Antagaon

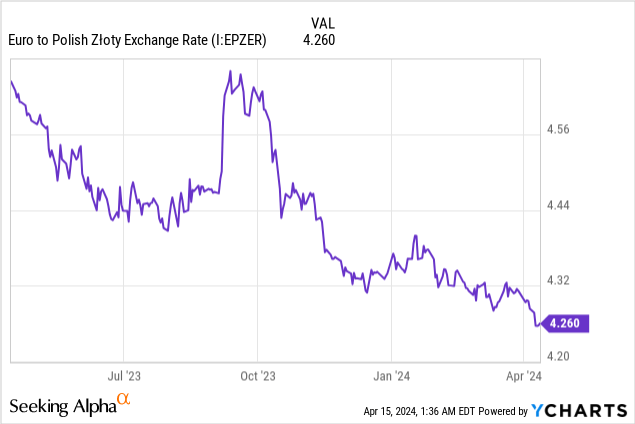

Poland (OTCPK:ASOZF) (OTCPK:ASOZY) remains a high-quality and under-the-radar option on the Polish market, which has been systematically and unjustifiably ignored.We focused on this in our last story, commenting big The Company engages in repurchases. In addition to their broader consulting and various software engagements focusing on the European Visegrad, Baltic and Balkan countries, they have strategic exposure to Israel’s defense budget and overall cybersecurity. Beyond operations, we note that the trend in the Polish zloty is looking quite good for political reasons, which is an important consideration when investing in Asseco since much of its revenue is denominated in Polish zloty.We also note that there may be a PE angle for Asseco, and the company may start to get better prices as it explores selling its insurtech assets, although The angle here is very small. Overall, valuations remain attractive relative to tech advisory peers, but we believe valuations are likely to fall back even if buying from these levels.

benefit

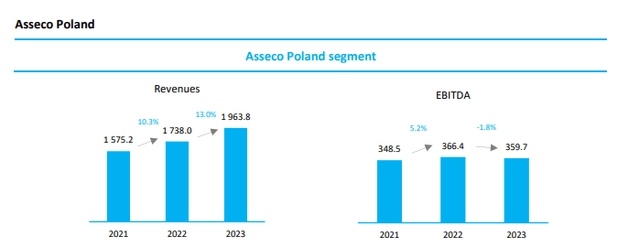

this Financial year results out. Let’s go through each segment one by one, starting with the Polish technology consulting and software business, which is least affected by the peculiarities of the various shareholding structures in which Asseco is a non-majority controlling shareholder. The segment’s revenue is PLN and is growing steadily in line with the overall long-term trend towards digitalization, particularly in its large financial and fintech franchises and in healthcare. They were awarded multiple projects related to the modernization of banking transaction systems to drive results. Much of that revenue (about 40% of the segment’s revenue) comes from long-term recurring revenue contracts, which is why the segment has continued to grow over the years. They have also recently won a number of cybersecurity projects, as well as consulting projects on NATO systems intended for use by NATO defense analysts.

Asseco Poland (Annual Report)

Overall EBITDA fell, but this was due to some comparison effects. When you strip out the operating income gain from the sale of certain personal protective equipment by one of Asseco’s Polish subsidiaries, the real evolution is actually flat. As a group holding company, profits from these disposals are ultimately included in other operating income and will not fall below the bottom line. Since this is a labor-intensive industry and wage inflation in Poland is very high, this also limits EBITDA growth.

