59 yuan

We previously covered Verizon Communications Inc. (NYSE:NYSE:VZ) re-rated it to Buy in January 2024 after falling into a classic bear market trap. Even so, we still believed it was impossible to time the market, especially given the extreme pessimism at the time.

Due to a slowdown in capex in 2024 and subsequent improvement in free cash flow generation, we may see management achieve its net debt to EBITDA targets over the next few years while continuing to pay dividends.

In this article, we discuss why we maintain a Buy rating despite VZ’s impressive recovery of +28.5% since its October 2023 bottom, triggering a drop in its forward dividend yield from its October 2023 peak of 8.55% To that time 6.62% of writing.

Sentiment surrounding telecom stocks has improved significantly in the past For several months, we have believed that VZ’s dividend investment thesis remains strong.

Despite recent rally, VZ dividend investing thesis remains compelling

With VZ set to report on its FQ1’24 earnings call on April 22, 2024, readers may indeed want to temper their expectations for free cash flow generation.

This is due to the higher projected cost of wireless equipment as consumers typically upgrade their devices during last season’s holiday season, in addition to higher promotional incentives similar to peer AT&T (T).

For reference, VZ reported volatile free cash flow of $2.3B in 1Q23, $5.6B in 4Q23, $6.7B in 4Q23, and $4.1B in 4Q23. B, mainly due to the unpredictable cost of wireless equipment.

The reason for this caution was attributed to similar misunderstandings that had occurred to T previously. Four weeks after the meeting, the company’s shares were down -23%.

While T ultimately delivered on fiscal 2023 free cash flow guidance of $16B, as it generated $4.2B in FQ2’23, $5.2B in FQ3’23, and $6.4B in FQ4’23, it’s painfully obvious that the stock It has not yet achieved a return to the pre-correction trading range as of this writing.

So while VZ management provided promising fiscal 2024 guidance, with adjusted EBITDA growing +2% year over year and adjusted EPS of $4.60 (-2.3% year over year due to higher cash taxes), free cash flow generation About $20.2B (8% year-over-year growth), at the midpoint we expect the sequential situation to be quite volatile.

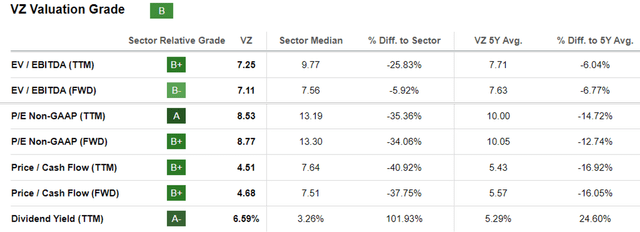

VZ valuation

Seeking Alpha

Combined with VZ’s huge long-term debt of $137.7B (-2.1% year-on-year/+36.7% from fiscal 2019 levels) and single-digit growth prospects, we can understand why VZ’s FWD EV/EBTIDA valuation is 7.11x, FWD P /E Valuation is 8.77x discounted.

In comparison, its 5-year average is 7.63 times/10.05 times, and the industry median is 7.56 times/13.30 times. The same is true for T’s 6.45x/7.46x and Comcast’s (CMCSA) 6.63x/9.48x, which means VZ isn’t the only company whose telecom business is typically heavily debt-laden.

Then again, we think VZ’s discount level presents an opportunity for dollar-cost averaging for opportunistic investors, as its dividend remains solid.

With annual dividend obligations of ~$11B, we may see the telco accelerate deleveraging, with the balance sheet likely to improve from the 2.83x net debt to EBITDA ratio reported in Q4 2023. The reported net debt to EBITDA ratio in Q4 was 2.88x.

Much of the tailwind is attributable to a slowdown in VZ capex, with peak 5G capex of $23B in fiscal 2022 (up 13.8% year-over-year) well behind us, further aided by management’s continued capital and network efficiencies.

Meanwhile, market analysts expect 6G is coming soon Through 2030, this means the telco’s capital expenditures are likely to remain low in the coming years, allowing management to maintain the dividend while deleveraging.

If anything, VZ continues to hint at substantial growth ahead, thanks to the aggressive rollout of its C-band spectrum, fueling the expansion of its fixed wireless access business, with a quarterly net addition target of around 350,000.

As of March 2024, the company had more than 3 million fixed wireless access customers, well above the midpoint of its original 2025 customer target of 4.5 million customers.

Additionally, VZ’s new mobile plan myPlan, launched in May 2023, has generated new growth thanks to increased consumer flexibility and exclusive streaming partnerships with major media companies, which will naturally trigger higher ARPA and lower churn rates.

It is now obvious that “Management reshuffleAs observed in the relatively optimistic fiscal 2024 guidance, “Great results have been achieved, further driven by the growing appeal/value of its bundled mobile and fixed wireless products.

So, is VZ stock a buy?sell, or hold?

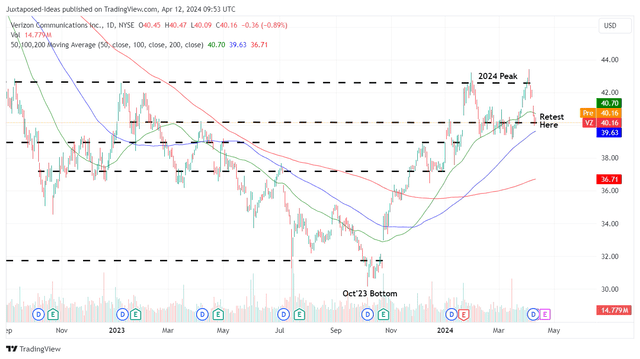

VZ 1 year stock price

trading view

Currently, VZ has failed to break above the 2024 peak of $42 twice, but appears to be well supported at $40.

As with dividend stocks, we believe the key metric for entry will be its forward yield, which currently stands at 6.62%, consistent with our previous article, albeit slower than its October 2023 peak of 8.55%.

compared to U.S. Treasury yields Ranging between 4.52% and 5.39%, we believe VZ’s rich yield remains attractive, especially given that the market has Fed cuts interest rates in 2024 as European Central Bank It also heralds the first cuts in June 2024.

At the same time, we agree with Seeking Alpha Quant’s Dividend Safety Grade C rating, which is attributed to management’s hopeful profit guidance for growth in adjusted EBITDA and free cash flow in fiscal 2024.

We maintain a Buy rating on VZ stock due to its solid dividend investment thesis, but do not have a specific entry point as it depends on the individual investor’s dollar cost averaging and portfolio allocation.

Since bottoming in October 2023, VZ is up +28.5%, outperforming T’s +14.1% and the broader market +19.2%, and readers may want to choose entry points on modest pullbacks to increase their margin of safety.

It goes without saying that anyone continuing to hold U.S. telecom stocks (including VZ) may want to monitor leading cable Discussions with regulatorsIt remains to be seen whether telcos will be required to bear the costs of remediation as a resolution has not yet been reached.

Investors may also want to note that this issue may be reviewed in the future. annual general meeting On May 9, 2024, the BellTel Retirees Association introduced a proposal calling for a vote to conduct a comprehensive independent study.

A pessimistic development could trigger another painful correction and possibly even severe capital losses.