Justin Paget/DigitalVision via Getty Images

introduce

Last year I started reporting Zoetis Corporation (NYSE:ZTS)a healthcare giant focused on animal health.

My most recent article on this stock was written on January 10th, when I headlined “animal Allies of the Kingdom: Zoetis and its path to 10%+ returns.

This is part of what I gained at the time:

Despite economic uncertainty, the company expects continued success in its key franchise businesses and expects double-digit growth in its companion animal portfolio operations.

Fast forward to now, and the company is currently trading below $200, with shares down more than 24% since my article was published in January.

- 18% of this decline was due to market weakness and continued growth in value rotation.

- The remaining 6% was driven by headlines about potentially huge side effects of one of its key blockbuster drugs.This is also the main reason why I wrote this update, as countless readers have asked If this is a serious risk or a buying opportunity, please let me know.

So in this article, I’m going to walk you through the recent decline and explain what the risk/reward looks like after one of the best compounding names on the market started showing significant weakness in recent years.

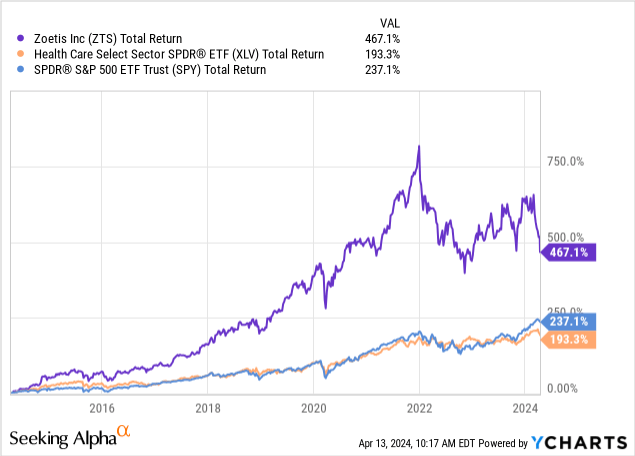

After all, despite the sell-off, ZTS is still up nearly 470% over the past decade! That’s nearly double the S&P 500’s return.

So, let’s get into the details!

Stock Headlines

Before we continue, I always want to mention one important thing before discussing potential litigation. In no way am I blaming Zoetis in this article. I’m just reporting based on the facts. I provide research. I’m not an activist.

One of the biggest risks in healthcare is litigation.

Since 2019, lawsuits involving pharmaceutical companies have accounted for a significant proportion of all litigation. Most of these cases are wide-reaching medical product liability lawsuits involving hundreds of plaintiffs. – law street

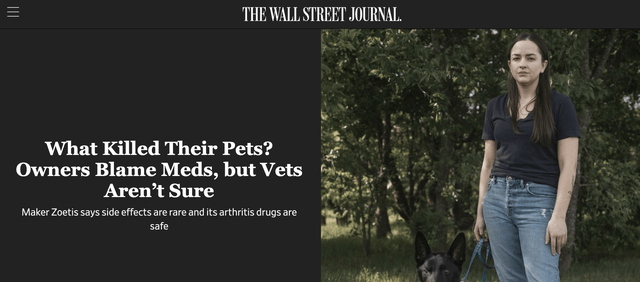

It also seemed to hit Zoetis, with the stock falling 8% on Friday after the Wall Street Journal report publish Title below:

wall street journal

The article begins by sharing the story of Daisy, a 12-year-old rescue dog who struggled with stiffness in her right rear hip.

After trying Zoetis’ new arthritis drug Librela, her symptoms became worse. Eventually, she had to be euthanized due to kidney failure.

The article stated that Librela and similar treatments for cats are the first antibody drugs approved by the U.S. Food and Drug Administration (“FDA”) for use in pets.

Essentially, they promise relief from painful arthritis in animals, and Librela is a drug that promises to be a new franchise drug for Zoetis.

Here’s what Zoetis had to say about Librela during its February 14 earnings call:

Launch of Librela and Solensia First two injectable monoclonal antibodies for relief of osteoarthritis, are radically improving the quality of life for dogs and cats and strengthening the human-animal bond.that’s why today Librela remains the number one selling OA pain product in Europe. – ZTS 2023 Q4 Earnings Conference Call

and:

Global growth primarily driven by new market launches,Depend on Librela Season 4 is fully online In the U.S.

And one more thing:

we moved to a Librela will be fully launched in the U.S. in early Q4,We’re already satisfied with the result So far, our field troops have been able to travel. Librela’s U.S. sales for the quarter were $44 million, at an all-time high The higher end we initially expected.

Back to the WSJ article, Zoetis has reportedly experienced side effects in less than 1% of the more than 18 million injections of both drugs administered to date, with both veterinarians and pet owners reporting that the drugs have achieved success.

