PhonlamaiPhoto/iStock via Getty Images

Do you remember when Marty’s father was fired from Back to the Future in 2015? This is not via text message or email. It was sent via fax!The movie gets a lot of things right, like drones and video conferencing, but it misses two of the most transformative developments The next decade: mobile phones and the Internet. The problem with many predictions about technology is that they don’t go far enough.

Some of the worst calls in history

1943: IBM (IBM) president predicts global needs perhaps Five computers.

1995: Newsweek publishes an op-ed by astronaut Clifford Stoll predicting that the Web will never replace physical newspapers and severely underestimating the potential of e-commerce. Amazon (AMZN) reported online sales revenue of $232 billion last year.

2007: Former Microsoft CEO Steve Ballmer predicts ‘no big breakthrough for iPhone’ Market share.AAPL) has nearly 1.5 billion users and trailing 12 month (TTM) sales of $386 billion.

2008: Oracle’s (ORCL) chief technology officer calls the cloud “complete nonsense.” Amazon and Microsoft (MSFT) reported sales of $91 billion and $88 billion, respectively, for Amazon Web Services (AWS) and Microsoft Smart Cloud during the past fiscal year. Oh, and Nvidia (NVDA) has a market cap of over $2 trillion thanks to soaring data center sales.

What’s the point?

Everyone makes mistakes about the future, even experts. Predicting the path technology will take is difficult, and many of us (me too!) are resistant to overhyped new things.

The point is, people tend to underestimate the extent to which new technologies will impact our daily lives. I remember when the internet first came out. It’s neat, but of little practical use. Dial-up speeds are extremely slow and erratic, and once you’re connected, there’s not much to do.

But technology continues to move toward more convenience and efficiency, such as e-commerce. It took a while, but in hindsight, it’s obvious.

That’s what I think when people downplay the potential of artificial intelligence (AI) in the business world and our favorite stocks. There will be a lot of failures and false starts along the way, but technology is coming. The International Monetary Fund predicts that 40% of global jobs will change. Over time, there may be more.

Some stocks will enter bubble territory and fail miserably in the long run, while some stocks will be wildly successful. I don’t put all my eggs in one basket and definitely not in every basket. But here are some factors to consider and why.

Arm Holdings

Arm (ARM) Holdings is a chip company that does not produce chips. It designs the so-called “architecture” for CPUs and GPUs that power smartphones, data centers, advanced driver-assistance technology and more. The company claims total shipments have reached 280 billion units, and its CPUs are used in 99% of the world’s smartphones.

There are several reasons to like this company:

- Since it’s not a manufacturer, gross margins are over 95% and free cash flow margins are close to 30%.

- The company has a strong balance sheet, with current assets of $3.6 billion and current liabilities of $866 million.

- Its market share is increasing in many industries.

- Remaining performance obligation (RPO) increased 38% year-over-year last quarter to $2.4 billion.

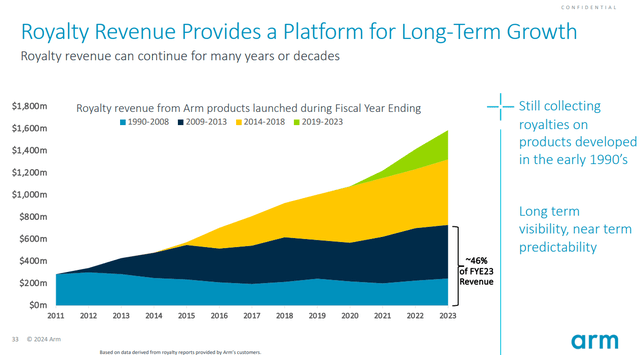

The best part of this business model is that the royalty revenue will continue to increase as old products continue to be used and new products are launched, as shown below.

Arm Holdings

Estate income is a great thing. Since R&D expenses were paid for years ago, the profits are huge.

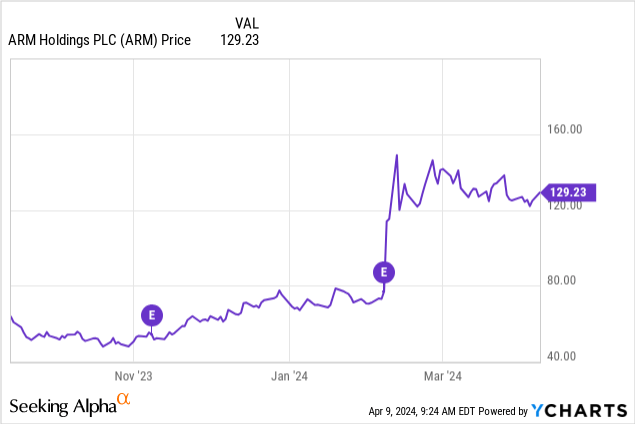

As the chart below shows, Arm’s stock price rose sharply after last quarter’s earnings report, so a short-term retracement is likely.

