Devrimb/iStock via Getty Images

No matter how positive the growth story is Sophie Technology (NASDAQ: SOFI), the stock just limped along. The market’s focus is on GAAP profits, but the company has delivered high profits and warranted a higher stock price.My investment thesis Extremely bullish on the stock based on big financial targets for 2026 and a lagging stock price as investors disengage from continued irrational concerns.

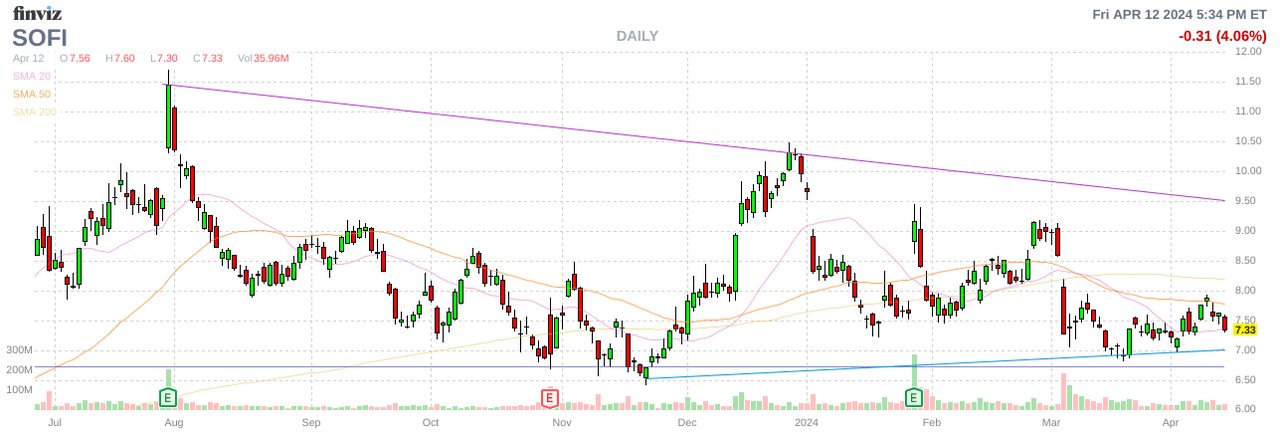

Source: Finviz

always negative spin

SoFi recently completed a $750 million convertible debt offering, sending the stock lower. The stock market immediately viewed the debt issuance as a negative, arguing that the fintech company needed to raise cash due to a recent lack of loan sales.

CEO Anthony Noto made a travel discussed the issuance and clearly highlighted how the 1.25% convertible bonds were half-yearly in arrears with interest payments and Preferred stock expiring on March 15, 2029 replaced the existing 12.5% preferred stock, and debt jumped to 15.0% in May, with a maturity of 5 years if not repaid. The debt issuance is a necessary and smart move that will save $40 million to $60 million in interest payments, and SoFi predicts the transaction will be accretive to tangible book value.

Regardless, the stock has yet to recover and topped $9 after the earnings report, after closing at just $7.33 last week. SoFi reported strong growth in 2023 despite headwinds in the lending market and a largely depressed market.

2026 goals

Heading into 2024, fintech companies are expected to have another solid year of growth, with the student debt market likely to reopen and opportunities to expand their mortgage business. Following the release of its 4Q23 earnings in late January, SoFi guided for strong growth this year, but these targets weren’t even significant guidance provided by management.

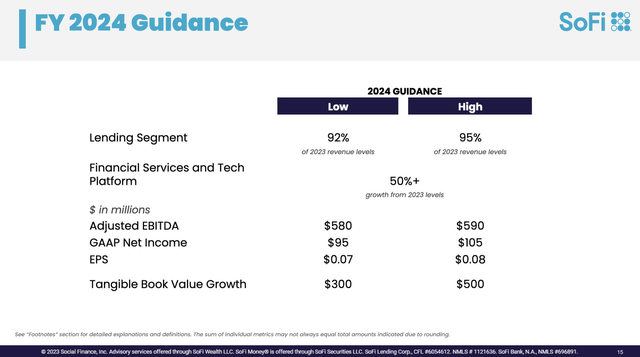

Source: SoFi Q4’23 Demo

The company even pointed to a weak lending business, which will account for only 95% of revenue in 2023.

