MF3d

Lin Research (NASDAQ: LRCX) is a staunch pillar of the semiconductor industry, producing the wafer fabrication equipment needed for global semiconductor production.Although it does not have the monopoly position of ASML, its advanced EUV lithography machine is an indispensable and important part of the semiconductor food chain. Without it, most industries will not be able to survive.

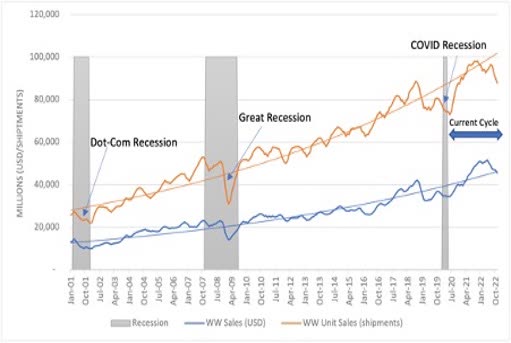

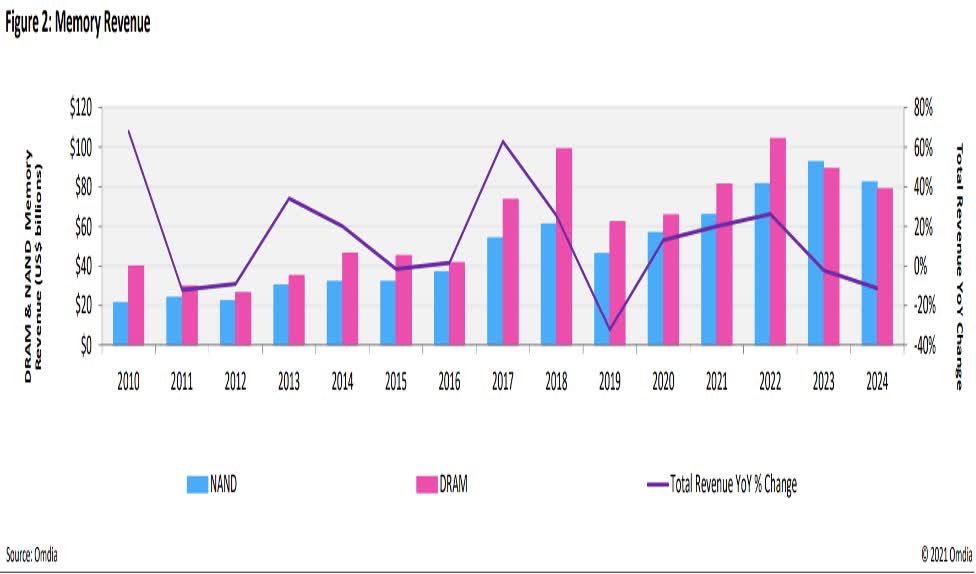

I own it and have planned to recommend it many times, but have often been hesitant about the cyclical, commodity nature of capital machinery and equipment in the semiconductor industry, which typically has overcapacity in all segments such as foundry, logic, and memory. As we can see from the industry and memory sector charts below, the semiconductor industry has gone through cycles.

semiconductor market (SIA and WSTS) Semiconductor memory market (immediately)

Lam Research itself has experienced Revenue has fallen twice in the past decade down 13% fiscal year 2019, and more recently predicted Post-pandemic dyspepsia fell 15% in fiscal 2024. Many times, it’s difficult to hit rock bottom, and it’s easy to pay too high a price in the hope that the good times will continue.

Still, Lam Research shares have soared 90% in the past year as demand for high-bandwidth memory for GPUs surges from companies such as memory supplier Micron (MU).

Lam Research is valued at 34x FY24 EPS of $30, which is expensive and will likely see sideways movement throughout the year, but I would add more to the downside given future growth and demand, esp. This is when the overall market retreats.

Let’s see what makes it work.

Strong demand and growth

Given the demand for artificial intelligence capital expenditure construction in the next three years, the wafer equipment industry is expected to The growth rate is 8.4% 2022 to 2027.

I also expect demand to remain strong and rise in 2027 based on Nvidia’s extraordinary estimated growth in AI GPUs from fiscal 2025 to fiscal 2027, as well as growth from Taiwan Semiconductor Manufacturing Company (TSM), the world’s largest semiconductor foundry.TSMC alone expects its AI revenue share to increase from 6% to low teen By 2027.

DRAM chip spending benefiting from artificial intelligence construction and strong demand in China, as well as smaller advanced nodes, have played to Lam Research’s strengths.