According to this article:

As of late last year, the FDA had received more than 3,800 reports of side effects from the drug. The European Medicines Agency has received more than 12,300 reports of side effects involving Librela and more than 7,700 reports of side effects involving Solensia since the drugs were launched in Europe in 2021. The figures include reports from the United States and other countries outside the European Union.

As a result, people are now starting a petition to recall Librela for further testing. At least one petition has more than 3,800 signatures.

With all of this in mind, I don’t believe Zoetis is staring into the abyss here. That may be the case, but for now, I believe we need more evidence that Zoetis released a drug that isn’t ready yet.

Librela and Solensia are targeting a protein called nerve growth factor, which helps animals feel less pain.

According to the Wall Street Journal, one reason for these problems may be that some veterinarians do not perform complete examinations and exams before administering these medications.

In other words, this drug may not be suitable for all dogs and cats. I’m not a medical professional (far from one, actually), but after listening to hours of lectures from professionals who want to personalize their health care, I think this makes sense.

Dr. Duncan Lascelles, professor of translational pain research and management at NC State College of Veterinary Medicine, helped Zoetis design the Solensia study, It is recommended that the drug be prescribed to dogs that meet the criteria used in the trial. The trials did not include dogs with neurological disease or lameness not related to osteoarthritis. – Wall Street Journal

Based on everything I’ve read so far, I’m not worried about Librela and Solensia being banned. While current trends may be very negative for the short-term business as some pet owners may stay away from these medications, I believe we could see more targeted applications.

By the way, this reminds me of IDEXX Laboratories (IDXX), a stock on which I have a Bullish rating. The company provides diagnostic tools and services. It helps veterinarians better understand an animal’s health, including laboratory testing and clinical analysis.

These issues with Zoetis appear to be very favorable for these solutions, as they may make it easier for people to better understand which medications they should be taking.

I may introduce IDXX soon.

Back to Zoetis, I wouldn’t be surprised if the actual impact on sales isn’t as severe as some are now anticipating.

This also helps its overall business remain very solid.

Core business remains strong

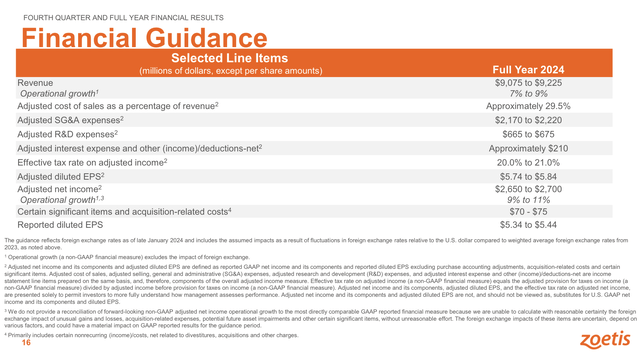

During the annual Global Healthcare Meeting On March 14, Barclays said it noted that on an operating basis, its revenue growth guidance is expected to be between 7% and 9%.

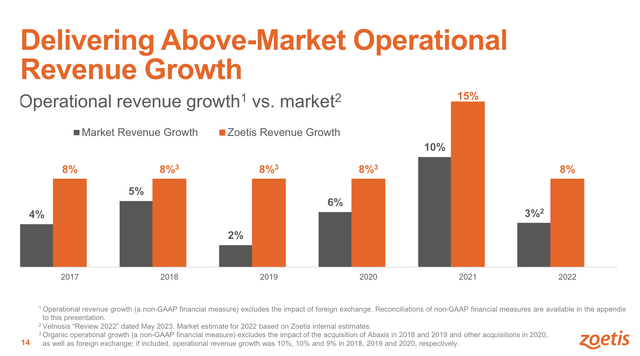

These numbers are impressive, as the company has led the market by about 3 percentage points each year for the past decade.

The chart below shows the historical performance of the market beat in the July 2023 Investor Overview.

Zoetis Corporation

In addition to strong revenue growth expectations, Zoetis expects revenue growth to be higher than revenue growth, with adjusted net profit guidance for 2024 of 9% to 11%.

This means the company is expected to further improve margins, with earnings growth exceeding revenue growth.

Essentially, Zoetis remains focused on driving profit growth despite significant investments in various aspects of the business, including R&D, manufacturing and supply chain, which explains why it expects adjusted net profit growth of at least 9% in 2024 .

Zoetis Corporation

Unfortunately, these numbers may have to come down. Even if the current arthritis drug problems can be curbed, I expect sales to be significantly lower than expected — at least until the company can restore pet owner confidence.

Additionally, while the company has encountered some headwinds in China, it believes the combination of the companion animal and livestock segments provides resilience to market volatility and allows the company to capitalize on various growth opportunities.

