Igor Alexander/E+ via Getty Images

The first-quarter earnings season is about two weeks away, and many manufacturers have already reported year-end 2023 results and preliminary first-quarter results.Jaguar is among the latest companies to report first-quarter operating performance mining(OTCQX: JAGGF) and, as always, it was another huge disappointment. Not only was production down 11% year over year compared to a simple comparison, but it was the company’s weakest quarter in more than five years and production continues to decline. On the positive side, this trend is expected to stop, we may have just completed production and Jaguar is excited to bring the Faina deposit (Turmalina mine) online later this year. In this update, we’ll take a deeper dive into fiscal 2023 and Q1 2024 results, recent developments, and where the stock is looking from a valuation perspective following its recent run-up.

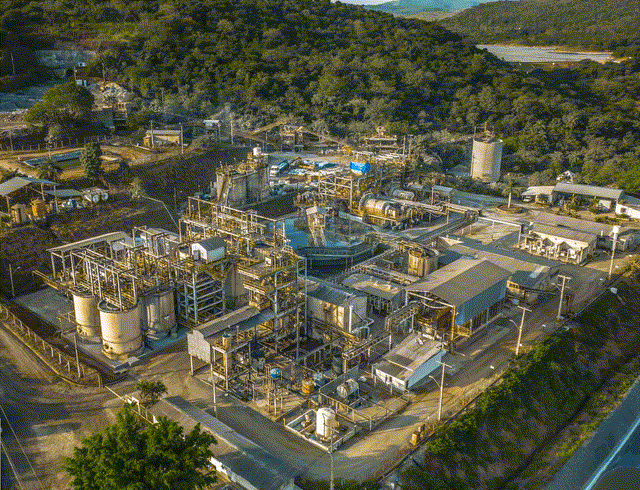

Jaguar Mining Operations – Company Website

Fiscal Year 2023 and Recent Results

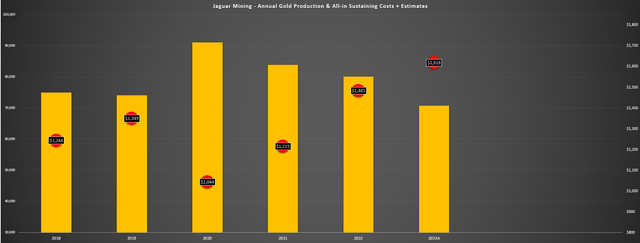

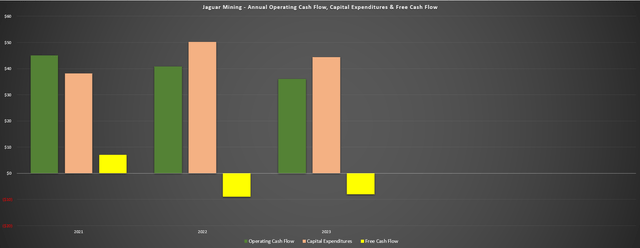

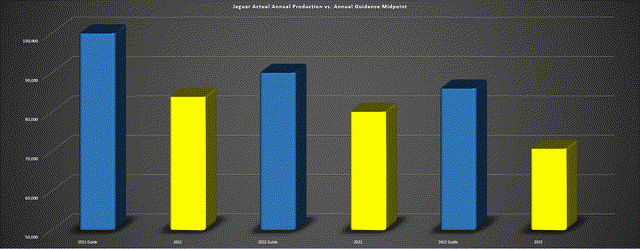

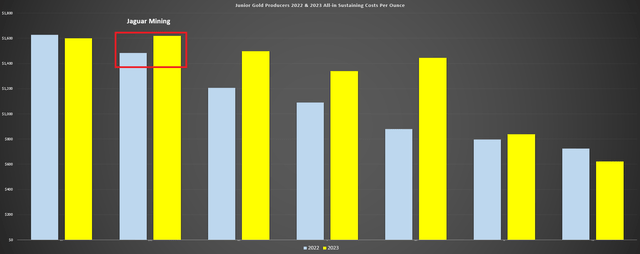

Jaguar Mining released fourth-quarter and fiscal 2023 results last month, reporting quarterly and annual production of approximately 18,500 ounces and approximately 70,700 ounces, respectively.The results were well below my expectations and below the company’s expectations Annual Guidance Midpoint 86,000 ounces, costs soared again, with overall sustaining costs (AISC) reaching $1,618/ounce, compared with $1,483/ounce in the same period last year. Not surprisingly, despite the cash flow impact of rising gold prices, cash flow generation suffered, with cash flow falling to approximately $36 million (FY2022: approximately $40.8 million), the company reported free cash flow of (-) ~$8 million (FY22: (-) ~$9 million) despite lower capex. While the market is forward-looking and has already priced in dismal financial results for 2023, the latest operating results reported in early April deteriorated despite easy year-over-year comparisons.