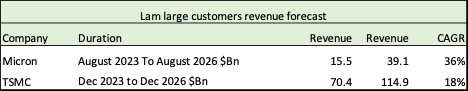

Here are revenue forecasts for two of Lam Research’s largest customers over the next three years, showing that Lam Research is likely to see continued demand from its largest customers. Micron, one of the world’s largest memory chip manufacturers, expects a compound annual growth rate of 36% from the bottom in fiscal 2023. TSMC, the world’s most valuable semiconductor foundry, is also expected to grow by 18% in the next three years.

semiconductor growth catalyst (Seeking Alpha)

Strong, long-term and sustained growth in the past: Even without the AI jump and the memory shock, Lam Research has performed extremely well, with a 10-year revenue CAGR of 16% from $4.6 billion in fiscal 2014 to fiscal 2023 even with two revenue declines. of US$17.4 billion, and the compound annual growth rate of earnings per share is also very high. Growth over the same period was 28%. This has delivered excellent returns to shareholders, with Lam Research’s 5-year return of 405% and 10-year total return of 1,734%. Why do I call it cyclical? If people don’t panic and persevere through the lows, these are the real long-term company rewards for growth. Lam Research’s revenue is a function of global die volume and overall die complexity, and while the cyclicality of the former should continue, the latter should see more sustained growth given its emphasis on AI GPUs.

market leader

Lam Research has more than 50% market share expected Growth 8% every year until 2031.

Strong wafer fabrication expertise, R&D and switching costs also give it a competitive advantage.

R&D spending will grow at a CAGR of 10% from 2014 to 2023, accounting for an average of 12% of sales, stabilizing at around $1.7 billion, and will not decrease even if sales decline. Because it’s further downstream, it doesn’t have to use as much capex as Micron – it can make better use of its capital. Capital spending over the past 10 years totaled $2.9 billion.

artificial intelligence factors

We see that Micron Technology’s share price return over the last 12 months was 93%, which is excellent. I recommended Micron in June 2023, mentioning that memory chips will be a key factor in the expansion of artificial intelligence. Micron management is very confident that they are at the bottom of the cycle, with significant improvements in average selling prices and demand growth. I should have gone further downstream and bought Lam Group as well, but I believe there will still be excellent growth in the next three years. I’m also surprised at how much AI is contributing to demand trends, which shows the increasing number of layers in 3D NAND wafers and the need for AI-enabled high-bandwidth memory DRAM wafers. For the same reason, the demand for gate all-purpose transistors and advanced packaging should also increase.

risk

Geopolitics: While the U.S. government targets the high-end market, namely Nvidia’s H100 and ASML’s EUV equipment, to restrict sales in China, Lam Group faces much less pressure from export restrictions. Lam Research’s business in China accounts for 40%, much higher than any other region or country. China will still be a possible threat.

Patterning is more powerful than etching: Among semiconductor wafer equipment, it seems that there is a shift from etching and deposition equipment, which is the strength of Lam Research, to patterning (this is a market segment) Led by ASMLgaining market share in 2023.

Capital expenditure and R&D intensive: Lam Research must invest a lot of cash in R&D and capital expenditures, with $12 billion spent on R&D and $2.8 billion in capital expenditures over the past decade. Lam Research is about 65% the size of its biggest rival Applied Materials (AMAT) and needs to continue investing in R&D and capital expenditures to maintain its market share. Still, R&D’s compound annual growth rate over the past decade has been much lower at 10%, while earnings growth has been 28%.

The risk of cyclical memory demand is high – Although Lam Research’s December 2023 quarter sales increased 8% sequentially to $3.76 billion, they were down 29% year-over-year, and NAND flash memory wafers declined sharply in 2023.

competition

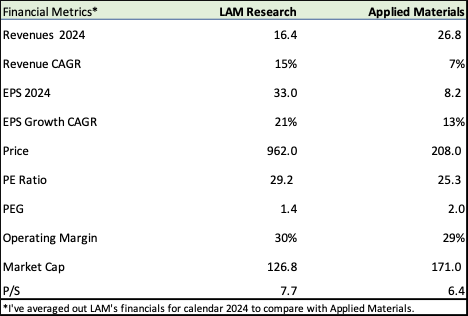

Lam Research & Applied Materials, Inc. (Seeking Alpha, Lin Research, Applied Materials, Fountainhead)

Lam Research does stand out compared to much larger rival Applied Materials. Its expected revenue growth of 15% is twice that of Applied Materials’ 7%, and its 21% earnings per share growth is also much better than Applied Materials’ 13%. Not surprisingly, it does trade at a whopping 29 times earnings compared to Applied Materials’ 25 times, but it’s much better in terms of price-to-earnings growth, with Applied Materials’ PEG ratio just 1.4 to 2. Both companies have excellent operating profit margins of 30% and 29% respectively.