Additionally, continued investments in therapeutic areas such as renal, heart disease, and oncology could be promising drivers of future growth.

We have meaningful lifecycle innovation, which tends to account for about 50% of our R&D spend. I would say when we see growth like the recent one, it’s more novel than lifecycle innovation.

(…) We are very pleased that we have a strong track record not only in R&D, but also in how our commercial teams use innovation to grow and expand markets. – Barclays Annual Healthcare Conference

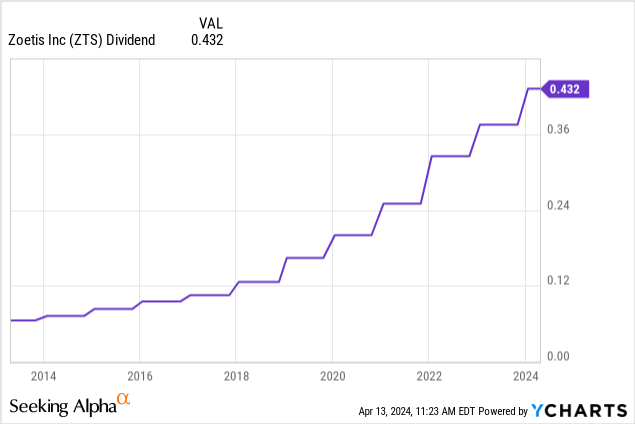

The company also has a very favorable dividend.

While its yield is just 1.2%, the dividend is protected by a sub-30% payout ratio, with a five-year compound annual growth rate of 23.5%.

So what does all this mean for its valuation?

Valuation

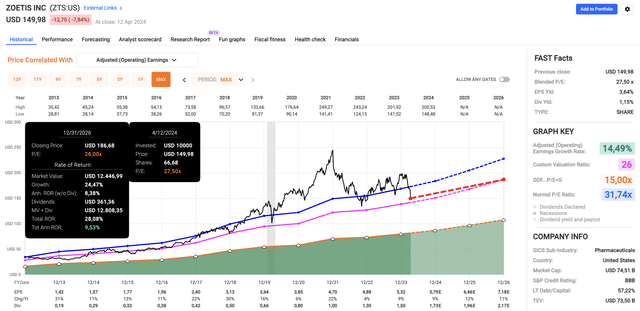

After the crash, ZTS’s combined P/E ratio was 27.5 times. This is lower than its normalized P/E ratio of 31.7 times. Technically, if the company’s EPS grows as expected, I would give the company a $228 price target.

Currently, using FactSet data in the chart below, the company is expected to grow earnings per share by 7% this year, followed by likely growth of 12% in 2025 and 11% in 2026.

quick chart

However, I believe we have to assume that the company’s growth will slow down. As I said before, even if the Librera issues are temporary, I expect sales to hit headwinds.

Nonetheless, I believe the company trades at a very attractive price given its long-term growth prospects.

In the first five years after being spun off from Pfizer (PFE), the company traded at a price-to-earnings ratio of nearly 26 times. Even if this valuation is maintained, annual returns could theoretically be closer to 10%.

Therefore, I will insist on purchase score.

That said, investors need to be aware that if Librera’s issuance exceeds expectations, the stock could experience more short-term turmoil.

While I would prefer not to have this happen, we always need to approach these potential litigation situations with extreme caution, which means I would never recommend that investors interested in ZTS immediately start taking full positions.

take away

Despite its recent setbacks, Zoetis still offers a compelling long-term investment opportunity.

Despite the challenges of adverse drug reactions and market volatility, the company’s strong core business and diversified growth strategy remain intact.

Investors should keep a close eye on developments, but consider the potential for a sales rebound and continued growth.

With a solid dividend and attractive valuation, Zoetis deserves caution but optimism purchase score.

Advantages Disadvantages

advantage:

- Strong core business: Zoetis has a resilient core business that consistently outperforms the industry, supported by its focus on the companion animal and livestock sectors.

- Diversified growth opportunities: The company’s continued investments in therapeutic areas such as kidney, heart disease and oncology position it for future growth amid market volatility.

- Attractive valuation: Despite recent challenges, ZTS trades at an attractive price with the potential to enhance long-term returns, especially given its historical valuation and growth trajectory.

- Dividend Stability: With a dividend yield below 30% and a five-year compound annual growth rate of 23.5%, Zoetis provides a stable dividend and additional value for investors seeking income.

shortcoming:

- Short term volatility: The stock could experience short-term turmoil, especially if concerns about adverse drug reactions persist, which could impact sales and investor sentiment.

- Supervision risks: Ongoing litigation and regulatory review, particularly surrounding the safety and effectiveness of new drugs such as Librela, creates regulatory risks that could negatively impact the Company’s financial performance.