z1b

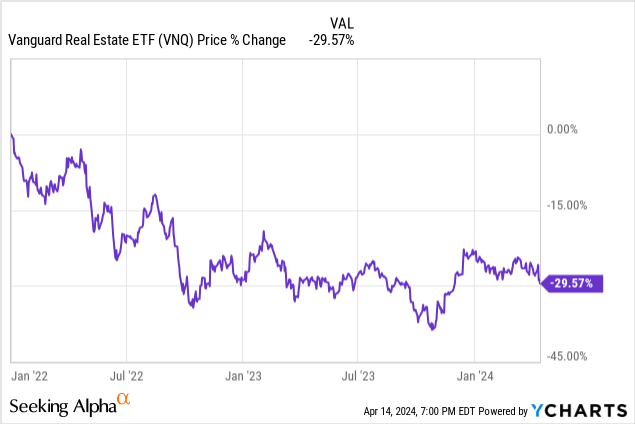

REITs (VNQ) have been in a bear market for about two years now.

Their shares plummeted in 2022 and have been in the doldrums ever since.

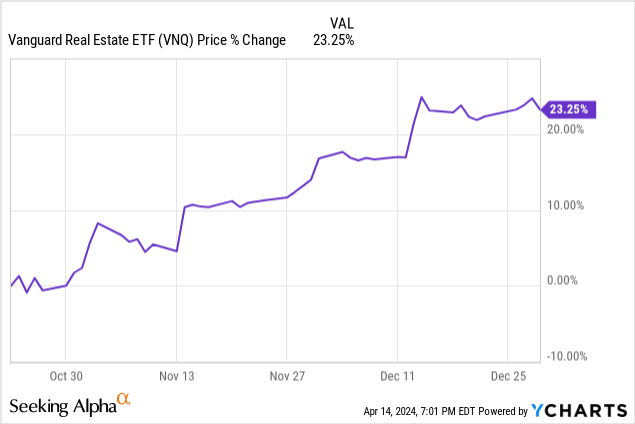

But at the end of 2023, REITs appear to be Finally starting to recover. Inflation is starting to cool, interest rate expectations are lower, and REITs are surging to higher levels:

But this recovery was short-lived.

The next inflation report showed that inflation was stickier than initially expected, leading to a sell-off in REITs as it suggested interest rates could “remain higher for longer.”

We buy the dips because we don’t buy.

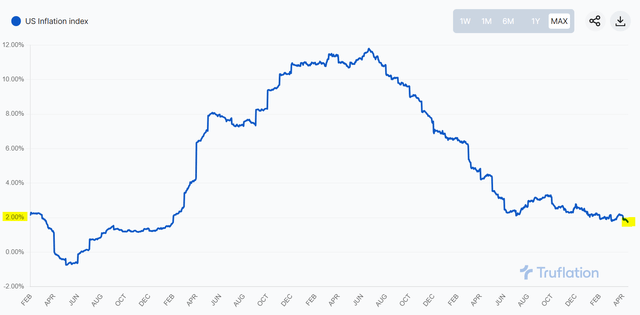

Inflation is not “stickier”. The CPI does not use real-time data on housing at all, so reported inflation is now higher than actual levels.

According to correctly adjusted Truflation data, inflation is currently below 2% and has been that way for some time:

Trufla

This explains why Fed Chairman Powell recently stated that they are not obsessed with reported interest rates and are willing to cut rates even if they remain above 2%. They realize that real inflation is already below that, and with such low inflation, today’s interest rates are actually quite high for today’s environment.

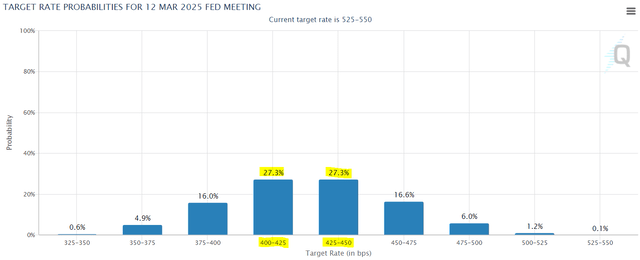

We can’t predict exactly when a rate cut will happen, but it’s likely that it will happen, and it’s just a matter of time. According to FedWatch data, debt markets (which are generally smarter than equity markets) currently price a 99.8% chance of a rate cut next year, and a cut of more than 100 basis points a year from now:

Fed Watch

This bodes well for REITs.