Finance and Valuation

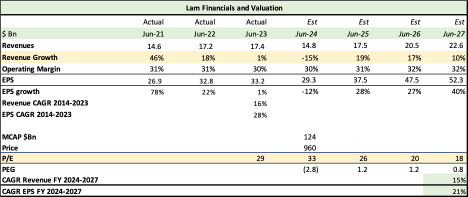

Lin studies finance (Seeking Alpha, Wall Street, Barron’s, Fountainhead, Lam Research)

Colin Research has performed quite well in the cyclical semiconductor industry, with only two revenue declines in the past decade, a 13% decline in fiscal 2019, and a 15% decline in the fiscal year ending in June 2024.

After 10 years of hard work, Lam Research has actually grown from US$4.6 billion in fiscal 2014 to US$17.4 billion in fiscal 2023 – a revenue compound annual growth rate of 16% in these 10 years, which is impressive.

Likewise, earnings per share fell 13% in fiscal 2019, but over the past 10 years it has grown at a staggering 28%, with clear operating leverage and better margins at almost double the revenue rate Improved profitability.For an equipment manufacturer affected by peaks and trough In the semiconductor space, this is very good for a cyclical stock and gives me a lot of confidence that Lam Research can bounce back from bad times very strongly.

Lam Research expects earnings per share to fall 12% to $29.26 in fiscal 2024, while eking out 1% growth in fiscal 2023. However, earnings will rebound strongly over the next three years, growing at a CAGR of 21% to $52 per share, based on analyst consensus and my estimates. We can see from the table that FY2023 and FY2024 are periods of indigestion due to the epidemic-induced growth of 78% and 22% in FY21 and FY22 respectively.

The bright side is that even in the current economic downturn year, operating profit margins have always remained above 30% – Lam Research is quite strict in controlling costs.

Going forward, revenue should grow at a CAGR of 15%, in line with its long-term CAGR of 16%, and earnings per share should grow at 21% on a higher basis.

Lam Research’s impressive shareholder returns have been driven by its strong cash flow, with an exemplary cash generation of $24.7 billion over the past decade, while $18.7 billion worth of buybacks reduced the share count from 175 million to 135 million shares , a decrease of 22%.

One big hurdle to overcome is price – Lam Research has gained 90% in the past 12 months and, like its cyclical peer Micron, is already priced in some forecast earnings growth over the next three years.

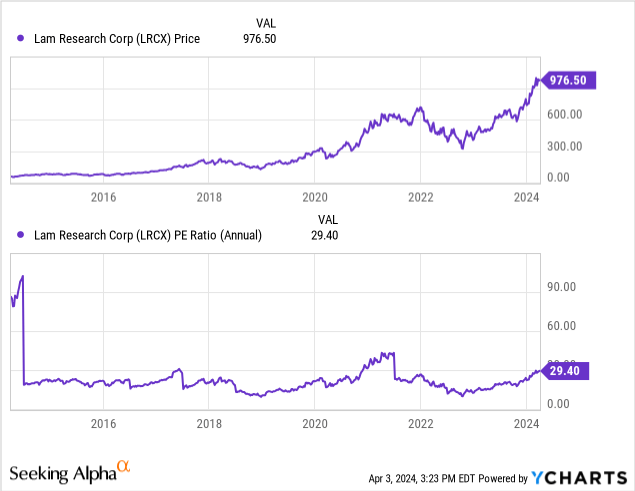

I conservatively value Lam Research at a P/E ratio of 25x, and as you can see from the chart, the P/E ratio is 33x, which is well above average.

Lam Research Total Return and P/E Ratio (Seeking Alpha)

Data provided by Y chart

At 25x 2027 P/E of $52, the stock would be worth $1,300 in three years, a gain of 35%, or a return of 10% per year + dividends. Therefore, returns will be low and not even close to last year’s 90% price appreciation. Ideally, the purchase price should be between $900 and $910 to get good value for money.

I own it, I bought late and will be looking to accumulate more at lower levels. I also believe Lam Research can command a better P/E ratio and has room to rise further for the following reasons:

- Expected growth in semiconductors due to artificial intelligence demand and expansion.

- Market leader in etching and deposition.

- Amazing cash generation, delivering strong returns to shareholders and leaving huge buyback potential.

- The EPS compound annual growth rate of 28% over the past 10 years demonstrates Lam Research’s ability to overcome cyclicality better than its peers and achieve long-term growth returns.

If Lam Research trades at a P/E of 29, the stock would be worth $1,450, giving a total potential return of 50% or 14% per year.