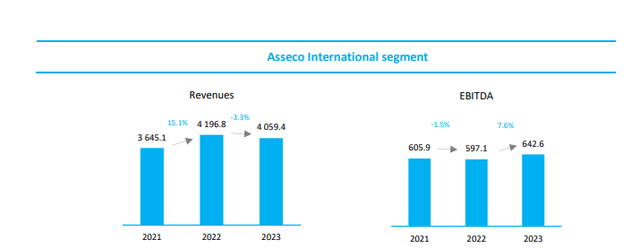

Another division is Asseco International, which operates in Eastern Europe outside of Poland. ERP solutions rank high here, as do collaborations with financial institutions and public institutions, which closely parallels the growth in sales in the Polish region. The business for SMEs in ERP is healthy here too, and generally speaking, the main German pole is suffering as the economic balance shifts further eastward, while the Eastern European economies have more room to absorb inflation benignly, and these economies The body is moving forward slowly. Transaction speeds are up, which is helping its payments system grow revenue.

Aseco International (Annual Report)

There are some financial quirks to be aware of. Asseco Group uses PLN as its reporting unit and the currency performed well in the 2023 financial year.

Although the inflation situation in Poland is quite severe, with higher wage growth and higher overall inflation figures, the main development is that the new government no longer contracts with Hungary and more EU countries, but instead allows new EU funds to flow into Poland , significantly improving its monetary and public finances. On a constant currency basis, the Asseco International segment would grow. The 7.6% EBITDA growth was also due to some one-time and M&A related impacts, as well as the emergence of some new integrations, but there was underlying growth on a constant currency basis.

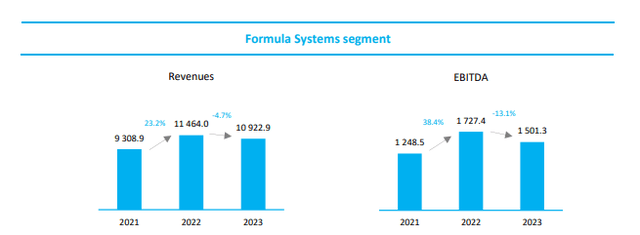

The situation with PLN could also impact Formula Systems (FORTY) holdings. Asseco owns about 25% of FORTY, which in turn owns shares in other businesses. Asseco and FORTY each own a minority stake but have effective contractual control, so the merger took place. Therefore, investors always need to face the fact that there is a very large NCI that offsets much of the segment’s combined figures. Roughly speaking, roughly 15% of EBIT comes from FORTY, based on proportional endorsement numbers provided by the company. Many of FORTY’s companies, such as Magic Software (MGIC) and Sapiens International (SPNS), have a large presence in the Israeli market even though they are listed on Nasdaq. On top of that, they also have significant euro and dollar exposure. There are no significant Polish-oriented companies in FORTY.

Forty Years of Performance (Annual Report)

As a result, FORTY’s sales fell despite all of its businesses growing well on a constant currency basis and being impacted by trends such as insurtech, cloud integration and general IT solutions and consulting. Through Israel’s Matrix IT, an IT company that also does a lot of work in cybersecurity and public institutions including the Border Force and the Israel Defense Forces, investors can also benefit from defense and security as Israel’s war continues. Bet strategically. Matrix IT is almost FORTY’s largest holding company.

Additionally, we should mention that Sapiens International is apparently considering a possible strategic sale to PE. Based on this possibility, prices increased by more than 13%. SPNS accounts for around 5% of Asseco’s market capitalization, which is not an insignificant amount and could lead to a slight upside.

bottom line

All businesses are experiencing some underlying inflationary pressures, ignoring the impact of the strong Polish zloty, but in tech-centric emerging markets the long-term trend is clearly good.

We are confident in their operating profile and PLN, which has strengthened their geographical presence in Poland, accounting for around 32% of pro-rata recognized sales, and the company’s valuation remains attractive. Technology consulting PE’s attention to Accenture (ACN) is about 30 times, while Asseco Poland’s attention is still about 13 times. The Polish market is well developed and in many ways the future looks brighter in Poland than elsewhere in Europe, even as they deal with severe inflation. The 4.48% tangible dividend yield is also a good testament to value, income, and growth, and the yield continues to grow. Asseco Poland is on the watch list if it retraces to slightly lower levels, as we think it could see some retracement, but it already looks quite attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.