Jaguar Mining Annual Production and Costs – Company Documents, Author Chart Jaguar Mining Annual Operating Cash Flow, CapEx and Free Cash Flow – Company Documents, Author Chart

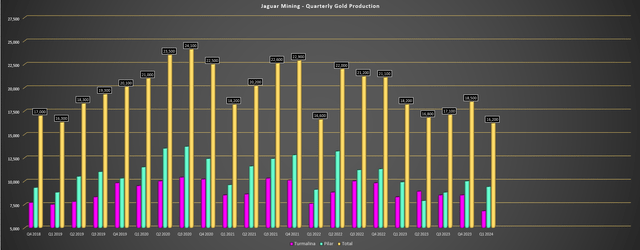

Looking at first-quarter results, Jaguar reported its weakest quarter in more than five years, producing only about 16,200 ounces of gold due to lower grades and throughput at its two mines. The weakest performer this quarter was Turmalina, whose gold production dropped by 17% year-on-year to about 6,800 ounces, with a processing volume of about 95,400 tons, 2.59 grams of gold per ton, and a slightly higher recovery rate.Jaguar noted first-quarter production was hampered by “Heavy Rainy Season” Dengue fever has a greater impact on employees than the epidemic. Fortunately, the company has seen a decline in dengue cases, with gold production in March just below 6,300 ounces, and is confident it can make up the shortfall in the first quarter of 2024. (Pilar) Mining volumes at the new BA-Torre ore body reached their highest level in two years, with the ore body accounting for around 20% of ore tonnage for the period.

Jaguar Mining Quarterly Gold Production – Company Documents, Author Chart

Given the weak first quarter results (approximately 15,700 ounces sold), this will be another quarter of poor financials, even if gold prices provide some help. That’s because most of gold’s first-quarter gains occurred in the second half of the quarter, with average realized gold prices of $2,070 per ounce, suggesting revenue will be down nearly 10% year-over-year from the roughly $35.8 million reported in the first quarter of 2023. Meanwhile, overall sustaining cost margins will remain under pressure given significantly lower volumes (~15,700 ounces vs. ~19,000 ounces), suggesting that the company’s first-quarter report will be disappointing when it announces results in May. That said, after years of disappointment, there appears to be light at the end of the tunnel, with Jaguar getting some nice interceptions from BA-Torre (Pilar) and hopefully bringing a higher-grade ore body online at Faina (Turmalina), It hopes the company will be able to bring a third mine online later this decade via the new Oncas de Pitangui project.

