Miscellaneous Photography

U.S. Bank (NYSE: USB) will release its first-quarter 2024 earnings report on Wednesday, which is expected to show resilient operating performance and a strong financial position, supporting mid- to long-term revenue attractiveness.

as i have covered in previous articles, I think U.S. Bancorp has a good earnings profile in the financial sector due to its quality profile and long-term sustainable dividends. As the bank is about to report its first-quarter earnings, in this article I preview its earnings and update its investment case to see if it remains an interesting revenue play in the U.S. financial industry.

U.S. Bank’s first quarter earnings preview

As I’ve covered in previous articles on the banking sector, revenue and earnings have been supported by rising interest rates over the past few years, but this tailwind appears to Coming to an end.As the latest earnings reports from major U.S. banks on Friday showed, including JPMorgan (JPMorgan) or FuGuo bank (World Financial Center), the benefits of high interest rates are gradually disappearing as customers demand higher interest rates on deposits or they move their funds elsewhere to seek higher-income alternatives.

As a result, net interest income is no longer increasing as JPMorgan Chase reported its first quarterly decline in net interest income in the past three years. Although there is still a lot of uncertainty about whether the Fed will eventually start cutting interest rates in the coming months, the market expects interest rates to fall in the future, which means that the NII may peak in 2023, and the downside is there. In front of you.

This is a particular blow to banks that rely heavily on NII, whose business models are often more suited to retail and commercial banking. In fact, this is USB’s business profile, as the bank is heavily involved in retail and business banking, although it is also involved in other activities such as payment services, corporate banking or wealth management.

Against this backdrop, it’s no surprise that USB’s operating momentum has been supported by the recent rise in interest rates, and its acquisition of Union Bank in 2022 has also provided a significant boost to its revenue and earnings.

In fact, the bank reported more than $28 billion in revenue last year, a record high, with an annual increase of 15.8%. This strong performance was mainly due to higher NII, which increased by 18.1% from the same period last year to US$17.5 billion, while non-interest income increased by 12% from the same period last year to US$10.6 billion.

However, USB’s NII has trended downward in recent quarters due to rising deposit costs and the negative impact of regional banking turmoil in 2023. good sign.

In fact, according to market forecasts, USB’s net interest income in the second quarter of 2024 is expected to be approximately US$4.03 billion, a quarterly decrease of approximately 2% and an annual decrease of approximately 13%. The net interest margin in the first quarter is expected to be 2.75% (compared to the first quarter of 2023). 2.78% in the fourth quarter and 3.19% in the first quarter of 2023). Its first-quarter total revenue is expected to be $6.7 billion, down slightly from the previous quarter, as non-interest income is expected to largely offset the decline in NII in the first quarter.

In terms of costs, its operating expenses are expected to be approximately US$4.3 billion, basically the same as the same quarter last year, because the bank has been able to obtain cost synergies from the acquisition of United Bank, which has offset the cost pressure from United Bank to a certain extent. . Its efficiency, as measured by cost-to-income ratio, is expected to be about 63%, which is an acceptable level but higher than the most efficient banks in the United States, which have cost-to-income ratios in the mid-50s.

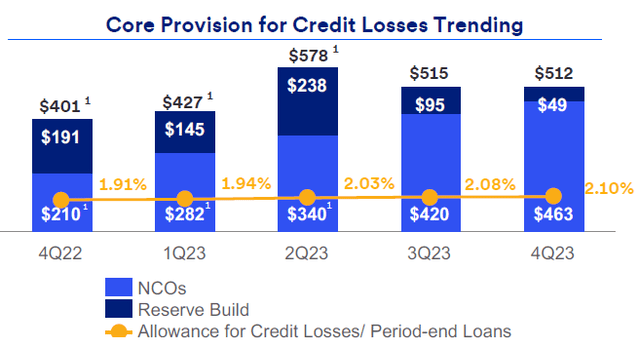

In terms of credit quality, USB has remained “good” in recent years, although its regulations have “normalized” in recent quarters to pre-pandemic levels.事實上,如下圖所示,USB 的貸款損失撥備在過去幾季逐漸增加,但預計與2024 年第一季的近期歷史記錄不會有太大差異,因為USB 的撥備預計約為498美元mega.

Regulation (U.S. Bank of America)

A large portion of the increase in provisions relates to commercial real estate (CRE) exposure, but Wells Fargo recently reported resilience numbers related to its CRE exposure, and USB may also have shown good credit quality levels, calming some of the more Bearish sentiment has emerged in recent months in anticipation of the bank’s exposure to commercial real estate. While there does exist some office-related risk, banks have been able to gradually increase reserves to reflect this risk, and I do not expect commercial real estate exposure to be a major headwind for the banking sector in 2024.

Still, investors should be aware that USB’s exposure to CRE is significant, approaching $54 billion by the end of 2023, or about 14% of its total loans. Of its CRE exposure, only 13% is office-related, or $7 billion in absolute terms; therefore, this portion may ultimately lead to higher loan losses in the near future.

USB’s net profit in the first quarter of 2024 is expected to exceed US$1.3 billion, and its return on equity (ROE), a key measure of banking industry profitability, is expected to be close to 11%, essentially unchanged from the previous quarter.

In terms of capital ratios, the bank is expected to maintain the trend of organic capital generation, with the CET1 ratio at approximately 10.05% as of the end of March. While this ratio is not the highest in the U.S. banking industry, it is well above the 7% capital requirement, leaving plenty of room for shareholders to allocate excess capital.

The current quarterly dividend is $0.49 per share, an increase of 2.1% from January last year, and the dividend yield on the current stock price is approximately 4.7%. This yield is higher than most of its peers, indicating that USB remains a good income option in the U.S. banking sector. With its dividend payout ratio below 50% and the bank’s strong capital position, its dividend is clearly safe and has a good future. growth prospects.

In addition, USB is more focused on rebuilding its capital ratios after acquiring Union Bank, but considering its current capital ratios are 300 basis points above regulatory levels, USB may eventually resume share repurchases in the coming quarters, which will improve its shareholder remuneration policy and act as a positive catalyst for share price increases.

in conclusion

U.S. Bancorp is expected to report relatively stable revenue and earnings in the first quarter of 2024, as the push from rising interest rates is no longer enough to sustain the bank’s growth. This means its investment case is increasingly income-focused, as USB offers an above-average dividend yield in the banking sector and is sustainable in the long term.