Keep it on your watch list and consider buying on dips.

UiPath

Robotic process automation (RPA) allows software to mimic human behavior and automate tedious tasks. Imagine a large company that requires employees to download documents, fill out forms, or enter data into its accounting system. Automation of this process has a huge impact on a company’s efficiency. That’s why I own shares of RPA provider UiPath (PATH).

UiPath has fiscal 2024 sales of $1.3 billion and annual recurring revenue (ARR) of $1.5 billion (up 24% and 22%, respectively). The company’s balance sheet is in strong shape, with $1.9 billion in cash and investments and no long-term debt. The company is expanding its presence among large customers, with a total customer base of more than 10,800.

Guidance for fiscal 2025 is tepid, with ARR growth of just 18%, but this gives management an opportunity to outperform and improve. This also means UiPath is reasonably valued at 9.5 times sales. The company will focus on how artificial intelligence can improve its efficiency and profitability, making this a perfect opportunity for UiPath to showcase its solutions.

Palantir

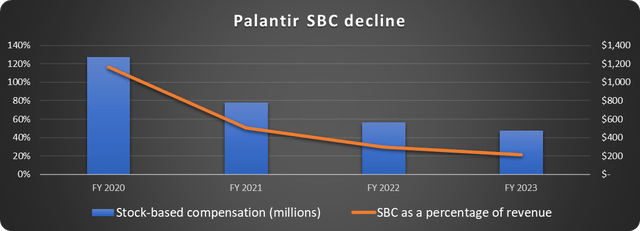

Palantir (PLTR) has been hammered over the years by excessive stock-based compensation (SBC) and unprofitability, and rightfully so. However, the company just reported its fifth consecutive quarter of profits, and SBC is declining sharply, as you can see below.

Source: Palantir. Diagrams drawn by the author.

The company has deep roots in the defense industry, but gold mining is the U.S. commercial market. Competition is fiercer than ever, and many companies will look to Palantir to assist with data analytics and artificial intelligence.

U.S. commercial sales increased 70% year-over-year to $131 million in the fourth quarter, while the total number of customers grew 35%. Palantir holds “boot camps” to introduce potential customers to its new AIP platform, which can be a boon for sales. It’s one thing to watch a demo, but it’s much better to be immediately shown how it can be applied directly to your client’s business.

Palantir’s rock-solid balance sheet shows $3.7 billion in cash and investments and no long-term debt. It’s no coincidence that Arm, UiPath, and Palantir have solid financial fundamentals and appear on this list.

Mayville Technology

The ultimate choice for artificial intelligence and shovel games is investing in companies that produce components that move and store data. Marvell Technology’s (MRVL) processors, controllers, switches and other products for data centers, consumer electronics, automotive and other industries meet this requirement. With the construction of huge data centers, artificial intelligence and customized computing provide Marvell with huge development opportunities.

Marvell’s revenue doubled from $2.9 billion to $5.9 billion in just two fiscal years before growth paused in fiscal 2024, with sales falling 7% to $5.5 billion. The company issued modest guidance for the first quarter of fiscal 2025 as consumer, carrier and network demand lagged, but expected data center revenue to grow. With the economy stronger than many expected, Marvell has a good chance of beating expectations.

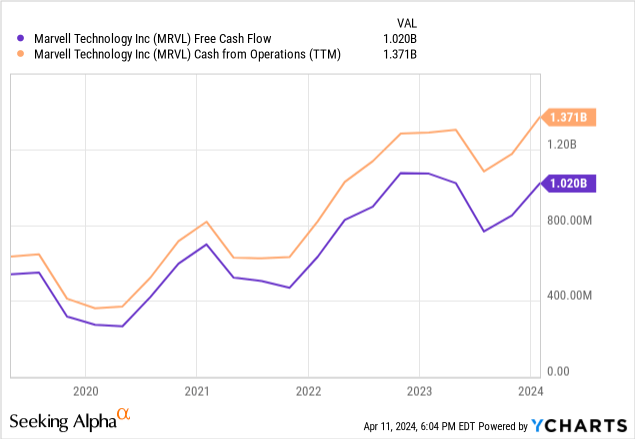

Marvell isn’t yet profitable on a GAAP basis, but most of its expenses are non-cash items such as depreciation and amortization of intangible assets. Therefore, I focus on free cash flow growth, which is on a steady upward trend, as shown in the chart below.

Management still has a lot of work to do to return to overall revenue growth, but the long-term opportunity is strong.

Is there a bubble in artificial intelligence?

As always, caution is warranted with regard to speculative companies. Proper position sizing and diversification are important. There are some stocks that I wouldn’t touch right now because of their valuations, but others would be excellent long-term investments.

A bubble emerged in July 1999, but the Nasdaq rose another 86% before peaking. So assuming a bubble exists, the right question might be: What inning are we in now?