They collapsed as interest rates rose, so they should recover as interest rates return to lower levels. Valuations are currently at historic lows, cash flow is still rising, and the upside potential is huge.

Here are two REITs worth buying ahead of the recovery:

RioCan is my favorite retail REIT. It owns primarily service-oriented retail properties in Toronto and other key Canadian markets:

rio de janeiro

Last year, we sold our position in Brixmor Property Group (BRX) for a substantial gain and invested part of the proceeds in Canadian peer RioCan.

We then note that RioCan has failed to recover and, as a result, its valuation is unusually low relative to its U.S. peers:

| Brixmoor | rio de janeiro | |

| P/AFFO | 15x | 10 times |

| Price to Earning Ratio/Net Asset Value | 10% discount | 30% discount |

Today, the same argument remains valid.

Despite continuing to post strong results, RioCan’s stock price has been stagnant.

Last year, its same-property NOI grew another 4.8% (above its 3% target) and FFO per share grew nearly 4%, despite being hurt by rising interest expenses.

This strong growth momentum will continue into 2024 and beyond, as RioCan owns prime retail properties in supply-constrained markets such as Toronto, where the population is growing rapidly and rents are currently well below market rates.

- Portfolio occupancy reached a record high of 98.4%. This equates to 100% occupancy in retail minus some unavoidable turnover.

- New retail construction costs about $600 per square foot, but RioCan’s current market price is only $340 per square foot. Management noted that “supply constraints are expected to persist as replacement costs for well-located retail stores are well above market value.”

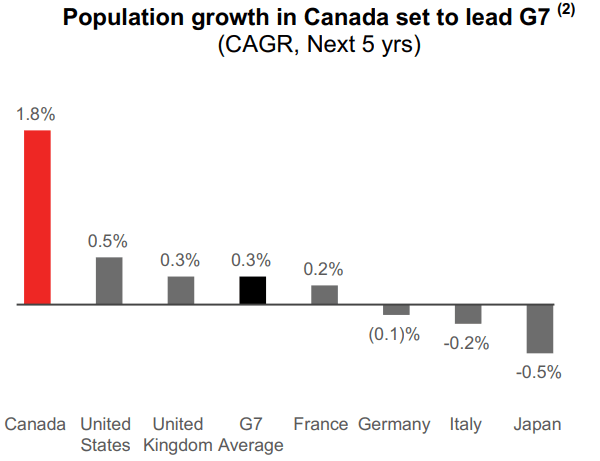

- At the same time, Canada is expected to lead the G7 in terms of population growth over the next five years, with a compound annual growth rate of 1.8%, compared with only 0.5% for the United States.

- New leases signed in 2023 will average $27.75 per square foot, approximately 30% higher than the current portfolio average. So not only will rents continue to grow, but they also have a good chance of increasing existing leases when they expire.

rio de janeiro

All in all, this bodes well for RioCan.

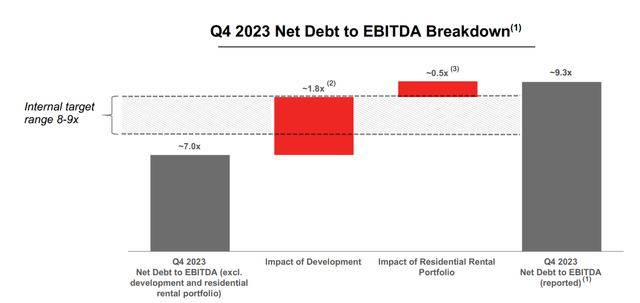

One drawback is that they are a bit more leveraged than typical REITs, so they are exposed to spikes in interest rates.

Therefore, they expect FFO per share growth in 2024 to be only 2.3%.