SoFi continues to provide conservative guidance, suggesting a repeat in 2024 is likely. Initial 2023 revenue guidance was only $193 to $2 billion, but the company ended up reaching $2.1 billion, a 35% increase.

The more important goal, once again ignored by the market, is a significant jump in adjusted EBITDA and growth in tangible book value. The market has become obsessed with GAAP EPS, but for a company growing $300 million to $500 million in TBV, this metric is almost worthless.

SoFi expected adjusted EBITDA in 2023 to be $270 million, but actually reached $432 million. The company is currently targeting nearly $600 million by 2024, but the market values the stock at only a fraction of the targeted growth rate of 35%.

As a refresher, SoFi provided some pretty dire economic views to underpin 2024 guidance, as follows:

- GDP shrinks in 2024 (The Conference Board) forecast Trough growth close to 1%)

- Unemployment rate jumps above 5%

- The Federal Reserve cuts interest rates 4 times (the Federal Reserve intensifies its efforts to turn 0 interest rate cuts)

- The federal funds rate ends the year at 4.5%

As in 2023, SoFi set its 2024 guidance based on dire financial conditions, which seemed unlikely ahead of the fintech’s Q1’24 results on April 29. With inflation steady and higher than expected, the Fed may not actually cut interest rates this year.

The more important guidance hidden in the Q4’23 earnings call was a substantial growth target through 2026.

- Revenue compound annual growth rate of 20% to 25%

- GAAP earnings per share of $0.55 to $0.80

- GAAP EPS growth of 20% to 25% after 2026

Essentially, SoFi continues to anticipate substantial long-term growth while continuing to navigate weak short-term economic data. Note that all of these growth targets do not include opportunities to invest in the business and launch major new products, as shown below:

- Small and medium enterprise business inspection

- SME business loans

- Wider asset management business

- Insurance

- Wider credit card portfolio

- New technology verticals

- new area

In other words, SoFi has a lengthy roadmap for new product launches while still growing its existing membership base. Consensus estimates for 2026 revenue have reached $3.4 billion, with the target not targeting annual growth of more than 20% and not considering the launch of new products.

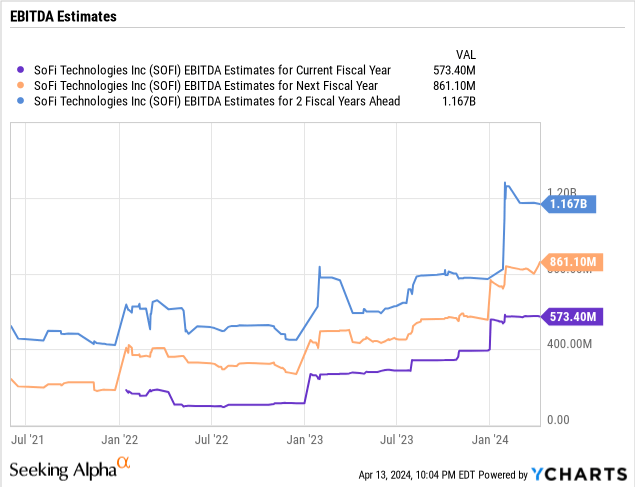

However, the stock’s market capitalization is only $7.7 billion, and adjusted EBITDA will reach $1.2 billion by 2026 based on a conservative target. For a company that’s growing much faster, SoFi trades below 10x its 20,225 EBITDA target.

take away

The key takeaway for investors is that while SoFi has a history of strong growth, its valuation is not accurately assessed based on growth rates. The market continues to interpret corporate decisions negatively until sound financial reasons are understood.

Investors should take advantage of this weakness and buy SoFi, which currently trades at a deep discount to growth and profitability. As previous research has highlighted, adjusted EBITDA is close to adjusted profits, and shares are trading below 10x the forward target.