recent developments

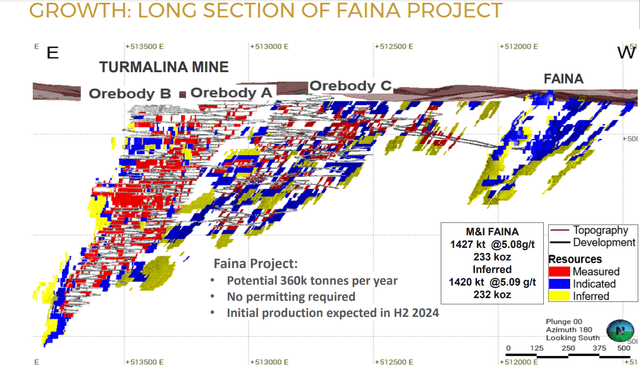

As for recent developments, there are certainly some positives, even if they haven’t been reflected in production and financial results so far. First, the company continues to report solid results from its BA-Torre ore body, which is a higher-grade ore body that will continue to contribute this year and has the potential to significantly lift production growth at Pilar in 2026 as the ore body benefits from each oz production increases vertical meters. At the same time, the company is working to bring the higher-grade Faina ore body into production, with reserves of approximately 787,000 tonnes grading 5.22 grams gold per tonne (132,000 ounces), well above Turmaline and its average reserve grade of 3.38 grams gold per tonne. So, while production is down significantly from fiscal 2020 levels of approximately 91,100 ounces, if the company can successfully seize these near-mine growth opportunities, it is expected to reach the 100,000 ounce mark at a lower cost by 2026.

Faina Long Section and Turmalina Mine – Company Website

If this were another company like Agnico Eagle (AEM) with a stellar track record of delivering on its promises, I’d be even more bullish on the potential. However, Jaguar has been overpromising, as discussed in the next section (“2024 Outlook”). While I don’t rule out the company’s ability to turn things around after three brutal years in business, the market will likely be slow to give the company credit for expected growth as it takes time to regain the market’s trust. That said, the medium-term target of 100,000 ounces does look quite feasible, as it is a relatively achievable target (close to the high-grade ounces of current infrastructure), which should set the stage for free cash flow generation in 2026 if gold prices can continue to rise. Provide a good nudge) Be cooperative.

Outlook 2024

Jaguar’s deliveries over the past three years have been pitiful compared to the median of its guidance, and were 18% less than gold delivered last year (~70,700 ounces delivered compared with ~86,000 ounces), on average over the past three years Deliveries were approximately 13,700 ounces.This is one of the worst records across the industry for meeting guidance among all producers. Fortunately, the Faina and BA-Torre ore bodies will help pick up some slack, but the company started the year once again behind the eight ball. In terms of cost effectiveness, the Brazilian real has weakened slightly against the U.S. dollar (UUP) and Brazil’s inflation rate continues to be lower, which should help reduce the rate of change in operating costs we see from 2020 to 2020. $647/oz cash cost -> $1,126/oz cash cost). However, most producers continue to experience single-digit inflation, and while Jaguar has been working on cost optimization, I am not optimistic about the company’s ability to maintain total costs below $1,750/oz for a relatively low-level operation that lacks economies of scale. optimism.

Jaguar Annual Gold Production vs Midpoint of Annual Guidance – Company Documents, Author Chart Jaguar Mining’s Annual AISC Meets Junior Producers – Company Documents, Author Chart

Fortunately, while Jaguar’s costs are rising at a much faster rate than its peers, this gives it significantly greater leverage against gold prices, which currently works in its favor. While AISC’s margins have averaged approximately $308/oz over the past two years, AISC’s margins are likely to double by FY23, assuming similar all-in sustaining costs and an average realized gold price of $2,200/oz (year-ago). At one time, it reached about $600 per ounce. That said, while this will result in a significant increase in free cash flow generation, and Jaguar could generate up to $20 million in free cash flow this year, it remains a highly leveraged small producer and I see no reason to lower – quality Microcap stocks should be trading at double-digit free cash flow multiples, let alone high-single-digit free cash flow multiples. Let’s take a deeper look at the valuations below:

