fifth month with positive total returns, but as the chart clearly shows, returns have been declining. The spread is very tight, leaving less room for future capital gains.

systematic income

market theme

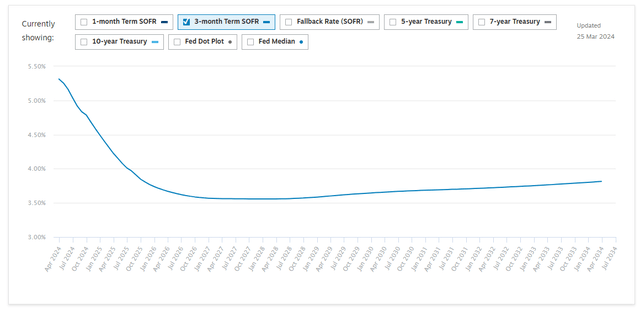

Rising yields, particularly on fixed/floating equities, are widely believed to be driving redemptions across the industry. When we say yields are rising, we are referring to the following example. First Horizon Series D (FHN.PR.D) is a preferred stock, with the first redemption date being May 1, 24, and a fixed coupon of 6.1% before that. As it happens, the stock will be redeemed on the first redemption date. However, if not redeemed, its coupon will convert to 3-month SOFR + 4.12% or approximately 9.4% from that date, which is a coupon increase of 3.3% or more than 50%.

We believe this is not the best way to measure redemption odds, since the increase in coupons does not tell us whether the company can refinance a given preferred stock at a better rate. Simply reissuing preferred stock at a similar interest rate is just a waste of money (because of the issuance fees) and work. Few companies have the extra cash to simply pay down preferred stock without refinancing.

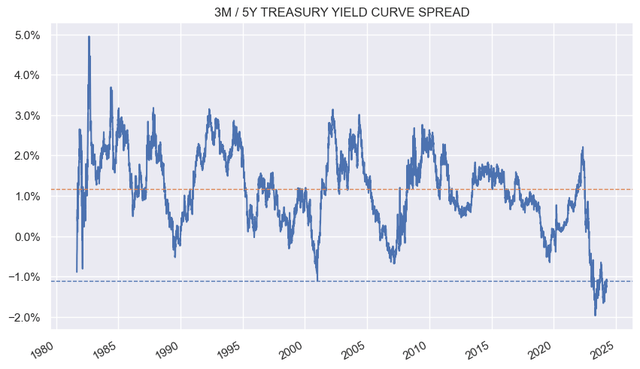

The increase in coupons is not the reason for preferred stock redemptions, but largely because of the unusual inversion of the yield curve. In other words, as the chart below shows, short-term rates are abnormally elevated relative to long-term rates. However, this is only because the market expects short-term rates to fall significantly relative to long-term rates over the next few years.

systematic income

Therefore, redemptions in response to coupon increases are not necessarily an obvious thing for the issuer. This is because the redemption of preferred shares that are about to be converted to a floating rate will not necessarily save the issuer money, even if the coupon increases on the first redemption date. Unless the market is wrong about the direction of short-term rates (as shown below), long-term fixed rates are best viewed as a first-order approximation of the consensus average of short-term rates.

Chatham

By that logic, paying a short-term interest rate over time isn’t that much different than a fixed-rate refinance, as both should end up costing roughly the same. Likewise, the market can be very wrong about the direction of interest rates, but it can be wrong in either direction, so unless the issuer has a very precise view of the path of short-term interest rates that deviates significantly from the market, redemption and refinancing into another Which fixed rate or preferred fixed/floating rate is not a one-and-done thing.

More important to an issuer’s decision whether to refinance than a change in coupon is the level of spreads on floating rates versus those currently prevalent in the preferred equity sector. As the chart below shows, preferred stock spreads have fallen to around 1% in total (particularly for exchange-traded financials, where the spread is only 0.28%, which looks quite generous). This suggests that issuers that believe they can issue new preferred stock at a spread below the fixed/floating preferred stock contract spread are likely to do so.

ice

One of them is FHN.PR.D highlighted above. FHN was hit last year by a sell-off from regional banks, with shares falling to $16.50. Also, remember that the second decline occurred when its planned merger with TD Bank failed. If the shares were not called, the spread they would pay would be more than 4% above SOFR. Banks may well be able to obtain financing at cheaper rates, if not in priority markets, then elsewhere.

FHN.PR.D was held in our income portfolio from April to October, when we rotated to Synovus Financial Series E (SNV.PR.E). SNV.PR.E’s first call date is July, and the coupon resets to 5-year note +4.127%. It’s still attractive because it offers a win-win — a nice tailwind in the event of redemptions (where it trades below “face value”) or if the coupon rises significantly. Very similar to FHN.PR.D – redemption is not impossible given the high spread of over 4% above the base rate. In the current environment, market demand for new issues is likely to be reduced.

Market comments

Commercial real estate remains the focus of the broader market. It is one of the few industries experiencing a decline. The FDIC showed a significant increase in stressed loans in non-residential non-agricultural sectors (e.g., office buildings, retail, restaurants), reaching their highest levels in a decade. Sachem is a mortgage REIT with significant exposure to the sector, and is of interest to retail investors as the industry leader and for its large portfolio of exchange-traded senior securities. The company had just reported disappointing results, sending the common stock down double digits on the day, but to be fair, it wasn’t far off where it was at the beginning of the year.

Sachem has several relievers in its product portfolio. One is that its loan terms are primarily one-year, allowing it to quickly escape industry-specific issues that have slowed growth. Second, its office-related exposure is about 12%, with residential loans accounting for about half of the portfolio and commercial mortgages accounting for less than 40%. Third, the company acquired a design/construction firm, allowing it to bring projects in-house and renovate existing properties.

In terms of key portfolio metrics, there were $6.4 million in non-cash impairments (credit provisions) last year. As a result, despite revenue growth, annual net profit fell by about a third from 2022 levels. That was worse than expected, sending the common stock down double digits. Non-accruals account for approximately 17% of the portfolio; however, leverage is lower at 1.6x. Preferred stocks and bonds didn’t react much.

Sachem is another example of how the relative pricing of bonds and preferred stocks makes no sense. Preferred SACH-A trades at a yield of 8.4%, with all bonds (see the mREIT sector in the Baby Bonds instrument) holding a deal at a similar or higher yield. Of the entire Sachem series of preferred securities, short-term bonds (such as SACC) have the best yield, at 8.3%. The bond asset coverage ratio is approximately 1.9 times.

The fact that the portfolio has a relatively short maturity means there should be enough cash in interest and principal to repay the bonds as they mature. Longer maturities don’t look as good, and their yield recovery is somewhat muted, especially if commercial real estate stress gets worse.

A common argument regarding holding mortgage REIT bonds is that they do not have asset coverage requirements because they are not subject to the rules of the Investment Company Act of 1940. Therefore, issuers such as CEFs and BDCs will not be able to have as low an asset coverage ratio as Sachem. This means that all else being equal, mREIT bonds require investors to be more cautious.