Thorston Asmus

U.S. large-cap stocks have surged 25% since late October as the Federal Reserve will soon pivot and slash interest rates. Stock movements are almost entirely driven by changes in valuations, not by changes in valuations. Changes in Basic Returns. I looked everywhere for evidence of an AI-driven boom in stock profits, but when you look at the actual data, the S&P 500 (spy) income Basically flat since 2022. The current situation of rapidly rising valuations without a corresponding increase in profits is unsustainable.Now add a new series of reports Inflation is not going away as plannedthere is a problem in the market.

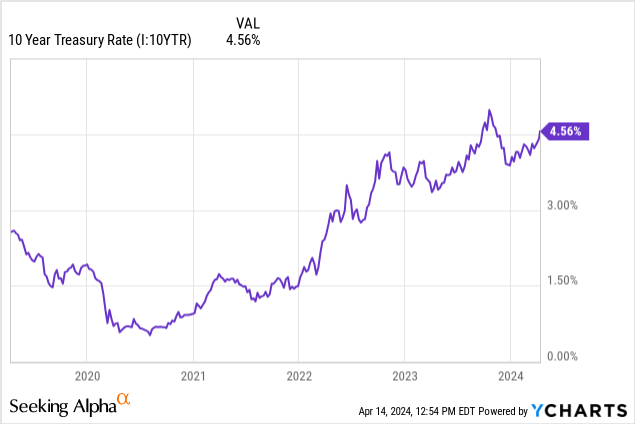

Yield responded in kind, Rebounded to above 4.5% last week As demand for bonds cools and supply of Treasury debt driven by budget deficits continues unabated.late summer Last year, after Fitch downgraded the U.S. government’s credit rating, the 10-year Treasury yield suddenly rose to 5%.At that time I compared the impact of rising interest rates to an approaching freight train The United States and the global economy. The story quieted down this winter with the idea that the Fed would pause on raising interest rates and possibly start to pivot from late October. Now it’s back again, Fed unable to cut interest rates amid stubborn inflation, long-term yields are likely to hit new cycle highs. This has profound implications for housing, cars, banks, technology, and the overall stock market/economy. So far, stocks are barely off their all-time highs, but this is a potential black swan for markets anticipating a return to ultra-loose monetary policy. Since the stock market’s six-month rally isn’t based on rising earnings, I think it could be reversed.

Yields are near 20-year highs

U.S. Treasury yields are significantly higher than a year ago. This time last year, the 10-year Treasury yield was hovering between 3.3% and 3.5% as markets digested the aftermath of last spring’s brief banking crisis. As I write this, U.S. Treasury yields are now over 4.5% and have significant upward momentum. The impact was even more pronounced in the home loan market where failed banks such as First Republic were located.This time last year, you could get jumbo mortgage The average is 5.96%, but now it costs 7.51%. For every $1,000,000 you draw down on your mortgage, your monthly payment is currently $6,999, compared with $5,970 a year ago.

Insurance costs soar Property taxes also increased significantly. What will happen when millions of U.S. homebuyers see teaser rates for homebuilder financing expire? We’ll find out. These are all natural consequences of the money-printing spree of 2020 and 2021, the consequences of which are only now beginning to be felt. We can trace similar effects in the automotive market. Carmax (KMX) just reported earnings, and the company’s stock price took a hit after the company missed its results due to capacity pressures, tighter lending standards and rising insurance costs. Is the problem just Carmax’s, or is there something wrong with them? All of this is happening at current interest rate levels.

Economics 101: Yields could be higher

There are theoretical and practical reasons to believe that interest rates should continue to move higher.JPMorgan Chase (JPM) CEO Jamie Dimon recently emphasized 6% interest rate risk in his annual letter to shareholders. The 2024 inflation report was hotter than expected, echoing historical patterns of inflation being difficult to eradicate. Theoretically, there’s reason to expect yields to rise as well. CBO projects U.S. budget deficit 5.6% of GDP 2024. Student loan relief is baked into the mix This is bound to fail in court, but let’s be honest, budget deficits are pretty reckless. A sustainable budget deficit is thought to be in the 3%-4% range, which would require an immediate tax increase of about 1.5% to 2% of GDP. What happens when the government wants to spend money without raising taxes to pay for it? They have to borrow money to do so. This puts upward pressure on yields.