But this is only temporary. Anticipating that interest rates will fall in the near term, REITs also plan to reduce debt by selling assets, typically at a cap rate below interest rates. Here’s what they said on a recent conference call:

“Our cumulative FFO results for 2022 and 2023 are within our 5-year target range of 5% to 7%. That is, by 2024, we expect FFO to be in the range of $1.79 to $1.82. That’s a strong 2.3 % Our growth is faced with significant increases in interest expenses as a result of the chronically high interest rate environment in which we operate: reducing debt and improving operating performance. Over the next 2.5 years, we expect inventory proceeds of approximately $800 million, the majority of which will be earmarked for debt repayment. These are not speculative inventory sales. They are contract-bound apartment closings. In 2023, we reduced our net debt to EBITDA ratio by 23 basis points to end the year at 9.28x. We expect to reduce net debt to EBITDA to 9x by the end of this year. We plan to further reduce this ratio as additional gains are realized.

I would like to add that the actual leverage is not that high. They trade on a P/E ratio of 9x because they have a large land bank and they have a large development pipeline but are not generating any cash flow yet. On an adjusted basis, debt to EBITDA is 7x, only 1-1.5x higher than its US peers.

rio de janeiro

As they now sell some of their recently developed assets and pay down debt, their leverage should decline quickly. On top of that, they also retain 40% of their cash flow for deleveraging, and their portfolio will continue to enjoy strong organic growth, further reducing leverage.

This explains why they still have a strong BBB investment grade rating despite using more leverage than a typical retail REIT.

So we still like RioCan very much.

The company’s failure to recover despite strong performance from its retail properties appears to be due to concerns about its balance sheet, but we believe the market will reprice to significantly higher valuations as REITs reduce leverage the stock.

Currently, the stock is priced at only 10 times FFO, a discount of nearly 30% to net value, and a dividend yield of nearly 6%. This dividend is paid monthly and continues to increase. The last rate hike was 2.8%.

Therefore, we reiterate our Strong Buy rating. RioCan is arguably the best tool available today to obtain prime retail real estate at discounted prices.

rio de janeiro

Armada Hofler Real Estate (AHH)

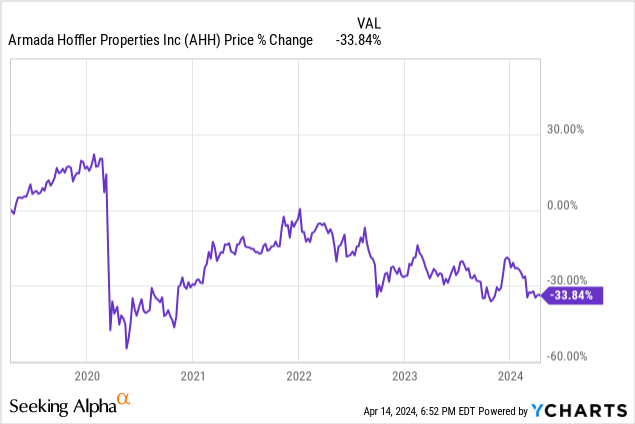

Armada is currently experiencing record cash flow, but its stock price is still 40% below pre-pandemic levels:

As a result, its pricing is close to its lowest valuation since listing. It is currently priced at just 8x FFO, which is expected to be a 35% discount to its NAV, and offers an 8% dividend yield.

I could understand this if REITs faced serious long-term headwinds and/or were too leveraged, but that’s not the case.

The REIT has been a real estate developer for more than 40 years, focusing on several key submarkets in the Mid-Atlantic/Southeast. It makes up a showy asset portfolio because it typically keeps the best assets for itself and sells the rest to other investors.

The vast majority of its portfolio is invested in service-oriented strip center and apartment communities that enjoy strong long-term growth prospects.

Hofler fleet

Its balance sheet is also quite strong, with debt maturities staggered and the REIT retaining ample cash flow to pay down debt over time.

The REIT even increased its dividend by a further 5% in March.

But the market doesn’t seem to care.

The stock is at a deep discount and I’m buying it.

Conclusion

REITs are still heavily discounted, but how long will this discount last?

No one can predict exactly when interest rates will return to lower levels, but we know it’s coming, and it should lead to an epic recovery in the REIT industry.

I’m not trying to hit rock bottom because that’s impossible. I gradually grow my portfolio every month and set myself up for profits in the years to come.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.