Valuation

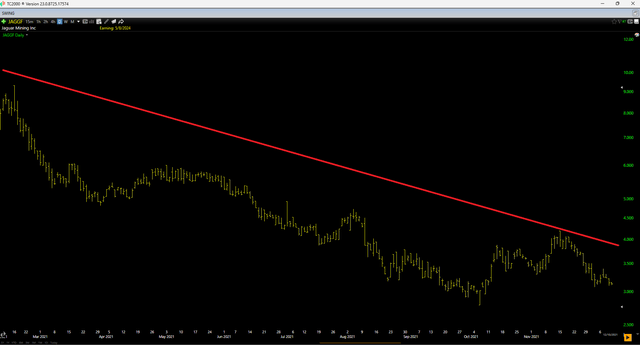

Based on approximately 82 million fully diluted shares and a share price of $2.15, Jaguar Mining has a market capitalization of approximately $176 million. This is not an unusual valuation for a small non-tier one jurisdiction producer in the gold industry (especially given its very poor track record of delivering on its promises and its much higher costs). While the stock has significant leverage to gold prices, it currently trades at around 10x fiscal 2024 free cash flow estimates, using a gold price assumption of $2,200/oz ($90/oz higher than the year-to-date average). ounces), approximately US$19 million. Some investors might think that’s a bargain considering the stock was trading at 16x free cash flow at its peak in 2020, but we quickly discovered that’s a bargain. no The stock’s sustainable multiple. In fact, despite a very mild correction in gold prices, the stock lost 70% of its value over the next year.

JAGGF Daily Chart (2021 Peak to 2022) – TC2000

So, what is the fair value of the stock?

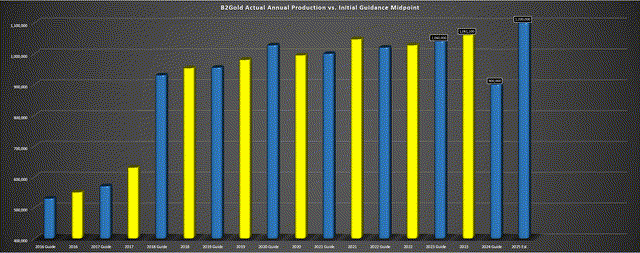

For a high-cost junior gold producer based in Brazil, using what I consider a more conservative free cash flow multiple of 6-8x, I think the stock is fair valued at $1.50 to $1.95. Even if we use the upper end of that range (8x) and fiscal 2024 estimates, Jaguar currently trades above its more conservative fair value assumption of $1.95. All in all, I think the stock has limited upside from current levels, and I think there are more attractive bets elsewhere in the sector, such as B2Gold (BTG), which trades at ~15x (2025 Producer ~ 1.2 million ounces versus Jaguar’s producer of around 80,000 ounces in 2025), higher margins, impressive track record of beating guidance, 5.0% dividend yield, yet trades at just FY2025 free cash flow estimates About 5.5 times estimated. Supporting a higher quality name is generally a better move when the quality is offered at a lower multiple and has a good sentiment background (BTG’s sentiment is near the bottom).

B2Gold Actual Production vs. Guidance Midpoint – Company Documents, Author Chart

Clearly, a rising tide lifts all boats, and if gold prices can remain at/above current levels, free cash flow will increase further next year and Jaguar’s stock price will certainly be closer to $3.00 per share. Still, I think 9.0x free cash flow is very generous for a low-quality producer with a spotty track record like Jaguar, especially when other brands across the industry still trade at depressed multiples. So since Jaguar is now more of a gold price play as it needs higher gold prices or multiple expansion from an already full multiple to re-rate, I don’t see any way to justify paying a higher price than U.S. stocks. A reasonable $2.20.

generalize

Jaguar Mining had another tough year in 2023, with a huge deviation from guidance, the company’s third consecutive annual deviation. Although 2024 is expected to be a better year due to initial contributions from the higher-grade Faina deposit, the year has not started well, with first-quarter production being the weakest in more than five years. On the positive side, gold prices have masked operating setbacks in the first quarter, and Jaguar will return to positive free cash flow after two years of outflows in 2022 and 2023. Free cash flow at much higher FY2025 prices With a stronger operating record and higher quality assets, I continue to see more attractive bets elsewhere in the sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.