Mainstream economic theory holds that excessive government borrowing will “Extrude“The private sector. Specifically, the Biden administration needs to borrow trillions of dollars to fund increased military spending, the green energy transition, and the social programs they want. But it’s doing so without raising taxes to pay for higher production.”exclude“Potential homebuyers looking for mortgages, small businesses looking for loans, etc. There’s always an inherent trade-off between government spending and the private sector. It’s a structural problem. To fix it during COVID-19, Congress decided to test modern monetary theory. In 2020 and 2021, the government borrowed a lot of money and they had the Fed buy basically all the debt they issued. Printing money and spending predictably led to runaway inflation. If you’re in power and want to spend money without raising taxes, you’re bound to increase yields. If you ask central banks to print money to finance deficits, you’re bound to cause inflation to spike.

Borrowing or printing money is not magic. The resources in our society are like this. Politics can only redistribute them in the short term and cannot fundamentally solve the problem of scarcity. Millions of Americans are struggling with the cost of living because the government printed too much money during the coronavirus pandemic.The reason millions of Americans can’t afford homes now is because the Fed is pushing them out through its multi-billion dollar pork barrel program In swing states. What happens next? The government won’t slow down spending, and they (probably) won’t raise taxes, so yields are likely to hit new highs in 2024. and 8% car loan interest rate.

Recent history also shows the potential for higher interest rates

Readers may want me to compare this to the 1970s to show how high interest rates could get. But we don’t have to go that far back. In the 1990s, 10-year nominal rates were above 6% for most of the decade, especially during the dot-com bubble, when yields peaked at nearly 7%. At the time, government budget deficits were much lower than today (or nonexistent in some years), and inflation was lower.

watching real rate of return (10-year yield minus inflation), we see that typical inflation-adjusted yields averaged about 3% in the 1990s. This was during a period when government deficits were at their smallest. During the dot-com bubble, real yields were closer to 3.5%. In the 1980s, when markets focused more on the Reagan-era deficits that followed the inflation of the 1970s, real yields close to 4% became the norm. Against this historical backdrop, it’s not difficult to justify a yield of 5.5% to 6.5%, even with relatively mild inflation. With 2.5% inflation and a real yield of 3.5%, the nominal yield on the 10-year Treasury bond is 6%. Another possible scenario is 3% inflation plus 3% real yields, which would produce the same result. I think these numbers are, if anything, conservative given the insane levels of government deficits right now.clinton administration Famous for the bond market In the 1990s, the United States was forced to raise taxes to fund its spending, and a second Biden or Trump administration could find itself repeating history.

The economy is built on 0% interest rates

From late 2008 to early 2022, short-term interest rates were around 0%, and interest rates on mortgages and corporate debt were also extremely low. This has allowed thousands of unprofitable companies to stay in business and allowed millions of people to build their business models around cheap financing. During this period, stock valuations gradually increased, first from abnormally low levels, then to normal levels, then to high levels, and finally to bubble levels. The popular real estate market is also increasingly divorced from fundamentals such as rents or local wages.

No one seems to be considering the possibility that yields could rise another 150 basis points this year, despite the government’s fiscal policy specifically designed to achieve this. As yields continue to rise, expect consequences. I don’t expect the Fed to save the situation either. The Fed can easily lower short-term rates and steepen the yield curve, but that doesn’t guarantee that the 10-year yield will fall. If interest rate cuts lead to expectations of higher inflation in the future, long-term yields may rise. If the Fed reverses its policy of shrinking its balance sheet, inflation could explode again and surge. After shattering public trust during the coronavirus pandemic, the Fed is more or less stuck in letting the market determine yields.

The housing market is still priced like mortgage rates are at 4%, automakers are still building $80,000 trucks designed to last 84 months, and hundreds of money-losing stocks can only stay in business by borrowing money at ultra-low interest rates. When interest rates are no longer zero, these business models no longer work so well. Throughout the 2010s and early 2020s, savers were losers, while borrowers and speculators were huge winners. As the impact of temperatures on yields rises a few degrees further, I expect some cracks are forming in the economy. The result for savers may no longer be losers – you can make big money in currency markets and niche investments like preferred stocks and merger arbitrage.

bottom line

Given that theory, history, and common sense all suggest that yields have the potential to continue rising, investors should consider the possibility that Treasury yields will soon rise to 6% or higher. Isn’t this the black swan in front of us? Maybe. No one seems to think yields will go higher, and many investors believe that if yields start to stray from normal levels, the Fed will just wave their magic wand and bring them back down. This idea is wrong – the only way to solve the problem of rising yields is to significantly raise taxes or cut government spending. Unless and until those two things happen, 10-year yields will likely be 6%, mortgage yields will be 9%, and used car loan yields will be 8%. We can debate the ramifications this would have on the stock market, but I certainly wouldn’t buy stocks yielding around 4% when you can get 6% on covered Treasury bonds.