ampueroleonardo/iStock Not published via Getty Images

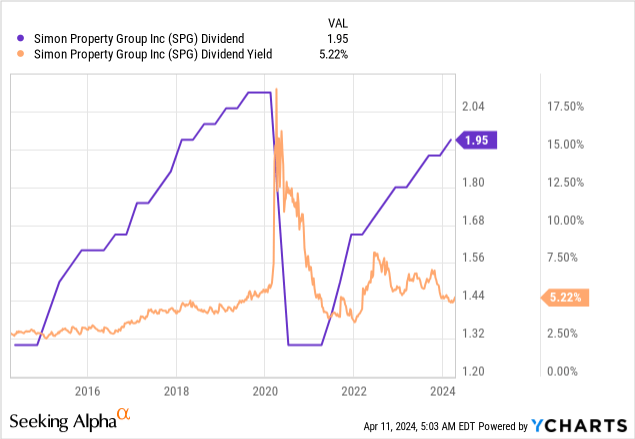

I have been buying from Simon Property Group (NYSE:SPG) over the past few months.The shopping mall and outlet center REIT last announced a quarterly cash dividend of $1.950 per share, a quarterly increase of 2.6%, and a dividend increase of $7.80 per share. The annualized return per share is 5.4%. SPG has increased its dividend by a 3-year CAGR 8.2%, but the distribution is still about 7% below its pre-pandemic peak.The REIT’s FFO for the fourth quarter of fiscal 2023 was $3.69 per share The REIT paid out 189% of its dividend, which included an investment gain of $0.31 per share from the sale of some of its Authentic Brands Group shares, but the REIT still covered the dividend handily.

SPG expects full-year 2024 FFO price of $11.85 to $12.10 per share, down from $12.51 per share in 2023 $12.20 per share, consensus was $12.20 per share. The guidance reflects a 3% increase in net operating income, despite headwinds from higher interest expense, which increased by at least 25 cents compared with 2023. At 12x, that’s a healthy multiple that’s roughly in line with its industry median. Crucially, SPG’s best-in-class portfolio of Class A shopping mall properties, $2 billion Share buyback programs and significant free cash flow generation have enabled the REIT to deliver strong mid- to long-term results. The real estate investment trust said on its fourth-quarter earnings call that its current dividend yield is above historical averages, so prospects for near-term dividend increases compared with buybacks are dim. SPG said they believed they were undervalued.REITs have risen since I took office last override It and its preferred shares (NYSE: SPG.PR.J).

Quality retail assets and NOI growth

The quality of SPG properties cannot be overstated. The company owns Class A malls and premium outlets in some of the best locations in the United States, and its occupancy rate was 95.8% as of the end of the fourth quarter, an increase of 90 basis points from 94.9% in the same period last year, and its underlying minimum rents per square foot was $56.82, an increase of 3.1% year over year. Coresight’s market research shows footfall at top shopping malls to grow in 2022 12% As Class B and C malls continue to remain closed, their turnover exceeded pre-pandemic levels in 2019.

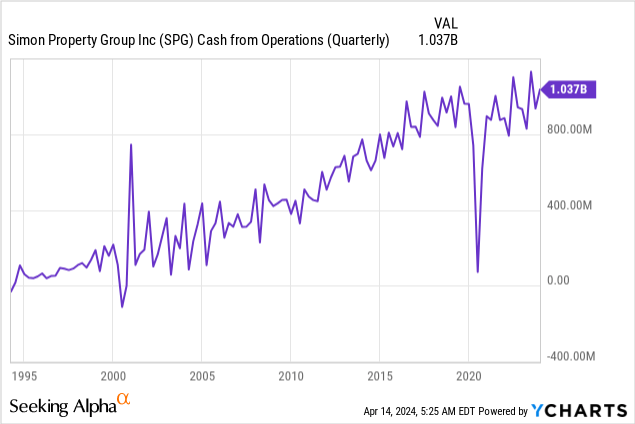

This dichotomy is at the core of SPG’s investment capabilities, just like its peers Penn Real Estate Investment Trust (OTC: PRETQ ) will outline the headwinds the industry faces due to the significant rise of e-commerce. SPG faces rising rents and occupancy as sticky demand for brick-and-mortar retail and retailers’ pursuit of quality continue to drive material improvements in REIT profitability. Operating cash is currently in line with pre-pandemic levels and will grow further due to rising occupancy rates and guidance for domestic real estate NOI growth of at least 3% in 2024. Domestic real estate NOI will grow by 7.3% in 2023 compared with the previous year. REIT reports Retail sales per square foot for the trailing 12 months ended December 31, 2023 were $743, down 1.3% from 2022.

Credit conditions as the Fed prepares to cut rates

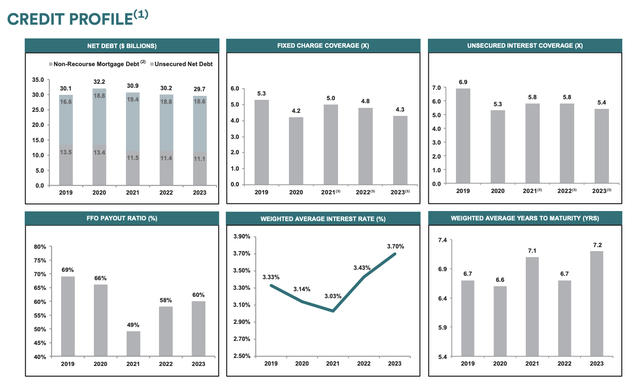

Simon Property Group Supplementary Report for the Fourth Quarter of Fiscal Year 2023

SPG’s balance sheet is incredible, with $1.17 billion in cash and cash equivalents, compared to $621 million a year ago. The REIT has access to $11 billion in liquidity, $8.1 billion of which is provided through its revolving credit facility.This is the weighted average number of years to maturity for SPG 7.2 years The annual growth rate at the end of the fourth quarter expanded from 6.7 years at the end of the third quarter. SPG also purchased 1.3 million shares of common stock in 2023 at an average price of approximately $110 per share.

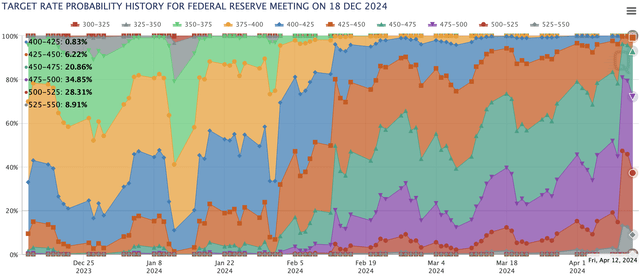

CME Group Fed Watch Tool

The most likely way is 35% chanceAccording to the CME FedWatch tool, the Fed’s goal for cutting interest rates this year is to lower the base rate by at least 50 basis points to 4.75% to 5.00%. However, the situation is changing rapidly and inflation remains more severe, which may undermine hopes of a significant rate cut this year. With potential demand for its space increasing, SPG currently offers an attractive dividend yield of 5.4%, or 12 times 2024 FFO. The real estate investment trust signed 4,500 leases in 2023 covering approximately 18 million square feet. Newly signed leases were priced at $74 per square foot, significantly higher than the current REIT average, and renewals were also higher than the average of $65 per square foot. This leasing momentum is expected to continue into 2024, as the current negative zeitgeist for REITs appears to be improving in the second half of the year due to interest rate cuts. I’m still an SPG buyer here.